LLC Annual Paperwork Filing Requirements

Introduction to LLC Annual Paperwork Filing Requirements

Forming a Limited Liability Company (LLC) is a significant step for any business, offering liability protection and tax benefits. However, maintaining an LLC requires ongoing compliance with state regulations, which includes filing annual paperwork. This process, while necessary, can be complex and varies by state. Understanding these requirements is crucial for avoiding penalties, fines, and even the dissolution of the LLC.

Why Annual Filings Are Necessary

Annual filings serve several purposes. They update the state on any changes in the company’s structure, such as new members, changes in addresses, or modifications in the business’s purpose. This information helps the state maintain accurate records and ensures that the LLC remains in good standing. Furthermore, these filings often involve paying annual fees, which support the state’s business registration and regulatory activities.

Types of Annual Filings

There are primarily two types of annual filings that LLCs must concern themselves with: the Annual Report and taxes.

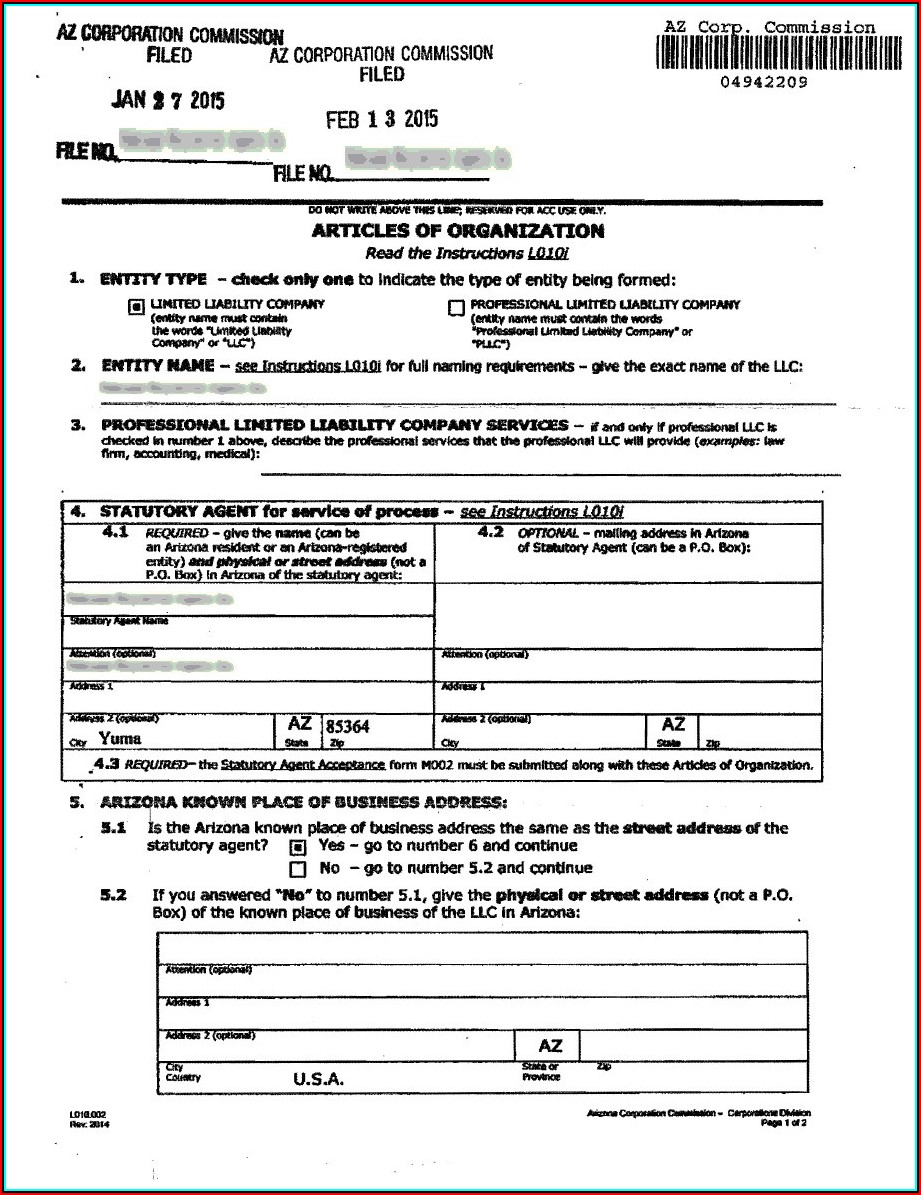

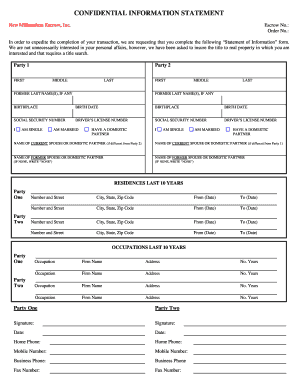

- Annual Report: This document, also known as the Statement of Information, requires the LLC to provide updated information about its business, including but not limited to:

- Business name and address

- Principal business address

- Names and addresses of members and managers

- Description of business activities

- Taxes: LLCs are considered pass-through entities for tax purposes, meaning the business income is only taxed at the individual level. However, LLCs must still file tax returns (Form 1065 for partnerships, or Form 1120 for corporations) and may need to pay annual taxes or fees to the state.

State Variations in Annual Filing Requirements

Each state has its own set of rules and deadlines for annual filings. For instance: - Filing Fees: These can range significantly, from under 50 to over 750, depending on the state. - Filing Deadlines: Some states require filings on the anniversary of the LLC’s formation, while others have a specific annual deadline (e.g., April 15th). - Required Information: The level of detail required in the annual report can vary, with some states asking for more comprehensive information about the business operations and financials.

Consequences of Not Filing Annual Paperwork

Failure to file annual paperwork can lead to severe consequences, including: - Late Fees: Additional charges for not meeting the deadline. - Penalties: Fines that can significantly increase the cost of compliance. - Loss of Good Standing: The LLC may no longer be considered in good standing with the state, which can impact its ability to conduct business. - Dissolution: In extreme cases, the state may dissolve the LLC for non-compliance, effectively ending the business’s legal existence.

Best Practices for Compliance

To ensure compliance with annual filing requirements: - Stay Informed: Regularly check with the state business registration office for any changes in requirements or deadlines. - Use Online Resources: Many states offer online filing systems that can simplify the process and reduce errors. - Seek Professional Help: If unsure, consider consulting with a legal or accounting professional who specializes in business compliance.

📝 Note: It's essential to maintain accurate and detailed records of all filings and communications with the state to ensure compliance and facilitate future filings.

Tools and Resources for Filing

Several tools and resources are available to help LLCs with their annual filings: - State Business Registration Websites: Most states provide detailed information and online filing systems for annual reports and taxes. - Accounting and Legal Software: Specialized software can help manage and prepare tax filings and annual reports. - Business Compliance Services: Companies that specialize in business compliance can offer guidance and handle filings on behalf of the LLC.

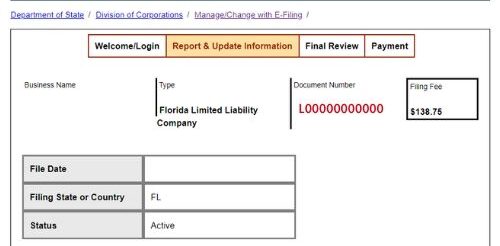

| State | Annual Filing Fee | Filing Deadline |

|---|---|---|

| California | $20 | Anniversary of formation |

| New York | $9 | Anniversary of formation |

| Florida | $138.75 | May 1st |

In summary, annual paperwork filing requirements for LLCs are a critical aspect of maintaining the legal integrity and good standing of a business. By understanding the specific requirements of their state and staying on top of filings, LLCs can avoid penalties and ensure continued operational compliance. Whether through personal management or with the help of professional services, adherence to these regulations is paramount for the longevity and success of any LLC.

To finalize, it’s crucial for LLC owners to be proactive in managing their annual filing obligations, ensuring they meet all necessary deadlines and provide accurate, complete information to the state. This proactive approach not only helps in avoiding legal and financial repercussions but also in maintaining a positive business reputation and uninterrupted operation.

What happens if an LLC fails to file its annual report?

+

If an LLC fails to file its annual report, it may face late fees, penalties, loss of good standing, and in severe cases, dissolution by the state. It’s crucial to comply with annual filing requirements to avoid these consequences.

How do I file my LLC’s annual report?

+

The process for filing an LLC’s annual report varies by state but often involves submitting the required information and fee through the state’s business registration website or by mail. It’s advisable to check with the state business registration office for specific instructions.

Can I file my LLC’s taxes and annual report at the same time?

+

While the annual report and taxes are separate filings, the deadlines may coincide in some states. However, it’s essential to ensure that both are filed correctly and on time. Consulting with a tax professional can help in managing these obligations efficiently.