5 Tips Disability Tax

Understanding Disability Tax Credits

For individuals living with disabilities, navigating the complex world of taxes can be overwhelming. The disability tax credit (DTC) is a valuable resource that can help alleviate some of the financial burdens associated with disabilities. In this article, we will explore the ins and outs of disability tax credits, including eligibility, application processes, and benefits.

Eligibility for Disability Tax Credits

To be eligible for the DTC, an individual must have a severe and prolonged impairment in physical or mental functions. This can include a wide range of conditions, such as blindness, deafness, mobility impairments, and cognitive impairments. The impairment must be certified by a medical practitioner, and the individual must meet the CRA’s (Canada Revenue Agency) specific criteria for eligibility.

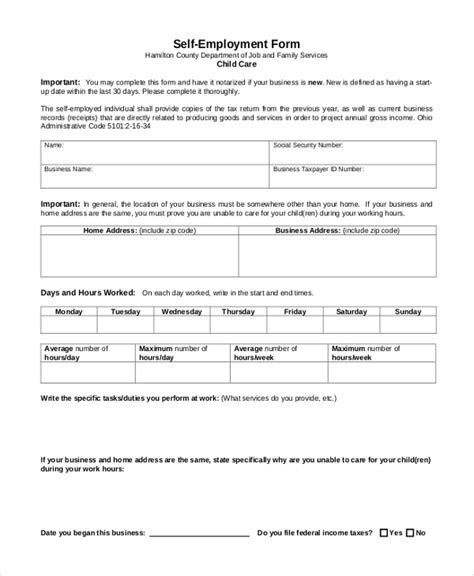

Applying for Disability Tax Credits

The application process for the DTC involves several steps: * Obtaining a T2201 form from the CRA website or by calling the CRA * Having a medical practitioner complete and certify the form * Submitting the completed form to the CRA for approval * Claiming the credit on your tax return once approved

📝 Note: It is essential to keep detailed records of your application and supporting documentation, as this can help facilitate the process and ensure a smooth review.

Benefits of Disability Tax Credits

The DTC can provide significant financial benefits to eligible individuals. The credit can be claimed on your tax return, and the amount will depend on your individual circumstances. Some of the benefits include: * A non-refundable tax credit of up to $8,416 (for 2022) * The ability to claim the credit retroactively for up to 10 years * The possibility of transferring the credit to a family member or caregiver

Additional Tips and Considerations

Here are some additional tips to keep in mind when applying for the DTC: * Keep detailed records of your medical expenses and supporting documentation * Consult with a tax professional to ensure you are claiming the credit correctly * Review your eligibility annually, as your circumstances may change * Explore other benefits and credits that may be available to you, such as the medical expense tax credit or the child disability benefit

| Year | Maximum Credit |

|---|---|

| 2022 | $8,416 |

| 2021 | $8,292 |

| 2020 | $8,165 |

In summary, the disability tax credit can be a valuable resource for individuals living with disabilities. By understanding the eligibility criteria, application process, and benefits, you can ensure you are taking advantage of this important credit. Remember to keep detailed records, consult with a tax professional, and review your eligibility annually to maximize your benefits.

To wrap things up, it’s crucial to stay informed about the disability tax credit and its application process. By doing so, you’ll be better equipped to navigate the system and receive the benefits you’re eligible for. Always consult with a tax professional or medical practitioner to ensure you’re meeting the necessary criteria and following the correct procedures.

What is the disability tax credit?

+

The disability tax credit is a non-refundable tax credit available to individuals with severe and prolonged impairments in physical or mental functions.

How do I apply for the disability tax credit?

+

To apply, obtain a T2201 form, have a medical practitioner complete and certify it, and submit it to the CRA for approval.

What are the benefits of the disability tax credit?

+

The benefits include a non-refundable tax credit of up to $8,416, the ability to claim the credit retroactively, and the possibility of transferring the credit to a family member or caregiver.