5 Ways Send Loan Papers

Introduction to Loan Papers

When it comes to loan applications, one of the most critical steps is submitting the necessary documents, often referred to as loan papers. These documents serve as proof of your identity, income, employment, and other essential details that lenders require to process your loan application. The method of sending these documents can vary depending on the lender’s requirements and the technology they use. In this article, we will explore five common ways to send loan papers, highlighting the pros and cons of each method to help you choose the most suitable one for your needs.

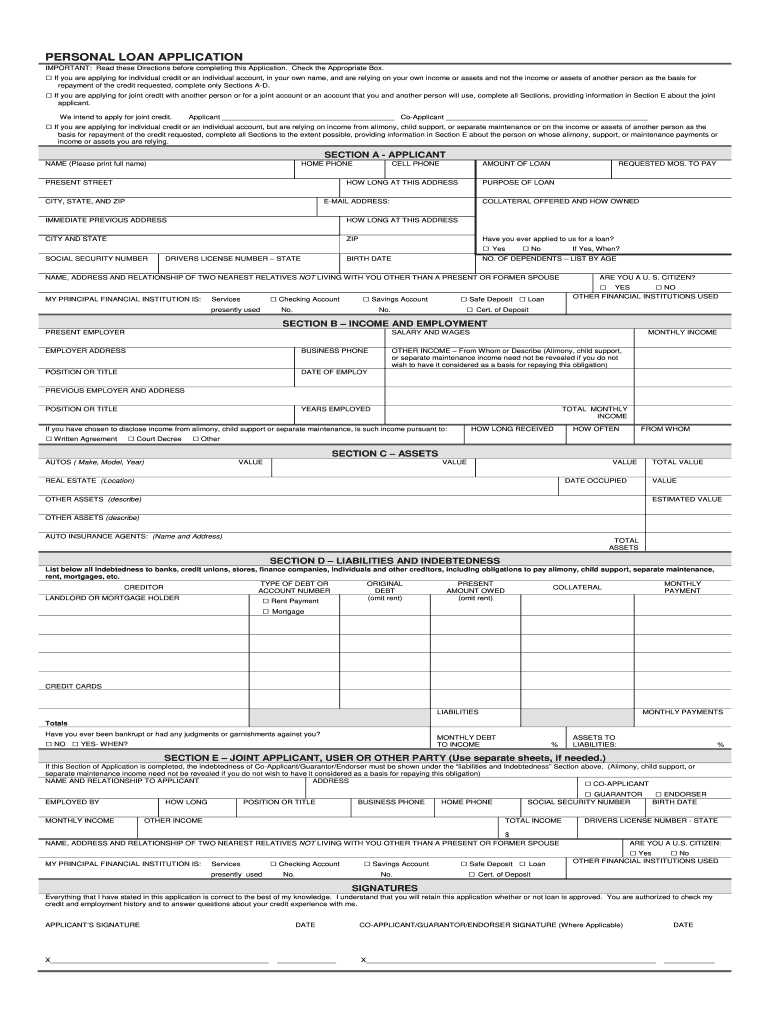

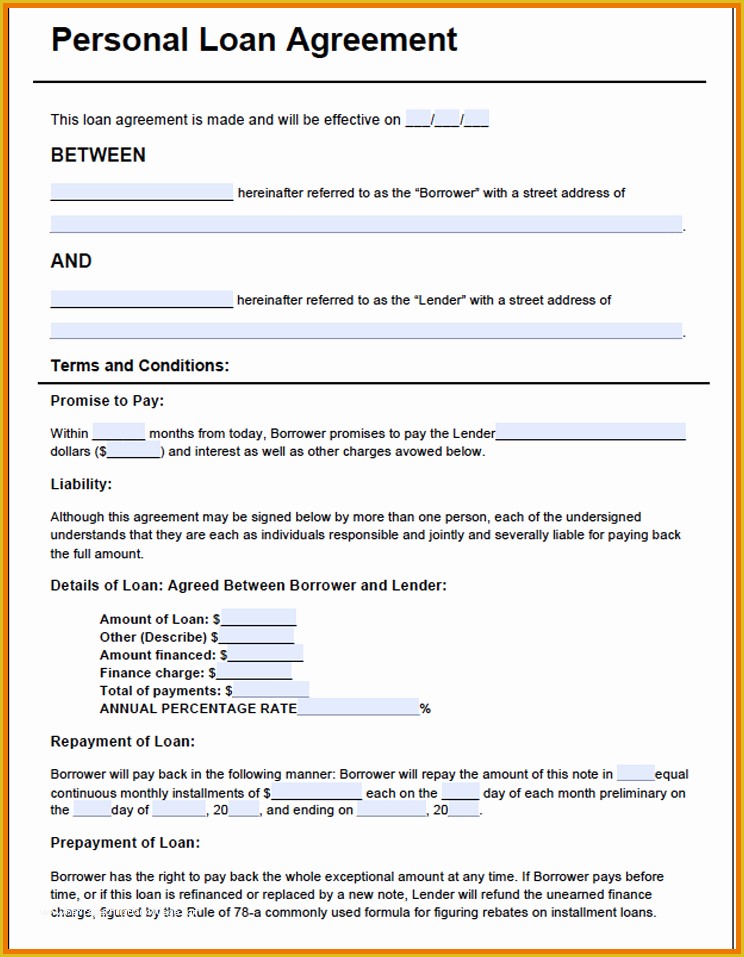

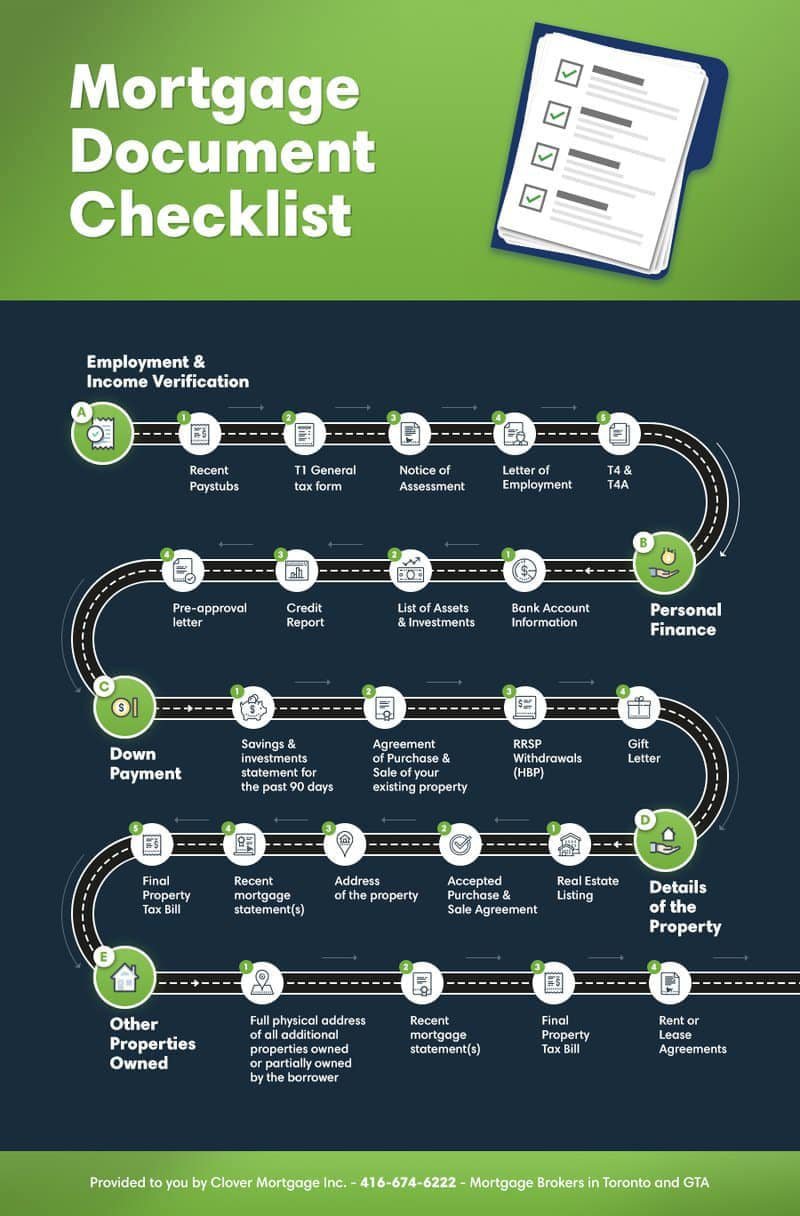

Understanding the Importance of Loan Papers

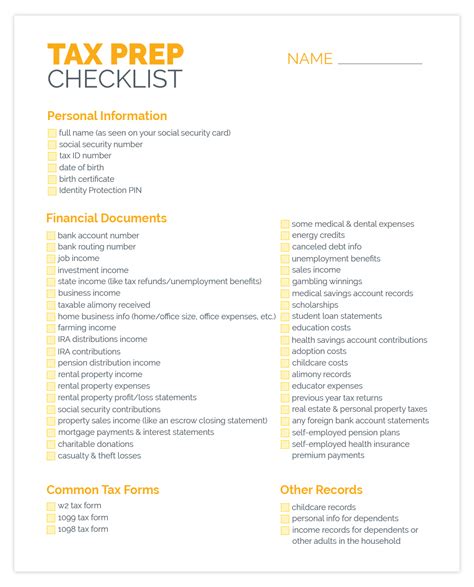

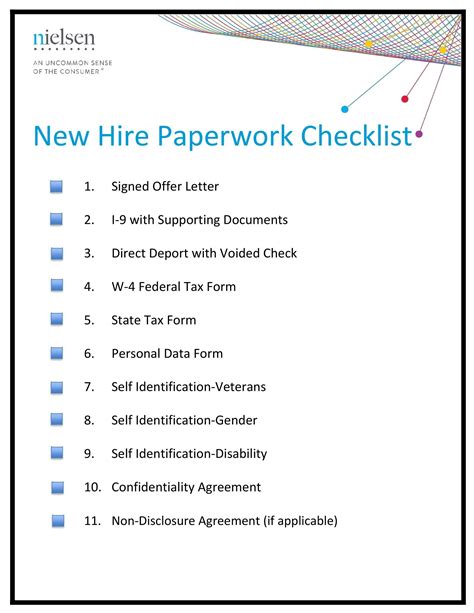

Before we dive into the ways to send loan papers, it’s essential to understand why these documents are crucial. Loan papers typically include: - Identification documents (ID, passport, etc.) - Income proof (pay stubs, tax returns, etc.) - Employment verification (letter from employer, etc.) - Asset documents (property deeds, vehicle titles, etc.) - Credit reports

These documents help lenders assess your creditworthiness and the risk involved in lending to you. Therefore, it’s crucial to submit them correctly and on time.

1. Email

Sending loan papers via email is a common practice. Most lenders have a dedicated email address where you can send your documents. This method is convenient because it allows you to send multiple documents at once and receive a confirmation almost immediately. However, security concerns are a significant issue with email, as sensitive information can be intercepted or accessed by unauthorized parties. To mitigate this risk, lenders often use encrypted email services or require you to send documents through a secure online portal.

2. Online Portals

Many lenders have online portals where you can upload your loan papers directly. This method is not only secure but also convenient, as you can upload documents at any time and from any location with an internet connection. Additionally, online portals often provide a checklist of required documents, making it easier for you to ensure you’ve submitted everything needed.

3. Fax

Although less common due to the rise of digital communication, faxing is still an option for sending loan papers. This method is relatively secure since the documents are transmitted directly to the lender’s fax machine. However, it requires access to a fax machine, which can be inconvenient. Moreover, quality issues can arise, especially if the fax machine is of poor quality, which might lead to illegible documents.

4. Postal Mail

Sending loan papers via postal mail is another traditional method. While it provides a physical record of your documents, it’s slower than digital methods and carries the risk of documents getting lost or delayed. Furthermore, security is a concern, as sensitive documents can be intercepted or accessed during transit.

5. In-Person Submission

For those who prefer a more personal approach or have concerns about digital security, submitting loan papers in person is an option. This method allows you to ensure that your documents are received and provides an opportunity to ask questions or clarify any doubts you might have. However, it’s the least convenient option, requiring you to physically visit the lender’s office, which might not be feasible for everyone, especially those with busy schedules or living far from the lender’s location.

📝 Note: Regardless of the method you choose, always ensure that you have copies of your documents and that you're sending them to the correct address or contact to avoid any delays in your loan application process.

In summary, the method you choose to send your loan papers should be based on your personal preferences, the level of security you require, and the convenience of the method. Understanding the pros and cons of each option can help you make an informed decision that suits your needs.

What are the most commonly required loan papers?

+

The most commonly required loan papers include identification documents, income proof, employment verification, and asset documents. The specific requirements can vary depending on the lender and the type of loan.

How do I ensure the security of my loan papers when sending them digitally?

+

To ensure the security of your loan papers when sending them digitally, look for lenders that use encrypted email services or secure online portals. You can also ask about their data protection policies to understand how your information will be safeguarded.

Can I submit my loan papers in person if I'm applying for a loan from an online lender?

+

Typically, online lenders do not have physical offices where you can submit documents in person. They usually have secure online portals for document submission. However, it's best to check with the lender directly, as some might have partnerships with local businesses where you can submit documents.

The process of sending loan papers is a critical step in your loan application journey. By understanding the different methods available and their implications, you can navigate this process more efficiently. Whether you choose to send your documents via email, through an online portal, by fax, via postal mail, or in person, the key is to ensure that your documents are received securely and on time. This not only facilitates a smoother loan application process but also protects your sensitive information from potential risks.