-

Keep Tax Paperwork For How Long

Keep tax paperwork for at least 3-7 years, depending on audit risk, including receipts, invoices, and W-2 forms, to ensure compliance with IRS record-keeping requirements and potential tax audits, deductions, and credit claims.

Read More » -

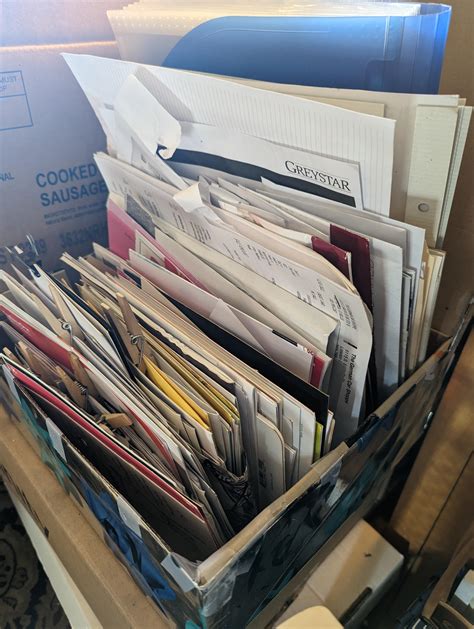

5 Ways Purge Paperwork

Learn how to purge old paperwork, decluttering files, and organizing documents efficiently, reducing paper clutter, and minimizing storage needs with effective paper management and record-keeping strategies.

Read More »