5 Documents Needed

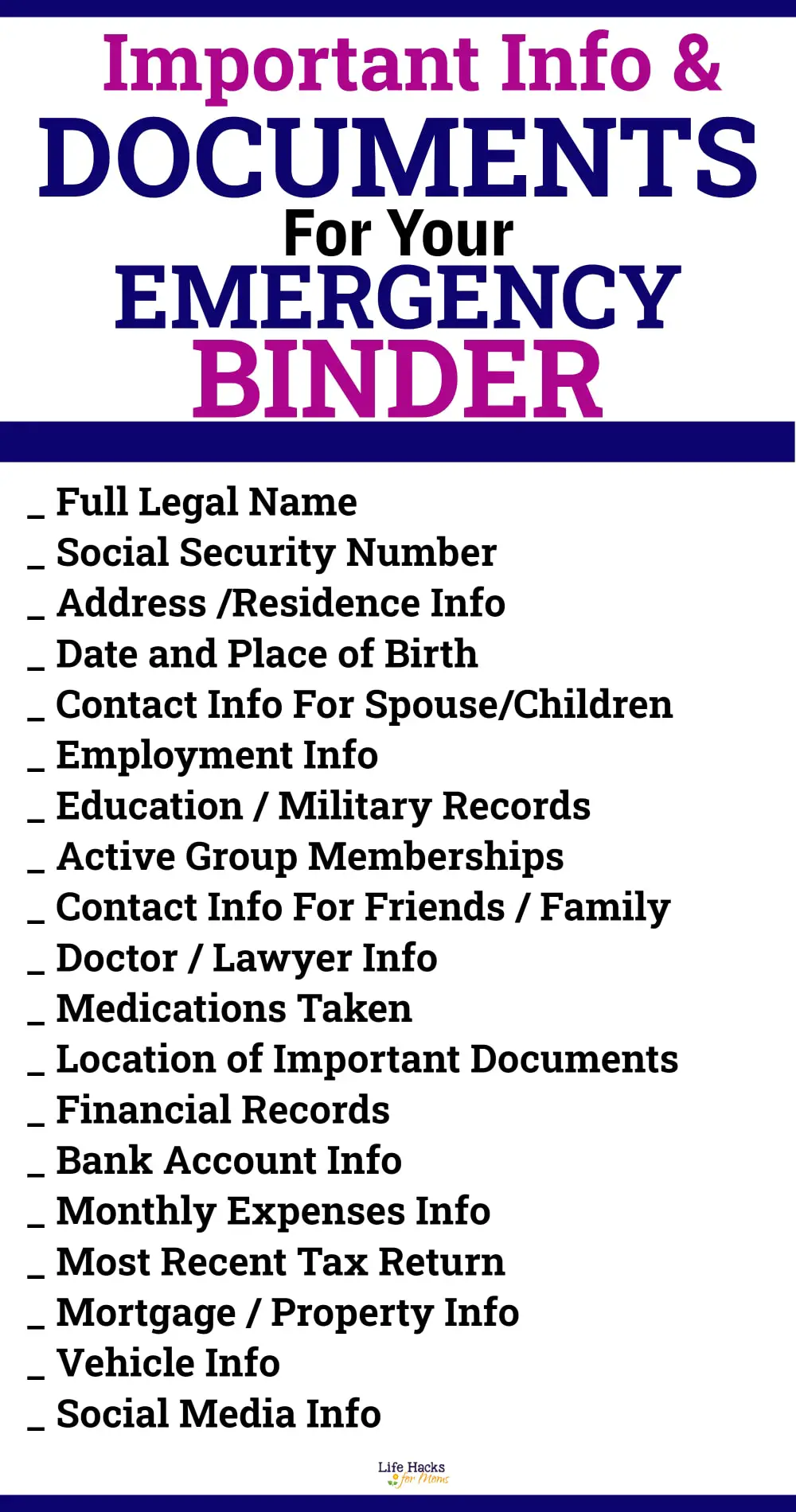

Introduction to Essential Documents

When it comes to legal, financial, and personal matters, having the right documents in order is crucial. These documents not only help in times of emergencies but also ensure that your wishes are respected and your loved ones are protected. In this article, we will discuss five essential documents that everyone should have.

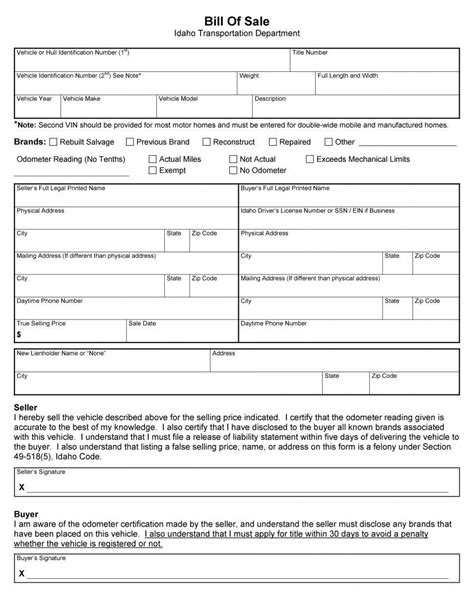

1. Last Will and Testament

A Last Will and Testament is a legal document that outlines how you want your assets to be distributed after your death. It includes details such as who will inherit your property, who will be the guardian of your minor children, and who will manage your estate. Having a will ensures that your wishes are carried out and reduces the likelihood of disputes among your heirs.

2. Power of Attorney

A Power of Attorney is a document that grants someone you trust the authority to make decisions on your behalf if you become incapacitated. This can include financial decisions, such as managing your bank accounts, and personal decisions, such as making medical choices. There are different types of Power of Attorney, including durable, springing, and limited.

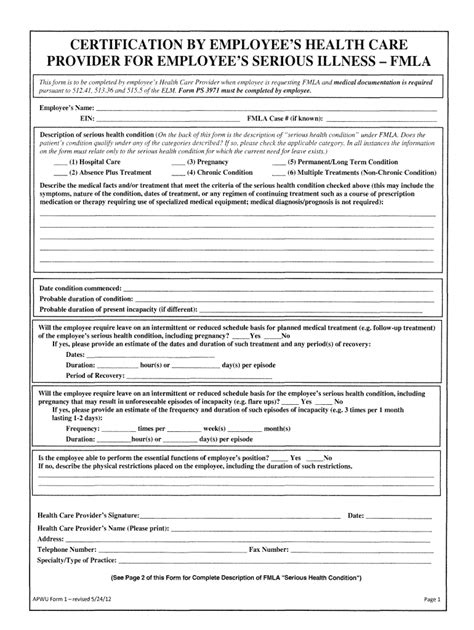

3. Advance Directive

An Advance Directive is a document that outlines your wishes for end-of-life medical care. It includes a Living Will, which specifies the type of care you want to receive if you are terminally ill or permanently unconscious, and a Healthcare Proxy, which appoints someone to make medical decisions on your behalf. Having an Advance Directive ensures that your wishes are respected and reduces the burden on your loved ones.

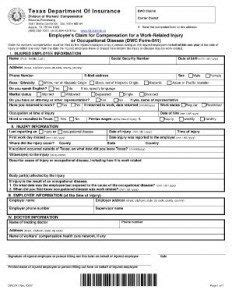

4. Insurance Policies

Insurance Policies, such as life insurance, disability insurance, and long-term care insurance, provide financial protection for you and your loved ones. These policies can help replace your income if you become disabled, provide for your dependents if you die, and cover the cost of long-term care if you need it.

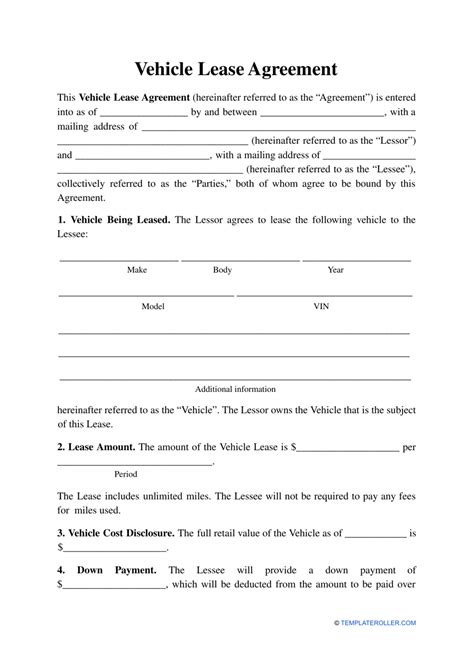

5. Trust

A Trust is a legal arrangement that allows you to transfer assets to a trustee, who manages them for the benefit of your beneficiaries. There are different types of trusts, including revocable and irrevocable trusts. Trusts can help you avoid probate, reduce estate taxes, and protect your assets from creditors.

📝 Note: It's essential to review and update your documents regularly to ensure they reflect your current wishes and circumstances.

To summarize, having the right documents in order is crucial for protecting your assets, respecting your wishes, and ensuring the well-being of your loved ones. The five essential documents discussed in this article are a Last Will and Testament, Power of Attorney, Advance Directive, Insurance Policies, and Trust. By having these documents in place, you can have peace of mind knowing that you are prepared for any situation that may arise.

What is the purpose of a Last Will and Testament?

+

The purpose of a Last Will and Testament is to outline how you want your assets to be distributed after your death and to appoint a guardian for your minor children.

What is the difference between a Power of Attorney and an Advance Directive?

+

A Power of Attorney grants someone the authority to make financial and personal decisions on your behalf, while an Advance Directive outlines your wishes for end-of-life medical care.

Do I need to have all five documents?

+

No, you may not need all five documents, but it’s essential to have the ones that apply to your situation. Consult with an attorney or financial advisor to determine which documents are right for you.