5 Docs After Repossession

Understanding the Repossession Process

When a borrower fails to make payments on a loan, the lender may repossess the collateral, which is often a vehicle. This process can be stressful and overwhelming, but it’s essential to understand the steps involved and the documents required after repossession. In this article, we will delve into the world of repossession, exploring the necessary documents and the implications of this process on borrowers.

Documents Required After Repossession

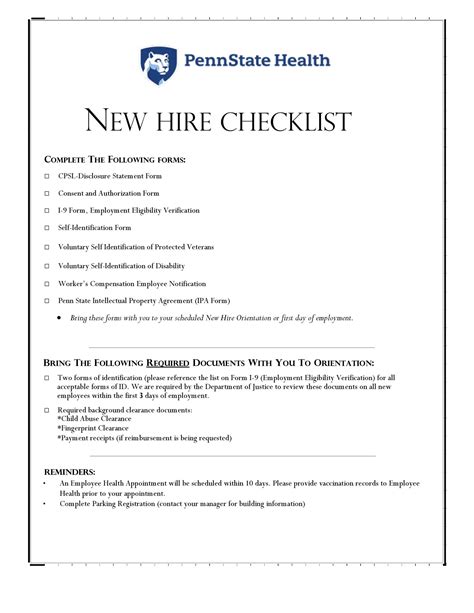

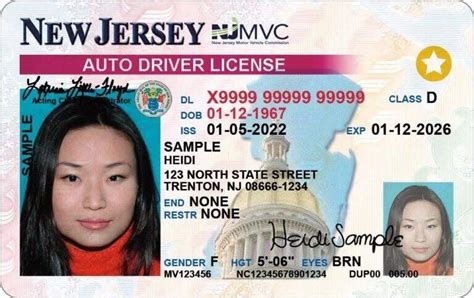

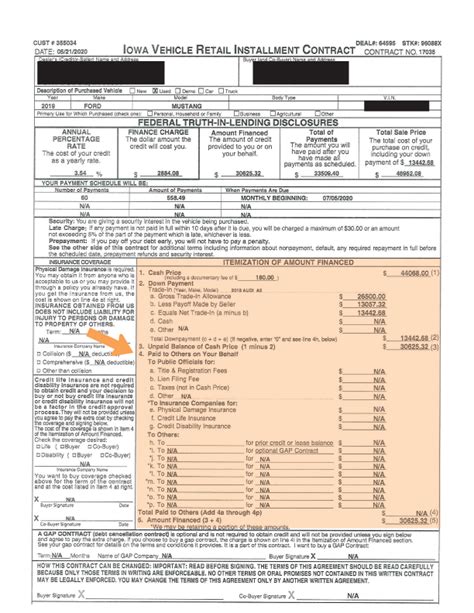

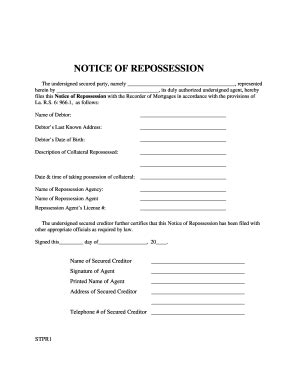

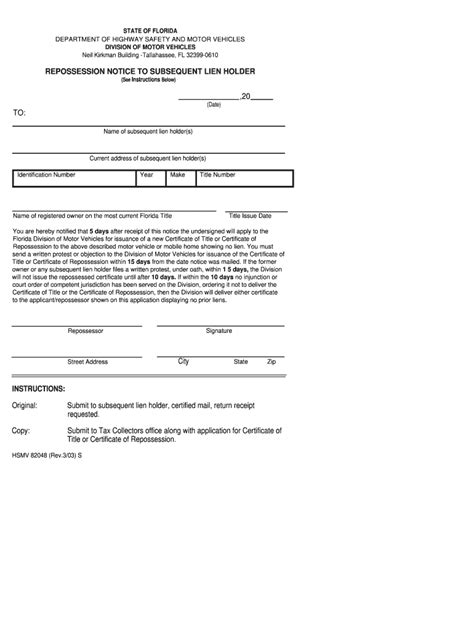

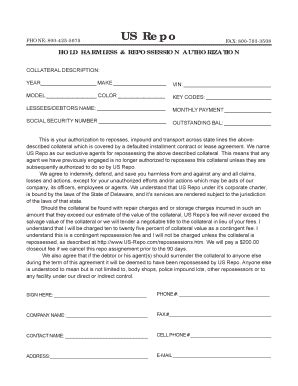

After a vehicle has been repossessed, the lender will typically require the borrower to provide certain documents to facilitate the process. These documents may include: * Repossession affidavit: This document confirms that the vehicle was repossessed and outlines the circumstances surrounding the repossession. * Notice of intent to sell: The lender must provide the borrower with a notice of intent to sell the repossessed vehicle, which includes the date, time, and location of the sale. * Proof of insurance: The borrower may be required to provide proof of insurance to ensure that the vehicle was insured at the time of repossession. * Registration and title: The borrower must provide the registration and title to the vehicle, which will be transferred to the new owner after the sale. * Any other relevant documents: Depending on the circumstances, the lender may require additional documents, such as a bill of sale or a release of lien.

The Repossession Process

The repossession process typically involves the following steps: * The lender sends a notice of default to the borrower, stating that the loan is in default and that the vehicle will be repossessed if payments are not made. * The lender hires a repossession company to retrieve the vehicle. * The repossession company locates the vehicle and takes possession of it. * The vehicle is then sold at auction or through a private sale. * The borrower is notified of the sale and the amount of money received from the sale.

Implications of Repossession

Repossession can have significant implications for borrowers, including: * Damaged credit score: Repossession can negatively impact a borrower’s credit score, making it more challenging to obtain credit in the future. * Financial losses: The borrower may be responsible for any deficiency balance, which is the amount of money still owed on the loan after the sale of the vehicle. * Emotional distress: Repossession can be a stressful and emotional experience, especially if the borrower has a strong attachment to the vehicle.

Rebuilding Credit After Repossession

While repossession can have long-term consequences, it’s possible to rebuild credit over time. Borrowers can take the following steps to improve their credit score: * Make on-time payments: Paying bills on time can help to establish a positive payment history. * Monitor credit reports: Borrowers should regularly review their credit reports to ensure that the information is accurate and up-to-date. * Avoid new credit inquiries: Applying for new credit can negatively impact credit scores, so borrowers should avoid applying for credit unless necessary.

📝 Note: Borrowers should carefully review their loan agreements and understand the terms and conditions before signing. It's also essential to communicate with lenders and seek professional advice if struggling to make payments.

In the end, repossession can be a complex and challenging process, but understanding the necessary documents and implications can help borrowers navigate this difficult situation. By taking proactive steps to rebuild credit and seeking professional advice, borrowers can work towards a more stable financial future. The key to success lies in being informed, proactive, and responsible, which can ultimately lead to a brighter financial outlook.

What happens to my vehicle after repossession?

+

After repossession, the lender will sell your vehicle at auction or through a private sale. You will be notified of the sale and the amount of money received from the sale.

Can I get my vehicle back after repossession?

+

It may be possible to get your vehicle back after repossession, but this typically requires paying off the outstanding loan balance and any additional fees. You should contact your lender to discuss your options.

How long does repossession stay on my credit report?

+

Repossession can stay on your credit report for up to 7 years, but the impact on your credit score will decrease over time as you make on-time payments and establish a positive payment history.