Unemployment Paperwork for Taxes Forms

Understanding Unemployment Paperwork for Taxes

When individuals receive unemployment benefits, it is essential to understand the associated tax implications. The paperwork involved in filing taxes while receiving unemployment benefits can be complex, but being informed can help simplify the process. In this article, we will delve into the forms and documents required for tax purposes, highlighting key points to consider.

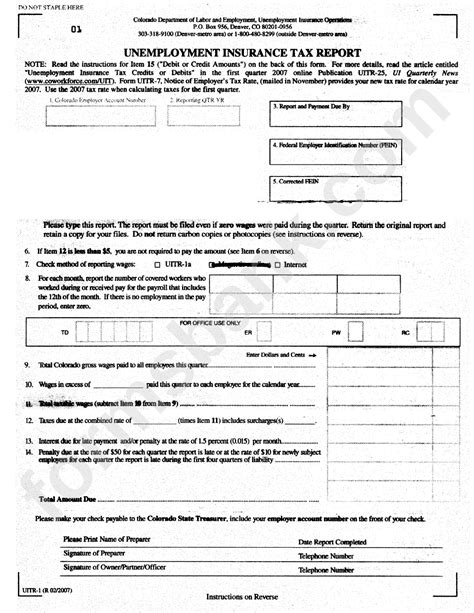

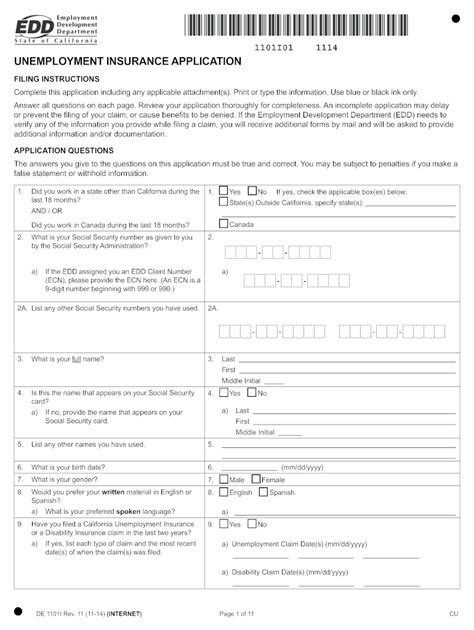

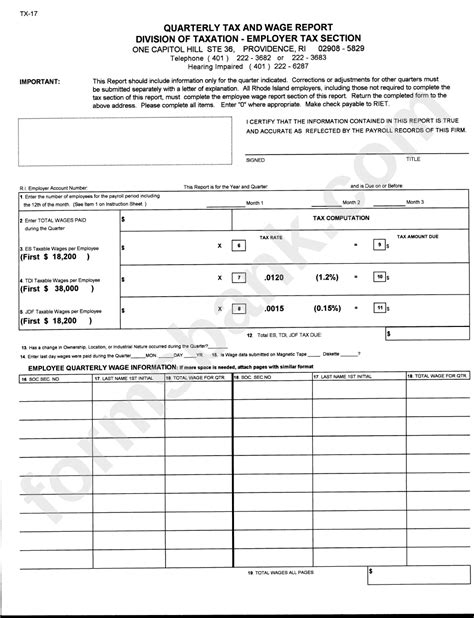

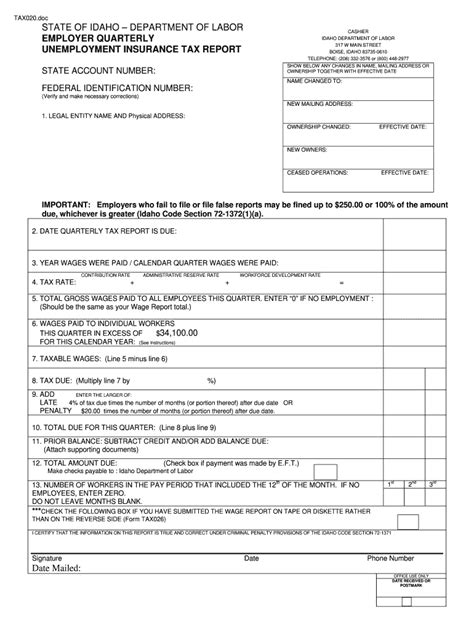

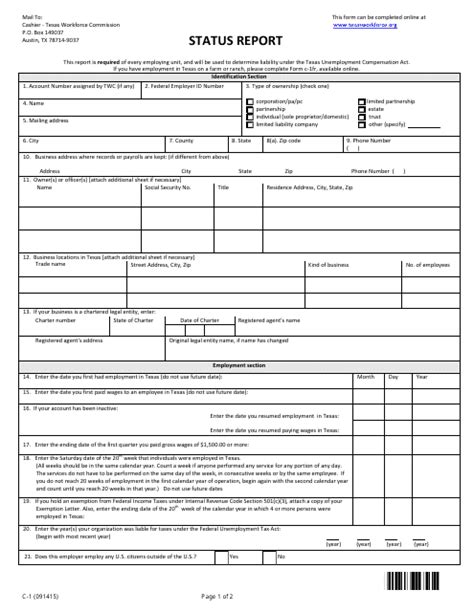

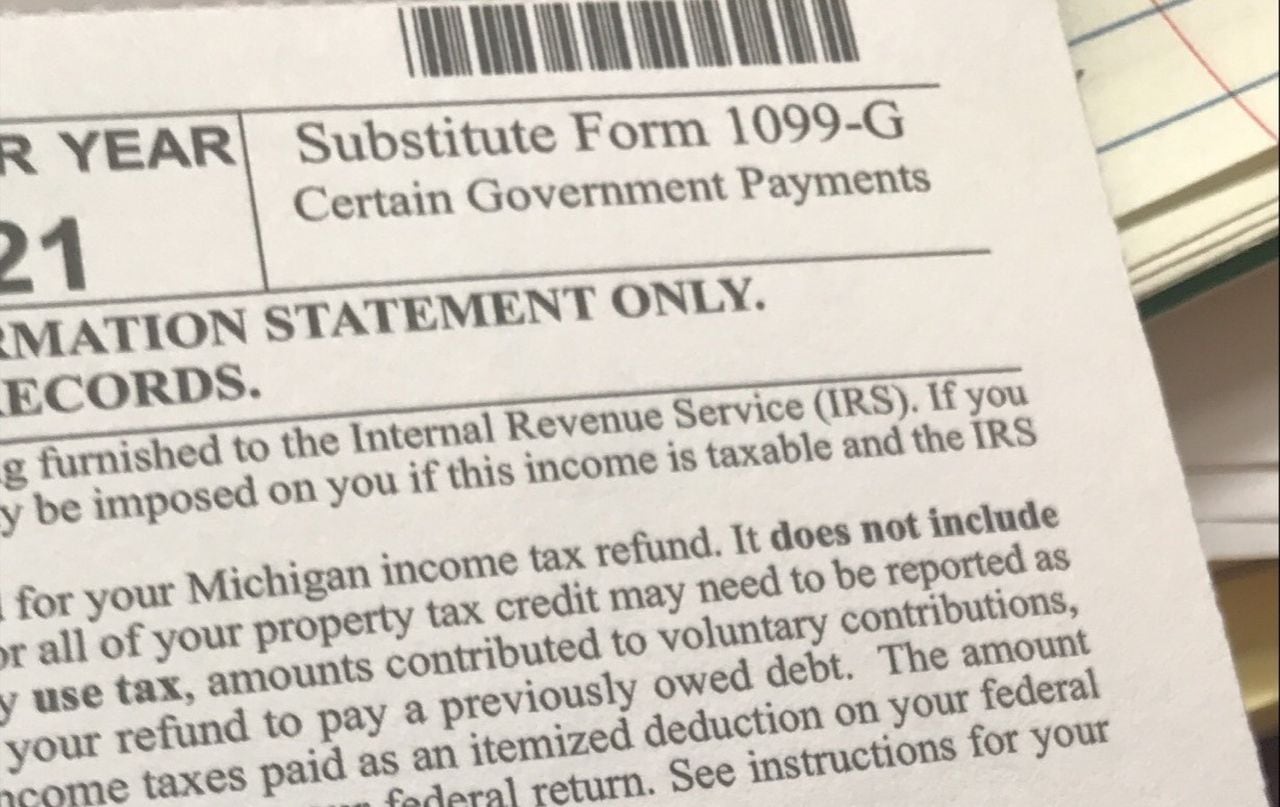

Forms Required for Unemployment Benefits

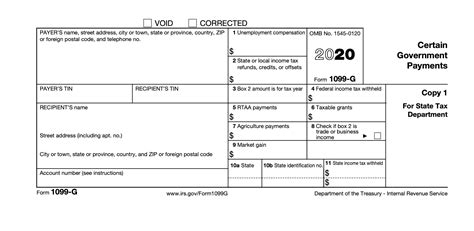

To file taxes correctly, individuals receiving unemployment benefits need to be familiar with the following forms: * Form 1099-G: This form is used to report unemployment benefits received during the tax year. It is typically issued by the state unemployment agency and includes the total amount of benefits paid. * Form W-4V: If individuals want to have federal income tax withheld from their unemployment benefits, they can complete Form W-4V. This form allows them to choose the amount of tax to be withheld. * Schedule 1 (Form 1040): When filing their tax return, individuals will report their unemployment benefits on Schedule 1 (Form 1040). This schedule is used to report additional income, such as unemployment benefits, that is not included on the main Form 1040.

Tax Implications of Unemployment Benefits

Unemployment benefits are considered taxable income by the federal government and most states. This means that individuals receiving these benefits will need to report them on their tax return. It is crucial to understand the tax implications to avoid any potential issues or penalties. Key points to consider: * Unemployment benefits are subject to federal income tax. * Most states also tax unemployment benefits, but some states exempt them from state income tax. * Individuals can choose to have federal income tax withheld from their unemployment benefits by completing Form W-4V.

Steps to Complete Unemployment Paperwork for Taxes

To ensure accurate and timely filing of taxes, follow these steps: * Receive Form 1099-G: The state unemployment agency will issue Form 1099-G by January 31st of each year, showing the total amount of unemployment benefits received during the previous tax year. * Complete Form W-4V (if applicable): If individuals want to have federal income tax withheld from their unemployment benefits, they should complete Form W-4V and submit it to the state unemployment agency. * Report unemployment benefits on Schedule 1 (Form 1040): When filing their tax return, individuals will report their unemployment benefits on Schedule 1 (Form 1040). * File tax return: Submit the completed tax return, including all required forms and schedules, to the IRS by the designated deadline.

💡 Note: It is essential to keep accurate records of all forms and documents related to unemployment benefits, as this information will be required when filing taxes.

Common Mistakes to Avoid

When completing unemployment paperwork for taxes, individuals should be aware of the following common mistakes to avoid: * Failing to report unemployment benefits on their tax return. * Not withholding enough federal income tax from their unemployment benefits. * Not keeping accurate records of forms and documents related to unemployment benefits.

Tax Credits and Deductions

While unemployment benefits are considered taxable income, there are tax credits and deductions that may be available to help reduce the tax liability. For example: * Earned Income Tax Credit (EITC): This credit is designed for low-to-moderate-income working individuals and families. * Child Tax Credit: This credit is available for families with qualifying children under the age of 17.

| Tax Credit/Deduction | Description |

|---|---|

| Earned Income Tax Credit (EITC) | A credit for low-to-moderate-income working individuals and families. |

| Child Tax Credit | A credit for families with qualifying children under the age of 17. |

In summary, understanding the paperwork involved in filing taxes while receiving unemployment benefits is crucial to avoid any potential issues or penalties. By being informed and taking the necessary steps, individuals can ensure accurate and timely filing of their taxes.

As we wrap up this discussion, it’s clear that navigating the complexities of unemployment paperwork for taxes requires attention to detail and a thorough understanding of the forms and documents involved. By following the steps outlined and avoiding common mistakes, individuals can simplify the process and ensure a smooth tax-filing experience.

What is Form 1099-G, and why is it important for taxes?

+

Form 1099-G is used to report unemployment benefits received during the tax year. It is essential for taxes because it shows the total amount of benefits paid, which must be reported on the tax return.

Can I have federal income tax withheld from my unemployment benefits?

+

Yes, you can choose to have federal income tax withheld from your unemployment benefits by completing Form W-4V and submitting it to the state unemployment agency.

Are unemployment benefits subject to state income tax?

+

Most states tax unemployment benefits, but some states exempt them from state income tax. It’s essential to check with your state’s tax authority to determine if your unemployment benefits are subject to state income tax.