Paperwork

7 Tax Tips

Introduction to Tax Planning

Tax planning is an essential aspect of personal and business finance. It involves taking advantage of all the deductions and credits available to minimize your tax liability. With the ever-changing tax laws, it can be challenging to stay up-to-date on the latest tax tips and strategies. In this article, we will explore seven tax tips that can help you navigate the complex world of taxation.

Understanding Tax Deductions

Tax deductions are expenses that can be subtracted from your taxable income, reducing the amount of tax you owe. There are various types of deductions, including charitable donations, medical expenses, and business expenses. It is essential to keep accurate records of your expenses throughout the year to ensure you can claim all the deductions you are eligible for. Some common deductions include: * Home office expenses for remote workers * Education expenses for students and professionals * Child care expenses for working parents

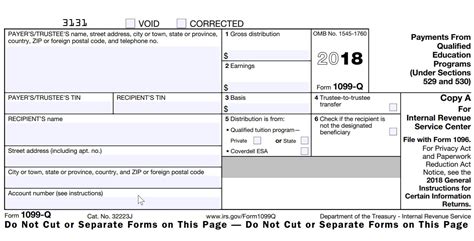

Tax Credits Explained

Tax credits are direct reductions to your tax bill, and they can be even more valuable than deductions. There are various types of tax credits, including earned income tax credit, child tax credit, and education tax credits. To qualify for these credits, you must meet specific requirements, such as income limits and eligibility criteria. Some common tax credits include: * Renewable energy credits for homeowners who install solar panels or wind turbines * Retirement savings contributions credit for low-to-moderate income workers * Adoption credit for families who adopt a child

Importance of Record Keeping

Accurate record keeping is crucial for tax planning. You should keep receipts, invoices, and bank statements for all your expenses, as well as records of your income and tax-related documents. This will help you ensure you can claim all the deductions and credits you are eligible for. Some tips for record keeping include: * Using a spreadsheet to track your expenses throughout the year * Scanning receipts and storing them electronically * Setting up a separate business account to keep personal and business expenses separate

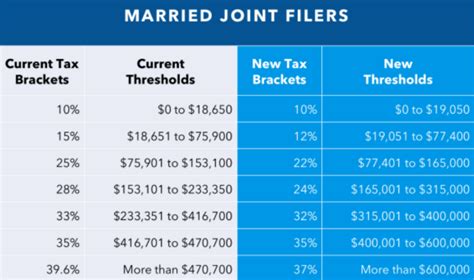

Tax Planning Strategies

There are various tax planning strategies that can help you minimize your tax liability. These include: * Income splitting for families with multiple income earners * Tax-loss harvesting for investors who have incurred losses * Retirement account contributions to reduce taxable income Some other strategies include: * Donating to charity to claim a charitable donation credit * Claiming the home office deduction for remote workers * Using a tax professional to ensure you are taking advantage of all the deductions and credits available

Common Tax Mistakes

There are several common tax mistakes that can result in penalties and fines. These include: * Missing deadlines for filing tax returns * Incorrectly claiming deductions or credits * Failure to report income or expenses Some other mistakes include: * Not keeping accurate records of expenses and income * Not seeking professional advice when needed * Not staying up-to-date on changes to tax laws and regulations

Conclusion and Final Thoughts

In conclusion, tax planning is a complex and ever-changing field that requires careful attention to detail. By understanding tax deductions, credits, and planning strategies, you can minimize your tax liability and ensure you are taking advantage of all the tax tips and credits available. Remember to keep accurate records, seek professional advice when needed, and stay up-to-date on changes to tax laws and regulations.

💡 Note: It is essential to consult with a tax professional to ensure you are meeting all the requirements and taking advantage of all the deductions and credits available.

What is the difference between a tax deduction and a tax credit?

+

A tax deduction reduces your taxable income, while a tax credit directly reduces your tax bill.

How can I ensure I am taking advantage of all the tax deductions and credits available?

+

Keep accurate records of your expenses and income, and consult with a tax professional to ensure you are meeting all the requirements and taking advantage of all the deductions and credits available.

What are some common tax mistakes that can result in penalties and fines?

+

Common tax mistakes include missing deadlines, incorrectly claiming deductions or credits, and failure to report income or expenses.