Find Debt Without Paperwork

Introduction to Finding Debt Without Paperwork

When it comes to managing finances, one of the most critical aspects is understanding and keeping track of debt. However, in many cases, individuals may find themselves in a situation where they need to find debt without having access to the necessary paperwork. This could be due to a variety of reasons such as lost documents, separation from a spouse who handled the finances, or even a scenario where the individual is trying to help a family member or friend who is not organized with their financial records. Regardless of the reason, the task of finding debt without paperwork can be daunting but not impossible.

Understanding the Importance of Finding Debt

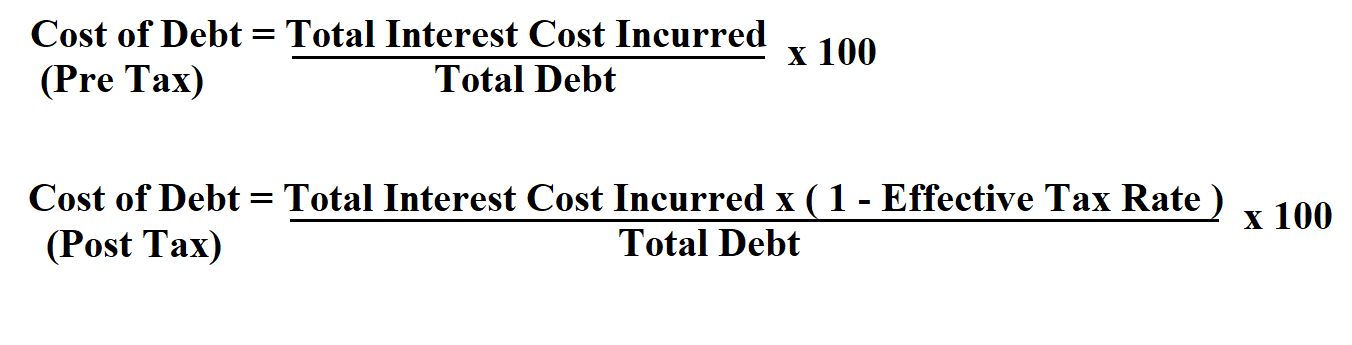

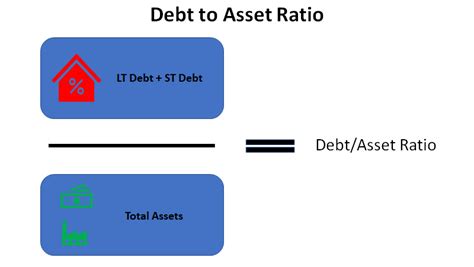

Before diving into the methods of finding debt without paperwork, it’s essential to understand why this task is crucial. Knowing your debt is the first step towards financial freedom. It allows you to create a plan to pay off your debts, avoid further debt accumulation, and improve your credit score over time. Without a clear picture of your debt, you might end up paying more in interest, missing payments, and damaging your credit profile.

Methods to Find Debt Without Paperwork

Several methods can help you find debt without relying on paperwork. Here are some steps you can follow:

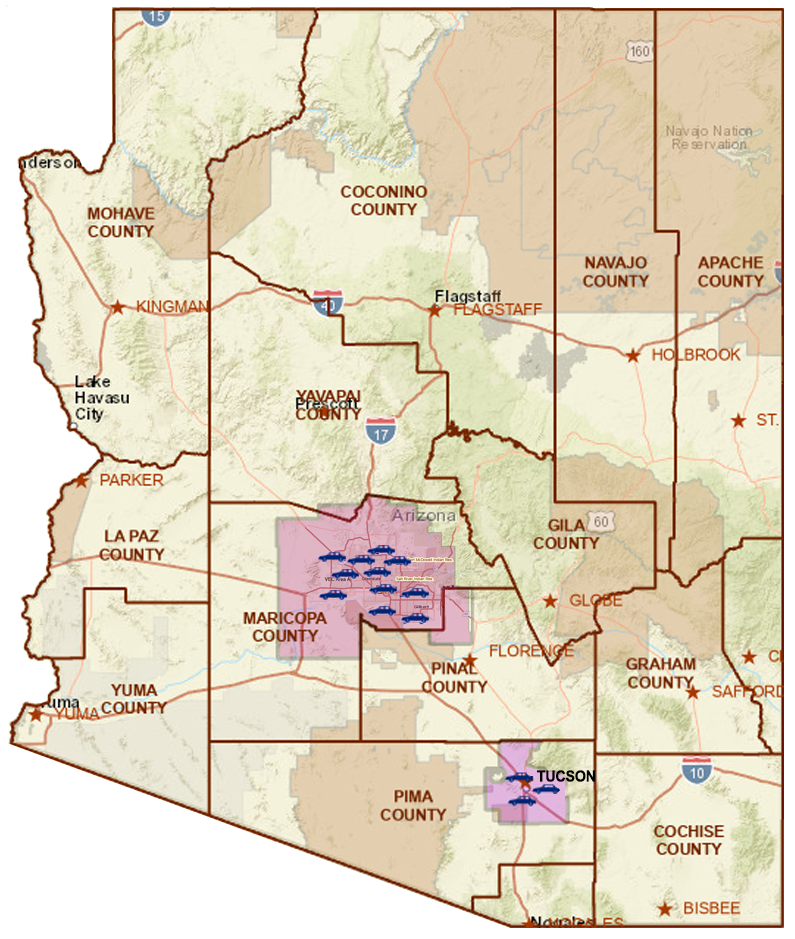

- Check Your Credit Report: Your credit report is a comprehensive document that lists all your debts, including credit cards, loans, and other financial obligations. You can request a free copy of your credit report from the three major credit reporting agencies (Equifax, Experian, and TransUnion) once a year. Reviewing your credit report will give you a detailed overview of your debt.

- Online Banking and Mobile Apps: Many banks and financial institutions offer online banking services and mobile apps that allow you to view your accounts, including debts such as credit cards and loans. Logging into these platforms can provide you with real-time information about your debt.

- Contact Your Creditors: If you know who your creditors are but don’t have the paperwork, you can contact them directly. They can provide you with information about your debt, including the balance, interest rate, and payment due dates.

- Tax Returns: Your tax returns may also contain information about your debt, especially if you’ve claimed interest payments on loans or credit cards as deductions.

Tools and Resources

Utilizing the right tools and resources can make the process of finding debt without paperwork more efficient. Here are a few:

- Debt Management Apps: Apps like Credit Karma, NerdWallet, and Mint can help you track your debt and provide tools to manage it effectively.

- Financial Advisors: Consulting with a financial advisor can provide you with professional guidance on how to find and manage your debt.

- Credit Counseling Agencies: Non-profit credit counseling agencies can offer free or low-cost advice and assistance in managing your debt.

| Tool/Resource | Description |

|---|---|

| Credit Karma | Offers free credit scores, reports, and tools to manage debt. |

| NerdWallet | Provides financial tools and advice, including debt management. |

| Mint | A personal finance app that helps track spending and debt. |

Creating a Plan to Pay Off Debt

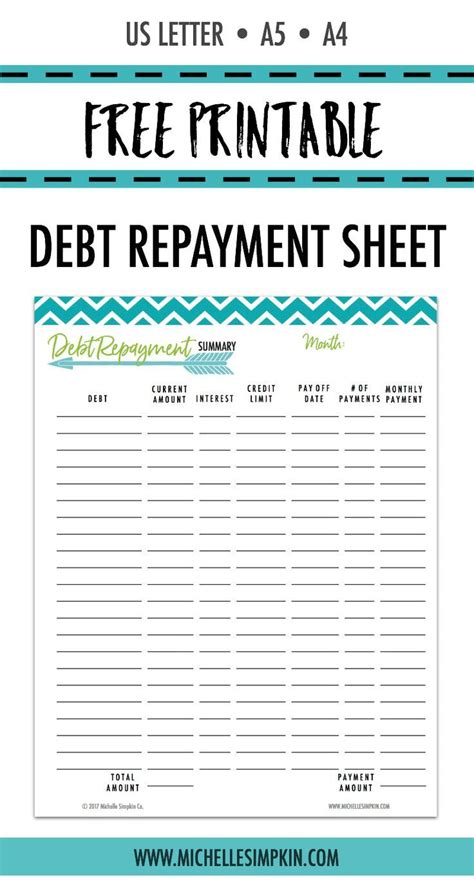

Once you’ve identified your debts, the next step is to create a plan to pay them off. This involves several key strategies:

- Prioritizing Debts: Decide which debts to pay off first. This could be based on the debt with the highest interest rate or the smallest balance.

- Budgeting: Create a budget that allocates enough money each month to pay off your debts.

- Consolidation: Consider consolidating your debts into a single loan with a lower interest rate and a single monthly payment.

- Snowball Method: Pay off debts one by one, starting with the smallest balance first, while making minimum payments on other debts.

📝 Note: It's crucial to stick to your plan and avoid accumulating new debt while you're paying off existing debts.

Maintaining Financial Health

Finding debt without paperwork is just the first step towards achieving financial health. It’s also important to maintain good financial habits over time. This includes:

- Regularly Checking Credit Reports: Ensure that your credit report is accurate and up-to-date.

- Monitoring Spending: Keep track of your spending to avoid overspending and accumulating new debt.

- Building an Emergency Fund: Save enough money to cover 3-6 months of living expenses to avoid going into debt when unexpected expenses arise.

In the end, managing debt without paperwork requires patience, diligence, and the right strategies. By understanding your debt, utilizing available tools and resources, and maintaining good financial habits, you can work towards a debt-free future and improve your overall financial well-being.

How often can I check my credit report for free?

+

You can request a free copy of your credit report from each of the three major credit reporting agencies (Equifax, Experian, and TransUnion) once a year.

What is the best method to pay off debt?

+

The best method to pay off debt depends on your individual financial situation. Common strategies include the snowball method, where you pay off debts with the smallest balances first, and the avalanche method, where you pay off debts with the highest interest rates first.

How can I avoid accumulating new debt while paying off existing debts?

+

To avoid accumulating new debt, it’s essential to stick to your budget, avoid using credit cards, and build an emergency fund to cover unexpected expenses.