Sell Stock from LLC Paperwork

Understanding the Process of Selling Stock from an LLC

When it comes to selling stock from a Limited Liability Company (LLC), it’s essential to understand the process and the necessary paperwork involved. An LLC is a type of business structure that provides personal liability protection for its owners, known as members. While LLCs are not required to issue stock, they can do so if they choose to. In this article, we will delve into the process of selling stock from an LLC, the required paperwork, and the key considerations to keep in mind.

Key Considerations Before Selling Stock

Before selling stock from an LLC, there are several key considerations to keep in mind. These include: * Compliance with LLC Operating Agreement: The LLC’s operating agreement should outline the procedures for issuing and selling stock. * Compliance with State Laws: The LLC must comply with the state laws and regulations regarding the issuance and sale of stock. * Tax Implications: The sale of stock can have tax implications for both the LLC and the buyer. * Valuation of the LLC: The LLC must be valued to determine the price of the stock.

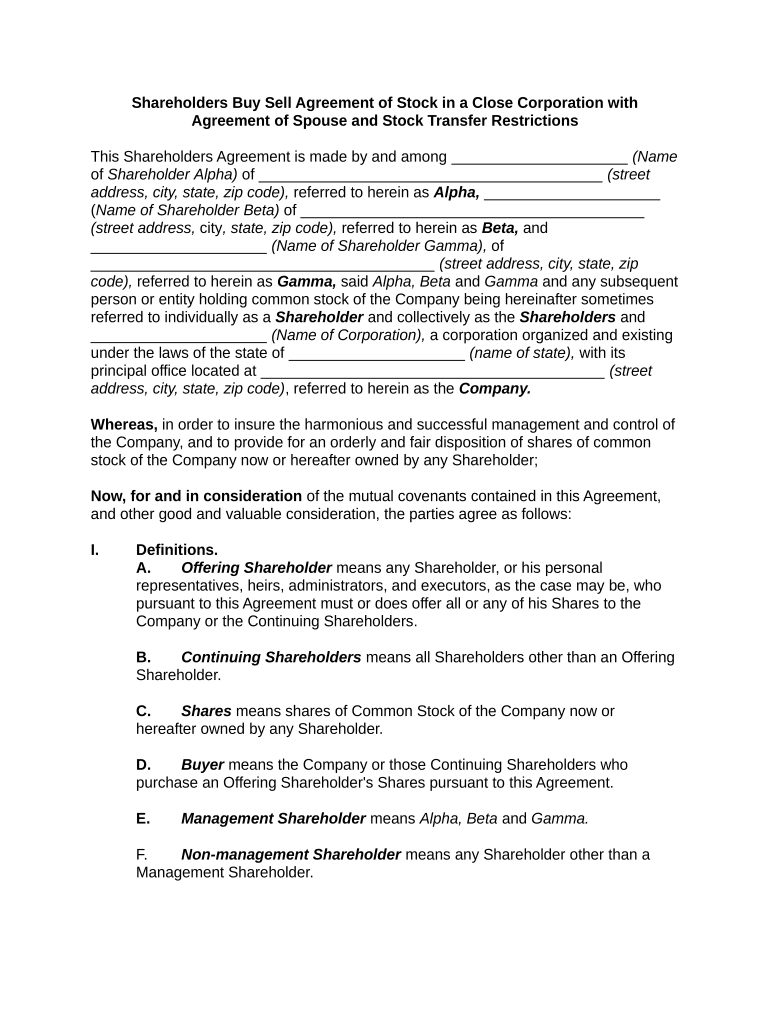

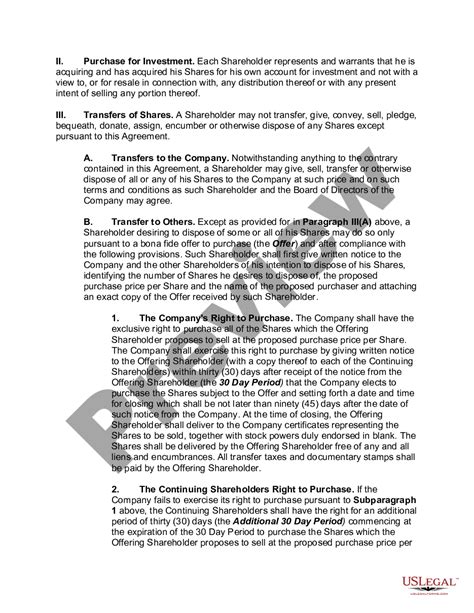

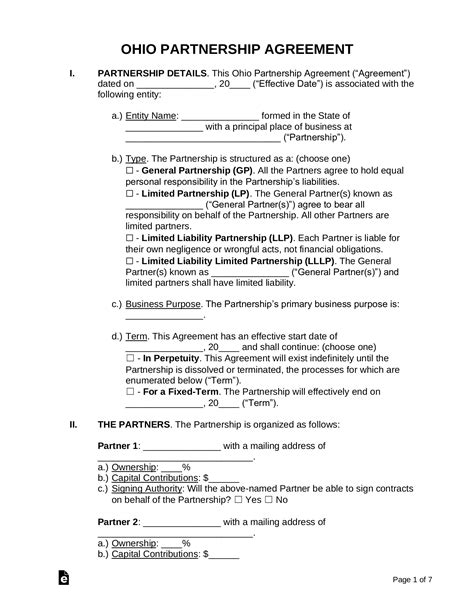

LLC Paperwork Required for Selling Stock

The following paperwork is typically required when selling stock from an LLC: * Articles of Organization: The LLC’s articles of organization should be updated to reflect the issuance of new stock. * Operating Agreement: The operating agreement should be amended to reflect the changes in ownership. * Stock Certificate: A stock certificate should be issued to the buyer, which serves as proof of ownership. * Shareholder Agreement: A shareholder agreement should be signed by all parties, outlining the terms and conditions of the stock sale.

Steps to Sell Stock from an LLC

The following steps should be taken when selling stock from an LLC: * Determine the Value of the LLC: The LLC should be valued to determine the price of the stock. * Prepare the Necessary Paperwork: The necessary paperwork, including the articles of organization, operating agreement, stock certificate, and shareholder agreement, should be prepared. * Obtain Approval from the Members: The sale of stock should be approved by the members of the LLC. * File the Necessary Documents: The necessary documents, including the updated articles of organization and operating agreement, should be filed with the state.

💡 Note: It's essential to consult with an attorney and/or accountant to ensure compliance with all applicable laws and regulations.

Tax Implications of Selling Stock from an LLC

The sale of stock from an LLC can have tax implications for both the LLC and the buyer. The tax implications will depend on the type of tax classification chosen by the LLC, such as a partnership, S corporation, or C corporation. It’s essential to consult with a tax professional to understand the tax implications of selling stock from an LLC.

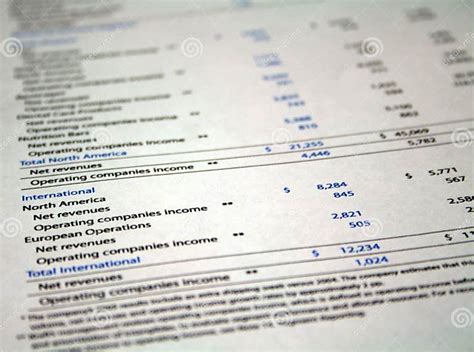

Valuation of the LLC

The valuation of the LLC is a critical step in the process of selling stock. The valuation will determine the price of the stock and should be based on the LLC’s financial statements, assets, and liabilities. There are several methods that can be used to value an LLC, including: * Asset-Based Valuation: This method values the LLC based on its assets, such as property, equipment, and inventory. * Income-Based Valuation: This method values the LLC based on its income, such as revenue and profits. * Market-Based Valuation: This method values the LLC based on the market value of similar businesses.

| Valuation Method | Description |

|---|---|

| Asset-Based Valuation | Values the LLC based on its assets |

| Income-Based Valuation | Values the LLC based on its income |

| Market-Based Valuation | Values the LLC based on the market value of similar businesses |

Conclusion and Final Thoughts

In conclusion, selling stock from an LLC requires careful consideration and planning. It’s essential to understand the process, the necessary paperwork, and the key considerations to keep in mind. The valuation of the LLC is a critical step in the process, and there are several methods that can be used to determine the value of the LLC. By following the steps outlined in this article and consulting with the necessary professionals, LLCs can successfully sell stock and achieve their business goals.

What is the difference between an LLC and a corporation?

+

An LLC is a type of business structure that provides personal liability protection for its owners, known as members. A corporation is a separate legal entity that is owned by shareholders and provides personal liability protection for its owners.

Can an LLC issue stock?

+

Yes, an LLC can issue stock, but it is not required to do so. If an LLC chooses to issue stock, it must comply with the state laws and regulations regarding the issuance and sale of stock.

What is the purpose of a shareholder agreement?

+

A shareholder agreement is a contract between the shareholders of an LLC that outlines the terms and conditions of the stock sale, including the rights and responsibilities of the shareholders.