Paperwork

5 Ways Get Bankruptcy Papers

Introduction to Bankruptcy Papers

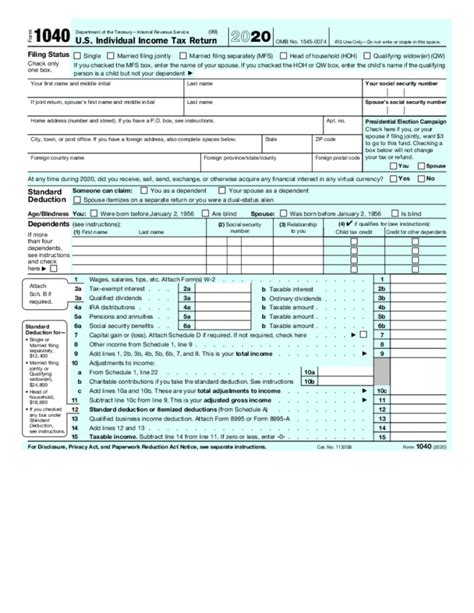

When an individual or a business is unable to repay their debts, they may consider filing for bankruptcy. This is a legal process that can provide relief from debt and help them start fresh. To initiate this process, one must obtain and complete the necessary bankruptcy papers. These documents are crucial as they provide detailed financial information about the debtor, including their income, expenses, assets, and liabilities. In this article, we will explore the ways to obtain bankruptcy papers and the steps involved in the process.

Understanding the Importance of Bankruptcy Papers

Bankruptcy papers are not just mere forms; they are legal documents that must be filled out accurately and thoroughly. Accuracy and honesty are paramount when completing these forms, as any discrepancies or omissions can lead to delays or even dismissal of the bankruptcy case. The primary purpose of these papers is to provide the court with a comprehensive overview of the debtor’s financial situation, which helps in determining the best course of action for debt relief.

5 Ways to Get Bankruptcy Papers

There are several ways to obtain the necessary bankruptcy papers. Here are five methods:

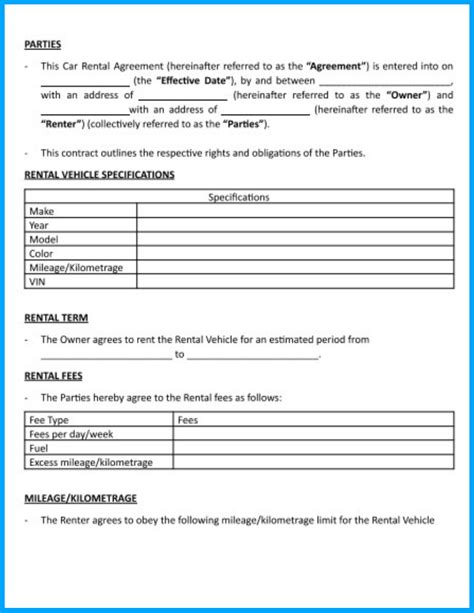

- Official Website of the U.S. Courts: The official website of the U.S. Courts provides access to all the necessary bankruptcy forms. These forms are available for download in PDF format and can be filled out electronically or printed and completed manually.

- Local Bankruptcy Court: Visiting the local bankruptcy court is another way to obtain the necessary papers. The court staff can provide guidance on which forms are needed and how to complete them correctly.

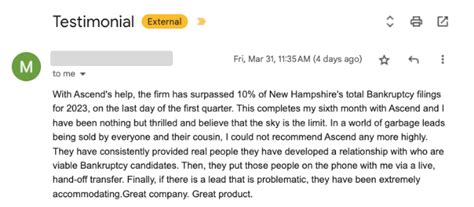

- Bankruptcy Attorney: Hiring a bankruptcy attorney can simplify the process of obtaining and completing the bankruptcy papers. Attorneys have the expertise to guide their clients through the complex legal process, ensuring that all forms are filled out accurately and submitted on time.

- Online Legal Services: Several online legal services offer bankruptcy forms and guidance on how to complete them. These services can be more affordable than hiring an attorney but may not offer the same level of personalized advice.

- Bankruptcy Software: There are software programs available that can help in preparing the bankruptcy papers. These programs guide the user through the process, ensuring that all necessary forms are completed and filed correctly.

Steps to Complete Bankruptcy Papers

Completing bankruptcy papers involves several steps:

- Gather Financial Information: Before starting to fill out the forms, it is essential to gather all relevant financial information, including income statements, expense records, asset valuations, and liability details.

- Choose the Correct Forms: Depending on the type of bankruptcy being filed (Chapter 7 or Chapter 13), different forms will be required. It is crucial to select the correct forms to avoid delays or complications in the process.

- Fill Out the Forms Accurately: Each form must be filled out completely and accurately. Any missing information or errors can lead to the rejection of the bankruptcy petition.

- Sign the Forms: Once all the forms are completed, they must be signed. This signifies that the information provided is true and accurate to the best of the debtor’s knowledge.

- File the Forms with the Court: The final step is to file the completed forms with the bankruptcy court. This can usually be done electronically or by mailing the documents to the court.

💡 Note: It is essential to ensure that all forms are filled out correctly and completely to avoid any issues with the bankruptcy filing.

Benefits of Filing for Bankruptcy

Filing for bankruptcy can provide several benefits to individuals and businesses overwhelmed by debt. Some of these benefits include:

- Debt Relief: Bankruptcy can provide a fresh start by eliminating or reducing debt.

- Protection from Creditors: Once a bankruptcy petition is filed, creditors are prohibited from making collection attempts, providing temporary relief from harassing phone calls and letters.

- Retaining Assets: Depending on the type of bankruptcy filed, it may be possible to retain certain assets, such as a primary residence or vehicle.

Conclusion

Obtaining and completing bankruptcy papers is the first step towards achieving debt relief through the bankruptcy process. By understanding the importance of these papers and the methods available for obtaining them, individuals and businesses can make informed decisions about their financial future. Whether through the official court website, a local bankruptcy court, a bankruptcy attorney, online legal services, or bankruptcy software, there are several ways to access the necessary forms. By following the steps to complete these forms accurately and filing them with the court, debtors can begin their journey towards a debt-free life.

What is the purpose of bankruptcy papers?

+

The primary purpose of bankruptcy papers is to provide the court with a comprehensive overview of the debtor’s financial situation, which helps in determining the best course of action for debt relief.

Where can I obtain bankruptcy papers?

+

Bankruptcy papers can be obtained from the official website of the U.S. Courts, a local bankruptcy court, a bankruptcy attorney, online legal services, or bankruptcy software.

What are the benefits of filing for bankruptcy?

+

Filing for bankruptcy can provide debt relief, protection from creditors, and the possibility of retaining certain assets.