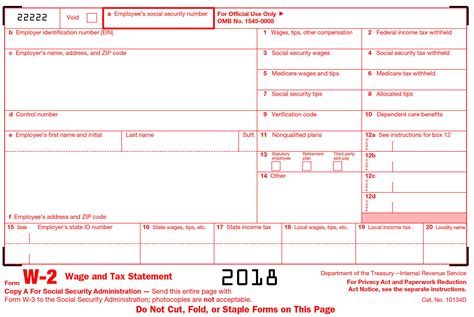

Get Last Year Tax Return Paperwork

Understanding the Importance of Last Year’s Tax Return Paperwork

When it comes to filing taxes, having access to last year’s tax return paperwork is crucial for a variety of reasons. Whether you’re looking to file your current year’s taxes, apply for a loan, or simply need to verify your income, having this paperwork readily available can save you time and stress. In this article, we’ll explore the ways to obtain last year’s tax return paperwork and highlight the significance of keeping accurate records.

Why Do I Need Last Year’s Tax Return Paperwork?

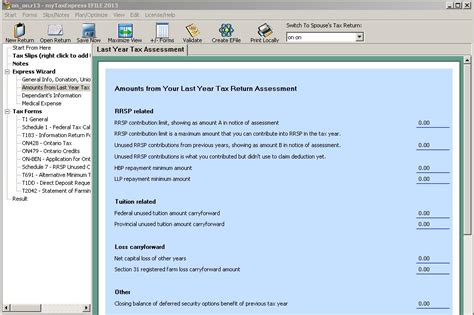

There are several scenarios where you might need to access your last year’s tax return paperwork. Some of the most common reasons include: * Filing Current Year’s Taxes: The IRS requires you to report certain information from your previous year’s tax return, such as your Adjusted Gross Income (AGI), to file your current year’s taxes. * Applying for Loans or Credit: Lenders often request tax return transcripts to verify your income and assess your creditworthiness. * Verifying Income for Scholarships or Financial Aid: Students and their families may need to provide tax return transcripts to verify income for scholarship or financial aid applications. * Audits and Tax-Related Issues: In the event of an audit or tax-related issue, having access to your previous year’s tax return paperwork can help resolve the matter more efficiently.

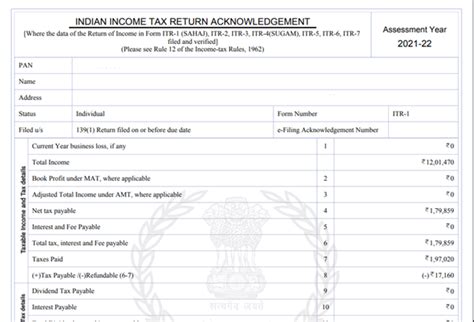

How to Get Last Year’s Tax Return Paperwork

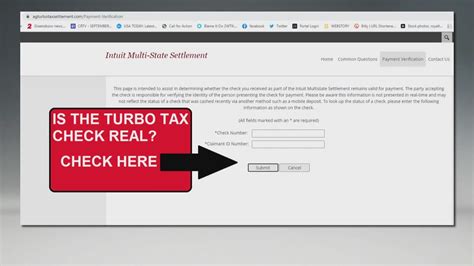

If you’ve misplaced your last year’s tax return paperwork or need a copy for any of the reasons mentioned above, don’t worry – there are several ways to obtain it: * IRS Website: You can request a transcript of your tax return online through the IRS website. This service is free and available for the current tax year and the previous three tax years. * IRS Phone: You can also call the IRS directly to request a transcript of your tax return. Be prepared to provide your Social Security number, date of birth, and address to verify your identity. * Mail or Fax: If you prefer to request a transcript by mail or fax, you can complete Form 4506-T and submit it to the IRS. This method may take longer, but it’s still an option. * Tax Preparation Software: If you used tax preparation software like TurboTax or H&R Block to file your taxes, you may be able to access your previous year’s tax return through their website or by contacting their customer support.

Tips for Keeping Accurate Tax Records

To avoid the hassle of trying to obtain last year’s tax return paperwork, it’s essential to keep accurate and organized tax records. Here are some tips to help you do so: * Store Electronic Copies: Save electronic copies of your tax returns, including any supporting documentation, in a secure and easily accessible location, such as an external hard drive or cloud storage. * Keep Paper Copies: Store paper copies of your tax returns and supporting documentation in a fireproof safe or a secure location, such as a safe deposit box. * Organize Your Records: Keep your tax records organized by year, and consider using a binder or folder to store each year’s documents. * Back Up Your Records: Regularly back up your electronic tax records to prevent loss or corruption.

📝 Note: It's essential to keep your tax records for at least three years in case of an audit or tax-related issue. However, it's recommended to keep them for longer, typically six years or more, to ensure you have access to the information you need.

Common Mistakes to Avoid When Requesting Last Year’s Tax Return Paperwork

When requesting last year’s tax return paperwork, there are some common mistakes to avoid: * Not Verifying Identity: Failing to verify your identity when requesting a transcript can lead to delays or rejection of your request. * Not Providing Required Information: Failing to provide the required information, such as your Social Security number or address, can lead to delays or rejection of your request. * Not Checking for Errors: Failing to check your transcript for errors or discrepancies can lead to issues with your tax return or other financial applications.

| Method | Availability | Cost |

|---|---|---|

| IRS Website | Current and previous three tax years | Free |

| IRS Phone | Current and previous three tax years | Free |

| Mail or Fax | Current and previous six tax years | Free |

| Tax Preparation Software | Varies depending on software | Varies depending on software |

In the end, having access to last year’s tax return paperwork is essential for a variety of reasons. By understanding the importance of keeping accurate tax records and avoiding common mistakes, you can ensure a smoother and more efficient process when requesting your tax return transcript. Remember to store your tax records securely, both electronically and in paper form, and consider using tax preparation software to help you stay organized. With the right knowledge and preparation, you’ll be well on your way to managing your tax records like a pro.

How long does it take to receive a tax return transcript?

+

The processing time for a tax return transcript varies depending on the method you choose. Online requests are typically processed immediately, while phone and mail requests may take 5-10 business days.

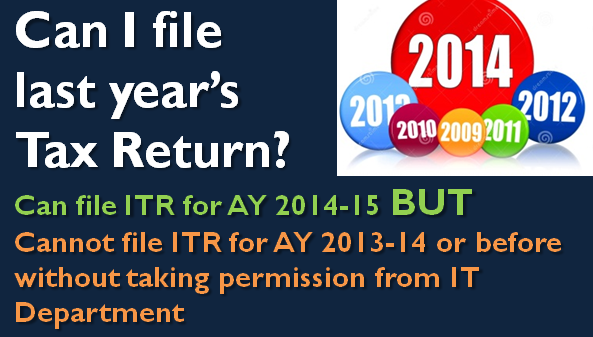

Can I request a tax return transcript for a previous year?

+

Yes, you can request a tax return transcript for a previous year. The IRS provides transcripts for the current tax year and the previous six tax years.

What information do I need to provide to verify my identity when requesting a tax return transcript?

+

To verify your identity, you’ll need to provide your Social Security number, date of birth, and address. You may also need to provide additional information, such as your filing status and AGI from your previous year’s tax return.