Paperwork

Get Copy of EIN Paperwork

Understanding the Importance of EIN Paperwork

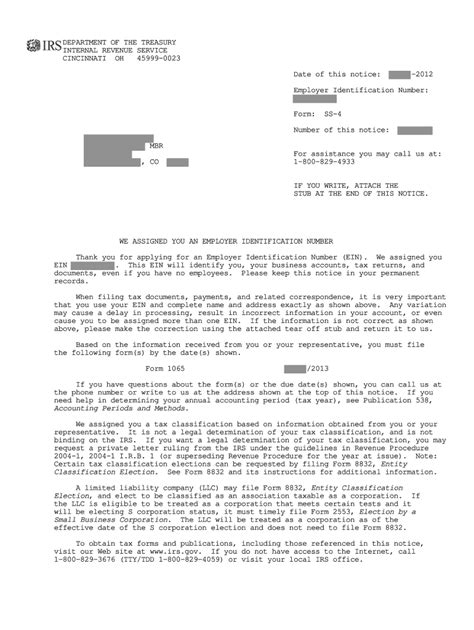

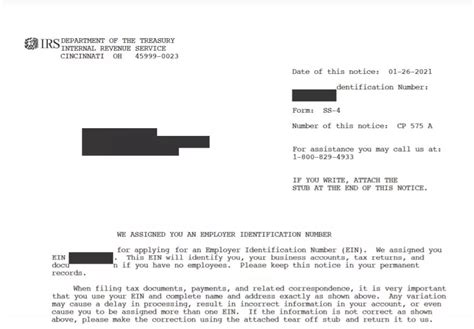

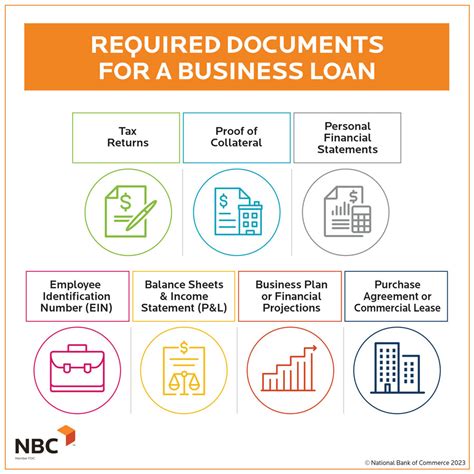

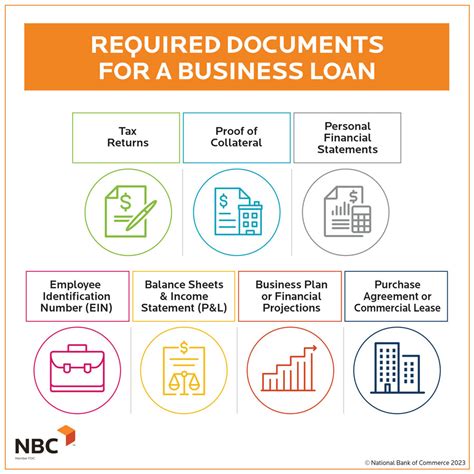

When you start a business, one of the crucial steps you need to take is obtaining an Employer Identification Number (EIN) from the Internal Revenue Service (IRS). This unique nine-digit number is used to identify your business for tax purposes and is required for various financial transactions, including opening a business bank account, hiring employees, and filing tax returns. After applying for and receiving your EIN, it’s essential to keep a copy of your EIN paperwork for your records. This document serves as proof of your business’s identity and is often required when dealing with financial institutions, vendors, and other business partners.

Why Keep a Copy of EIN Paperwork?

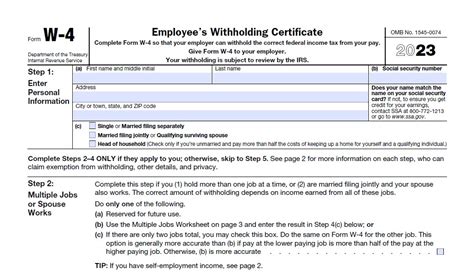

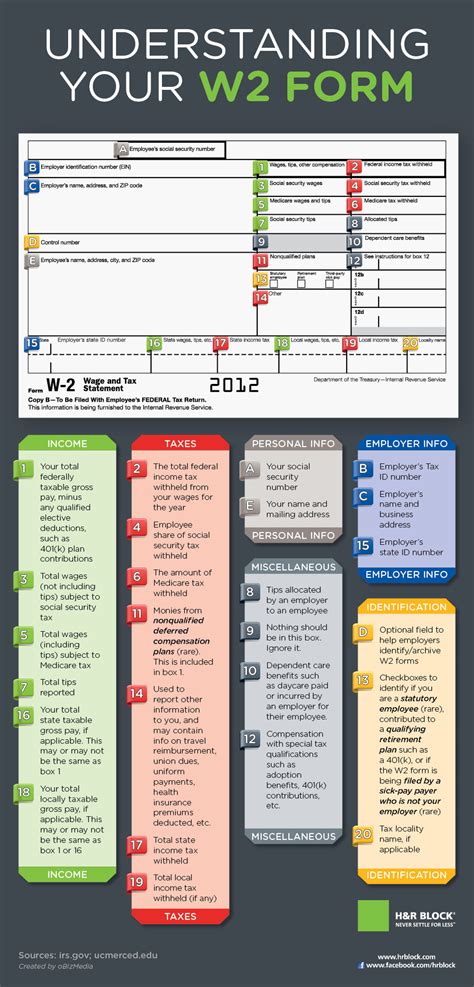

Keeping a copy of your EIN paperwork is vital for several reasons: - Verification Purposes: You may need to provide your EIN to verify your business’s identity when opening a bank account, applying for credit, or entering into contracts with other businesses. - Tax Compliance: Your EIN is necessary for filing tax returns and making tax payments. Having a copy of your EIN paperwork can help ensure you have the correct number and other essential details when dealing with tax-related matters. - Employee Hiring: If you plan to hire employees, you’ll need your EIN to report employment taxes and to complete necessary paperwork, such as W-4 forms.

How to Obtain a Copy of EIN Paperwork

If you’ve lost your original EIN confirmation letter or need a copy for your records, you can contact the IRS directly. Here are the steps to follow: - Call the IRS Business and Specialty Tax Line: You can reach the IRS at their Business and Specialty Tax Line at 1-800-829-4933. This line is available from 7:00 a.m. to 7:00 p.m. local time, Monday through Friday. - Visit the IRS Website: While you cannot directly download a copy of your EIN confirmation letter from the IRS website, you can find information on how to apply for an EIN and other related topics. - Write to the IRS: If you prefer, you can write to the IRS at the address listed on their official website, requesting a copy of your EIN confirmation letter. Be sure to include your business name, address, and a contact phone number.

📝 Note: When requesting a copy of your EIN paperwork, be prepared to provide identifying information about your business to verify your identity and ensure the security of your business's tax information.

Organizing Your Business Documents

Once you have a copy of your EIN paperwork, it’s crucial to store it securely along with other important business documents. Consider the following tips for organizing your business paperwork: - Digital Storage: Scan your documents and store them digitally in a secure cloud storage service. This can provide easy access and help protect against loss or damage. - Physical Storage: Keep physical copies of critical documents, such as your EIN confirmation letter, in a safe or a fireproof filing cabinet. - Regular Backups: Regularly backup your digital files to prevent loss in case of a technical failure or cyberattack.

Security and Privacy Considerations

Your EIN and related paperwork contain sensitive information about your business. It’s essential to handle this information with care to protect your business’s privacy and security: - Limit Access: Only share your EIN with individuals or entities that have a legitimate need to know. - Secure Disposal: When disposing of documents containing your EIN, use a shredder or secure disposal service to prevent unauthorized access.

Conclusion and Future Steps

Maintaining accurate and secure records, including your EIN paperwork, is a critical aspect of managing a successful business. By understanding the importance of your EIN, knowing how to obtain a copy of your paperwork, and implementing good organizational and security practices, you can ensure your business runs smoothly and remains in compliance with tax and other regulatory requirements. Remember, your EIN is a key identifier for your business, and handling it appropriately will protect your business’s integrity and facilitate your interactions with financial institutions, employees, and partners.

What is an Employer Identification Number (EIN)?

+

An Employer Identification Number (EIN) is a unique nine-digit number assigned by the IRS to identify a business for tax purposes.

How do I apply for an EIN?

+

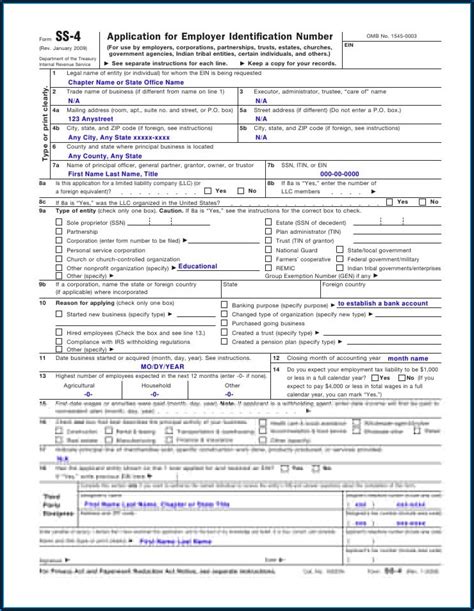

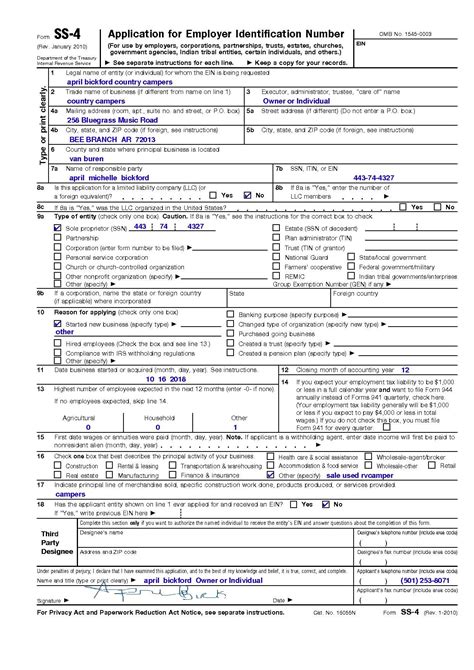

You can apply for an EIN online through the IRS website, by phone, or by mail or fax using Form SS-4.

Why is it important to keep a copy of my EIN paperwork?

+

Keeping a copy of your EIN paperwork is important for verification purposes, tax compliance, and hiring employees. It serves as proof of your business’s identity and is often required by financial institutions and other business partners.