5 Ways Find EIN

Understanding the Importance of an Employer Identification Number (EIN)

An Employer Identification Number (EIN) is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to identify businesses and other entities for tax purposes. It’s essential for various transactions, including opening a business bank account, filing tax returns, and hiring employees. Knowing how to find an EIN is crucial for business owners, as it’s a requirement for legally operating a business in the United States. In this article, we’ll explore five ways to find an EIN, making it easier for entrepreneurs to manage their business’s tax obligations.

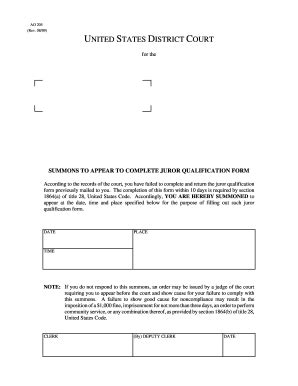

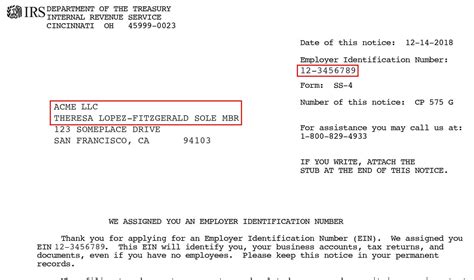

Method 1: Checking IRS Confirmation Letter

The most straightforward way to find an EIN is by checking the confirmation letter received from the IRS when the EIN was initially assigned. This letter is usually sent via mail after submitting the application, either online or by mail, fax, or phone. The confirmation letter includes the EIN, business name, and address. It’s essential to keep this letter safe, as it serves as proof of the EIN assignment. If the letter is lost, it’s possible to contact the IRS to request a new copy or use other methods to retrieve the EIN.

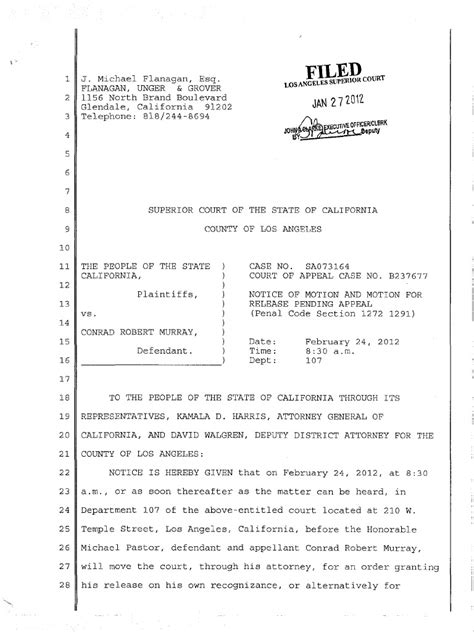

Method 2: Reviewing Previous Tax Returns

Another way to find an EIN is by reviewing previous tax returns. The EIN is typically listed on tax returns, such as Form 1040 for individual businesses or Form 1120 for corporations. Checking these forms can provide the necessary information to retrieve the EIN. It’s essential to ensure the tax returns are for the correct business entity, as individuals may have multiple businesses or entities.

Method 3: Contacting the IRS Business and Specialty Tax Line

For those who are unable to find their EIN through the previous methods, contacting the IRS is a viable option. The IRS Business and Specialty Tax Line is available to provide assistance with EIN-related inquiries. By calling the dedicated phone number, business owners can speak with an IRS representative who can help retrieve the EIN. It’s essential to have the business’s legal name, address, and other identifying information ready to verify the identity and provide the correct EIN.

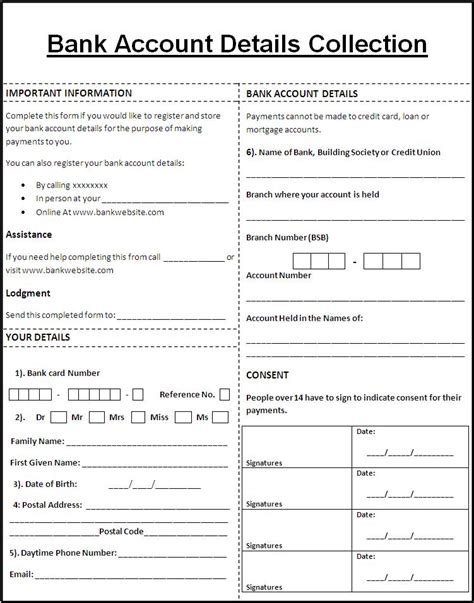

Method 4: Checking Business Bank Account Documents

Business owners can also find their EIN by checking bank account documents. When opening a business bank account, the EIN is usually required to complete the application process. As a result, the EIN may be listed on bank statements, loan documents, or other financial records. Reviewing these documents can provide the necessary information to retrieve the EIN. It’s essential to ensure the documents are for the correct business entity and account.

Method 5: Using the IRS Website or Online Account

The IRS website provides an online platform for business owners to retrieve their EIN. By creating an online account or logging in to an existing one, entrepreneurs can access their business’s tax information, including the EIN. This method is convenient, as it allows business owners to retrieve their EIN at any time, without having to contact the IRS or search through physical documents.

📝 Note: It's essential to keep the EIN confidential, as it's sensitive information that can be used for identity theft or other malicious activities.

In summary, finding an EIN is a relatively straightforward process, with multiple methods available to retrieve this essential information. By checking the IRS confirmation letter, reviewing previous tax returns, contacting the IRS, checking business bank account documents, or using the IRS website or online account, business owners can easily find their EIN and manage their tax obligations.

To further illustrate the process, consider the following table:

| Method | Description |

|---|---|

| Checking IRS Confirmation Letter | Review the confirmation letter received from the IRS when the EIN was assigned. |

| Reviewing Previous Tax Returns | Check previous tax returns, such as Form 1040 or Form 1120, for the EIN. |

| Contacting the IRS | Call the IRS Business and Specialty Tax Line for assistance with retrieving the EIN. |

| Checking Business Bank Account Documents | Review bank statements, loan documents, or other financial records for the EIN. |

| Using the IRS Website or Online Account | Access the IRS website or online account to retrieve the EIN. |

As business owners navigate the process of finding their EIN, it’s essential to remember that this information is crucial for tax compliance and other business-related transactions. By using one of the five methods outlined above, entrepreneurs can ensure they have the necessary information to operate their business efficiently and effectively.

Ultimately, understanding how to find an EIN is vital for business owners, as it enables them to manage their tax obligations and maintain compliance with IRS regulations. By following the methods outlined in this article, entrepreneurs can easily retrieve their EIN and focus on growing their business.

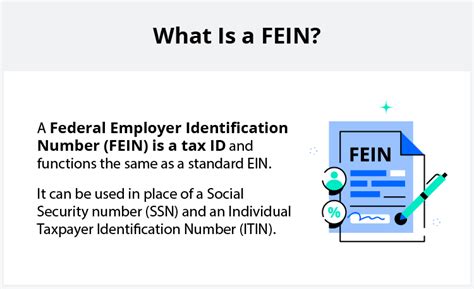

What is an Employer Identification Number (EIN)?

+

An Employer Identification Number (EIN) is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to identify businesses and other entities for tax purposes.

Why is an EIN important for businesses?

+

An EIN is essential for businesses, as it’s required for various transactions, including opening a business bank account, filing tax returns, and hiring employees.

How can I apply for an EIN if I don’t have one?

+

You can apply for an EIN online through the IRS website, by mail, fax, or phone. The application process typically involves providing business information, such as the business name, address, and type of entity.