Paperwork

California New Hire Paperwork Requirements

Introduction to California New Hire Paperwork Requirements

When hiring new employees in California, it’s essential to understand the necessary paperwork requirements to ensure compliance with state and federal laws. The process involves several documents that must be completed and maintained for each new hire. In this article, we will delve into the specifics of California new hire paperwork requirements, providing a comprehensive guide for employers.

Required Documents for New Hires

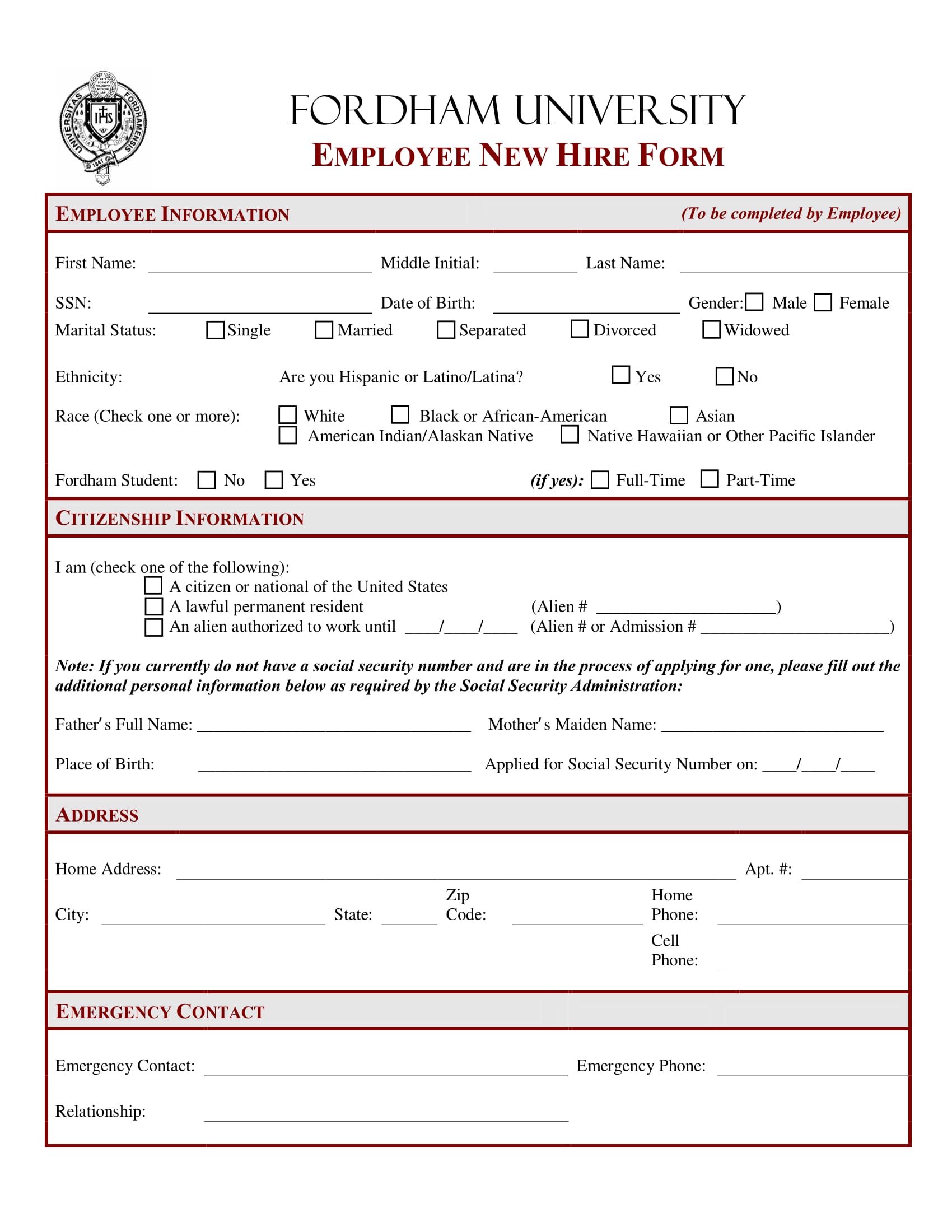

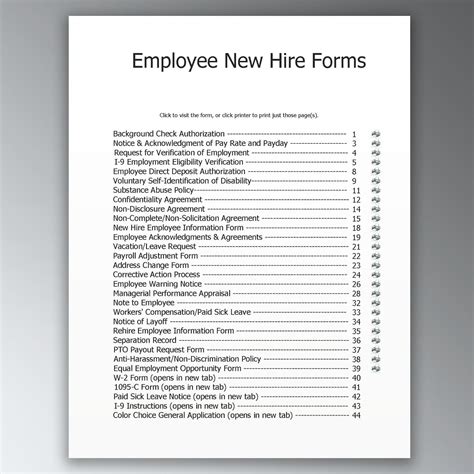

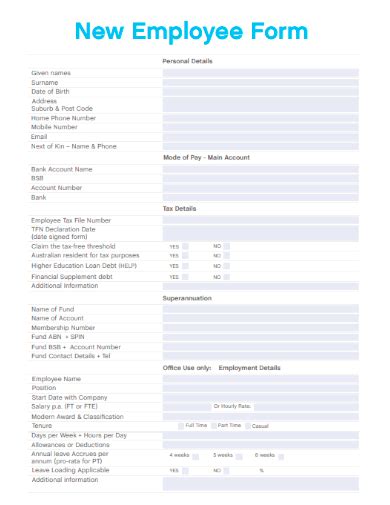

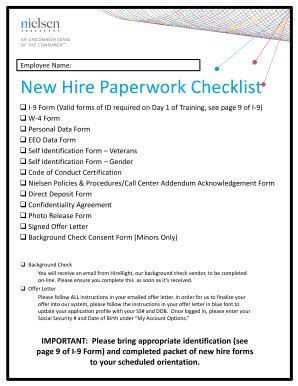

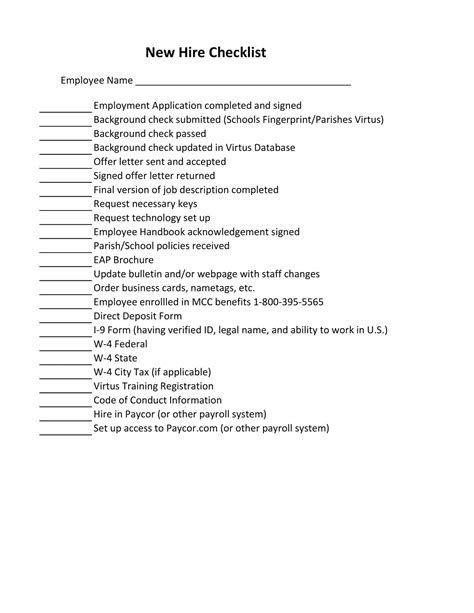

The following documents are mandatory for all new hires in California:

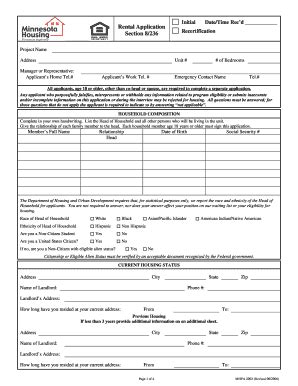

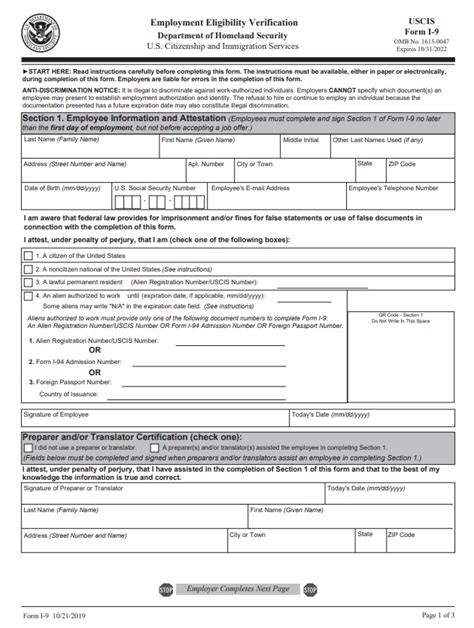

- I-9 Form (Employment Eligibility Verification): This form verifies the employee’s identity and eligibility to work in the United States. It must be completed within three business days of the employee’s first day of work.

- W-4 Form (Employee’s Withholding Certificate): This form determines the amount of federal income tax to be withheld from the employee’s wages. It is required for all new hires and must be updated annually or whenever the employee’s tax situation changes.

- California Withholding Allowance Certificate (DE 4): Similar to the W-4 form, the DE 4 form determines the amount of state income tax to be withheld from the employee’s wages.

- Employee Handbook Acknowledgement: Employers are required to provide new hires with an employee handbook that outlines company policies, procedures, and expectations. The acknowledgement form confirms that the employee has received and read the handbook.

Additional Requirements for California Employers

In addition to the required documents, California employers must also comply with the following:

- New Hire Reporting: Employers must report all new hires to the California New Employee Registry within 20 days of the employee’s first day of work. This report includes the employee’s name, address, and Social Security number, as well as the employer’s name, address, and federal employer identification number.

- Workers’ Compensation Insurance: California employers are required to provide workers’ compensation insurance to all employees, which covers work-related injuries and illnesses.

- Unemployment Insurance: Employers must also pay unemployment insurance taxes to fund benefits for employees who become unemployed through no fault of their own.

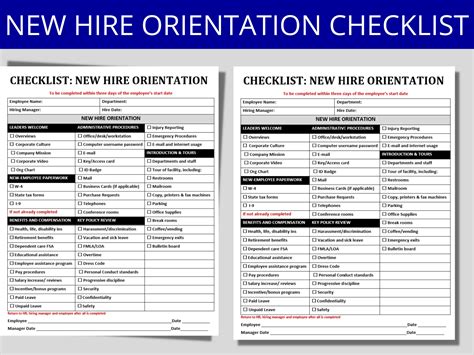

Best Practices for Managing New Hire Paperwork

To ensure compliance with California new hire paperwork requirements, employers should:

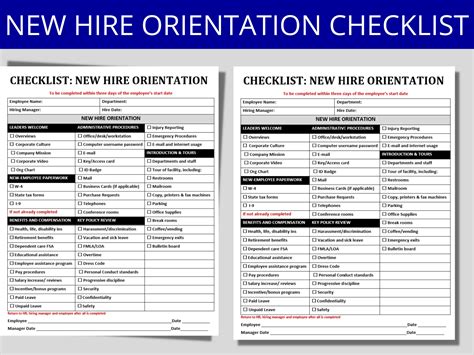

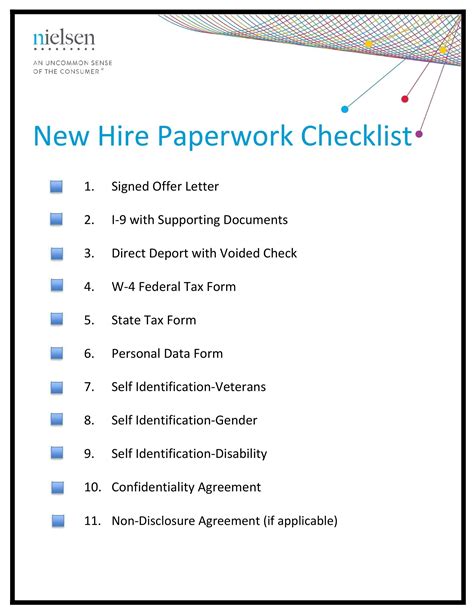

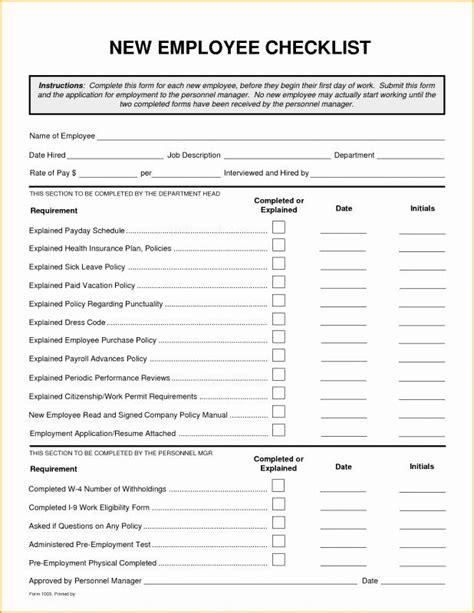

- Use an onboarding checklist: Create a comprehensive checklist to ensure that all required documents are completed and maintained for each new hire.

- Designate a point of contact: Appoint a specific person or department to handle new hire paperwork and ensure that all documents are completed and filed correctly.

- Use electronic document management: Consider using electronic document management systems to streamline the onboarding process and reduce the risk of errors or lost documents.

Penalties for Non-Compliance

Failure to comply with California new hire paperwork requirements can result in significant penalties, including:

- Fines: Employers may face fines of up to $1,000 for each new hire who is not reported to the California New Employee Registry.

- Audits: The California Employment Development Department (EDD) may conduct audits to ensure compliance with new hire reporting requirements.

- Liability: Employers may be liable for unpaid wages, benefits, or workers’ compensation claims if they fail to maintain accurate and complete records.

💡 Note: Employers should consult with an attorney or HR expert to ensure compliance with all applicable laws and regulations.

Conclusion and Final Thoughts

In conclusion, California new hire paperwork requirements are complex and require careful attention to detail. By understanding the necessary documents and best practices for managing new hire paperwork, employers can ensure compliance with state and federal laws, avoid penalties, and maintain a positive and productive work environment. It is essential to stay up-to-date with changing laws and regulations to ensure that all new hires are properly onboarded and that all required documents are completed and maintained.

What is the deadline for reporting new hires to the California New Employee Registry?

+

Employers must report all new hires to the California New Employee Registry within 20 days of the employee’s first day of work.

What is the purpose of the I-9 form?

+

The I-9 form verifies the employee’s identity and eligibility to work in the United States.

Can employers use electronic document management systems for new hire paperwork?

+

Yes, employers can use electronic document management systems to streamline the onboarding process and reduce the risk of errors or lost documents.