5 RMD Paperwork Tips

Understanding RMD Paperwork: A Comprehensive Guide

Required Minimum Distributions (RMDs) are a crucial aspect of retirement planning, particularly for individuals with traditional IRAs or employer-sponsored retirement plans. The RMD rules dictate that you must take a minimum distribution from your retirement account each year, starting from the age of 72. However, managing RMD paperwork can be overwhelming, especially for those who are not familiar with the process. In this article, we will delve into the world of RMD paperwork, providing you with valuable tips and insights to ensure a smooth and compliant experience.

Tip 1: Understand the RMD Rules and Regulations

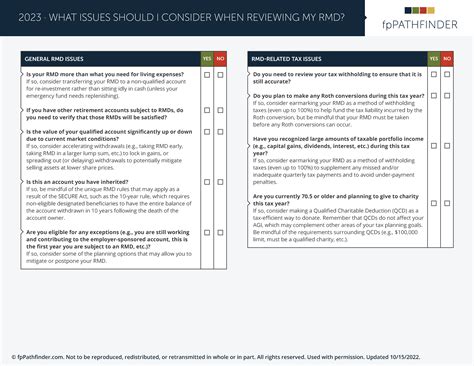

Before diving into the paperwork, it is essential to understand the RMD rules and regulations. The IRS sets the rules for RMDs, and failure to comply can result in penalties and fines. The first step is to determine if you are required to take an RMD. Generally, you must take an RMD if you have a traditional IRA or an employer-sponsored retirement plan, such as a 401(k) or 403(b), and you are 72 years old or older. You can use the IRS’s Uniform Lifetime Table to calculate your RMD. This table provides a life expectancy factor based on your age, which is used to determine the minimum amount you must withdraw from your account.

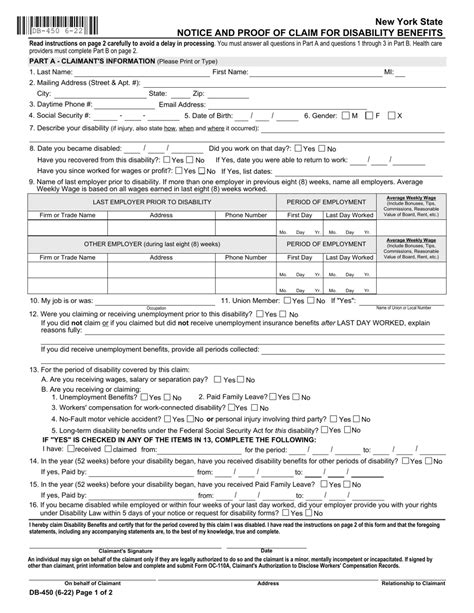

Tip 2: Gather Necessary Documents and Information

To complete your RMD paperwork, you will need to gather various documents and information. These may include: * Your retirement account statements * Your birthdate and age * The fair market value of your retirement account as of December 31st of the previous year * The life expectancy factor from the Uniform Lifetime Table * Any other relevant documentation, such as tax returns or Social Security statements It is crucial to have all the necessary documents and information readily available to avoid delays or errors in the process.

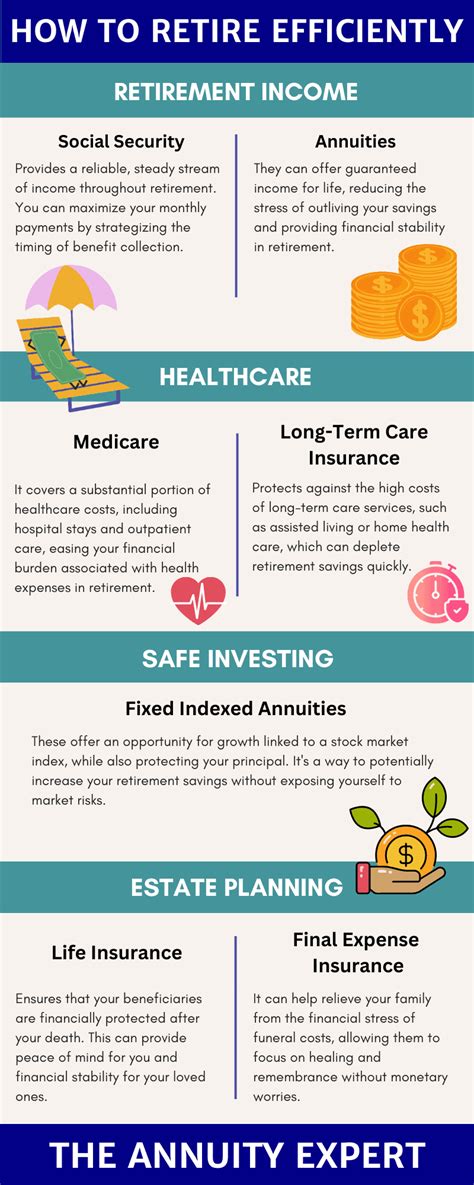

Tip 3: Choose the Right Distribution Method

When it comes to taking your RMD, you have several distribution methods to choose from. These include: * Lump Sum Distribution: Taking the entire RMD amount in a single payment * Periodic Payments: Receiving the RMD amount in regular installments, such as monthly or quarterly * Annuity Payments: Using the RMD amount to purchase an annuity, which provides a guaranteed income stream It is essential to consider your individual circumstances and goals when selecting a distribution method. You may want to consult with a financial advisor or tax professional to determine the best approach for your situation.

Tip 4: Consider Tax Implications and Planning Opportunities

RMDs are taxable, and the amount you withdraw will be included in your taxable income. However, there are tax planning opportunities to consider. For example: * Charitable Donations: You can use your RMD to make charitable donations, which can help reduce your taxable income * Tax-Loss Harvesting: You can use your RMD to offset capital gains from other investments, reducing your tax liability * Roth Conversions: You can convert your traditional IRA to a Roth IRA, which can provide tax-free growth and withdrawals in retirement It is crucial to consider the tax implications of your RMD and explore opportunities to minimize your tax liability.

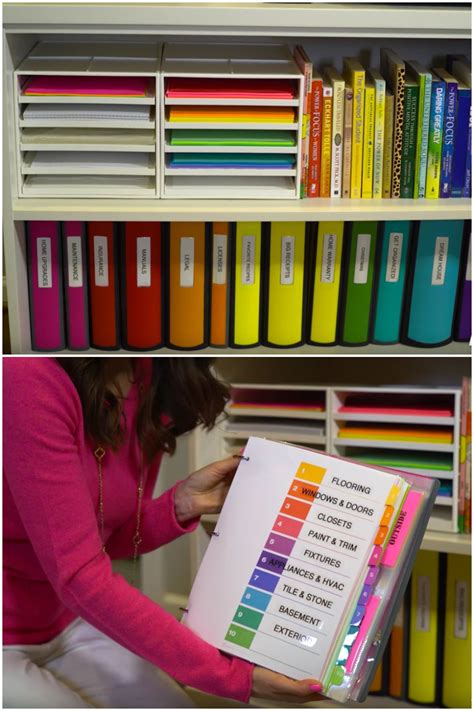

Tip 5: Stay Organized and Compliant

Finally, it is essential to stay organized and compliant when managing your RMD paperwork. This includes: * Keeping accurate records of your RMD calculations and distributions * Ensuring timely distributions to avoid penalties and fines * Reviewing and updating your RMD calculations annually to reflect changes in your account balance or life expectancy factor By staying organized and compliant, you can avoid errors and ensure a smooth RMD experience.

💡 Note: It is crucial to consult with a financial advisor or tax professional to ensure compliance with RMD rules and regulations, as well as to explore tax planning opportunities.

In summary, managing RMD paperwork requires a thorough understanding of the rules and regulations, as well as careful planning and organization. By following these 5 tips, you can ensure a compliant and efficient RMD experience, minimizing errors and maximizing your retirement income.

What is the purpose of an RMD?

+

The purpose of an RMD is to ensure that individuals with traditional IRAs or employer-sponsored retirement plans withdraw a minimum amount from their accounts each year, starting from the age of 72, to prevent them from accumulating tax-deferred savings indefinitely.

How do I calculate my RMD?

+

You can calculate your RMD using the IRS’s Uniform Lifetime Table, which provides a life expectancy factor based on your age. You will need to know the fair market value of your retirement account as of December 31st of the previous year and your birthdate and age.

What are the consequences of not taking my RMD?

+

If you fail to take your RMD, you may be subject to a penalty of 50% of the amount that should have been withdrawn, as well as interest on the unpaid amount. It is essential to take your RMD timely to avoid these penalties and fines.