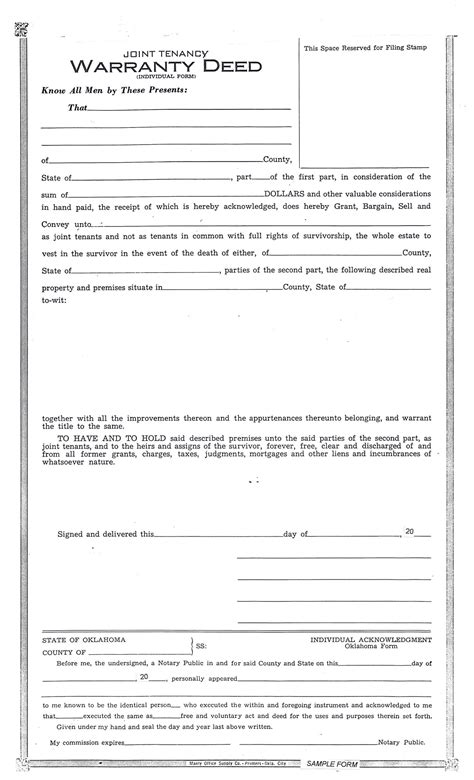

Warranty Deed in Closing Paperwork

Understanding the Role of a Warranty Deed in Closing Paperwork

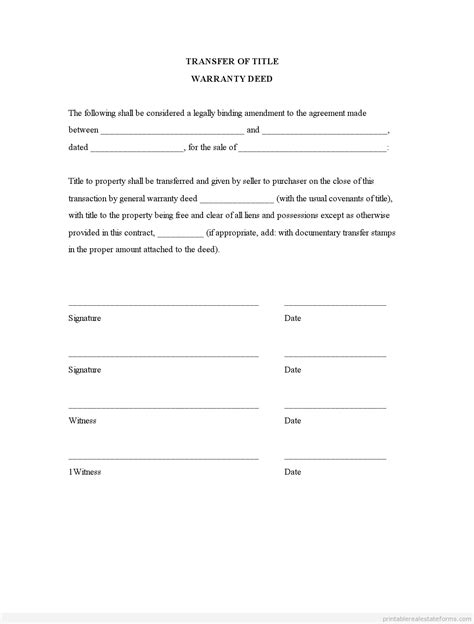

When it comes to real estate transactions, the paperwork involved can be overwhelming, especially for first-time buyers or sellers. One of the most critical documents in this process is the warranty deed. A warranty deed is a type of deed that provides the buyer with guarantees regarding the property’s ownership and any potential issues that may arise. In this blog post, we will delve into the details of a warranty deed, its importance in closing paperwork, and what it entails for both buyers and sellers.

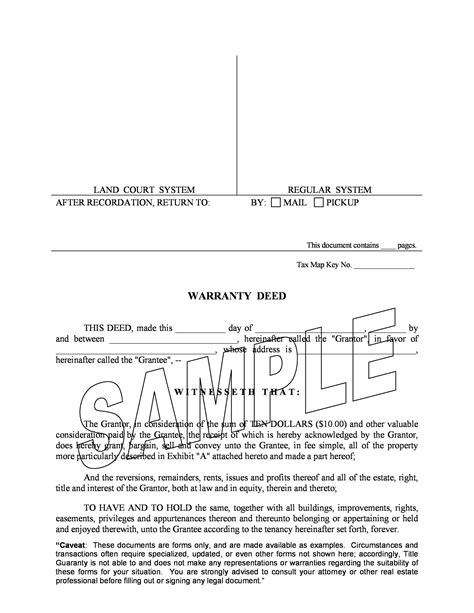

What is a Warranty Deed?

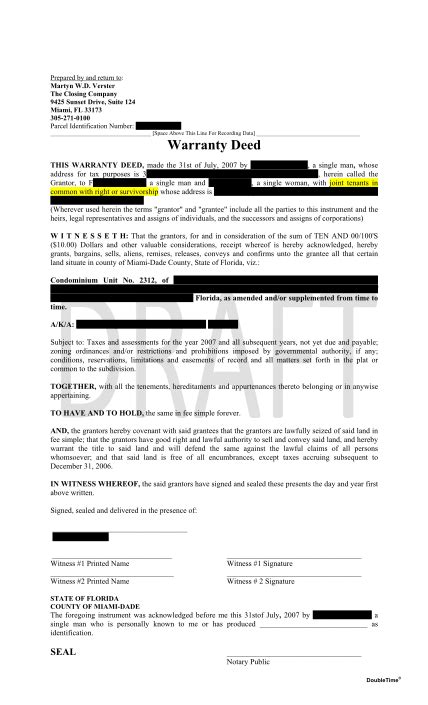

A warranty deed, also known as a general warranty deed, is a legal document that transfers the ownership of a property from the seller to the buyer. It includes several key provisions that protect the buyer’s interests, including: - Clear title: The seller guarantees that they have the right to sell the property and that there are no undisclosed liens or encumbrances. - Quiet enjoyment: The buyer has the right to possess the property without interference from others. - Warranty of title: The seller promises to defend the buyer against any claims or disputes regarding the property’s ownership. - Freedom from encumbrances: The property is free from any liens, mortgages, or other financial obligations that are not disclosed.

Importance of a Warranty Deed in Closing Paperwork

The warranty deed plays a crucial role in the closing process of a real estate transaction. It provides the buyer with assurance that the seller has the right to sell the property and that the property is free from any issues that could affect its value or the buyer’s ownership. Without a warranty deed, the buyer may be exposed to risks such as: - Hidden liens or encumbrances: Undisclosed debts or claims against the property that can affect its value or the buyer’s ownership. - Disputes over ownership: Potential disputes or claims from other parties regarding the property’s ownership. - Financial losses: The buyer may incur financial losses if the property is found to have undisclosed issues or if the seller is not the rightful owner.

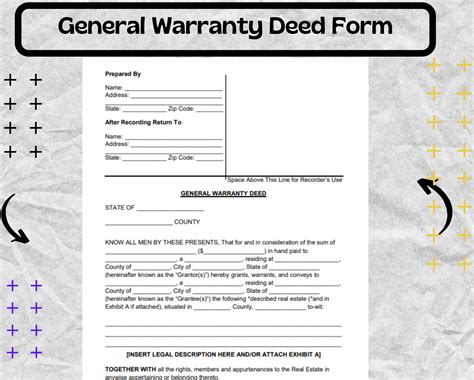

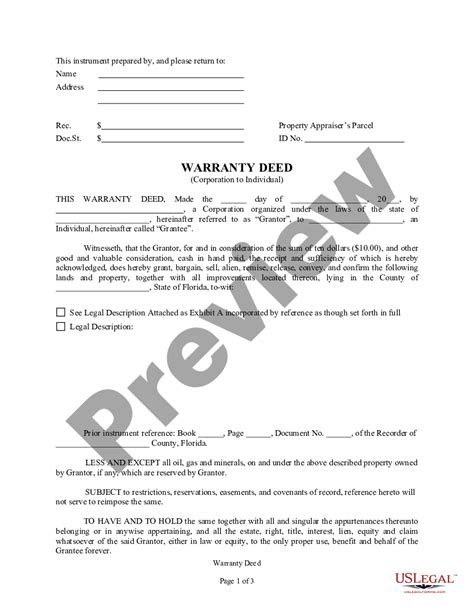

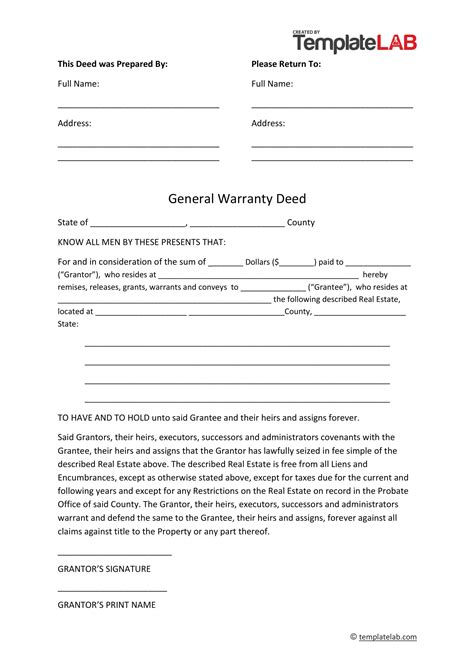

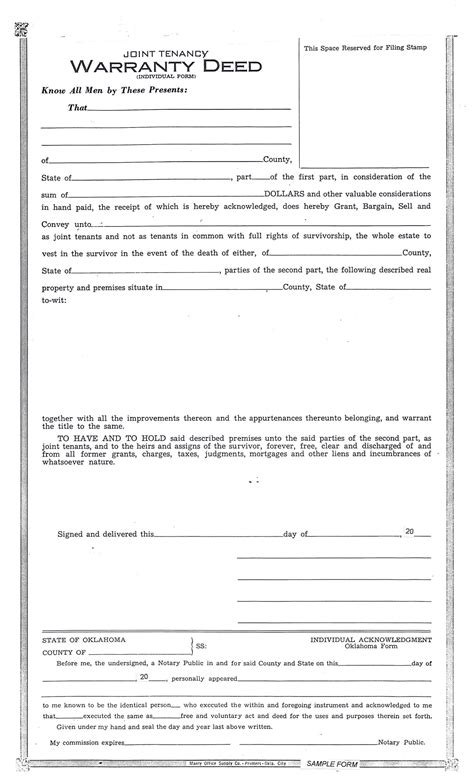

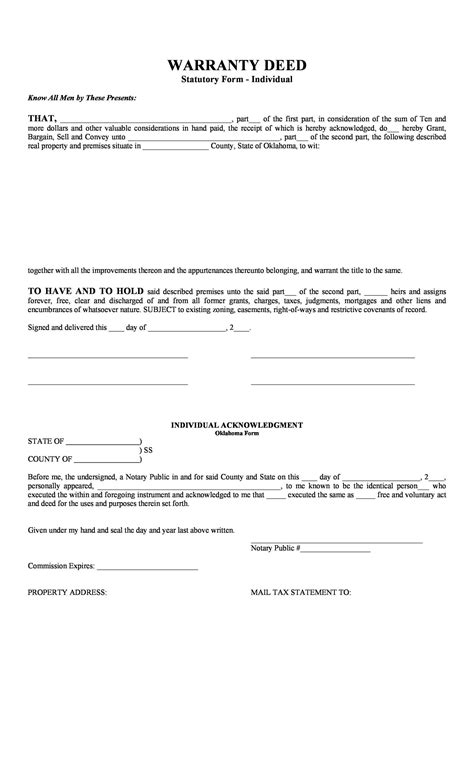

Key Components of a Warranty Deed

A warranty deed typically includes the following key components: - Granting clause: The seller transfers the ownership of the property to the buyer. - Habendum clause: The seller guarantees that they have the right to sell the property and that the property is free from any liens or encumbrances. - Warranty clause: The seller promises to defend the buyer against any claims or disputes regarding the property’s ownership. - Description of the property: A detailed description of the property, including its location, boundaries, and any improvements. - Consideration: The amount paid by the buyer to the seller for the property.

Benefits of a Warranty Deed

A warranty deed provides several benefits to both buyers and sellers, including: - Protection for the buyer: The warranty deed provides the buyer with guarantees regarding the property’s ownership and any potential issues that may arise. - Increased confidence: The buyer can have increased confidence in their purchase, knowing that the seller has provided guarantees regarding the property’s ownership. - Simplified closing process: The warranty deed can simplify the closing process by providing a clear and comprehensive transfer of ownership.

📝 Note: It is essential to carefully review the warranty deed and understand its provisions before signing. Buyers and sellers should also consider seeking the advice of a real estate attorney to ensure that their interests are protected.

Comparison with Other Types of Deeds

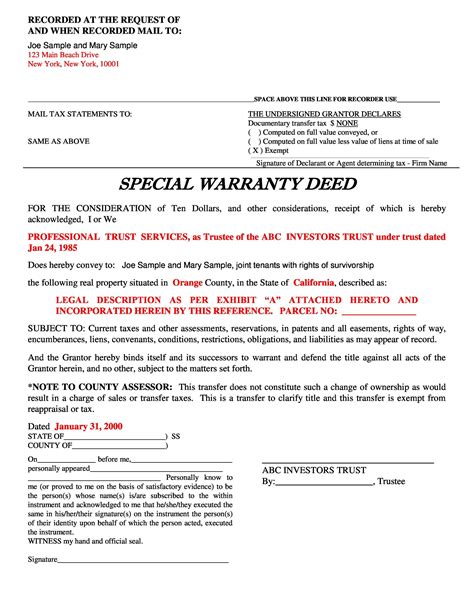

There are several other types of deeds that can be used in real estate transactions, including: - Quitclaim deed: A quitclaim deed transfers the seller’s interest in the property to the buyer, but it does not provide any guarantees regarding the property’s ownership. - Special warranty deed: A special warranty deed provides guarantees regarding the property’s ownership, but only for the period during which the seller owned the property. - Bargain and sale deed: A bargain and sale deed is used in some states and provides a limited guarantee regarding the property’s ownership.

| Type of Deed | Guarantees | Protection for Buyer |

|---|---|---|

| Warranty Deed | Clear title, quiet enjoyment, warranty of title, freedom from encumbrances | High |

| Quitclaim Deed | None | Low |

| Special Warranty Deed | Guarantees regarding property's ownership, but only for the period during which the seller owned the property | Medium |

Best Practices for Buyers and Sellers

To ensure a smooth and successful real estate transaction, buyers and sellers should follow these best practices: - Carefully review the warranty deed: Understand the provisions and guarantees included in the deed. - Seek the advice of a real estate attorney: Ensure that your interests are protected and that you understand the implications of the warranty deed. - Conduct a thorough title search: Verify the seller’s ownership and identify any potential issues with the property’s title. - Negotiate the terms of the warranty deed: Buyers and sellers can negotiate the terms of the warranty deed to ensure that their interests are protected.

In summary, a warranty deed is a critical document in real estate transactions that provides buyers with guarantees regarding the property’s ownership and any potential issues that may arise. By understanding the role of a warranty deed in closing paperwork and following best practices, buyers and sellers can ensure a smooth and successful transaction. The warranty deed offers protection and increased confidence for buyers, while also providing a clear and comprehensive transfer of ownership. Whether you are a buyer or seller, it is essential to carefully review the warranty deed and seek the advice of a real estate attorney to ensure that your interests are protected.

What is the difference between a warranty deed and a quitclaim deed?

+

A warranty deed provides guarantees regarding the property’s ownership, while a quitclaim deed only transfers the seller’s interest in the property to the buyer without any guarantees.

What are the benefits of a warranty deed for buyers?

+

A warranty deed provides buyers with protection and increased confidence in their purchase, as it guarantees that the seller has the right to sell the property and that the property is free from any liens or encumbrances.

Can a warranty deed be used for all types of real estate transactions?

+

No, a warranty deed is typically used for residential and commercial real estate transactions, but it may not be suitable for all types of transactions, such as transfers of property between family members or transfers of property through a trust.