5 Forms Seasonal Employees Need

Introduction to Seasonal Employment

Seasonal employment is a common practice in various industries, including retail, hospitality, and agriculture. As the demand for products or services fluctuates throughout the year, businesses often hire temporary workers to help manage the workload. These seasonal employees play a crucial role in ensuring the smooth operation of companies during peak periods. To facilitate the hiring and management of seasonal employees, certain forms and documents are essential. In this article, we will discuss the five key forms that seasonal employees need to complete.

Form 1: W-4 Form - Employee’s Withholding Certificate

The W-4 form, also known as the Employee’s Withholding Certificate, is a crucial document that seasonal employees must complete. This form helps employers determine the correct amount of federal income tax to withhold from an employee’s wages. The W-4 form requires employees to provide their personal details, including their name, address, and Social Security number. Additionally, employees must indicate their filing status, number of dependents, and any other income that may affect their tax withholding.

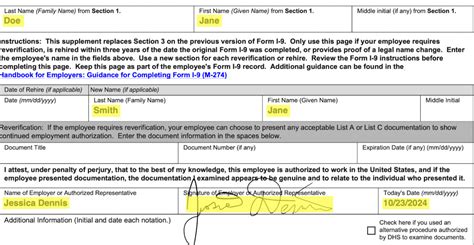

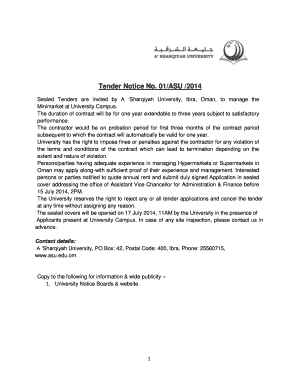

Form 2: I-9 Form - Employment Eligibility Verification

The I-9 form, or Employment Eligibility Verification, is another essential document for seasonal employees. This form is used to verify an employee’s identity and eligibility to work in the United States. The I-9 form requires employees to provide documentation, such as a passport, driver’s license, or Social Security card, to prove their identity and work authorization. Employers must review and verify the documents provided by the employee to ensure compliance with immigration laws.

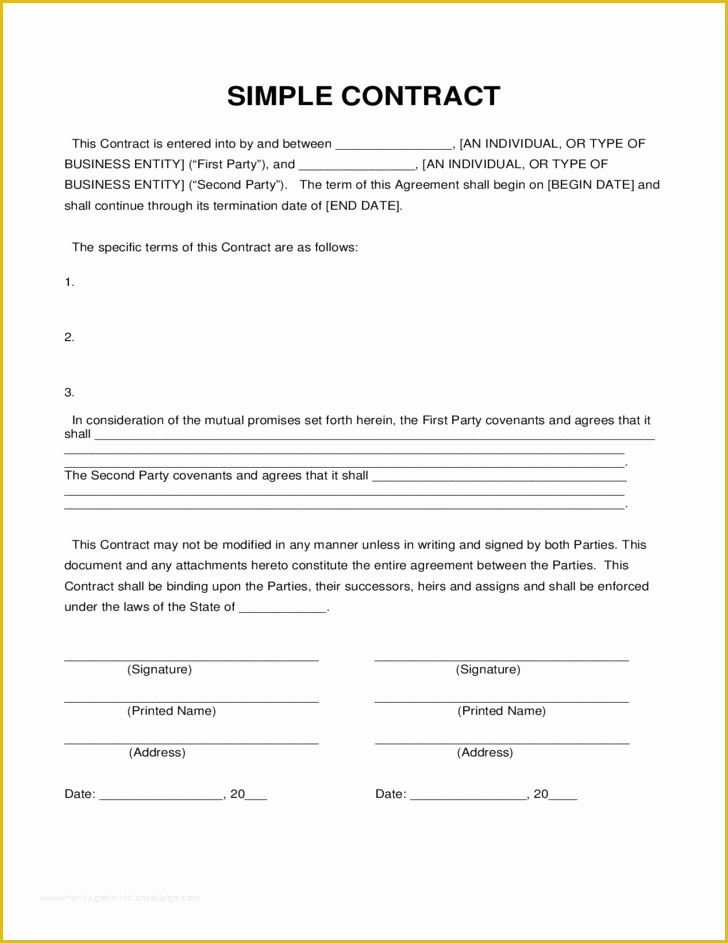

Form 3: Direct Deposit Form

A direct deposit form is a convenient way for seasonal employees to receive their paychecks. This form allows employees to authorize their employer to deposit their wages directly into their bank account. The direct deposit form typically requires employees to provide their bank account details, including the account number and routing number. By completing this form, seasonal employees can ensure that they receive their paychecks promptly and securely.

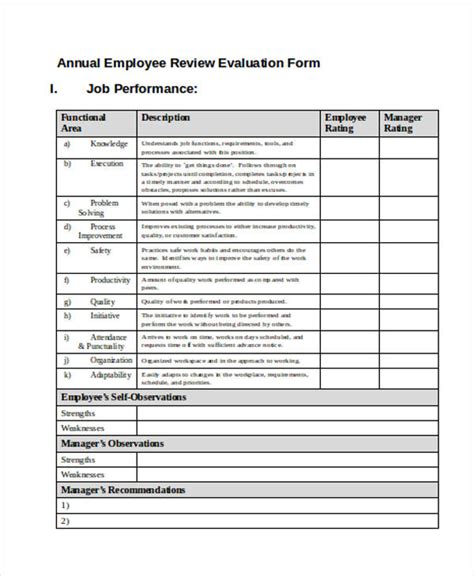

Form 4: Benefits Enrollment Form

Depending on the employer, seasonal employees may be eligible for benefits, such as health insurance, retirement plans, or paid time off. A benefits enrollment form is used to enroll seasonal employees in these benefits programs. This form typically requires employees to provide their personal details, choose their benefits options, and authorize any necessary deductions from their wages. By completing this form, seasonal employees can take advantage of the benefits offered by their employer.

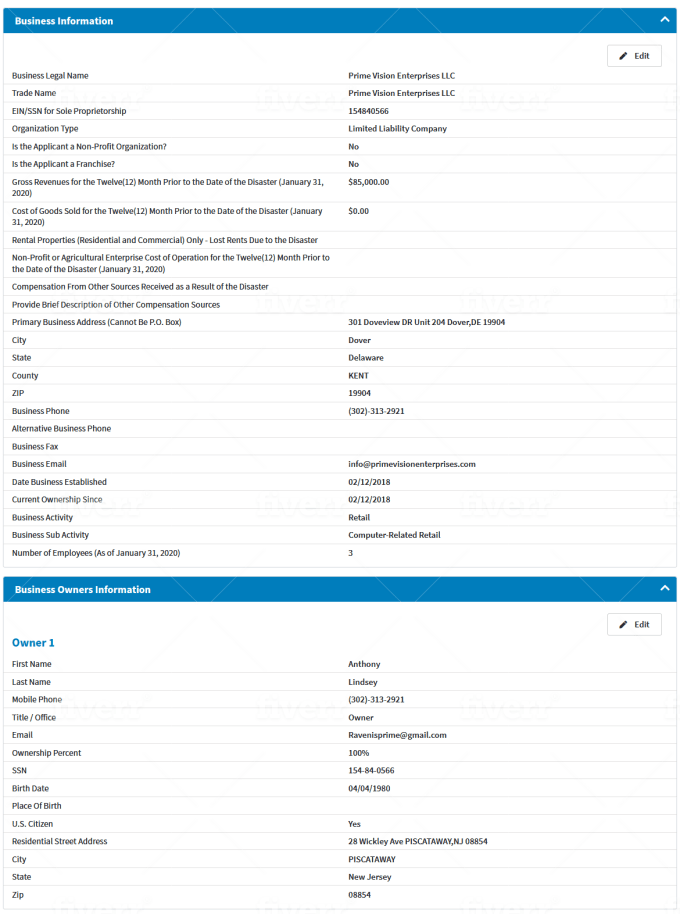

Form 5: Tax Identification Number (TIN) Verification Form

The Tax Identification Number (TIN) verification form is used to verify a seasonal employee’s TIN, which is typically their Social Security number. This form is essential for employers to ensure that they are reporting accurate tax information to the authorities. The TIN verification form requires employees to provide their TIN and confirm their identity. By completing this form, seasonal employees can help their employer comply with tax laws and regulations.

| Form Name | Purpose |

|---|---|

| W-4 Form | Employee's Withholding Certificate |

| I-9 Form | Employment Eligibility Verification |

| Direct Deposit Form | Authorizes direct deposit of wages |

| Benefits Enrollment Form | Enrolls employees in benefits programs |

| Tax Identification Number (TIN) Verification Form | Verifies employee's TIN |

💡 Note: It is essential for seasonal employees to complete these forms accurately and thoroughly to ensure compliance with tax laws and regulations.

In summary, the five forms that seasonal employees need to complete are the W-4 form, I-9 form, direct deposit form, benefits enrollment form, and Tax Identification Number (TIN) verification form. These forms are crucial for employers to manage their seasonal workforce effectively and comply with tax laws and regulations. By completing these forms, seasonal employees can ensure that they receive their paychecks promptly, take advantage of benefits programs, and comply with tax laws.

What is the purpose of the W-4 form?

+

The W-4 form is used to determine the correct amount of federal income tax to withhold from an employee’s wages.

Why is the I-9 form important?

+

The I-9 form is used to verify an employee’s identity and eligibility to work in the United States.

Can seasonal employees opt out of benefits programs?

+

Yes, seasonal employees can opt out of benefits programs, but they must complete the benefits enrollment form to indicate their decision.