Paperwork

Tax Forms for College Withdrawal Payments

Understanding Tax Forms for College Withdrawal Payments

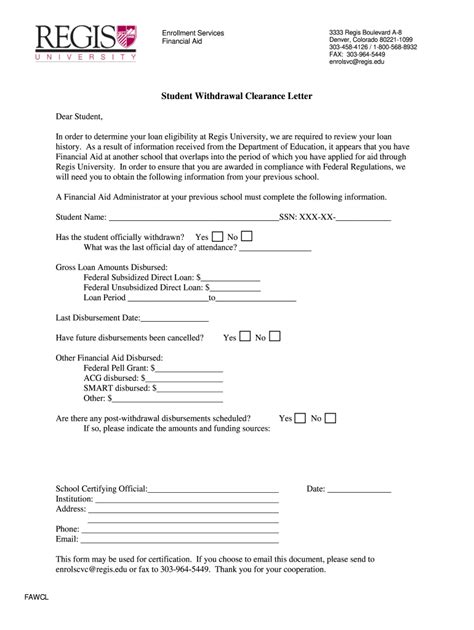

When a student withdraws from college, either voluntarily or involuntarily, the institution is required to report certain information to the Internal Revenue Service (IRS) and provide the student with specific tax forms. These forms are essential for students to accurately report their income and claim eligible tax credits. In this article, we will delve into the world of tax forms for college withdrawal payments, exploring the different types of forms, their purposes, and how to navigate the process.

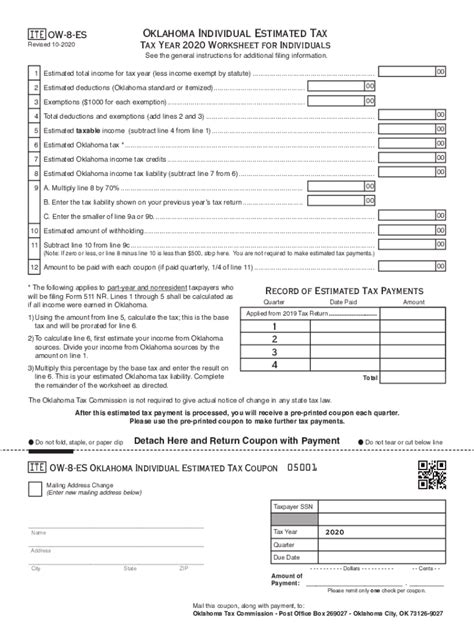

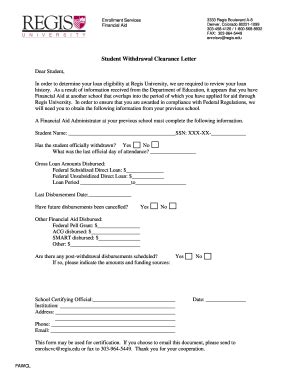

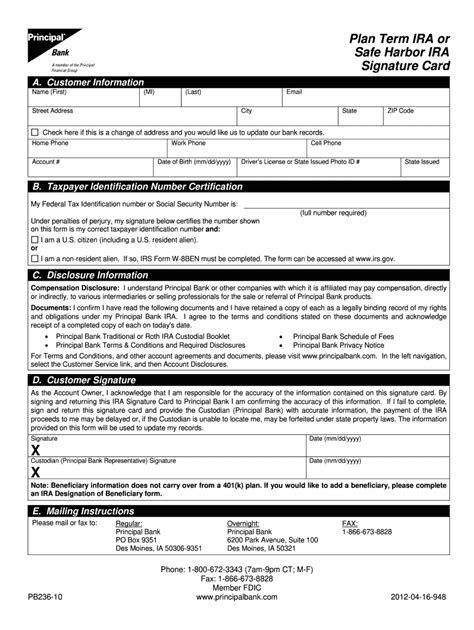

Types of Tax Forms for College Withdrawal Payments

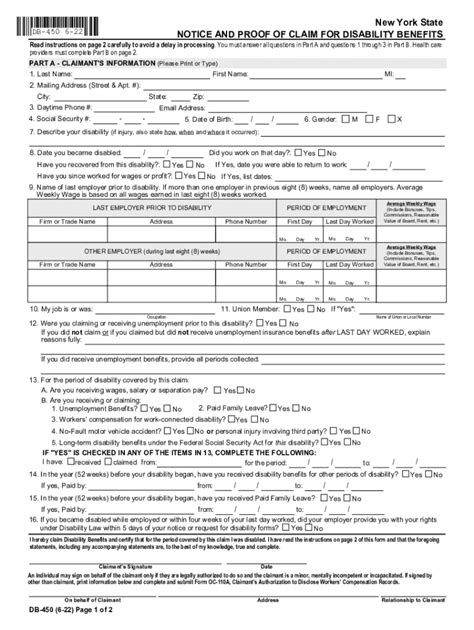

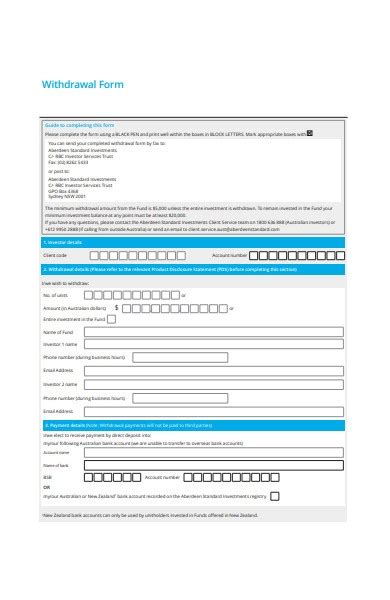

There are several tax forms that colleges and universities are required to provide to students who withdraw from their programs. The most common forms include: * Form 1098-T: This form, also known as the Tuition Statement, reports the amount of qualified tuition and related expenses (QTRE) paid by the student during the tax year. The form is used to claim the American Opportunity Tax Credit (AOTC) or the Lifetime Learning Credit (LLC). * Form W-2: This form reports the amount of income earned by the student, including any scholarships, grants, or other forms of financial aid that are considered taxable income. * Form 1099-MISC: This form reports miscellaneous income, such as prizes, awards, or other types of income that are not subject to withholding.

Purpose of Tax Forms for College Withdrawal Payments

The primary purpose of these tax forms is to provide students with the necessary information to accurately report their income and claim eligible tax credits. The forms help students to: * Claim the AOTC or LLC, which can help offset the cost of tuition and related expenses * Report taxable income, such as scholarships or grants, to avoid penalties and interest * Take advantage of other tax benefits, such as the Student Loan Interest Deduction

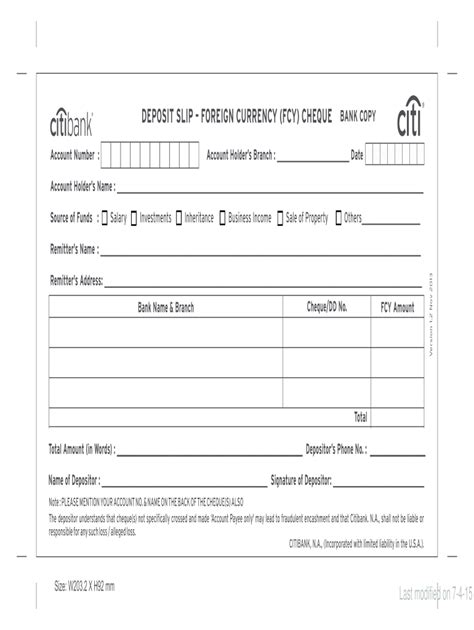

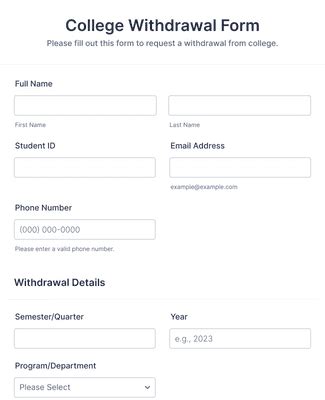

How to Navigate the Tax Form Process

Navigating the tax form process can be overwhelming, especially for students who are unfamiliar with tax laws and regulations. Here are some steps to follow: * Review the forms carefully: Make sure to review each form carefully, ensuring that all information is accurate and complete. * Gather required documents: Gather all required documents, including receipts, invoices, and other supporting documentation. * Claim eligible tax credits: Claim eligible tax credits, such as the AOTC or LLC, by completing the relevant forms and submitting them with your tax return. * Report taxable income: Report taxable income, such as scholarships or grants, on your tax return to avoid penalties and interest.

💡 Note: It is essential to consult with a tax professional or financial advisor to ensure that you are taking advantage of all eligible tax credits and deductions.

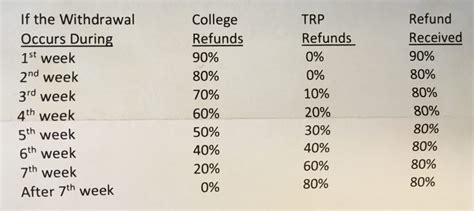

Table of Common Tax Forms for College Withdrawal Payments

The following table summarizes the most common tax forms for college withdrawal payments:

| Form | Purpose |

|---|---|

| Form 1098-T | Reports qualified tuition and related expenses (QTRE) |

| Form W-2 | Reports taxable income, including scholarships and grants |

| Form 1099-MISC | Reports miscellaneous income, such as prizes and awards |

Importance of Accurate Reporting

Accurate reporting of income and expenses is crucial when it comes to tax forms for college withdrawal payments. Failure to report income or claim eligible tax credits can result in penalties and interest. On the other hand, accurate reporting can help students take advantage of tax benefits and reduce their tax liability.

Conclusion

In conclusion, tax forms for college withdrawal payments are an essential part of the tax process for students who withdraw from college. By understanding the different types of forms, their purposes, and how to navigate the process, students can ensure that they are taking advantage of all eligible tax credits and deductions. It is essential to consult with a tax professional or financial advisor to ensure that all forms are completed accurately and submitted on time.

What is the purpose of Form 1098-T?

+

Form 1098-T reports the amount of qualified tuition and related expenses (QTRE) paid by the student during the tax year, which is used to claim the American Opportunity Tax Credit (AOTC) or the Lifetime Learning Credit (LLC).

Do I need to report taxable income on my tax return?

+

Yes, you need to report taxable income, such as scholarships or grants, on your tax return to avoid penalties and interest.

Can I claim the American Opportunity Tax Credit (AOTC) if I withdraw from college?

+

Yes, you can claim the AOTC if you withdraw from college, but you must meet the eligibility requirements, which include being enrolled at least half-time in a degree program and having paid qualified tuition and related expenses.