5 Ways Get Tax Paperwork

Introduction to Tax Paperwork

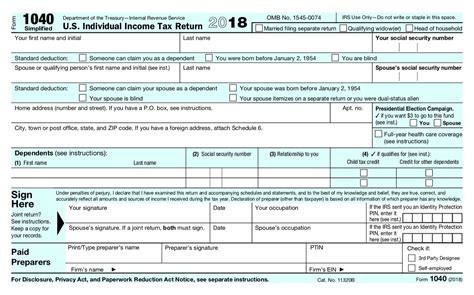

When it comes to managing finances, one of the most critical aspects is handling tax paperwork. Tax paperwork encompasses a wide range of documents and forms required for filing taxes, applying for tax refunds, or claiming tax deductions. For individuals and businesses alike, understanding how to obtain and manage these documents is essential for compliance with tax laws and regulations. In this article, we will explore five ways to get tax paperwork, highlighting the importance of each method and providing insights into how they can be used effectively.

Understanding Tax Paperwork

Before diving into the methods of obtaining tax paperwork, it’s crucial to understand what tax paperwork entails. Tax paperwork includes but is not limited to: - W-2 forms for employees, showing their income and taxes withheld. - 1099 forms for freelancers and independent contractors, detailing their income. - Receipts for expenses that can be deducted, such as charitable donations or business expenses. - Tax returns from previous years, which can be necessary for audits or as references for future filings.

Method 1: Directly from Employers or Clients

For employees, one of the primary sources of tax paperwork is their employer. Employers are required to provide W-2 forms to their employees by the end of January each year, detailing the employee’s income and the amount of taxes withheld. Similarly, clients are supposed to provide 1099 forms to freelancers and independent contractors, showing the amount paid to them during the tax year. It’s essential to ensure these forms are accurate and received in a timely manner to facilitate smooth tax filing.

Method 2: Online Platforms and Portals

Many employers, banks, and investment companies now offer online platforms where individuals can access their tax documents. These platforms are secure and convenient, allowing users to download or print their tax paperwork directly. Some notable platforms include: - ADP for payroll services. - TurboTax or H&R Block for tax preparation and filing. - Bank websites for accessing 1099-INT forms for interest income.

Method 3: Requesting from the IRS

In cases where tax paperwork is missing or not received, individuals can request these documents from the Internal Revenue Service (IRS). The IRS provides transcripts of tax returns, which can be useful for various purposes, including applying for loans or verifying income. Requests can be made online through the IRS website or by calling the IRS directly.

Method 4: Through Tax Preparation Services

Tax preparation services like TaxAct, Credit Karma Tax, and FreeTaxUSA offer another avenue for obtaining and managing tax paperwork. These services not only help in preparing and filing tax returns but also provide access to necessary forms and documents. They often have tools to import W-2 and 1099 forms directly from employers and financial institutions, streamlining the tax preparation process.

Method 5: Directly from Financial Institutions

Financial institutions, such as banks and investment firms, are also sources of tax paperwork. They provide forms like 1099-INT for interest income, 1099-DIV for dividend income, and 1099-B for capital gains and losses from the sale of securities. These forms are usually mailed to account holders by the end of January or made available through online banking platforms.

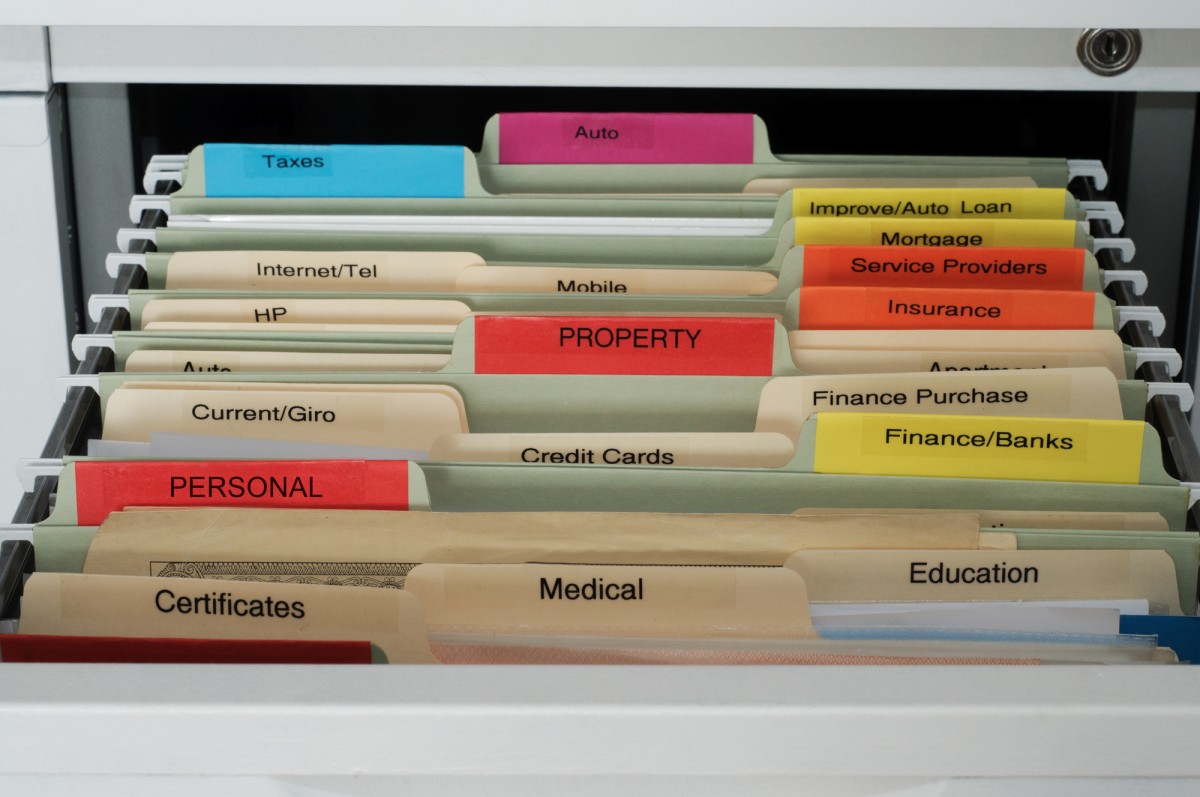

📝 Note: When dealing with tax paperwork, it's essential to keep all documents organized and easily accessible, as they may be needed for future reference or in case of an audit.

To manage tax paperwork effectively, consider the following tips: - Keep digital copies of all tax documents in a secure and backed-up location. - Set reminders for important tax-related deadlines. - Review tax paperwork carefully for accuracy before filing.

In the realm of tax management, being proactive and organized is key. By understanding the various methods of obtaining tax paperwork and implementing effective management strategies, individuals and businesses can navigate the complex world of taxation with greater ease and confidence.

To summarize the key points, the five methods outlined provide comprehensive coverage for obtaining necessary tax documents. Whether through direct issuance by employers or clients, online platforms, the IRS, tax preparation services, or financial institutions, each method plays a vital role in the tax filing process. Effective management of these documents is also crucial, emphasizing the need for organization and diligence in handling tax paperwork.

What is the deadline for receiving W-2 forms from employers?

+

Employers are required to provide W-2 forms to their employees by January 31st of each year.

How can I request a transcript of my tax return from the IRS?

+

You can request a transcript of your tax return online through the IRS website or by calling the IRS directly.

What types of tax paperwork can I access through online banking?

+

Through online banking, you can typically access forms like 1099-INT for interest income, 1099-DIV for dividend income, and sometimes W-2 forms if your employer participates in the service.