Contractor Paperwork Processing Guide

Introduction to Contractor Paperwork Processing

As a contractor, managing paperwork efficiently is crucial for the success of your business. It helps in maintaining a smooth workflow, ensuring compliance with regulations, and reducing the risk of errors or legal issues. Contractor paperwork encompasses a wide range of documents, from contracts and invoices to compliance certificates and tax forms. In this guide, we will walk you through the steps and best practices for processing contractor paperwork effectively.

Understanding Types of Contractor Paperwork

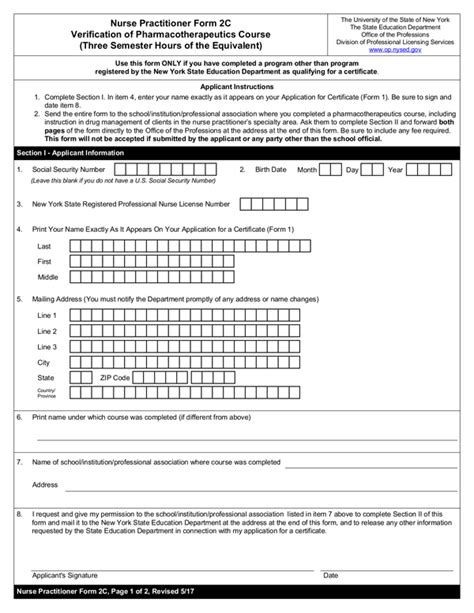

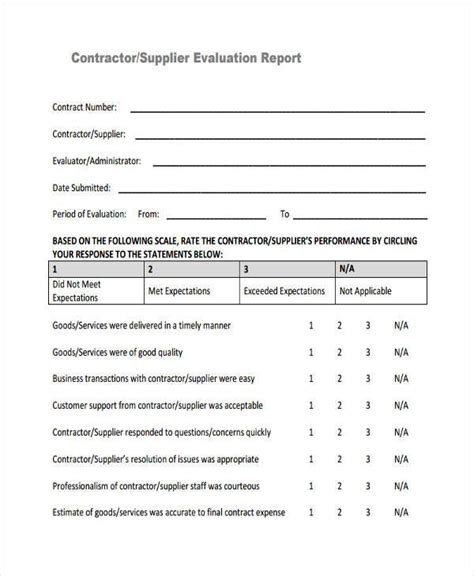

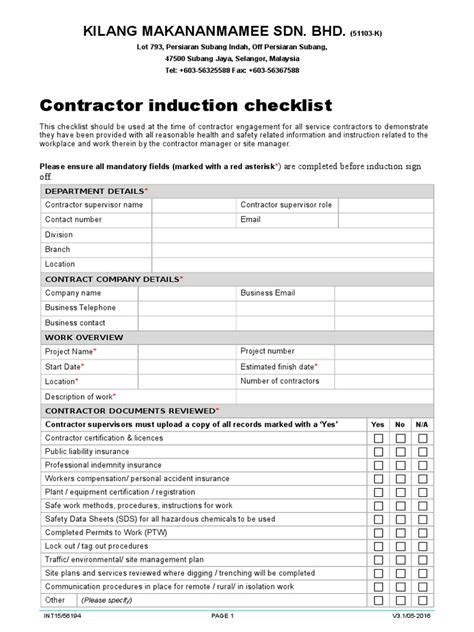

Before diving into the processing steps, it’s essential to understand the various types of paperwork you’ll encounter as a contractor. These include: - Contracts and Agreements: These outline the scope of work, payment terms, and responsibilities between you and your clients or subcontractors. - Invoices and Payment Receipts: These are used for billing clients and keeping track of payments received. - Compliance and Safety Documents: These include certificates of insurance, licenses, and safety protocols that ensure you are legally allowed to operate and are taking necessary safety precautions. - Tax and Financial Documents: These are crucial for managing your business’s financial health and include tax returns, expense reports, and balance sheets.

Step-by-Step Guide to Processing Contractor Paperwork

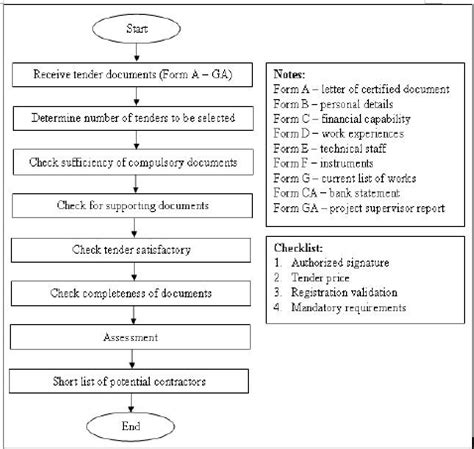

Processing contractor paperwork involves several key steps that help maintain organization and efficiency. Here’s a breakdown of the process: 1. Receipt and Review: Upon receiving any paperwork, review it immediately to ensure all information is accurate and complete. This includes contracts, invoices, compliance documents, and any other legal or financial papers. 2. Organization and Filing: Implement a systematic filing system, whether digital or physical, where all documents are categorized and easily accessible. This could include separate folders for contracts, invoices, tax documents, etc. 3. Action and Follow-Up: Take necessary actions based on the paperwork. For example, sending invoices to clients, submitting compliance documents to relevant authorities, or following up on unpaid invoices. 4. Digitalization and Backup: Consider digitizing your paperwork to reduce physical storage needs and enhance security. Always backup your digital files to protect against data loss.

Tools and Software for Efficient Paperwork Processing

Utilizing the right tools and software can significantly streamline your paperwork processing. Some options include: - Digital Storage Services: Cloud storage platforms like Google Drive, Dropbox, or Microsoft OneDrive can securely store and organize your documents. - Accounting and Invoicing Software: Programs such as QuickBooks, Xero, or Wave can help manage financial documents, generate invoices, and track payments. - Contract Management Software: Specific software designed for contract lifecycle management can help in drafting, executing, and monitoring contracts.

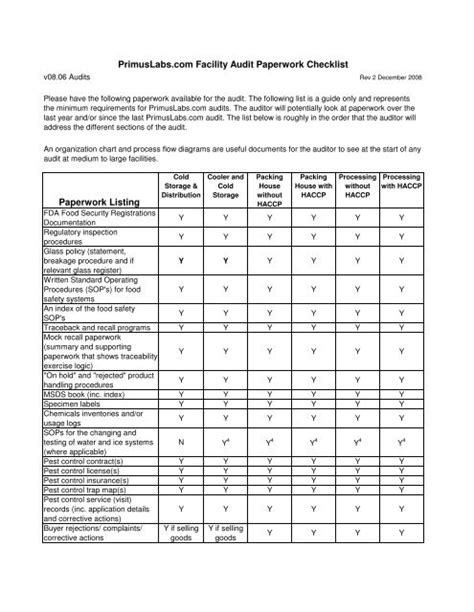

Best Practices for Contractor Paperwork Management

Adopting best practices can help in maintaining a well-organized and compliant paperwork system. Consider the following: - Regular Audits: Periodically review your paperwork to ensure everything is up-to-date and compliant with current regulations. - Training: Ensure that all team members understand the importance and process of paperwork management. - Security Measures: Implement strong security measures to protect sensitive information, especially when dealing with digital documents.

📝 Note: Always consult with legal and financial advisors to ensure your paperwork processes comply with all relevant laws and regulations.

Challenges in Contractor Paperwork Processing

Despite the benefits of efficient paperwork processing, contractors often face several challenges, including: - Time Consumption: Managing paperwork can be time-consuming, taking away from time that could be spent on core business activities. - Complexity: Understanding and complying with various legal and financial requirements can be complex and overwhelming. - Cost: Implementing a robust paperwork management system can require significant upfront investment.

Solutions to Common Challenges

Several solutions can help mitigate the challenges associated with contractor paperwork processing: - Outsourcing: Consider outsourcing paperwork management to professional services that specialize in handling contractor documents. - Automation: Leverage technology and automation tools to streamline processes, reduce manual errors, and increase efficiency. - Education and Training: Invest in education and training for yourself and your team to better understand legal, financial, and regulatory requirements.

In wrapping up the key points of this guide, it’s clear that efficient contractor paperwork processing is vital for the success and compliance of any contracting business. By understanding the types of paperwork, following a systematic processing approach, leveraging the right tools, and adopting best practices, contractors can reduce administrative burdens and focus on their core activities. This not only enhances operational efficiency but also contributes to a more organized, compliant, and profitable business model.

What are the most critical documents for a contractor to manage?

+

The most critical documents include contracts, invoices, compliance certificates, and tax forms. These documents are essential for legal compliance, financial management, and maintaining a smooth workflow.

How can contractors efficiently manage their paperwork?

+

Contractors can efficiently manage their paperwork by implementing a systematic filing system, digitizing documents, using specialized software for contract and financial management, and regularly auditing their paperwork for compliance and accuracy.

What are the benefits of outsourcing paperwork management for contractors?

+

Outsourcing paperwork management can help contractors save time, reduce the risk of non-compliance, and minimize the complexity associated with legal and financial documentation. It allows contractors to focus on their core business activities.