-

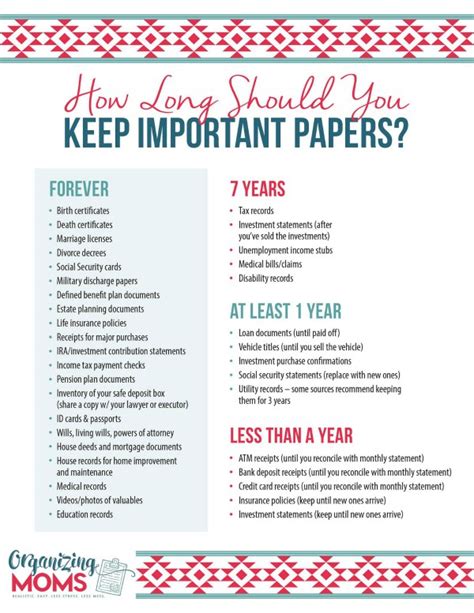

Years of Paperwork to Keep

Keep tax returns, receipts, and financial records for 3-7 years, depending on IRS audit timelines, while also retaining investment statements, bank records, and estate planning documents to ensure compliance and organization, simplifying personal finance management and audit preparation.

Read More » -

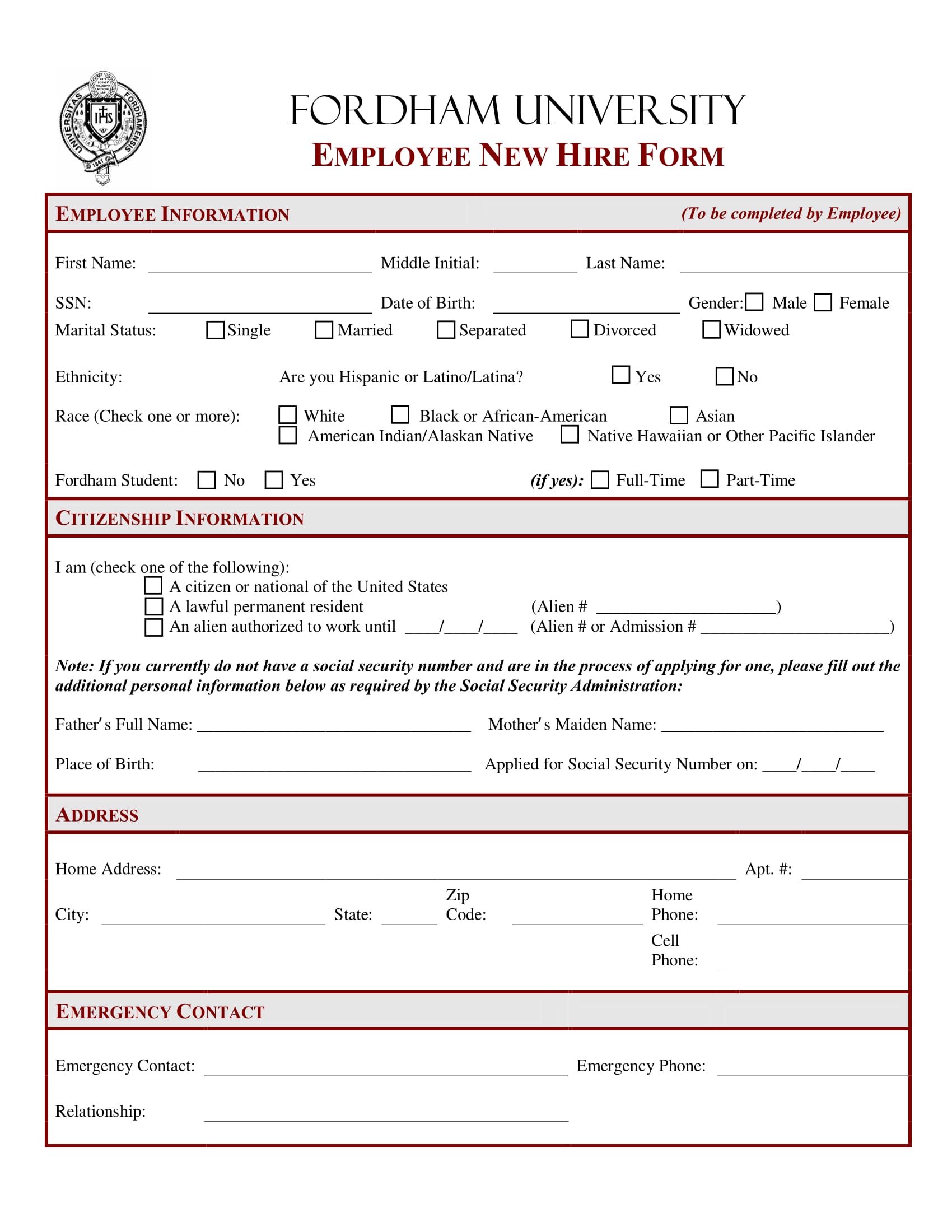

California New Hire Paperwork Requirements

Discover required new hire paperwork in California, including I-9, W-4, and workers' compensation forms, to ensure compliance with California labor laws and regulations for employee onboarding and payroll processing.

Read More » -

Paperwork Helps Judges

Paperwork aids judges in making informed decisions by providing essential documents, court records, and case files, facilitating efficient judicial processing and ensuring due process, while promoting transparency and accountability in the legal system, supporting fair trials and verdicts.

Read More »