Find IRS Paperwork Easily

Introduction to IRS Paperwork

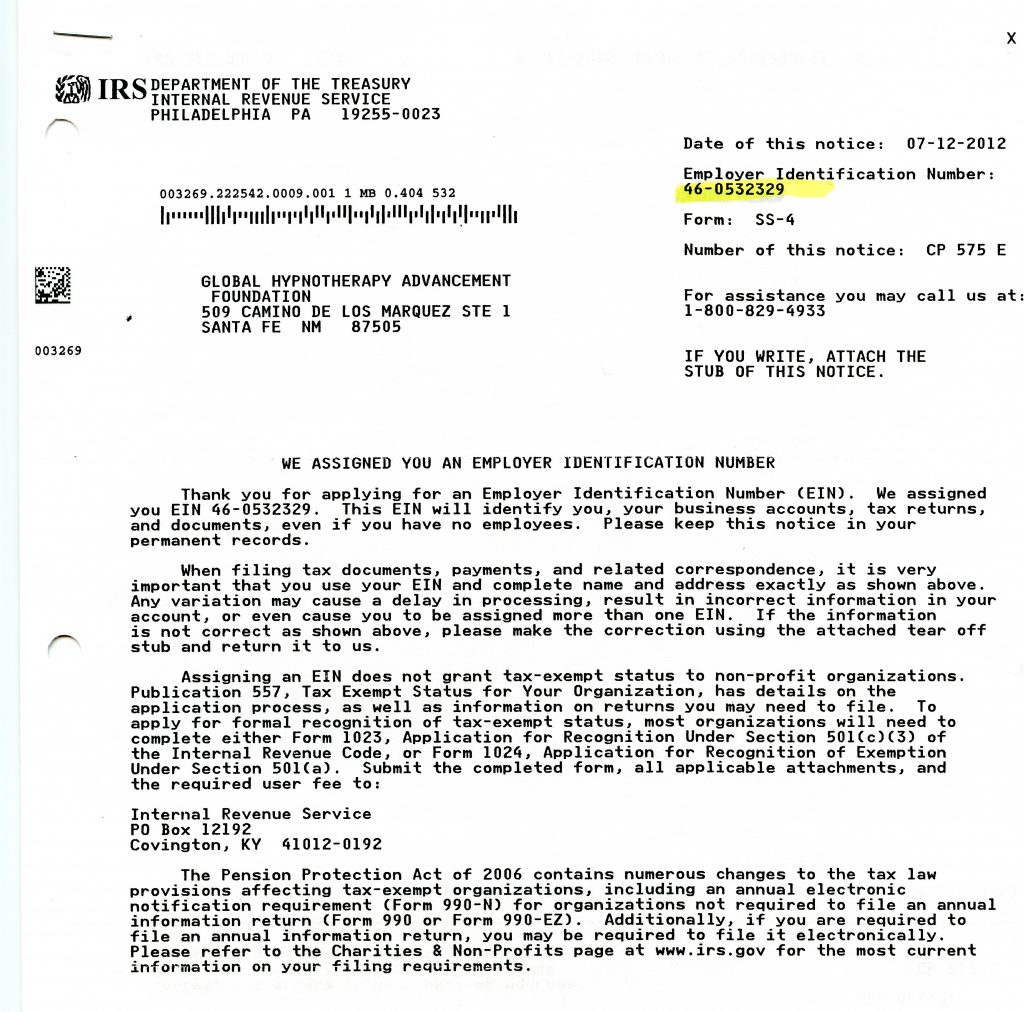

The Internal Revenue Service (IRS) is responsible for collecting taxes and enforcing tax laws in the United States. As part of its responsibilities, the IRS requires individuals and businesses to submit various forms and documents, collectively known as IRS paperwork. This paperwork can be overwhelming, especially for those who are not familiar with the tax system. In this article, we will discuss the different types of IRS paperwork, how to find them, and tips for completing them accurately.

Types of IRS Paperwork

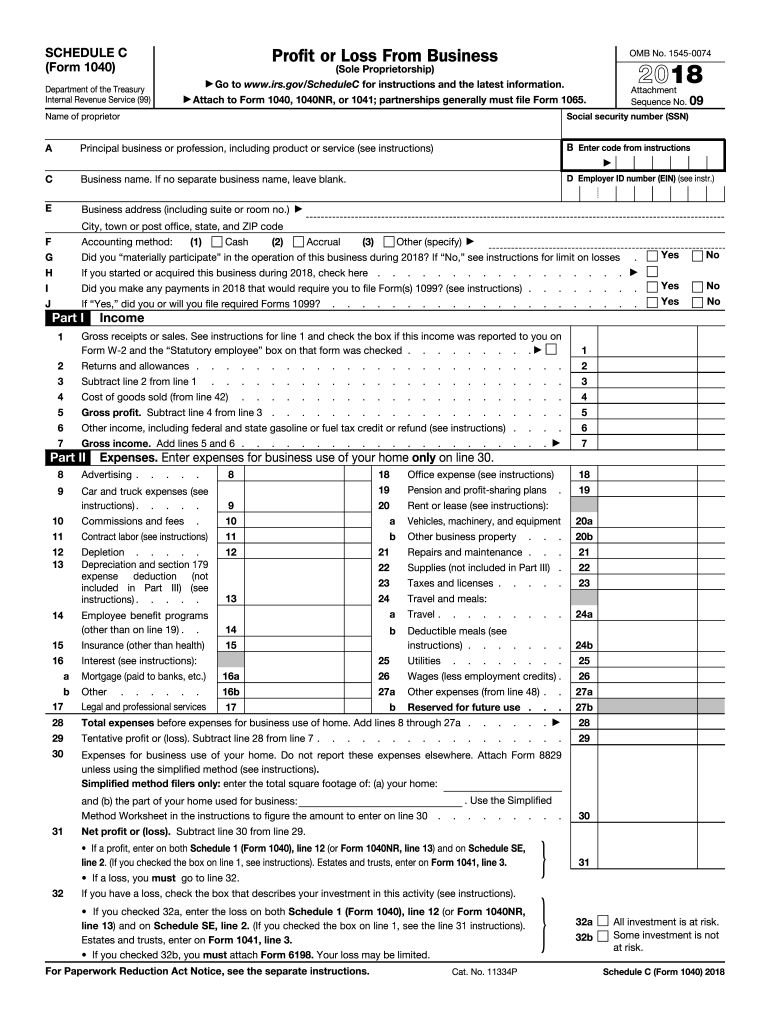

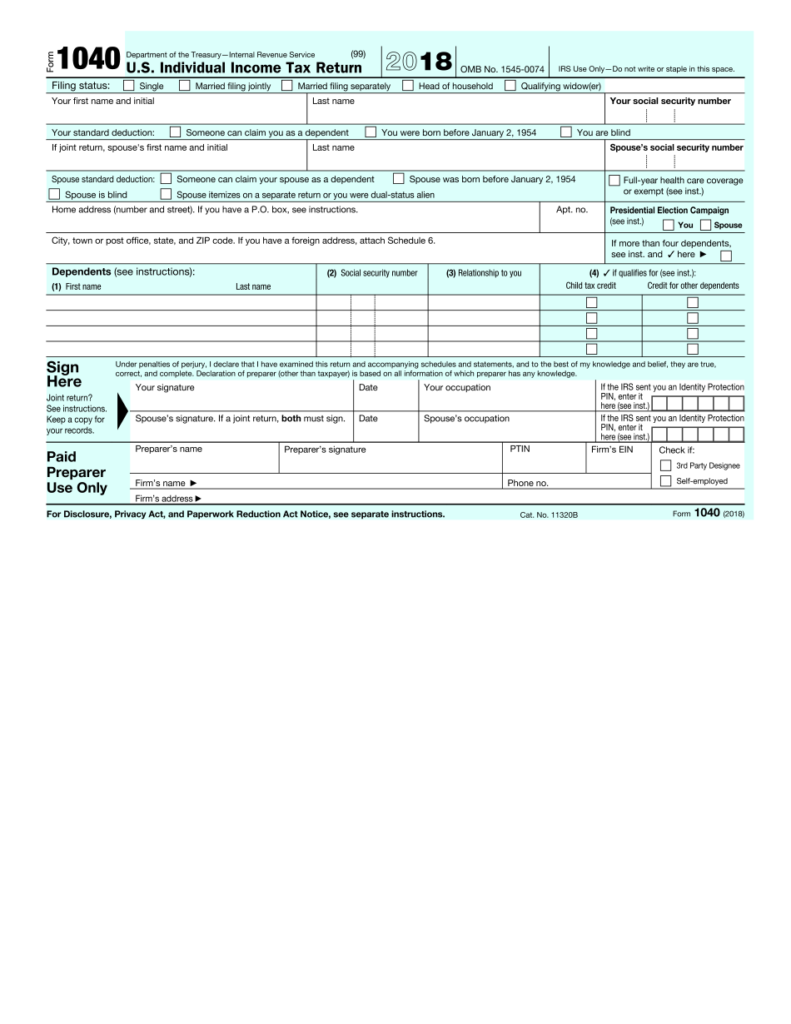

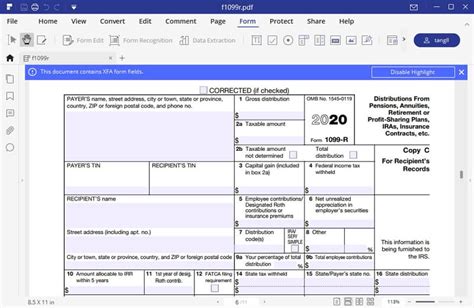

There are several types of IRS paperwork that individuals and businesses may need to complete. Some of the most common types include: * Form 1040: The standard form for personal income tax returns * Form 1099: Used to report income from self-employment, freelance work, or other non-employment sources * Form W-2: Used to report income and taxes withheld from employment * Form W-4: Used to determine the amount of taxes to be withheld from an employee’s paycheck * Form 941: Used to report employment taxes and pay any taxes due

These forms can be found on the IRS website or through various tax preparation software.

How to Find IRS Paperwork

Finding the right IRS paperwork can be a challenge, especially with the numerous forms and documents available. Here are some ways to find the IRS paperwork you need: * Visit the IRS website: The official IRS website (irs.gov) has a comprehensive list of all IRS forms and publications. You can search for specific forms by number or keyword. * Use tax preparation software: Tax preparation software like TurboTax or H&R Block can help you find and complete the necessary IRS paperwork. * Contact the IRS directly: You can call the IRS or visit a local IRS office to ask for assistance with finding the right paperwork.

📝 Note: It's essential to ensure you have the most up-to-date version of any IRS form or publication to avoid errors or penalties.

Tips for Completing IRS Paperwork

Completing IRS paperwork can be a daunting task, but with the right tips and strategies, you can make the process easier and less stressful. Here are some tips to keep in mind: * Read the instructions carefully: Before starting to complete any IRS form, read the instructions carefully to ensure you understand what information is required. * Gather all necessary documents: Make sure you have all the necessary documents, such as receipts, invoices, and bank statements, to support your tax return. * Use tax preparation software: Tax preparation software can help you complete IRS paperwork accurately and efficiently. * Seek professional help: If you’re unsure about how to complete any IRS form or need help with a complex tax situation, consider seeking the help of a tax professional.

Common IRS Paperwork Mistakes

Making mistakes on IRS paperwork can lead to delays, penalties, or even audits. Here are some common mistakes to avoid: * Inaccurate or incomplete information: Make sure to provide accurate and complete information on all IRS forms. * Math errors: Double-check your calculations to avoid math errors. * Missing signatures: Ensure that all IRS forms are signed and dated. * Incorrect filing status: Choose the correct filing status to avoid errors or penalties.

| Form | Purpose | Deadline |

|---|---|---|

| Form 1040 | Personal income tax return | April 15th |

| Form 1099 | Report income from self-employment or freelance work | January 31st |

| Form W-2 | Report income and taxes withheld from employment | January 31st |

In summary, finding and completing IRS paperwork can be a challenging task, but with the right resources and strategies, you can make the process easier and less stressful. Remember to always read the instructions carefully, gather all necessary documents, and seek professional help if needed.

As we finalize our discussion on IRS paperwork, it’s essential to remember that accuracy and timeliness are crucial when submitting tax returns and other documents to the IRS. By following the tips and strategies outlined in this article, you can ensure a smooth and efficient tax filing process.

What is the deadline for filing Form 1040?

+

The deadline for filing Form 1040 is typically April 15th of each year.

How do I find the right IRS form for my tax situation?

+

You can find the right IRS form by visiting the official IRS website (irs.gov) or using tax preparation software.

What are the consequences of making mistakes on IRS paperwork?

+

Making mistakes on IRS paperwork can lead to delays, penalties, or even audits. It’s essential to ensure accuracy and completeness when submitting tax returns and other documents to the IRS.