Paying Off College Withdrawal Fees

Understanding College Withdrawal Fees

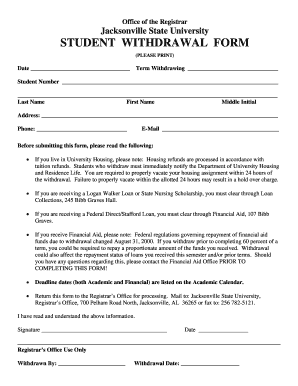

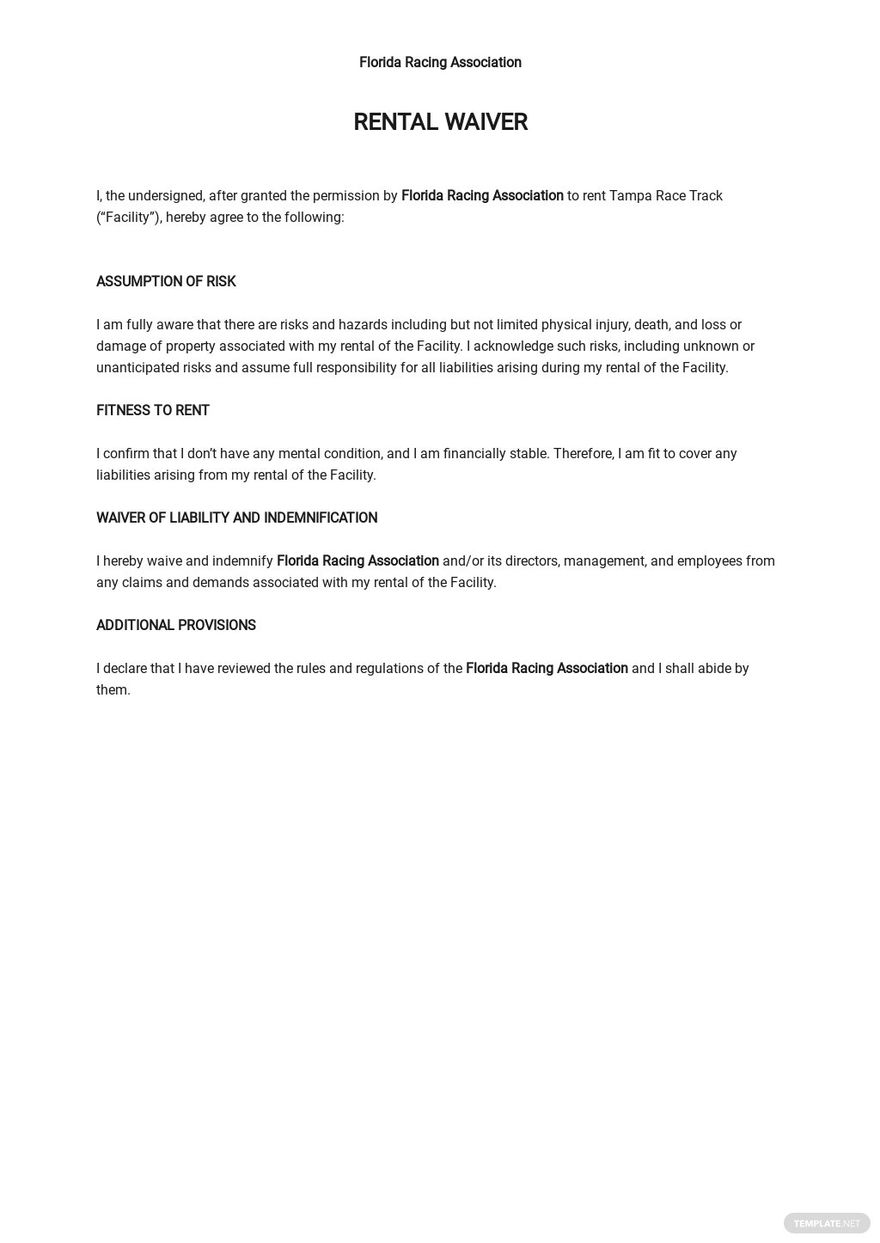

When students decide to withdraw from college, they often face significant fees that can be overwhelming. These fees can range from a few hundred to several thousand dollars, depending on the institution and the timing of the withdrawal. It’s essential to understand the withdrawal process and the associated fees to make informed decisions about one’s education. In this article, we will delve into the world of college withdrawal fees, exploring the reasons behind them, the consequences of withdrawing, and strategies for paying them off.

Reasons for Withdrawing from College

There are various reasons why students might choose to withdraw from college. Some common reasons include: * Financial difficulties * Academic struggles * Personal or family issues * Health problems * Dissatisfaction with the program or institution Regardless of the reason, it’s crucial to consider the potential consequences of withdrawing, including the impact on one’s academic and professional career.

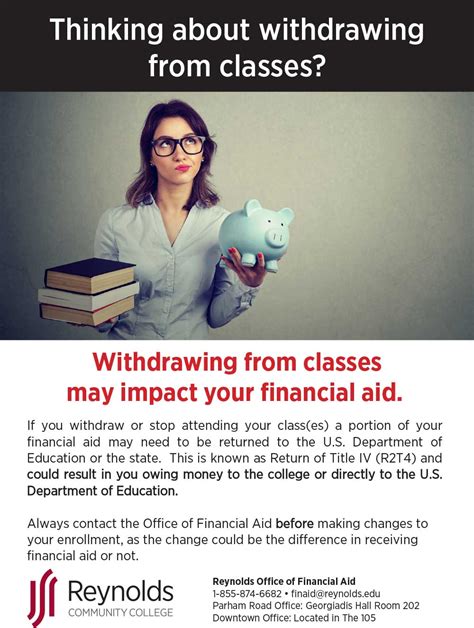

Consequences of Withdrawing from College

Withdrawing from college can have significant consequences, including: * Loss of financial aid: Students who withdraw may lose their financial aid, including scholarships, grants, and loans. * Impact on credit score: Unpaid fees and loans can negatively affect one’s credit score, making it challenging to secure loans or credit in the future. * Limited job opportunities: Withdrawing from college can limit job opportunities, as many employers require a degree or certificate. * Emotional and psychological impact: Withdrawing can be emotionally and psychologically challenging, leading to feelings of failure and disappointment.

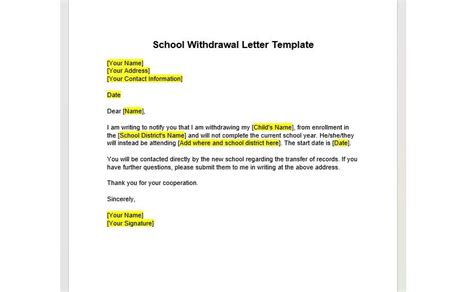

Strategies for Paying Off College Withdrawal Fees

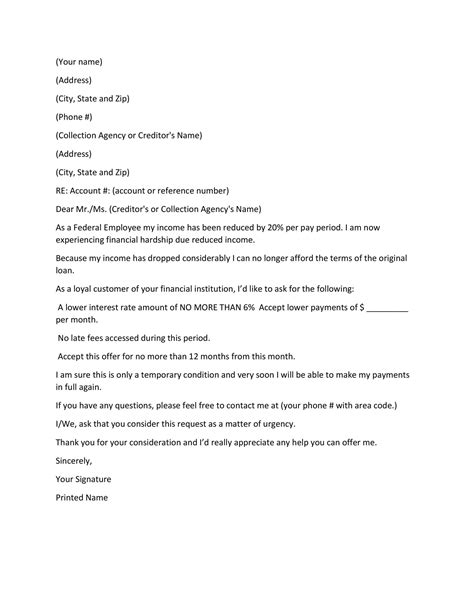

Paying off college withdrawal fees can be a daunting task, but there are strategies that can help. Some options include: * Negotiating with the institution: Students may be able to negotiate with the college or university to reduce or waive the fees. * Setting up a payment plan: Institutions may offer payment plans, allowing students to pay off the fees over time. * Seeking financial assistance: Students may be eligible for financial assistance, such as loans or grants, to help pay off the fees. * Considering a income-driven repayment plan: If the fees are related to a federal student loan, students may be able to switch to an income-driven repayment plan, which can lower monthly payments.

💡 Note: It's essential to review and understand the terms and conditions of any payment plan or financial assistance program before committing to it.

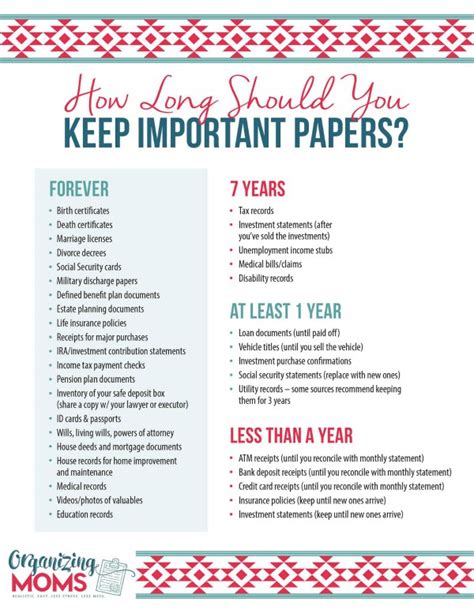

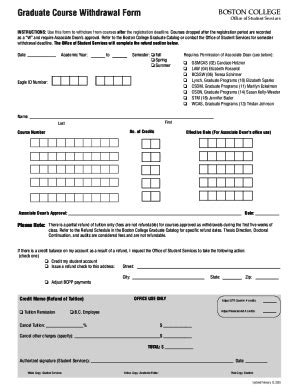

Creating a Budget to Pay Off Withdrawal Fees

Creating a budget is crucial when paying off college withdrawal fees. Students should: * Track their income and expenses: Understanding where their money is going can help students identify areas for reduction. * Prioritize expenses: Students should prioritize essential expenses, such as rent, utilities, and food, over non-essential expenses. * Allocate a portion of their income: Students should allocate a portion of their income towards paying off the withdrawal fees. * Consider a side hustle: Taking on a part-time job or freelance work can help students increase their income and pay off the fees faster.

| Monthly Income | Essential Expenses | Non-Essential Expenses | Withdrawal Fee Payment |

|---|---|---|---|

| $2,000 | $1,500 | $200 | $300 |

Seeking Professional Help

If students are struggling to pay off college withdrawal fees, they may want to consider seeking professional help. A financial advisor or credit counselor can provide guidance and support in creating a budget and developing a plan to pay off the fees. Additionally, students may want to consider reaching out to their institution’s financial aid office or student affairs department for assistance.

In the end, paying off college withdrawal fees requires a strategic approach, patience, and persistence. By understanding the reasons behind the fees, the consequences of withdrawing, and the strategies for paying them off, students can take control of their financial situation and move forward with confidence. The key is to stay informed, create a budget, and seek help when needed. With the right mindset and support, students can overcome the challenges of paying off college withdrawal fees and achieve their academic and professional goals.

What are college withdrawal fees?

+

College withdrawal fees are charges imposed on students who withdraw from college. These fees can range from a few hundred to several thousand dollars, depending on the institution and the timing of the withdrawal.

How can I pay off college withdrawal fees?

+

There are several strategies for paying off college withdrawal fees, including negotiating with the institution, setting up a payment plan, seeking financial assistance, and considering an income-driven repayment plan.

What are the consequences of withdrawing from college?

+

The consequences of withdrawing from college can include loss of financial aid, impact on credit score, limited job opportunities, and emotional and psychological impact.