5 Ways File Bankruptcy

Introduction to Filing Bankruptcy

Filing for bankruptcy can be a complex and daunting process, but it can also provide a fresh start for individuals and businesses overwhelmed by debt. There are several types of bankruptcy, each with its own rules and procedures. In this article, we will explore the different ways to file for bankruptcy, including the pros and cons of each option.

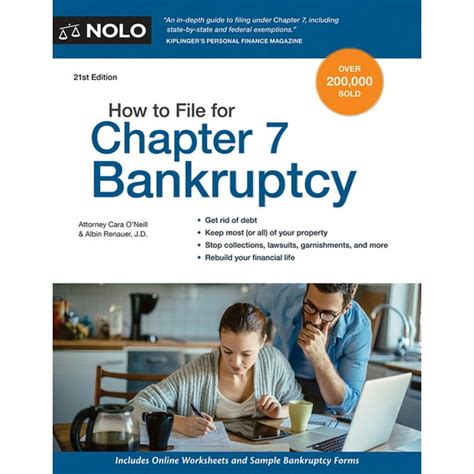

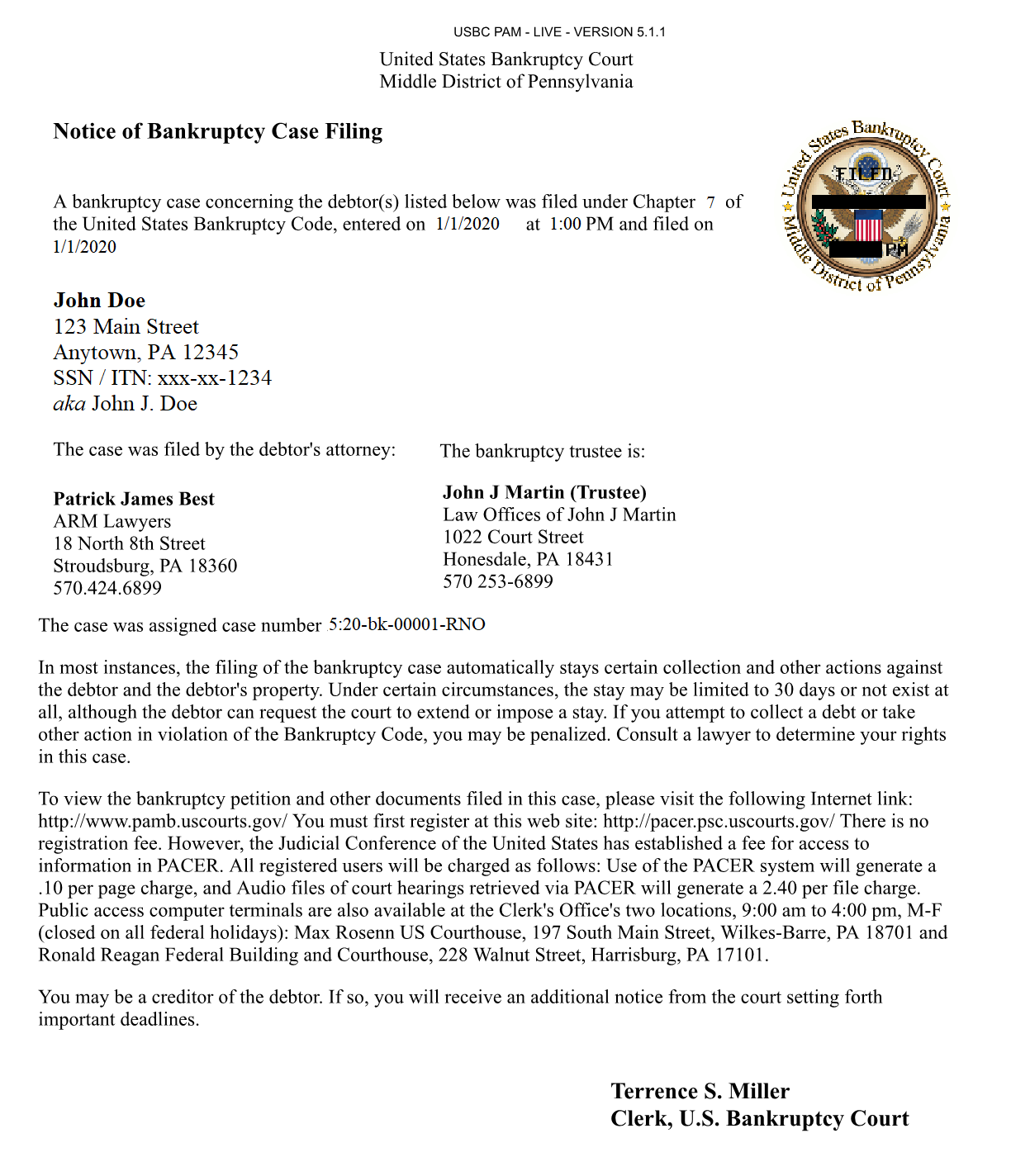

Chapter 7 Bankruptcy

Chapter 7 bankruptcy, also known as liquidation bankruptcy, is the most common type of bankruptcy. This type of bankruptcy involves the sale of non-exempt assets to pay off creditors. Non-exempt assets include property, vehicles, and other valuables, while exempt assets include primary residences, retirement accounts, and personal belongings. To file for Chapter 7 bankruptcy, individuals must pass a means test, which determines whether they have enough income to repay a portion of their debts.

Chapter 13 Bankruptcy

Chapter 13 bankruptcy, also known as reorganization bankruptcy, allows individuals to create a repayment plan to pay off a portion of their debts over time. This type of bankruptcy is ideal for individuals who have a steady income and want to keep their assets. To file for Chapter 13 bankruptcy, individuals must propose a repayment plan that outlines how they will pay off their debts over a period of three to five years.

Chapter 11 Bankruptcy

Chapter 11 bankruptcy is typically used by businesses, but individuals with significant assets and debts can also file for this type of bankruptcy. This type of bankruptcy involves the reorganization of debts and the creation of a repayment plan. Businesses that file for Chapter 11 bankruptcy can continue to operate while they repay their debts, while individuals can use this type of bankruptcy to repay debts and keep their assets.

Other Types of Bankruptcy

In addition to Chapter 7, Chapter 13, and Chapter 11 bankruptcy, there are other types of bankruptcy, including: * Chapter 12 bankruptcy: This type of bankruptcy is designed for family farmers and fishermen. * Chapter 9 bankruptcy: This type of bankruptcy is designed for municipalities. * Chapter 15 bankruptcy: This type of bankruptcy is designed for cross-border cases.

👉 Note: It's essential to consult with a bankruptcy attorney to determine which type of bankruptcy is best for your situation.

Steps to File Bankruptcy

To file for bankruptcy, follow these steps: * Determine which type of bankruptcy is best for your situation. * Gather financial documents, including income statements, expense reports, and debt lists. * Complete credit counseling and debt management courses. * File a petition with the bankruptcy court. * Attend a meeting of creditors. * Complete a financial management course.

Here is a table outlining the different types of bankruptcy:

| Type of Bankruptcy | Description |

|---|---|

| Chapter 7 | Liquidation bankruptcy |

| Chapter 13 | Reorganization bankruptcy |

| Chapter 11 | Reorganization bankruptcy for businesses and individuals |

In summary, filing for bankruptcy can be a complex process, but it can also provide a fresh start for individuals and businesses overwhelmed by debt. By understanding the different types of bankruptcy and following the steps to file, individuals can make informed decisions about their financial futures.

The key to a successful bankruptcy filing is to seek professional advice from a qualified bankruptcy attorney. They can help guide you through the process and ensure that you comply with all the necessary requirements.

Now that we have explored the different ways to file for bankruptcy, let’s move on to the final thoughts.

In final thoughts, it’s essential to approach bankruptcy with a clear understanding of the process and the potential outcomes. By doing so, individuals can make informed decisions about their financial futures and take the first steps towards a debt-free life.

What is the difference between Chapter 7 and Chapter 13 bankruptcy?

+

Chapter 7 bankruptcy involves the sale of non-exempt assets to pay off creditors, while Chapter 13 bankruptcy involves the creation of a repayment plan to pay off a portion of debts over time.

How long does the bankruptcy process take?

+

The length of the bankruptcy process varies depending on the type of bankruptcy and the complexity of the case. On average, Chapter 7 bankruptcy takes 4-6 months, while Chapter 13 bankruptcy takes 3-5 years.

Will filing for bankruptcy affect my credit score?

+

Yes, filing for bankruptcy can negatively affect your credit score. However, the impact of bankruptcy on credit scores can vary depending on the individual’s credit history and the type of bankruptcy filed.