5 Ways Equifax

Introduction to Credit Reporting and Equifax

The world of finance is complex and multifaceted, with various institutions and organizations playing crucial roles in managing and regulating financial data. One such entity is Equifax, a leading credit reporting agency that collects, stores, and analyzes vast amounts of consumer and business credit information. Equifax plays a vital role in the financial sector, providing critical data that helps lenders, creditors, and other stakeholders make informed decisions about creditworthiness. In this article, we will delve into the world of Equifax, exploring its functions, importance, and the impact it has on individuals and businesses.

Understanding Equifax and Its Functions

Equifax is one of the three major credit reporting agencies in the United States, alongside Experian and TransUnion. These agencies gather information from various sources, including creditors, public records, and other databases, to create comprehensive credit reports. Equifax’s primary function is to collect, verify, and analyze this data, which is then used to generate credit scores. These scores are a crucial metric for lenders, as they help determine an individual’s or business’s creditworthiness and ability to repay debts.

The Importance of Equifax in the Financial Sector

The role of Equifax in the financial sector cannot be overstated. By providing accurate and up-to-date credit information, Equifax enables lenders to assess risk more effectively, making the credit market more efficient and stable. This, in turn, benefits consumers and businesses by facilitating access to credit and financial services. Furthermore, Equifax’s data is used in various other contexts, such as employment screening, insurance underwriting, and fraud prevention, highlighting its broad impact on the economy and society.

5 Ways Equifax Impacts Your Financial Life

Equifax’s influence on your financial life is multifaceted and significant. Here are five key ways in which Equifax impacts your financial situation: * Credit Score Determination: Equifax plays a critical role in determining your credit score, which is a key factor in deciding whether you qualify for loans or credit cards and at what interest rates. * Loan and Credit Approvals: The data Equifax provides is used by lenders to evaluate your creditworthiness, influencing whether your loan or credit applications are approved or denied. * Interest Rates and Terms: Your Equifax credit report and score can affect the interest rates you’re offered on loans and credit cards, as well as the terms of these financial products. * Employment and Insurance Opportunities: In some cases, potential employers or insurance providers may use Equifax data as part of their screening processes, making it relevant to employment and insurance opportunities. * Identity Theft and Fraud Protection: Equifax offers services aimed at protecting individuals from identity theft and fraud, highlighting its role in consumer financial security.

Managing Your Credit Report with Equifax

Given the significant impact of Equifax on your financial life, it’s essential to manage your credit report effectively. This includes regularly checking your report for accuracy, disputing any errors, and taking steps to improve your credit score over time. By being proactive, you can ensure that your Equifax credit report reflects your financial situation accurately, potentially leading to better financial outcomes.

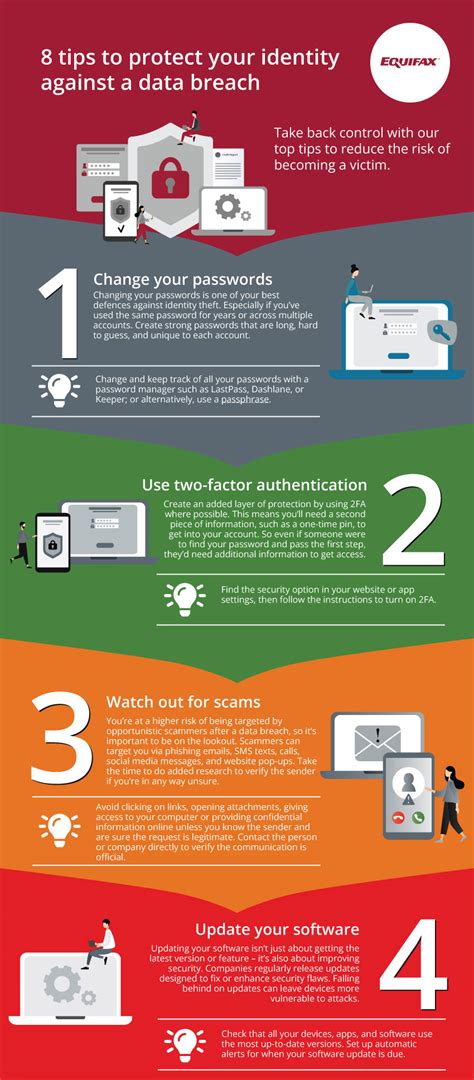

Security and Data Protection

The security of the data held by Equifax and other credit reporting agencies is a critical concern. Following a major data breach in 2017, Equifax has faced scrutiny and legal action, leading to increased efforts to enhance data protection and security measures. Understanding these efforts and how they impact data privacy is essential for consumers and businesses alike.

📝 Note: Regularly monitoring your credit report and understanding how Equifax and other credit reporting agencies work can help you navigate the complex world of personal finance more effectively.

In summary, Equifax plays a pivotal role in the financial sector, impacting individuals and businesses through its credit reporting and scoring services. Understanding how Equifax works and managing your credit report proactively can lead to better financial health and more favorable financial outcomes. By staying informed and engaged, you can navigate the complex financial landscape more effectively, leveraging the services of Equifax and other credit reporting agencies to your advantage.

What is the primary function of Equifax?

+

Equifax’s primary function is to collect, verify, and analyze consumer and business credit information, which is then used to generate credit scores and reports.

How does Equifax impact my financial life?

+

Equifax impacts your financial life in several ways, including determining your credit score, influencing loan and credit approvals, affecting interest rates, and playing a role in employment and insurance screenings.

Why is it important to manage my credit report with Equifax?

+

Managing your credit report with Equifax is crucial because it ensures the accuracy of your credit information, which can affect your ability to secure loans, credit cards, and other financial services at favorable terms.