5 Steps to Roll SEP IRA

Introduction to SEP IRA Rollovers

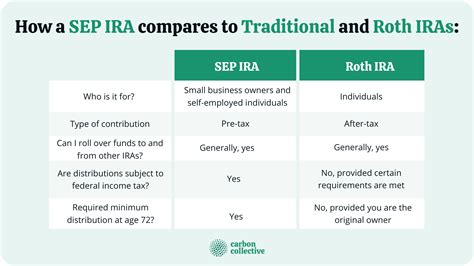

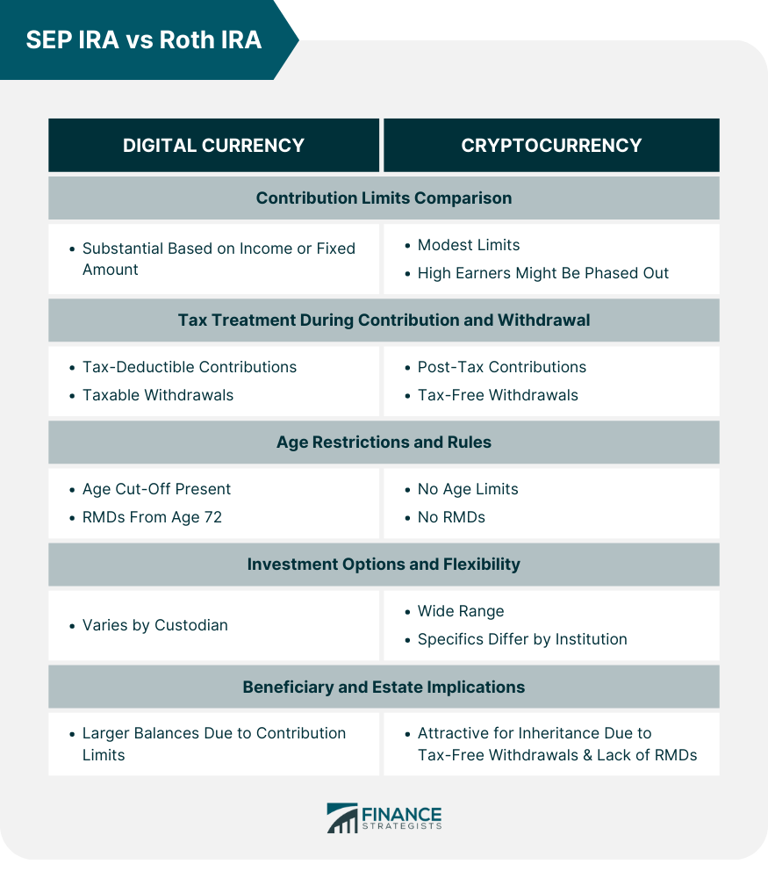

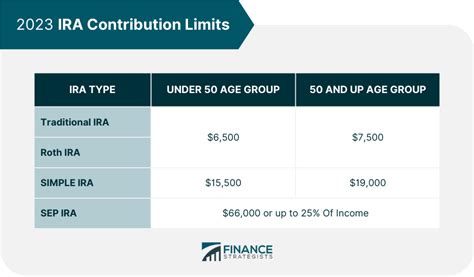

A SEP (Simplified Employee Pension) IRA is a type of retirement plan that allows self-employed individuals and small business owners to make tax-deductible contributions to a retirement account. However, there may come a time when you need to roll over your SEP IRA to another retirement account, such as a traditional IRA or a 401(k) plan. This can be due to various reasons, including changing jobs, retiring, or simply wanting to consolidate your retirement accounts. In this article, we will guide you through the process of rolling over a SEP IRA in 5 easy steps.

Step 1: Determine Your Rollover Options

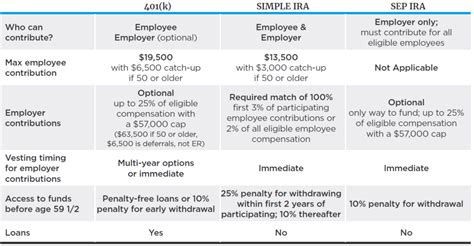

Before you start the rollover process, it’s essential to determine your options. You can roll over your SEP IRA to a traditional IRA, a 401(k) plan, or another qualified retirement plan. Each option has its own rules and regulations, so it’s crucial to understand the differences. For example, if you roll over your SEP IRA to a traditional IRA, you can consolidate your accounts and manage your retirement savings more easily. On the other hand, if you roll over your SEP IRA to a 401(k) plan, you may be able to take advantage of any matching contributions offered by your employer.

Step 2: Choose a Rollover Method

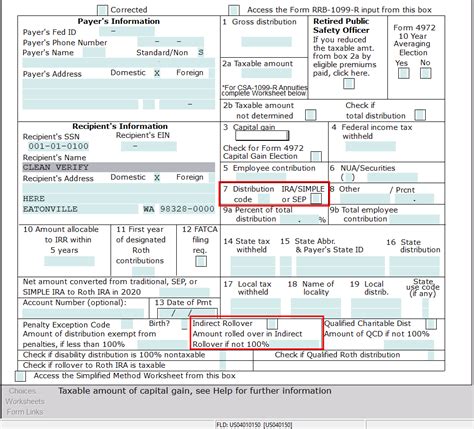

There are two ways to roll over a SEP IRA: a direct rollover and an indirect rollover. A direct rollover involves transferring the funds directly from your SEP IRA to your new retirement account. This method is generally recommended, as it avoids any potential tax implications. An indirect rollover, on the other hand, involves withdrawing the funds from your SEP IRA and depositing them into your new retirement account within 60 days. This method can be more complicated and may result in tax penalties if not done correctly.

Step 3: Gather Required Documents

To roll over your SEP IRA, you will need to gather certain documents, including:

- Your SEP IRA account statement

- Your new retirement account application

- A direct rollover form (if applicable)

- Your identification and social security number

Step 4: Complete the Rollover

Once you have gathered the required documents, you can complete the rollover. If you are doing a direct rollover, you will need to contact your SEP IRA custodian and request a direct transfer to your new retirement account. If you are doing an indirect rollover, you will need to withdraw the funds from your SEP IRA and deposit them into your new retirement account within 60 days. It’s crucial to follow the rules and regulations for indirect rollovers to avoid any tax penalties.

Step 5: Verify the Rollover

After completing the rollover, it’s essential to verify that the funds have been transferred correctly. You can do this by checking your new retirement account statement or contacting your custodian. You should also review your account to ensure that the funds are invested according to your preferences. It’s also a good idea to keep records of the rollover, including any documentation and correspondence with your custodian.

📝 Note: It's essential to understand the rules and regulations surrounding SEP IRA rollovers to avoid any tax implications or penalties. It's recommended that you consult with a financial advisor or tax professional to ensure a smooth and successful rollover.

The process of rolling over a SEP IRA can seem complex, but by following these 5 easy steps, you can ensure a smooth and successful transfer of your retirement funds. Remember to always follow the rules and regulations surrounding SEP IRA rollovers and to consult with a financial advisor or tax professional if you have any questions or concerns.

What is a SEP IRA?

+

A SEP (Simplified Employee Pension) IRA is a type of retirement plan that allows self-employed individuals and small business owners to make tax-deductible contributions to a retirement account.

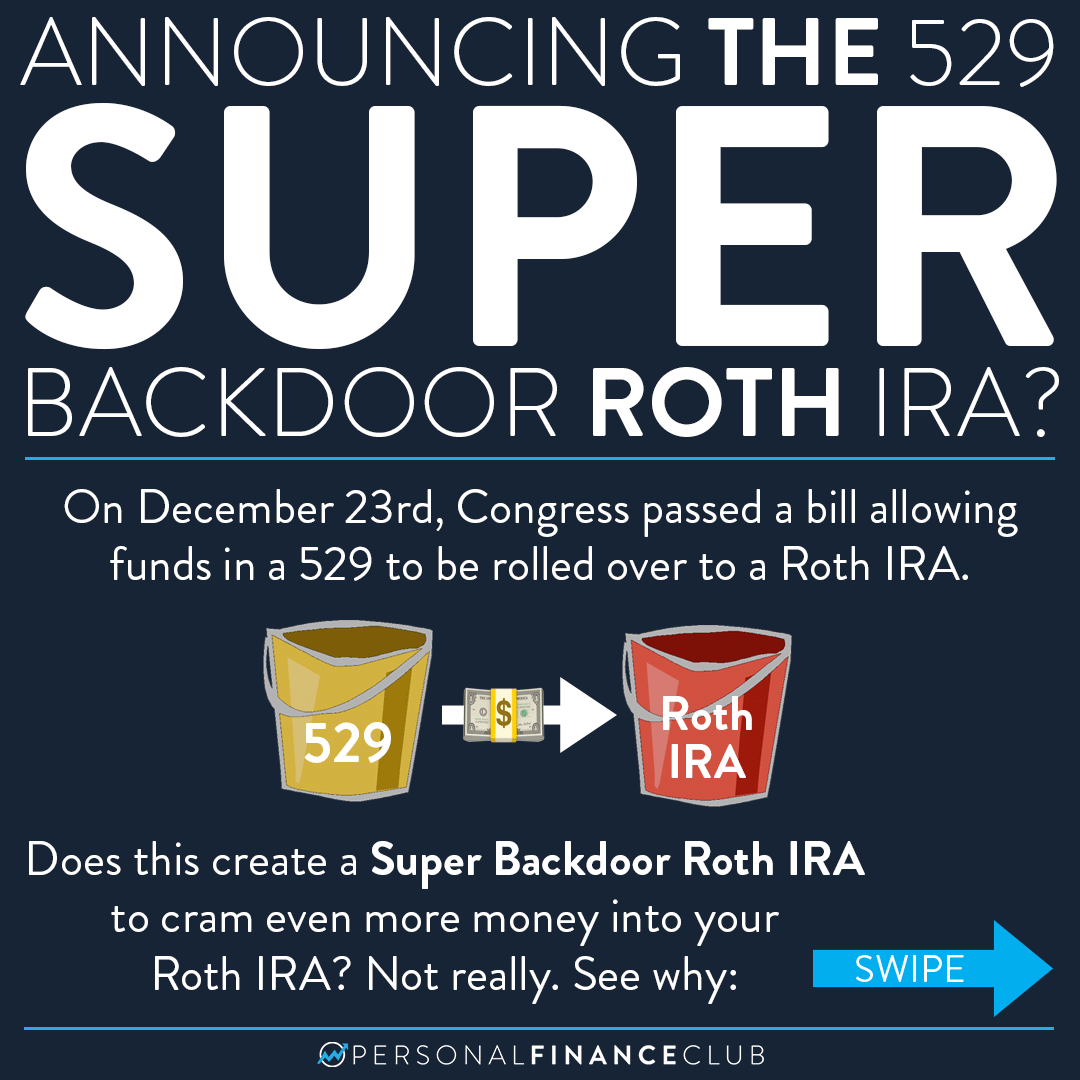

Can I roll over my SEP IRA to a Roth IRA?

+

Yes, you can roll over your SEP IRA to a Roth IRA, but you will need to pay taxes on the converted amount. It's recommended that you consult with a financial advisor or tax professional to determine the best course of action for your individual situation.

How long does a SEP IRA rollover take?

+

The time it takes to complete a SEP IRA rollover can vary depending on the method you choose and the efficiency of your custodian. Direct rollovers are generally faster, taking around 1-2 weeks, while indirect rollovers can take up to 60 days.

In the end, rolling over a SEP IRA requires careful planning and attention to detail. By following the steps outlined in this article and consulting with a financial advisor or tax professional, you can ensure a smooth and successful transfer of your retirement funds. Remember to always prioritize your financial security and take the time to understand the rules and regulations surrounding SEP IRA rollovers.