-

7 Tax Tips

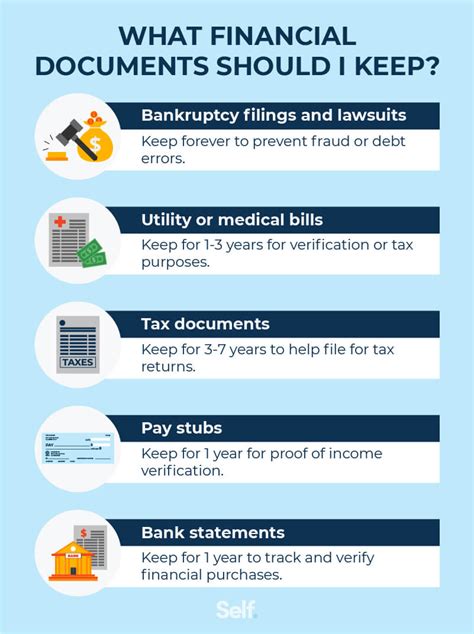

Learn how long to keep tax paperwork, including receipts, invoices, and returns, to ensure compliance with IRS regulations and maintain accurate financial records for audits, deductions, and credits.

Read More » -

7 Tax Tips

Keep tax return paperwork for at least 3 years, including receipts, W-2 forms, and 1099s, to ensure audit protection and accurate record-keeping for tax deductions, credits, and refunds, maintaining organized financial records.

Read More »