5 Tips Organize Bills

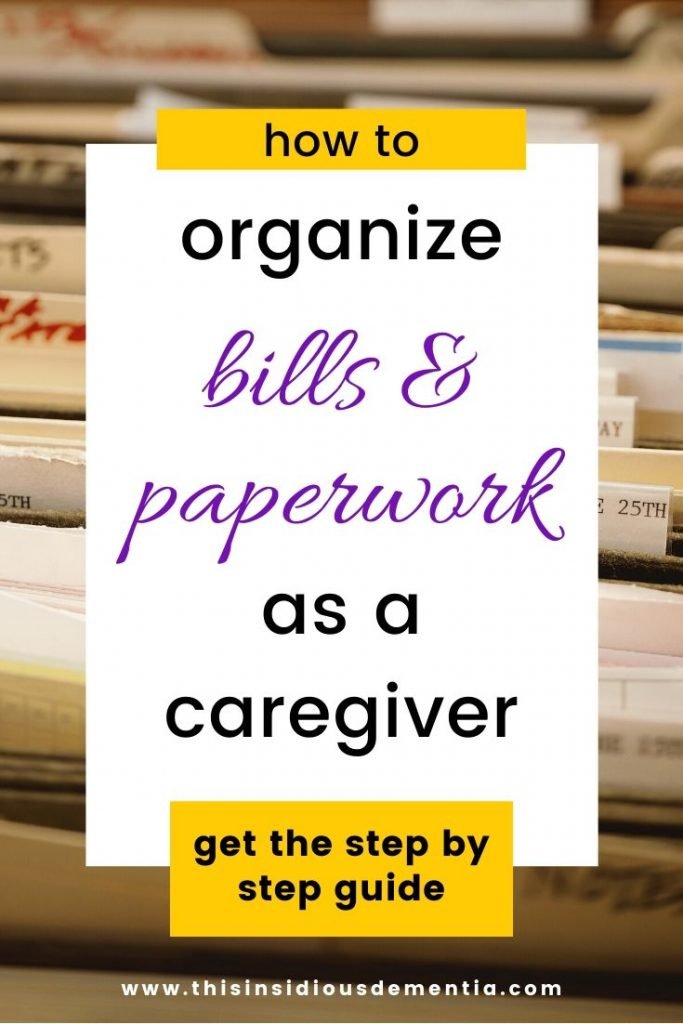

Introduction to Organizing Bills

Managing bills effectively is a crucial aspect of personal finance and can significantly reduce stress and financial insecurity. With the multitude of bills to keep track of, from rent/mortgage, utilities, and credit cards to insurance and subscriptions, staying organized is key to avoiding late payments, fines, and a negative impact on your credit score. In this article, we will explore 5 essential tips to help you organize your bills efficiently.

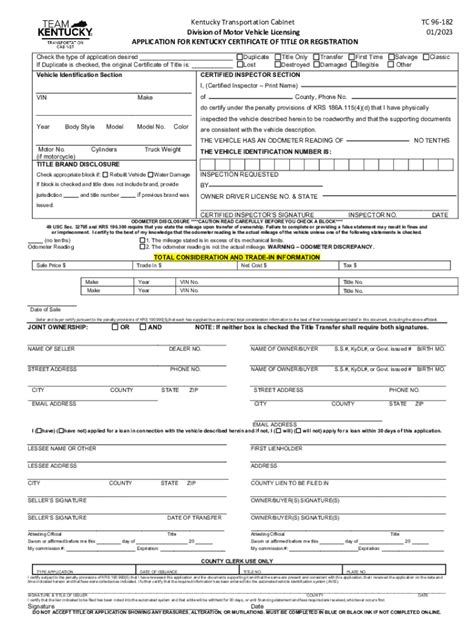

Understanding Your Bills

Before diving into the tips, it’s essential to have a clear understanding of your bills. This includes knowing the due dates, payment amounts, and the payment methods accepted by each creditor. Taking the time to review each bill carefully can help you identify any potential issues, such as incorrect charges or unexpected changes in your payment schedule. Keeping a record of your bills, either physically or digitally, can also be beneficial for tracking payments and detecting any discrepancies.

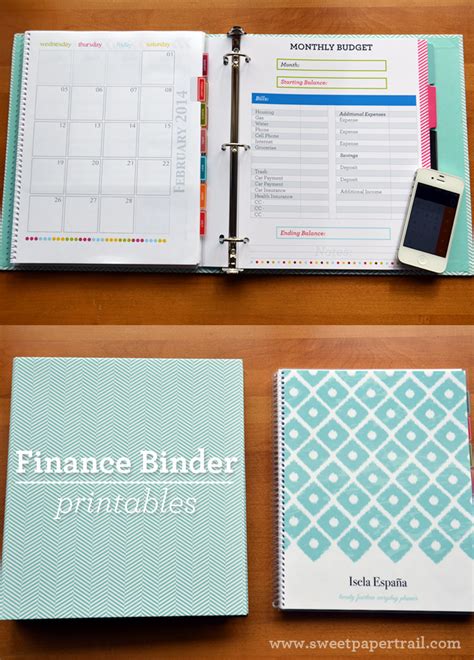

Tips for Organizing Bills

Here are five practical tips to help you organize your bills effectively: - Automate Your Payments: Setting up automatic payments for your bills can ensure that you never miss a payment. Most creditors offer automatic payment options, and you can usually set this up through their website or by contacting their customer service department. - Use a Budgeting App: There are many budgeting apps available that can help you track your bills and stay on top of your finances. These apps often allow you to link your accounts, set reminders for bill due dates, and even make payments directly through the app. - Implement the 50/30/20 Rule: Allocating 50% of your income towards necessary expenses (like rent and utilities), 30% towards discretionary spending, and 20% towards saving and debt repayment can help you manage your bills more effectively. - Consider a Bill Calendar: Creating a calendar specifically for your bills can provide a visual reminder of upcoming due dates. You can use a physical calendar or create a digital one on your phone or computer. - Prioritize Your Bills: If you’re facing financial difficulties and can’t pay all your bills on time, prioritize essential bills like rent/mortgage, utilities, and minimum payments on debts. Communicating with your creditors can also help, as they may offer temporary hardship programs or payment extensions.

Benefits of Organized Bill Management

Effective bill management offers numerous benefits, including reduced financial stress, improved credit scores, and the avoidance of late fees. By staying on top of your bills, you can also better plan for the future, whether that involves saving for a big purchase, paying off debt, or building an emergency fund. Moreover, avoiding late payments can prevent negative marks on your credit report, which can impact your ability to secure loans or credit at favorable interest rates in the future.

💡 Note: Regularly reviewing your budget and bill payment schedule can help you identify areas for improvement and make adjustments as needed to maintain financial stability.

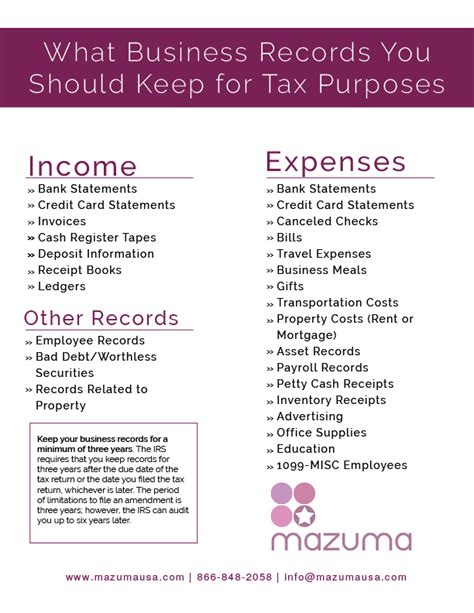

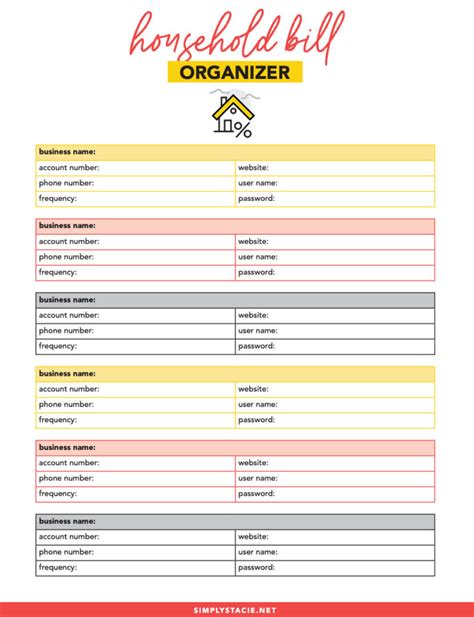

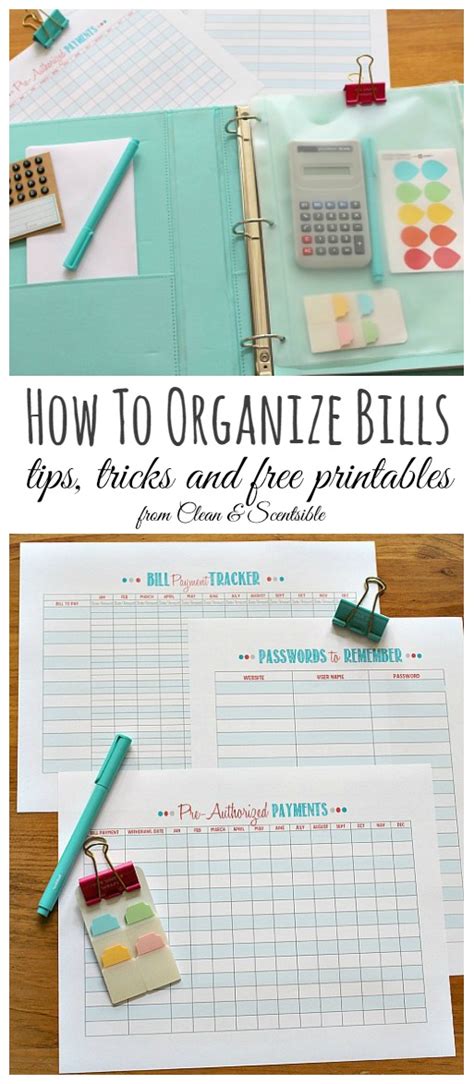

Tools for Bill Organization

In addition to budgeting apps and calendars, there are other tools that can aid in bill organization. Spreadsheets can be particularly useful for tracking payments and due dates, especially if you prefer a more hands-on approach to managing your finances. Furthermore, online bill pay services offered by banks and credit unions can streamline the payment process, allowing you to pay multiple bills from a single platform.

| Tool | Description |

|---|---|

| Budgeting Apps | Help track expenses, create budgets, and set reminders for bill due dates. |

| Bill Calendars | Provide a visual schedule of upcoming bill due dates. |

| Spreadsheets | Allow for detailed tracking of bill payments and due dates. |

| Online Bill Pay Services | Enable the payment of multiple bills from a single platform. |

Final Thoughts on Bill Organization

In conclusion, organizing your bills is a straightforward yet powerful step towards achieving financial stability and peace of mind. By implementing a few simple strategies, such as automating payments, using budgeting tools, and prioritizing bills, you can ensure that you never miss a payment and can better manage your financial resources. Remember, staying organized is key to avoiding the pitfalls of late fees, damaged credit scores, and financial stress.

What are the benefits of automating bill payments?

+

Automating bill payments ensures that bills are paid on time, reducing the risk of late fees and negative impacts on credit scores. It also saves time and can help in budgeting by having a consistent payment schedule.

How can I prioritize my bills if I’m facing financial difficulties?

+

Prioritize essential bills like rent/mortgage, utilities, and minimum payments on debts. Communicate with your creditors to explore options like temporary hardship programs or payment extensions. Consider seeking advice from a financial advisor for personalized guidance.

What tools are available for organizing bills?

+

Available tools include budgeting apps, bill calendars, spreadsheets, and online bill pay services. Each tool offers unique features to help track, manage, and pay bills efficiently, reducing the likelihood of missed payments and associated penalties.