LLC Paperwork Processing Time

Understanding LLC Paperwork Processing Time

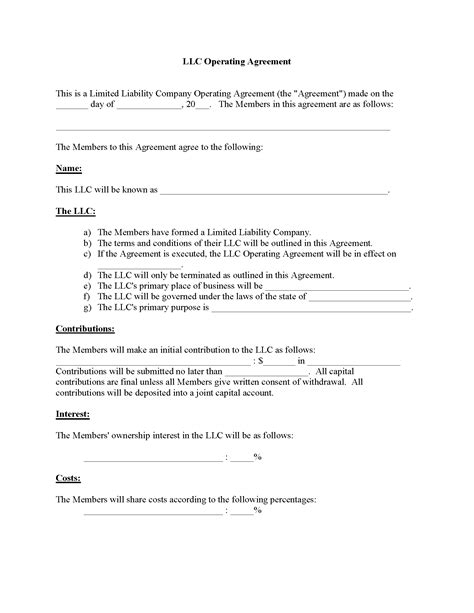

When deciding to form a Limited Liability Company (LLC), one of the key factors to consider is the processing time for the necessary paperwork. The time it takes for the state to process LLC formation documents can vary significantly from one state to another. Factors such as the method of filing, the complexity of the application, and the workload of the state’s business registration office can all impact how quickly the LLC is formally established.

Factors Affecting Processing Time

Several factors can influence the LLC paperwork processing time. These include: - Filing Method: The method used to file the LLC formation documents can significantly affect the processing time. Online filings are generally processed faster than mail-in filings. - State Workload: The volume of business registrations and other filings the state is handling at any given time can impact processing times. States with higher volumes may take longer to process paperwork. - Application Complexity: The simplicity or complexity of the LLC application can also affect processing time. Applications with errors or omissions may be delayed or even rejected, requiring resubmission.

Typical Processing Times by State

While it’s challenging to provide an exact processing time for every state due to the variables involved, here is a general overview of what you might expect:

| State | Typical Processing Time |

|---|---|

| Alabama | 2-3 business days (online), 3-5 business days (mail) |

| California | 3-5 business days (online), 15-20 business days (mail) |

| New York | 2-3 business days (online), 7-10 business days (mail) |

| Florida | 1-2 business days (online), 5-7 business days (mail) |

It’s essential to check with the specific state where you are forming your LLC for the most current and detailed information regarding processing times.

Expedited Services

For those who need their LLC formation processed quickly, many states offer expedited services for an additional fee. These services can significantly reduce the processing time, in some cases to as little as 24 hours. The cost and availability of expedited services vary by state, so it’s crucial to inquire about these options when you submit your application.

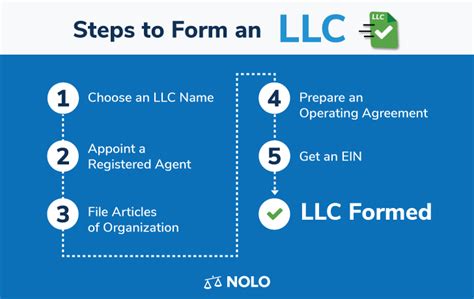

Preparing for the Formation Process

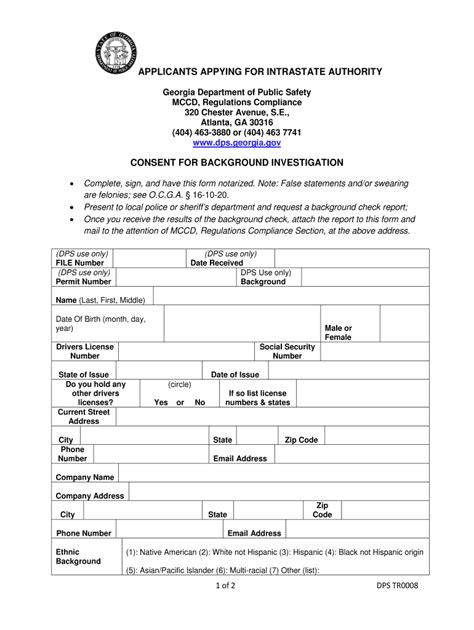

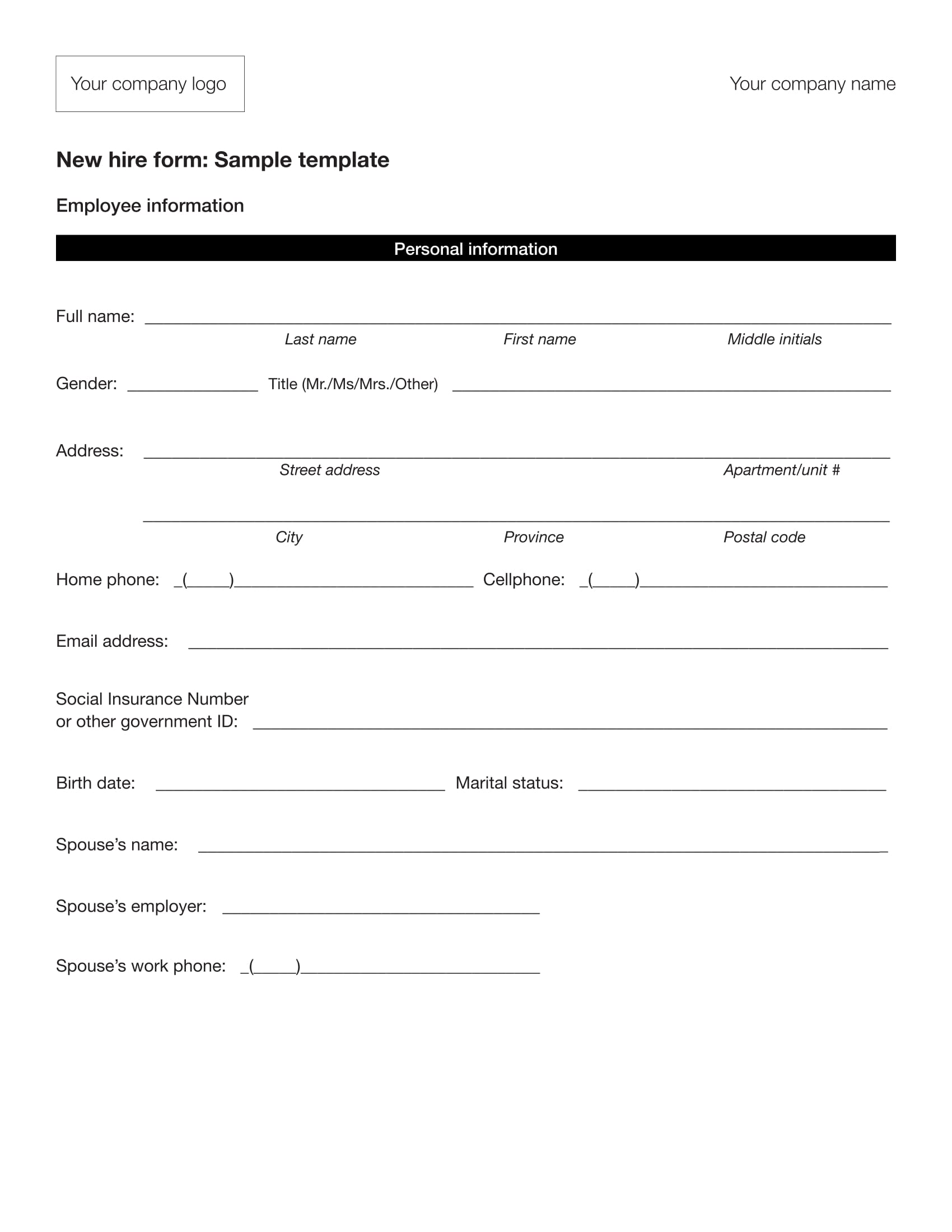

To ensure a smooth and efficient LLC formation process, it’s vital to be well-prepared. This includes: - Choosing a unique business name that complies with the state’s naming requirements. - Appointing a registered agent who has a physical address in the state where the LLC is being formed. - Preparing the necessary formation documents, which typically include the Articles of Organization. - Ensuring all information is accurate and complete to avoid delays or rejection.

💡 Note: It's highly recommended to consult with a legal or business professional to ensure all aspects of the LLC formation are properly handled, especially for complex businesses or those with multiple members.

Maintaining Compliance

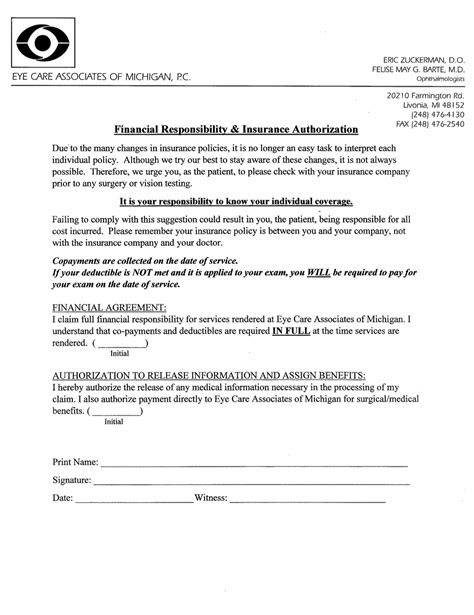

After the LLC is formed, it’s essential to maintain compliance with state regulations. This includes filing annual reports and maintaining a registered agent. Failure to comply with these requirements can result in fines, penalties, or even the dissolution of the LLC.

In summary, the LLC paperwork processing time can vary based on several factors including the state, filing method, and complexity of the application. Understanding these factors and being prepared can help streamline the formation process. Whether you’re forming a new business or expanding an existing one, being informed about the LLC formation process is key to a successful and compliant business operation.

To finalize, forming an LLC requires careful planning and attention to detail to navigate the paperwork and processing times effectively. By understanding the factors that influence processing times and being prepared, entrepreneurs can set their businesses up for success from the very start.

What is the fastest way to form an LLC?

+

The fastest way to form an LLC is typically through online filing with expedited services, which can process the application in as little as 24 hours in some states.

How do I check the status of my LLC application?

+

You can usually check the status of your LLC application by visiting the website of the state’s business registration office or by contacting them directly via phone or email.

What happens if my LLC application is rejected?

+

If your LLC application is rejected, you will be notified of the reasons for the rejection. You can then correct the issues and resubmit the application. It’s advisable to seek professional help to ensure the application is accurate and complete before resubmission.