File I-9 Separately

Introduction to Form I-9

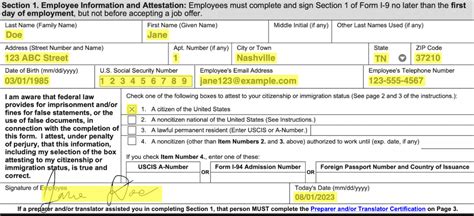

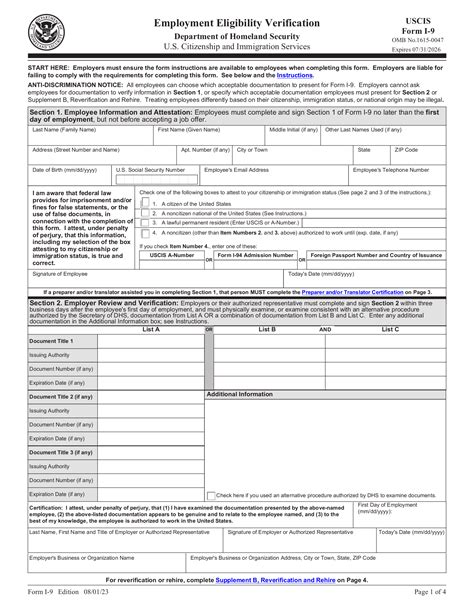

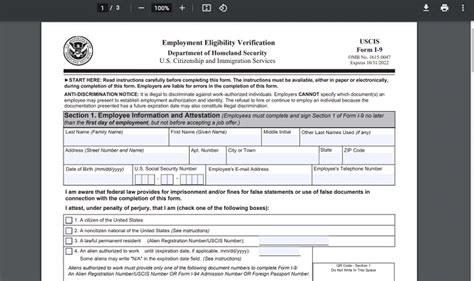

The Form I-9, also known as the Employment Eligibility Verification form, is a crucial document that employers in the United States must use to verify the identity and employment authorization of their employees. The U.S. Citizenship and Immigration Services (USCIS) is responsible for managing this process, ensuring that all employees are eligible to work in the country. In this blog post, we will delve into the world of Form I-9, exploring its importance, the verification process, and the potential consequences of non-compliance.

Importance of Form I-9

The Form I-9 is essential for maintaining a legal and compliant workforce. Employers must complete the form for each new hire, including citizens and non-citizens, to confirm their identity and work authorization. Failure to comply with Form I-9 requirements can result in significant fines and penalties, making it a critical aspect of human resources management. The form is used to verify the identity and employment eligibility of all employees, including:

- U.S. citizens

- Non-citizen nationals

- Lawful permanent residents

- Aliens authorized to work in the United States

Verification Process

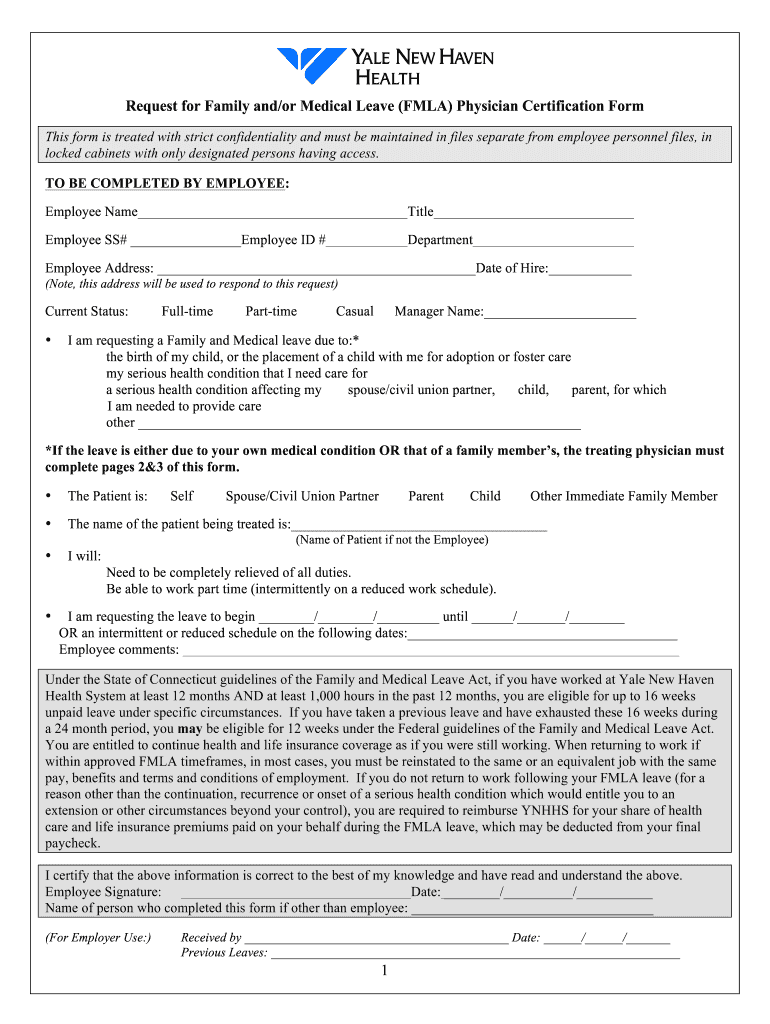

The verification process for Form I-9 involves several steps, including: * Section 1: Employee Information: The employee must complete this section, providing their name, address, date of birth, and other identifying information. * Section 2: Employer Review and Verification: The employer must review the employee’s documents, verify their identity and work authorization, and complete this section. * Section 3: Reverification and Updates: If an employee’s work authorization expires, the employer must reverify their eligibility to work in the United States.

Some of the acceptable documents for Form I-9 verification include: * U.S. passport * Driver’s license * Social Security card * Permanent Resident Card * Employment Authorization Document (EAD)

Consequences of Non-Compliance

Employers who fail to comply with Form I-9 requirements can face severe penalties, including: * Fines ranging from 230 to 2,292 per violation * Imprisonment for repeat offenders * Debarment from participating in federal contracts * Loss of business licenses

📝 Note: Employers must maintain accurate and complete Form I-9 records for all employees, as audits and inspections can occur at any time.

Best Practices for Form I-9 Compliance

To ensure compliance with Form I-9 requirements, employers should: * Develop a comprehensive I-9 compliance program, including training for HR staff and managers * Use E-Verify, a web-based system that checks the employment eligibility of new hires * Maintain accurate and complete Form I-9 records, including storage and retention procedures * Conduct regular audits and inspections to ensure compliance and identify potential issues

| Document | Description |

|---|---|

| U.S. Passport | Proof of citizenship and identity |

| Driver's License | Proof of identity |

| Social Security Card | Proof of work authorization |

In summary, Form I-9 is a critical component of employment eligibility verification in the United States. Employers must understand the importance of compliance, the verification process, and the potential consequences of non-compliance. By following best practices and maintaining accurate records, employers can ensure a compliant and legal workforce.

What is the purpose of Form I-9?

+

The purpose of Form I-9 is to verify the identity and employment authorization of all employees in the United States.

What are the consequences of non-compliance with Form I-9 requirements?

+

Employers who fail to comply with Form I-9 requirements can face fines, imprisonment, debarment from federal contracts, and loss of business licenses.

How long must employers maintain Form I-9 records?

+

Employers must maintain Form I-9 records for all employees for at least three years after the date of hire or one year after the date of termination, whichever is later.