5 Ways Get Loan

Introduction to Loan Options

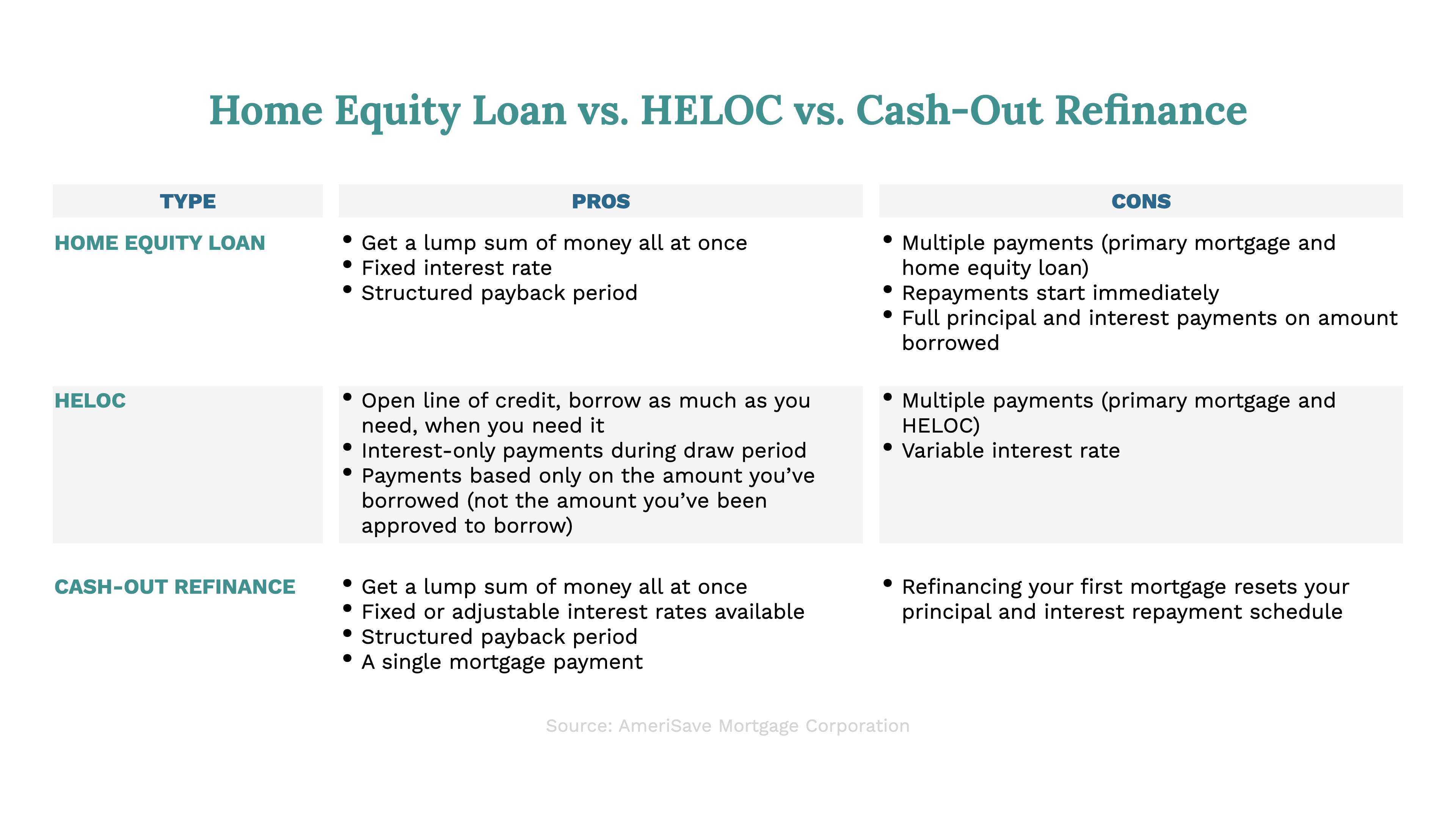

In today’s economy, obtaining a loan can be a daunting task, especially for those with less-than-perfect credit or limited financial resources. However, there are several options available for individuals and businesses to secure the funding they need. This article will explore five ways to get a loan, including traditional bank loans, online lenders, credit unions, peer-to-peer lending, and alternative lenders.

Traditional Bank Loans

Traditional bank loans are one of the most common ways to secure funding. Banks offer a variety of loan options, including personal loans, mortgages, and business loans. To qualify for a traditional bank loan, borrowers typically need to have a good credit score, a stable income, and a solid credit history. The application process can be lengthy, and borrowers may need to provide collateral or a co-signer to secure the loan. Interest rates and fees vary depending on the lender and the borrower’s creditworthiness.

Online Lenders

Online lenders have become increasingly popular in recent years, offering a convenient and often faster alternative to traditional bank loans. These lenders use algorithms and machine learning to assess creditworthiness and provide loan decisions in minutes. Online lenders often have more lenient credit requirements than traditional banks, making it easier for borrowers with poor credit to secure funding. However, interest rates and fees can be higher than those offered by traditional banks.

Credit Unions

Credit unions are member-owned financial cooperatives that offer a range of financial services, including loans. Credit unions often have more flexible lending requirements than traditional banks and may offer more competitive interest rates and terms. To join a credit union, borrowers typically need to meet certain eligibility requirements, such as working for a specific employer or living in a particular area.

Peer-to-Peer Lending

Peer-to-peer lending platforms connect borrowers with individual investors, allowing borrowers to secure funding from multiple sources. These platforms often have more lenient credit requirements than traditional banks and may offer more competitive interest rates and terms. However, fees can be higher, and borrowers may need to pay origination fees or late payment fees.

Alternative Lenders

Alternative lenders offer a range of loan options, including merchant cash advances, invoice financing, and equipment financing. These lenders often have more flexible lending requirements than traditional banks and may offer more competitive interest rates and terms. However, fees can be higher, and borrowers may need to pay origination fees or late payment fees.

📝 Note: Borrowers should carefully review the terms and conditions of any loan before signing, including interest rates, fees, and repayment terms.

Here are some key considerations when choosing a loan option: * Credit score: Borrowers with good credit scores may qualify for more competitive interest rates and terms. * Income: Borrowers need to have a stable income to qualify for a loan. * Collateral: Some lenders may require collateral, such as a car or property, to secure the loan. * Fees: Borrowers should carefully review the fees associated with the loan, including origination fees, late payment fees, and interest rates.

| Loan Option | Interest Rate | Fees | Credit Requirements |

|---|---|---|---|

| Traditional Bank Loan | 6-36% | 0-5% | Good credit score, stable income |

| Online Lender | 6-36% | 0-10% | Lenient credit requirements |

| Credit Union | 6-18% | 0-5% | Membership requirements, good credit score |

| Peer-to-Peer Lender | 6-36% | 0-10% | Lenient credit requirements |

| Alternative Lender | 10-50% | 0-20% | Lenient credit requirements, collateral may be required |

In summary, there are several loan options available for individuals and businesses, each with its own advantages and disadvantages. Borrowers should carefully review the terms and conditions of any loan before signing, including interest rates, fees, and repayment terms. By considering these factors and choosing the right loan option, borrowers can secure the funding they need to achieve their financial goals.

What is the best way to get a loan?

+

The best way to get a loan depends on the borrower’s individual circumstances, including their credit score, income, and financial goals. Borrowers should carefully review the terms and conditions of any loan before signing, including interest rates, fees, and repayment terms.

What are the benefits of using an online lender?

+

Online lenders offer a convenient and often faster alternative to traditional bank loans. They may have more lenient credit requirements, and borrowers can apply for a loan from the comfort of their own home.

What is peer-to-peer lending?

+

Peer-to-peer lending platforms connect borrowers with individual investors, allowing borrowers to secure funding from multiple sources. These platforms often have more lenient credit requirements than traditional banks and may offer more competitive interest rates and terms.

What are the risks of using an alternative lender?

+

Alternative lenders may charge higher interest rates and fees than traditional banks, and borrowers may need to pay origination fees or late payment fees. Borrowers should carefully review the terms and conditions of any loan before signing.

How can I improve my credit score to qualify for a loan?

+

Borrowers can improve their credit score by making on-time payments, reducing debt, and avoiding negative credit marks. They should also monitor their credit report and dispute any errors or inaccuracies.