Get Executor of Estate Paperwork

Understanding the Role of an Executor in Estate Planning

When a person passes away, their estate, which includes all their assets, debts, and properties, needs to be managed and distributed according to their wishes as outlined in their will. The person responsible for this task is known as the executor of the estate. The executor plays a crucial role in ensuring that the deceased person’s estate is handled properly, which includes paying off debts, managing assets, and distributing the estate to the beneficiaries as specified in the will.

The process of getting executor of estate paperwork involves several steps, including probate, which is the legal process of validating a will and appointing an executor. The executor must apply to the court to open a probate estate, and once the will is validated, the executor is officially appointed and can begin managing the estate.

Steps to Become an Executor of an Estate

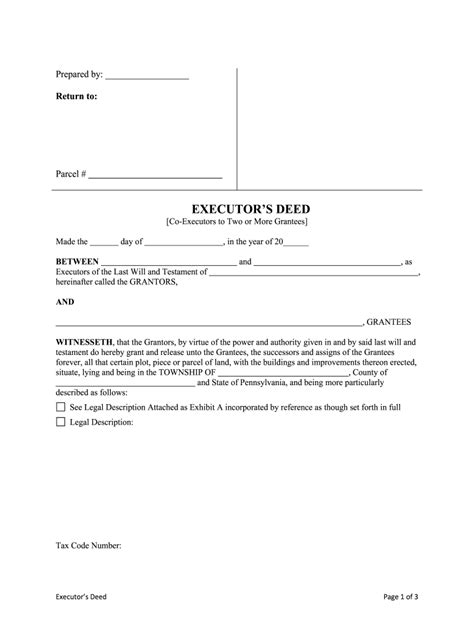

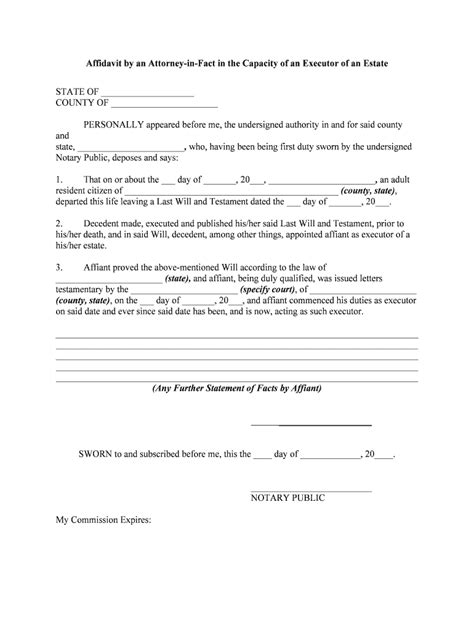

To become an executor of an estate, one must follow specific steps and obtain the necessary paperwork. Here are the general steps involved: - Nomination in the Will: The first step to becoming an executor is to be nominated in the will of the deceased. The testator (the person making the will) chooses an executor they trust to manage their estate according to their wishes. - Application for Probate: After the testator’s death, the nominated executor applies to the court for probate. This involves submitting the will and other required documents to the probate court. - Court Approval: The court reviews the application and the will to ensure it is valid. If everything is in order, the court issues a document known as Letters Testamentary or Letters of Administration, which officially appoints the executor and grants them the legal authority to manage the estate. - Inventory of Estate Assets: The executor must then create an inventory of the estate’s assets, which includes real estate, personal property, bank accounts, investments, and any other assets the deceased owned. - Paying Debts and Taxes: The executor is responsible for paying any debts the estate owes, as well as filing tax returns on behalf of the estate. - Distribution of Assets: Finally, the executor distributes the remaining assets to the beneficiaries according to the will.

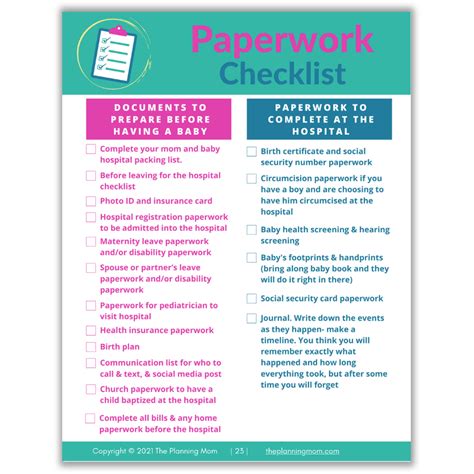

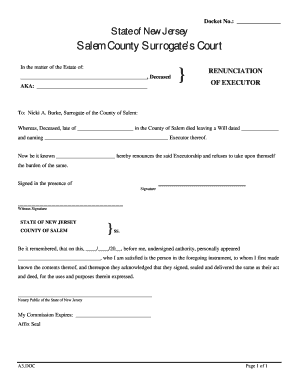

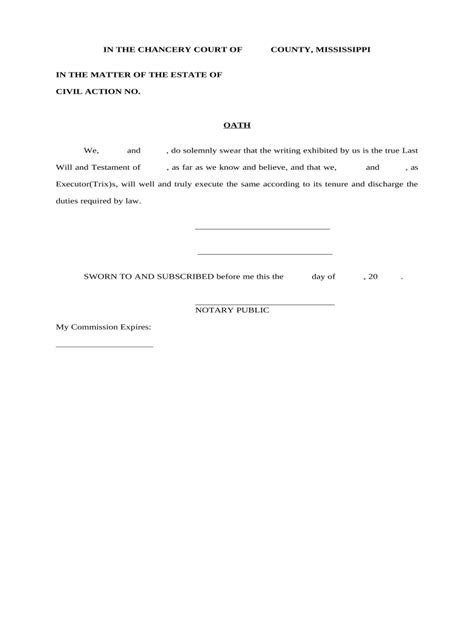

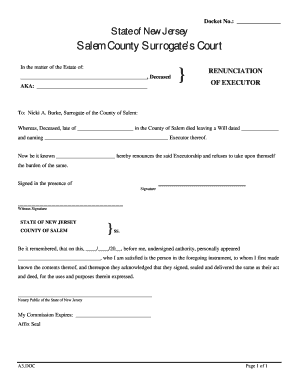

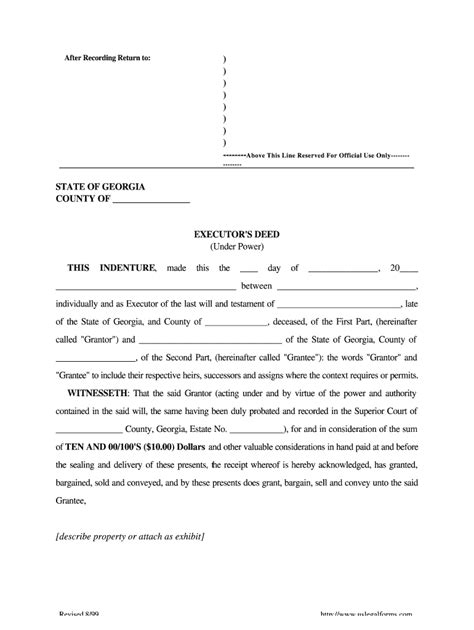

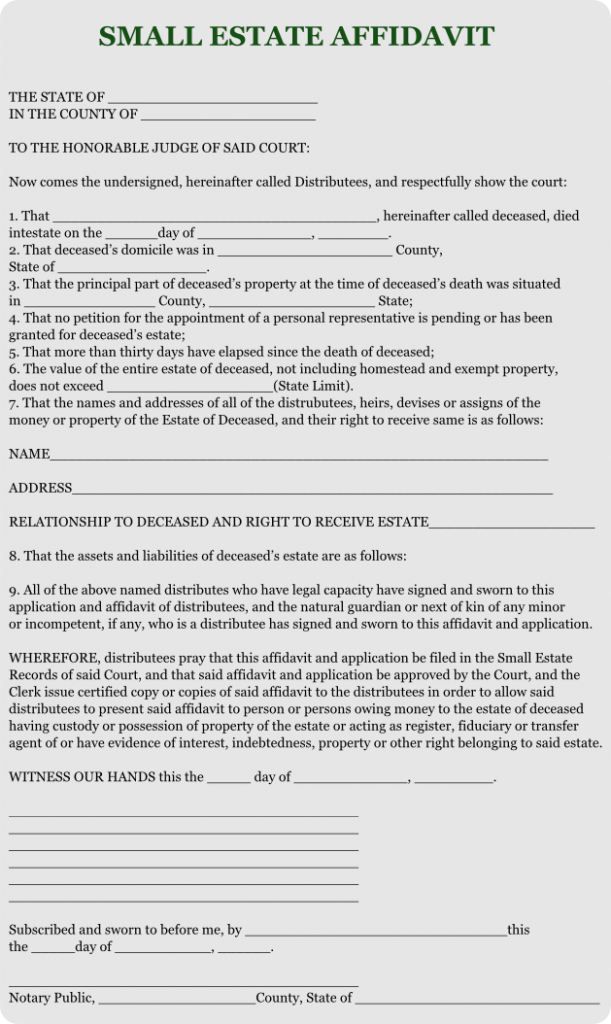

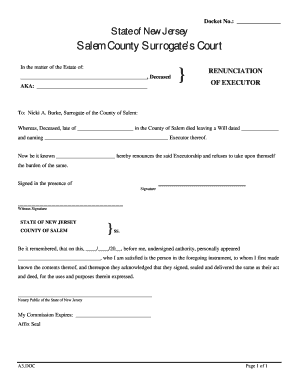

Documents Required for Executor of Estate

The process of managing an estate involves numerous documents and paperwork. Some of the key documents an executor will need to obtain or complete include: - Will: The original will of the deceased, which outlines their wishes regarding the distribution of their estate. - Letters Testamentary or Letters of Administration: These documents, issued by the probate court, officially appoint the executor and grant them the authority to act on behalf of the estate. - Inventory of Assets: A detailed list of all the assets within the estate. - Tax Returns: The executor must file tax returns for the estate, which may include income tax returns and estate tax returns, depending on the size and nature of the estate. - Accounting of Estate: The executor must keep detailed records of all financial transactions related to the estate, including income, expenses, and distributions to beneficiaries.

It's also important for the executor to keep track of all correspondence and interactions with beneficiaries, creditors, and other parties involved in the estate. This can include emails, letters, and meeting notes.

Challenges Faced by Executors

Being an executor can be a challenging and time-consuming role, especially for those who are not familiar with legal and financial matters. Some of the common challenges faced by executors include: - Complexity of Probate Laws: Probate laws vary by state, and navigating these laws can be complex and overwhelming. - Managing Conflicts: Executors may face conflicts with beneficiaries, especially if the will is contested or if there are disagreements over the distribution of assets. - Financial Management: Managing the estate’s finances, including paying debts, filing tax returns, and making distributions, requires a good understanding of financial matters.

📝 Note: It's advisable for executors to seek professional advice, such as from an attorney or a financial advisor, to ensure they fulfill their duties correctly and avoid any potential legal issues.

Conclusion and Final Thoughts

In conclusion, the role of an executor in estate planning is vital to ensure that the wishes of the deceased are carried out and their estate is managed efficiently. The process of getting executor of estate paperwork involves several steps, including nomination in the will, application for probate, and court approval. Executors face various challenges, including the complexity of probate laws, managing conflicts, and financial management. By understanding the responsibilities and challenges associated with being an executor, individuals can better prepare themselves for this important role and ensure that the estate is handled with care and professionalism.

What are the main responsibilities of an executor of an estate?

+

The main responsibilities of an executor include managing the estate’s assets, paying debts and taxes, and distributing the remaining assets to the beneficiaries according to the will.

How is an executor officially appointed?

+

An executor is officially appointed when the probate court issues Letters Testamentary or Letters of Administration after validating the will and approving the executor’s application for probate.

What documents are required for an executor to manage an estate?

+

Key documents include the original will, Letters Testamentary or Letters of Administration, an inventory of estate assets, tax returns, and detailed records of all financial transactions related to the estate.