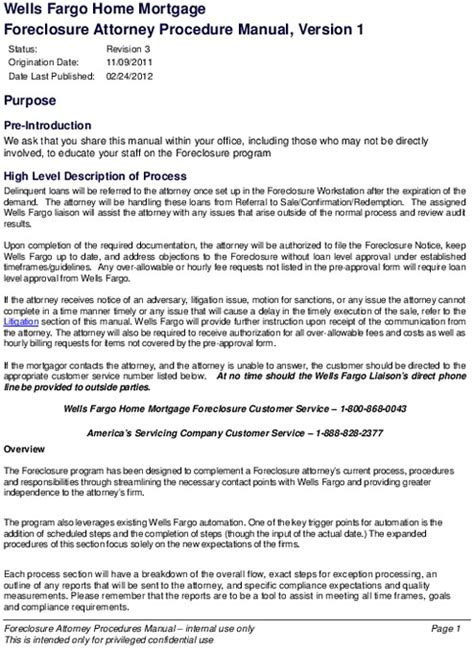

Foreclosure Paperwork Processing Guide

Introduction to Foreclosure Paperwork Processing

The process of handling foreclosure paperwork is complex and requires a thorough understanding of the legal and financial aspects involved. It is essential for lenders, attorneys, and other stakeholders to grasp the intricacies of foreclosure paperwork processing to ensure that the process is executed efficiently and in compliance with relevant laws and regulations. This guide aims to provide a comprehensive overview of the foreclosure paperwork processing steps, highlighting key considerations and best practices.

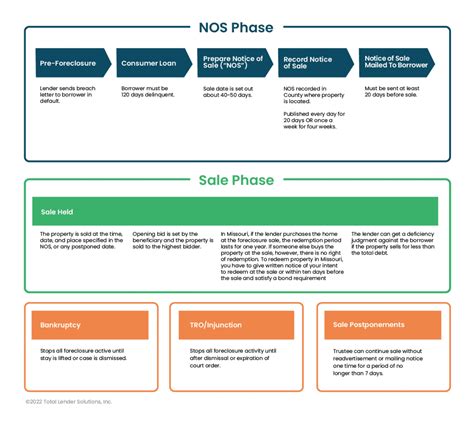

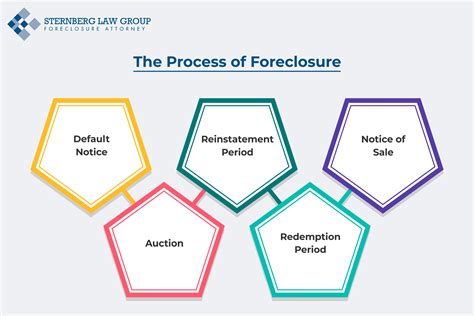

Pre-Foreclosure Steps

Before initiating the foreclosure process, lenders must take several steps to ensure that the borrower is in default and that all pre-foreclosure requirements are met. These steps include: * Reviewing the loan documents to verify the borrower’s default status * Sending a notice of default to the borrower, informing them of the intention to foreclose * Waiting for the required period, usually 30 days, for the borrower to cure the default * Conducting a title search to identify any liens or encumbrances on the property

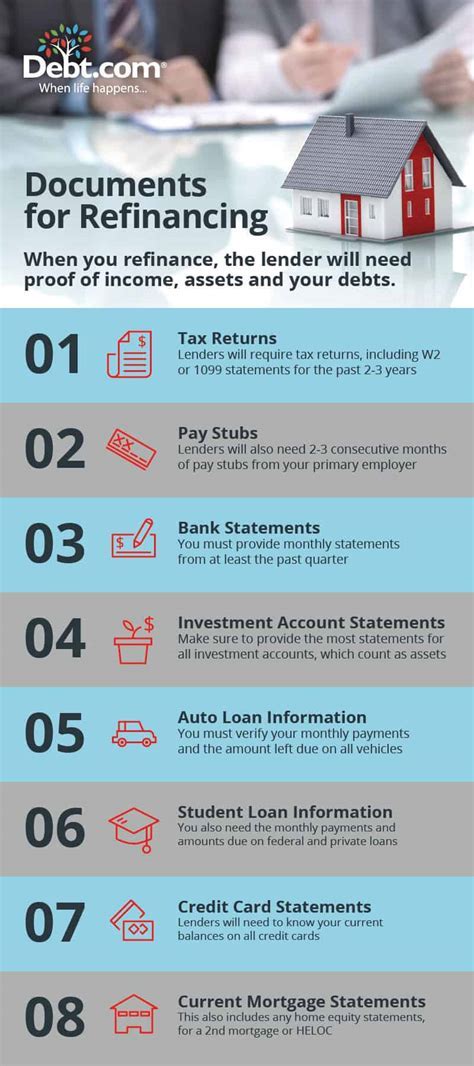

Foreclosure Paperwork Processing

The foreclosure paperwork processing stage involves preparing and filing the necessary documents with the court or relevant authorities. The key documents required for foreclosure include: * Complaint or petition: The initial document filed with the court to initiate the foreclosure process * Lis pendens: A notice filed with the county recorder’s office to alert potential buyers of the pending foreclosure * Notice of sale: A public notice announcing the date, time, and location of the foreclosure sale * Deed of trust: The document that secures the loan and grants the lender the right to foreclose

Types of Foreclosure

There are two primary types of foreclosure: judicial foreclosure and non-judicial foreclosure. Judicial foreclosure involves court supervision and is typically used in states where the lender must file a lawsuit to foreclose. Non-judicial foreclosure, on the other hand, does not require court involvement and is usually faster and less expensive.

Post-Foreclosure Steps

After the foreclosure sale, the lender must take several steps to finalize the process, including: * Eviction: Removing the borrower or any occupants from the property * REO (Real Estate Owned) management: Managing and maintaining the property until it is sold * Disposition: Selling the property to recover the outstanding loan balance

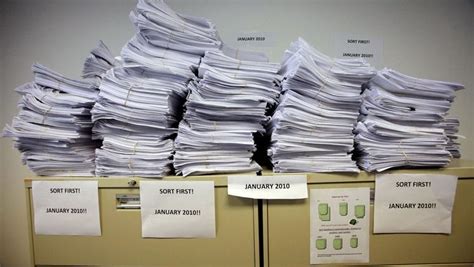

Best Practices for Foreclosure Paperwork Processing

To ensure efficient and compliant foreclosure paperwork processing, lenders and attorneys should adhere to the following best practices: * Accurate documentation: Maintaining accurate and detailed records of all correspondence and transactions * Timely filing: Filing documents with the court or relevant authorities in a timely manner to avoid delays * Compliance with regulations: Ensuring that all foreclosure paperwork processing steps comply with relevant laws and regulations

📝 Note: Lenders and attorneys should consult with local authorities and experts to ensure compliance with specific state and local regulations.

Common Challenges in Foreclosure Paperwork Processing

Foreclosure paperwork processing can be complex and prone to errors. Common challenges include: * Inaccurate or incomplete documentation * Delays in filing or processing documents * Non-compliance with regulations * Disputes over property ownership or liens

Technology and Foreclosure Paperwork Processing

The use of technology can significantly improve the efficiency and accuracy of foreclosure paperwork processing. Some benefits of technology include: * Automated document preparation: Using software to generate and populate foreclosure documents * Electronic filing: Submitting documents electronically to reduce processing times and errors * Case management systems: Utilizing specialized software to track and manage foreclosure cases

| Foreclosure Stage | Documents Required | Timeline |

|---|---|---|

| Pre-foreclosure | Notice of default, loan documents | 30 days |

| Foreclosure filing | Complaint or petition, lis pendens | Varies by state |

| Foreclosure sale | Notice of sale, deed of trust | Varies by state |

In summary, foreclosure paperwork processing is a complex and highly regulated process that requires careful attention to detail and compliance with relevant laws and regulations. By understanding the pre-foreclosure steps, foreclosure paperwork processing, and post-foreclosure steps, lenders and attorneys can ensure efficient and compliant foreclosure processing. The use of technology and adherence to best practices can also improve the efficiency and accuracy of foreclosure paperwork processing.

What is the difference between judicial and non-judicial foreclosure?

+

Judicial foreclosure involves court supervision and is typically used in states where the lender must file a lawsuit to foreclose. Non-judicial foreclosure, on the other hand, does not require court involvement and is usually faster and less expensive.

What documents are required for foreclosure paperwork processing?

+

The key documents required for foreclosure include the complaint or petition, lis pendens, notice of sale, and deed of trust.

How can technology improve foreclosure paperwork processing?

+

Technology can improve foreclosure paperwork processing by automating document preparation, enabling electronic filing, and utilizing case management systems to track and manage foreclosure cases.