Get ATM Paperwork Easily

Introduction to ATM Paperwork

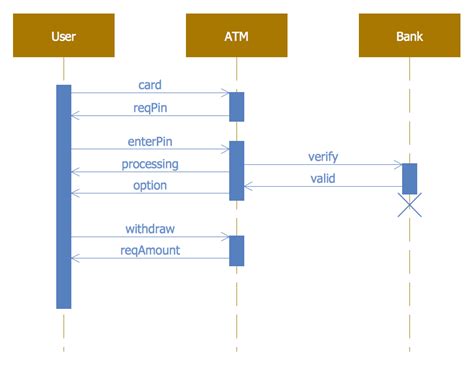

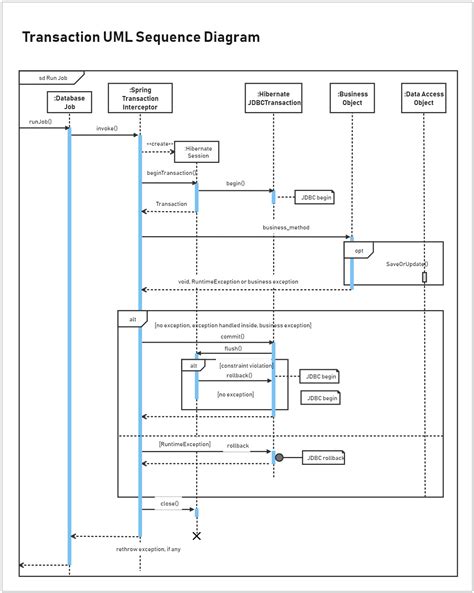

Managing finances and keeping track of transactions are essential aspects of personal and business financial management. One of the key tools for this purpose is the Automated Teller Machine (ATM). When using an ATM, it’s crucial to understand the importance of the paperwork associated with these transactions, such as receipts and statements. This paperwork serves as a record of your transactions, helping you keep track of your account balance, identify any potential discrepancies, and manage your finances more effectively.

Understanding the Importance of ATM Paperwork

ATM paperwork is not just a piece of paper; it’s a vital document that provides a record of your financial transactions. Keeping these records can help you in several ways: - Tracking Expenses: By retaining ATM receipts, you can monitor your spending habits and make adjustments as needed to stay within your budget. - Identifying Discrepancies: Regularly reviewing your ATM statements and receipts can help you identify any unauthorized transactions or errors, allowing you to report them to your bank promptly. - Budgeting: Having a clear picture of your income and expenses, as reflected in your ATM paperwork, enables you to create a more accurate and effective budget.

How to Obtain ATM Paperwork Easily

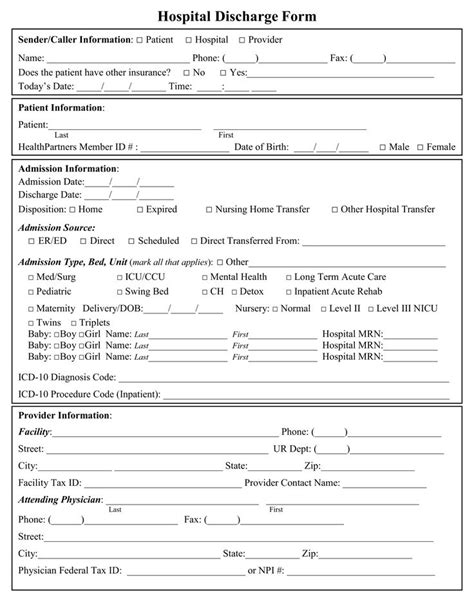

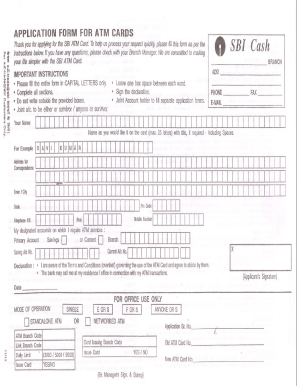

Obtaining ATM paperwork is relatively straightforward. Here are the steps to follow: - ATM Receipts: Whenever you use an ATM for a transaction, ensure you take the receipt provided. This receipt will contain details of the transaction, including the date, time, amount, and your remaining balance. - Online Banking: Most banks offer online banking services where you can view your account statements and transaction history. This is a convenient way to access your ATM paperwork electronically. - Mobile Banking Apps: Many banks have mobile apps that allow you to manage your accounts, including viewing transaction history and downloading statements directly to your device. - Bank Branch Visit: If you prefer physical copies or need them for record-keeping, you can visit your bank’s branch and request printed statements or specific transaction records.

Tips for Managing ATM Paperwork

Effective management of ATM paperwork involves organization and regular review. Here are some tips: - Digital Storage: Consider scanning your ATM receipts and statements and storing them digitally. This not only saves physical space but also makes it easier to search and retrieve specific documents when needed. - Regular Audits: Schedule regular audits of your financial transactions to ensure everything is in order. This can help in early detection of any fraudulent activities or banking errors. - Secure Disposal: When disposing of ATM paperwork, ensure you do so securely to prevent identity theft or fraud. Shredding documents is a recommended practice.

📝 Note: Always keep your ATM paperwork in a safe and secure location, whether physical or digital, to protect your financial information.

Benefits of Digital ATM Paperwork

The shift towards digital ATM paperwork offers several benefits, including: - Environmentally Friendly: Reduces the need for physical paper, contributing to a more sustainable environment. - Convenience: Digital documents are easily accessible from anywhere and at any time, provided you have an internet connection. - Security: Digital storage can be highly secure, with options for encryption and password protection, reducing the risk of fraud or loss.

Challenges and Solutions

While digital ATM paperwork offers many advantages, there are also challenges to consider: - Technical Issues: Dependence on digital systems can sometimes be hindered by technical glitches or internet connectivity issues. - Security Concerns: The risk of cyberattacks and data breaches is a significant concern when storing sensitive financial information digitally. - Accessibility: Not everyone may have equal access to digital technologies, potentially excluding some individuals from the benefits of digital ATM paperwork.

| Format | Benefits | Challenges |

|---|---|---|

| Physical | Tangible record, easy to understand | Space-consuming, security risks |

| Digital | Convenient, environmentally friendly, secure | Technical issues, accessibility concerns |

In summary, managing ATM paperwork, whether physical or digital, is a crucial aspect of financial management. By understanding its importance, knowing how to obtain it easily, and implementing effective management strategies, individuals can better control their finances and protect their financial information.

What is the purpose of ATM paperwork?

+

ATM paperwork, such as receipts and statements, serves as a record of your financial transactions, helping you track expenses, identify discrepancies, and manage your finances effectively.

How can I obtain my ATM transaction records?

+

You can obtain your ATM transaction records through ATM receipts, online banking, mobile banking apps, or by visiting your bank’s branch.

What are the benefits of digital ATM paperwork?

+

The benefits of digital ATM paperwork include convenience, environmental sustainability, and enhanced security through encryption and password protection.