Paperwork

Get Executor Paperwork Easily

Introduction to Executor Paperwork

When a person passes away, their estate must be managed and distributed according to their wishes as outlined in their will. The person responsible for this task is known as the executor or personal representative. The executor’s role involves a significant amount of paperwork, including legal documents, tax forms, and financial records. Navigating this process can be challenging, especially for those who are inexperienced in legal and financial matters.

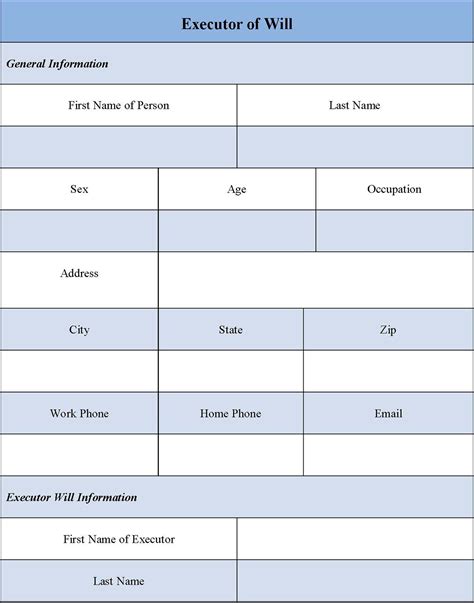

Understanding the Role of an Executor

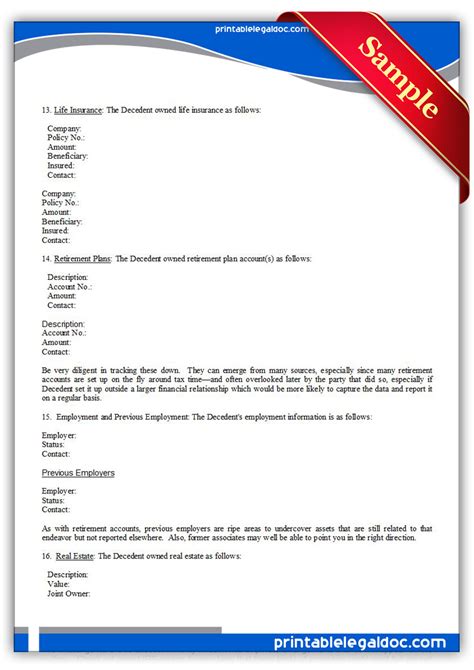

The executor is appointed by the deceased in their will to carry out the instructions contained within it. This role comes with a multitude of responsibilities, including: - Identifying and inventorying the estate’s assets: This includes all properties, investments, vehicles, personal belongings, and any other items of value. - Paying off debts and taxes: The executor must ensure that all of the deceased’s debts, including credit card bills, loans, and taxes, are paid. - Distributing assets: After debts and taxes are paid, the executor distributes the remaining assets according to the will. - Managing the estate’s finances: This may involve opening an estate bank account, paying bills, and possibly selling assets to cover expenses or to distribute cash to beneficiaries.

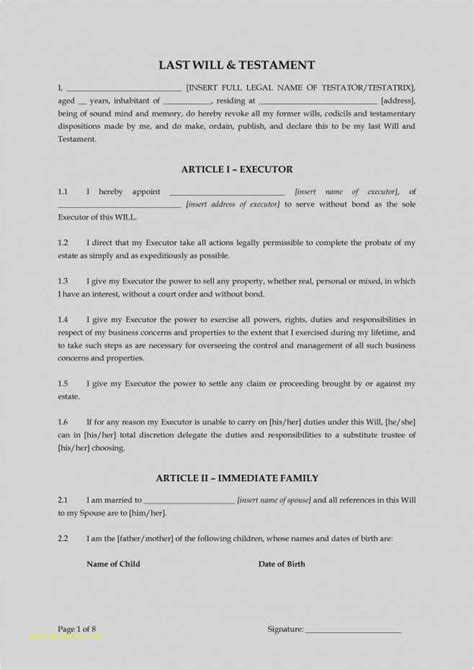

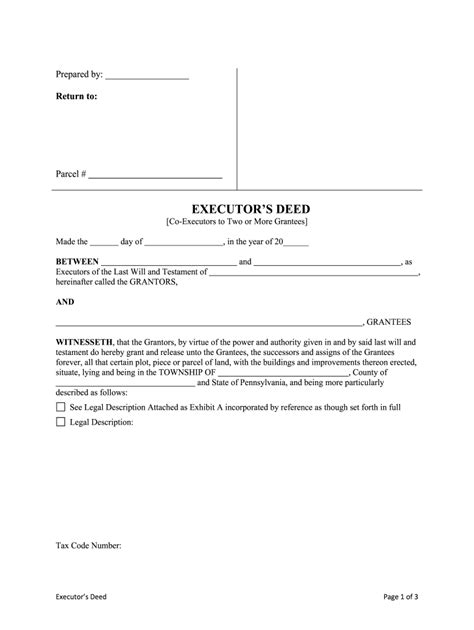

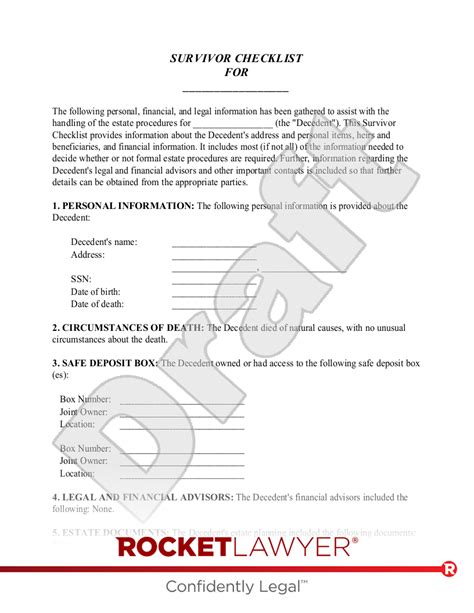

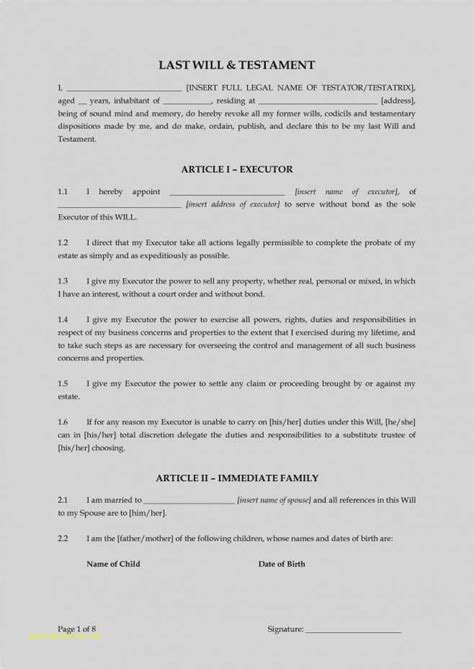

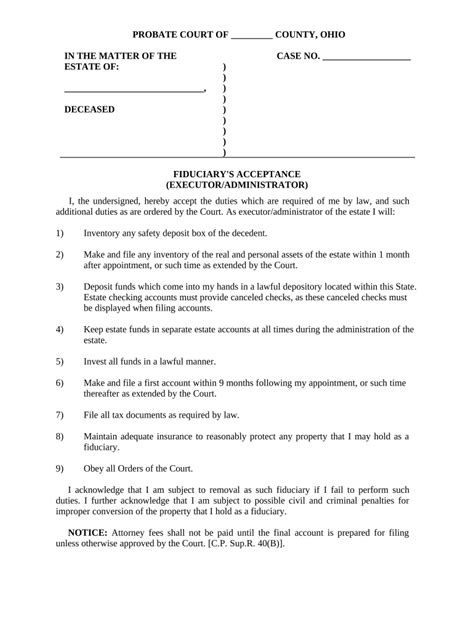

Executor Paperwork: A Breakdown

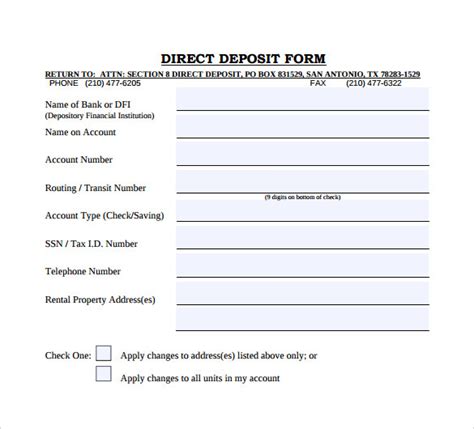

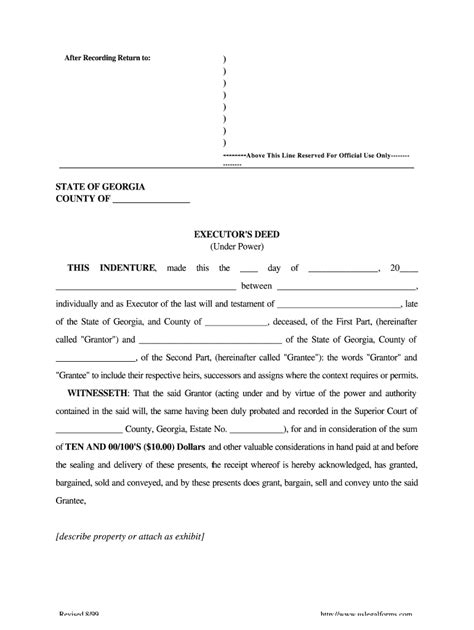

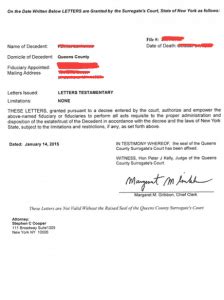

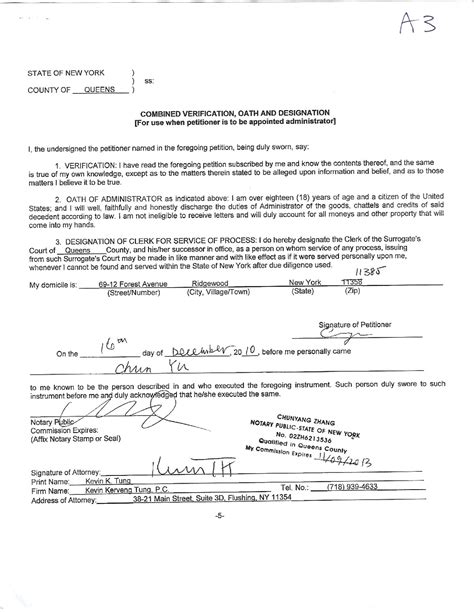

The paperwork involved in being an executor can be overwhelming. Key documents and tasks include: - Probate documents: If the estate goes through probate, the executor will need to file various legal documents with the court, including the will and a petition to open probate. - Inventory of assets: A detailed list of the estate’s assets and their values. - Tax returns: The executor must file the deceased’s final personal tax return, as well as any necessary estate tax returns. - Letters Testamentary: These are legal documents issued by the court that confirm the executor’s authority to manage the estate. - Estate accountings: Detailed records of all income, expenses, and distributions made from the estate.

Simplifying the Process

To make the process of handling executor paperwork easier, consider the following steps: - Seek professional help: An attorney specializing in estate law can guide you through the legal process and ensure all paperwork is correctly filled out and filed. - Keep detailed records: Organization is key. Keep all receipts, invoices, and correspondence related to the estate in a safe and accessible place. - Communicate with beneficiaries: Keeping the beneficiaries informed about the progress of the estate settlement can help manage expectations and reduce potential conflicts. - Understand estate taxes: While not all estates owe taxes, it’s crucial to understand the tax implications to ensure compliance with tax laws and to minimize tax liabilities.

Technology and Executor Paperwork

In recent years, technology has played an increasingly significant role in simplifying the process of managing executor paperwork. Online platforms and software designed for estate management can help with tasks such as: - Organizing documents: Securely storing and accessing important documents digitally. - Tracking finances: Easily monitoring income and expenses related to the estate. - Communicating with beneficiaries and professionals: Secure and organized communication tools can facilitate updates and discussions.

| Document | Description |

|---|---|

| Will | The legal document that outlines how the deceased wants their estate to be distributed. |

| Letters Testamentary | Confirm the executor's authority to act on behalf of the estate. |

| Tax Returns | Final personal tax return of the deceased and any necessary estate tax returns. |

📝 Note: It's essential to consult with a legal professional to ensure all legal requirements are met and to navigate the complexities of estate law.

Conclusion and Final Thoughts

Being an executor is a significant responsibility that involves a considerable amount of paperwork and legal compliance. By understanding the role, simplifying the process through organization and professional help, and leveraging technology, executors can more efficiently manage the estate and fulfill their duties. Remember, the process can be complex and time-consuming, but with the right approach and support, it can be navigated successfully.

What is the primary role of an executor?

+

The primary role of an executor is to manage the estate of the deceased, ensuring that all debts are paid, taxes are filed, and assets are distributed according to the will.

Do all estates need to go through probate?

+

No, not all estates need to go through probate. The necessity for probate depends on the size of the estate, the types of assets, and the laws of the jurisdiction where the deceased lived.

How can technology help with executor paperwork?

+

Technology can help by providing secure platforms for organizing documents, tracking finances, and communicating with beneficiaries and professionals. This can make the process more efficient and reduce the risk of errors.