Paperwork

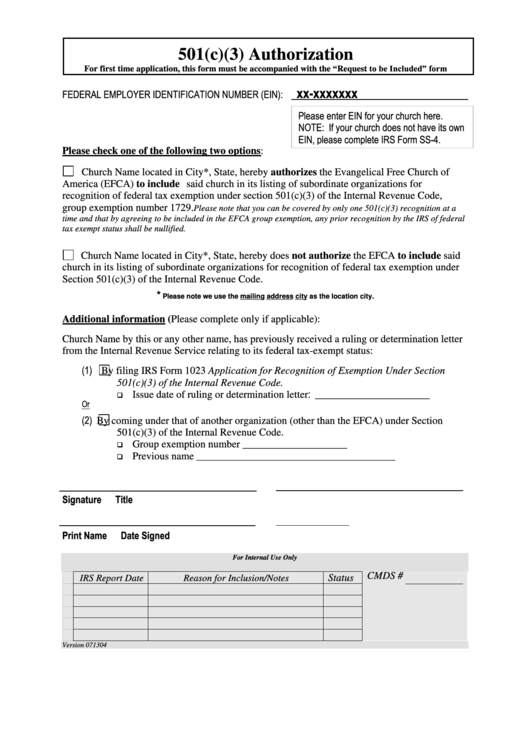

Update 501c3 Paperwork Easily

Introduction to 501c3 Paperwork Updates

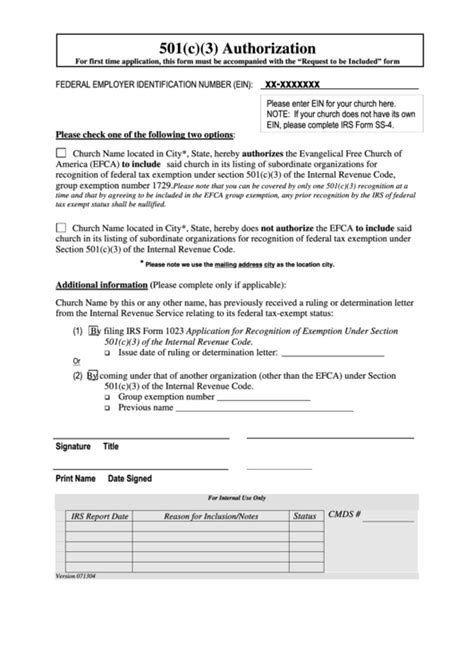

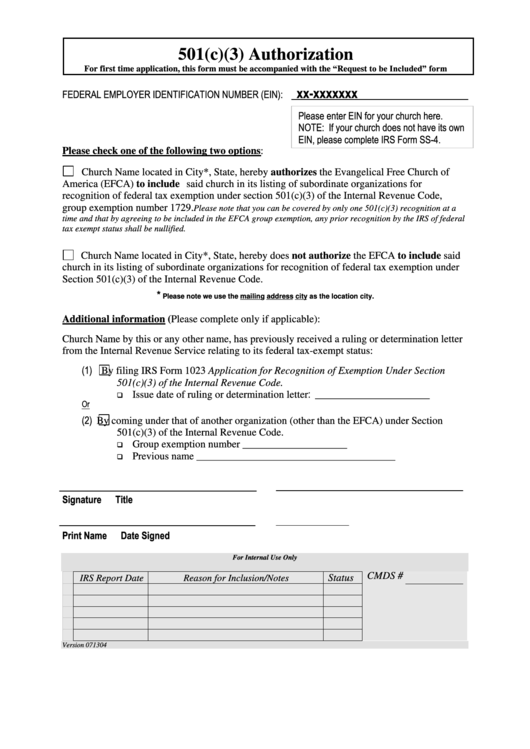

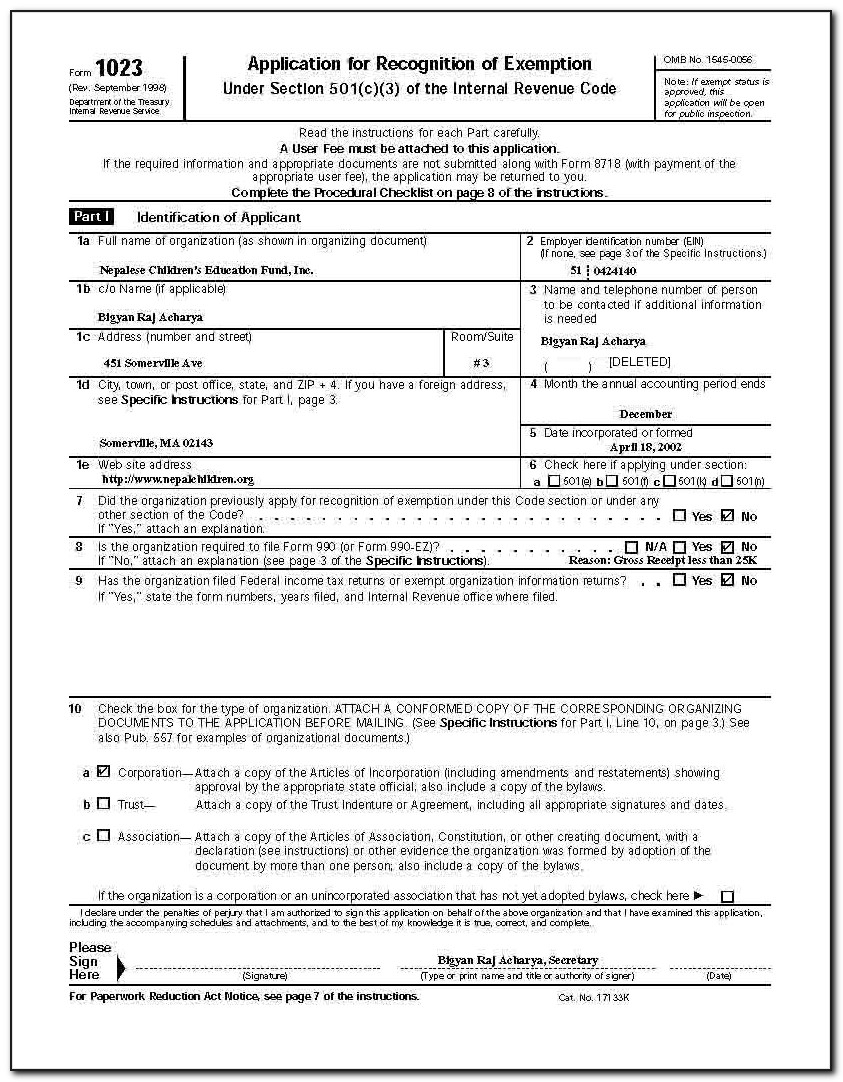

Updating 501c3 paperwork is a crucial task for non-profit organizations to maintain their tax-exempt status. The process involves filing annual information returns and other forms with the Internal Revenue Service (IRS). In this article, we will guide you through the steps to update your 501c3 paperwork easily and efficiently.

Understanding 501c3 Requirements

Before diving into the update process, it’s essential to understand the requirements for 501c3 organizations. These non-profits must file Form 990 or Form 990-EZ annually, depending on their annual gross receipts and total assets. The forms require detailed information about the organization’s financial activities, governance, and compliance with tax laws.

Steps to Update 501c3 Paperwork

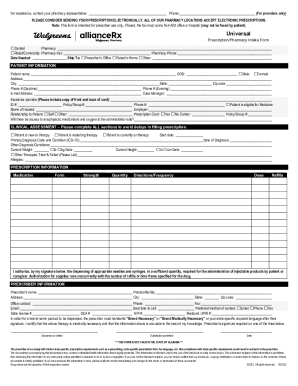

To update your 501c3 paperwork, follow these steps: * Review your organization’s financial records and ensure accuracy. * Gather required documents, including Form W-2 and Form 1099 for employees and independent contractors. * Complete the applicable form (Form 990 or Form 990-EZ) and submit it to the IRS by the deadline. * Ensure compliance with state charity registration requirements.

Forms and Schedules Required

The following forms and schedules are required for 501c3 organizations: * Form 990: Annual information return for organizations with annual gross receipts of 200,000 or more or total assets of 500,000 or more. * Form 990-EZ: Annual information return for organizations with annual gross receipts of less than 200,000 and total assets of less than 500,000. * Schedule A: Public charity status and public support. * Schedule B: Schedule of contributors. * Schedule D: Supplemental financial statements. * Schedule G: Supplemental information regarding fundraising or gaming activities.

Best Practices for Updating 501c3 Paperwork

To ensure a smooth update process, follow these best practices: * Review and update your organization’s bylaws to ensure compliance with IRS requirements. * Maintain accurate and detailed financial records to facilitate the filing process. * Seek professional help if you’re unsure about any aspect of the update process. * Stay informed about changes in tax laws and regulations affecting 501c3 organizations.

📝 Note: It's essential to file your 501c3 paperwork on time to avoid penalties and potential loss of tax-exempt status.

Common Mistakes to Avoid

When updating your 501c3 paperwork, avoid the following common mistakes: * Inaccurate or incomplete information on forms and schedules. * Failure to file required forms and schedules. * Missed deadlines for filing annual information returns. * Non-compliance with state charity registration requirements.

| Form | Description | Filing Deadline |

|---|---|---|

| Form 990 | Annual information return for organizations with annual gross receipts of $200,000 or more or total assets of $500,000 or more. | 15th day of the 5th month after the end of the organization's tax year. |

| Form 990-EZ | Annual information return for organizations with annual gross receipts of less than $200,000 and total assets of less than $500,000. | 15th day of the 5th month after the end of the organization's tax year. |

In summary, updating 501c3 paperwork requires attention to detail, accuracy, and compliance with IRS regulations. By following the steps outlined in this article and avoiding common mistakes, your non-profit organization can maintain its tax-exempt status and continue to fulfill its mission.

What is the deadline for filing Form 990?

+

The deadline for filing Form 990 is the 15th day of the 5th month after the end of the organization’s tax year.

What are the consequences of missing the filing deadline?

+

Missing the filing deadline can result in penalties, fines, and potential loss of tax-exempt status.

Can I file Form 990 electronically?

+