College Loan Paperwork Requirements

Introduction to College Loan Paperwork

Applying for a college loan can be a daunting task, especially when it comes to the paperwork required. With so many forms and documents to fill out, it’s easy to get overwhelmed. However, understanding the necessary paperwork and requirements can make the process much smoother. In this article, we will break down the typical paperwork requirements for college loans, including federal and private loans, and provide tips on how to navigate the process.

Federal Student Loans

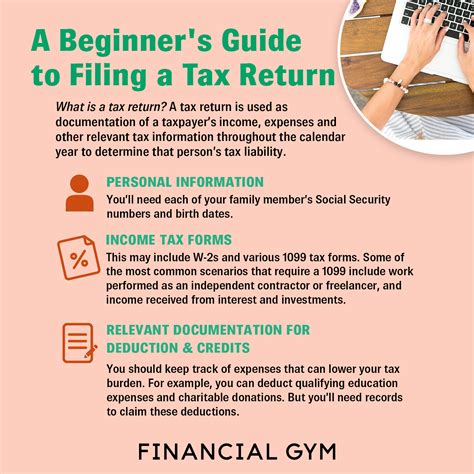

To apply for federal student loans, students must complete the Free Application for Federal Student Aid (FAFSA). This form is used to determine eligibility for federal, state, and institutional financial aid. The FAFSA requires students to provide personal and financial information, including:

- Social Security number

- Driver’s license number

- Income tax returns

- W-2 forms

- Asset information

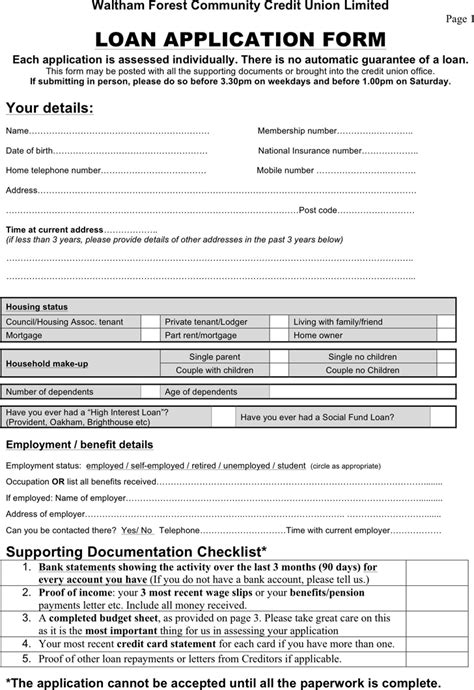

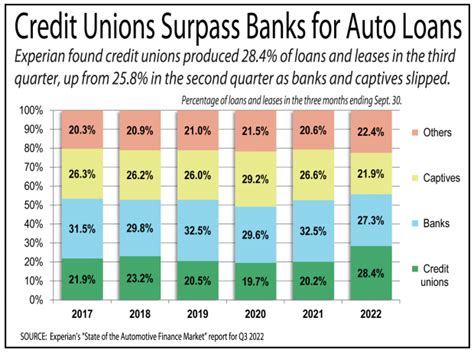

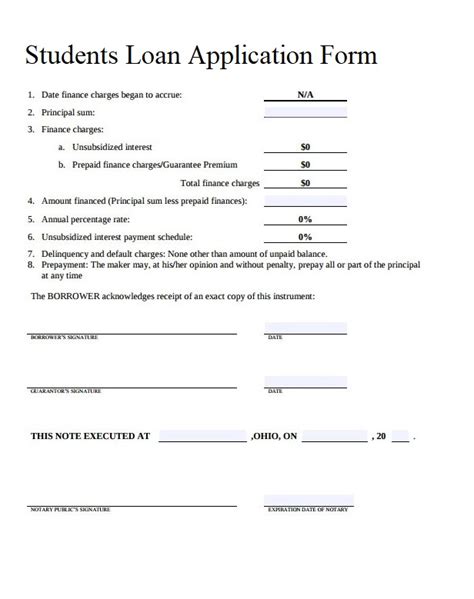

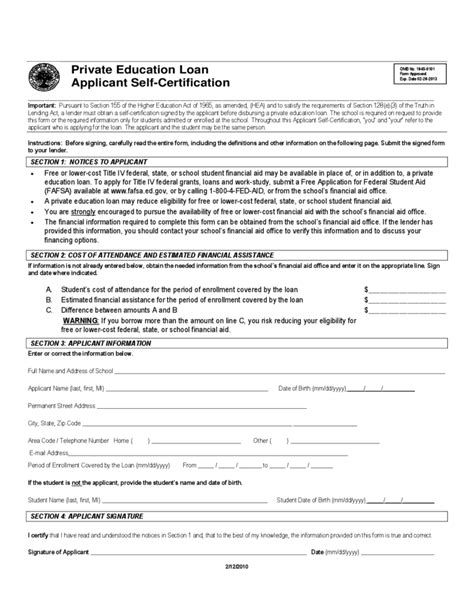

Private Student Loans

Private student loans, on the other hand, are offered by banks, credit unions, and other lenders. The paperwork requirements for private loans vary depending on the lender, but typically include:

- Credit application

- Income verification

- Employment verification

- Asset information

- Co-signer information (if applicable)

Loan Application Process

Once the necessary paperwork is completed, the loan application process can begin. For federal loans, the FAFSA is submitted to the U.S. Department of Education, which then sends the results to the student’s school. The school will review the results and determine the student’s eligibility for federal loans. For private loans, the lender will review the credit application and make a determination based on the student’s creditworthiness.

Required Documents

In addition to the FAFSA or credit application, students may need to provide other documents to complete the loan application process. These may include:

| Document | Description |

|---|---|

| Identification | Driver’s license, passport, or state ID |

| Proof of income | Pay stubs, W-2 forms, or tax returns |

| Proof of enrollment | Transcripts or letter from the school |

| Co-signer information | Co-signer’s credit information and identification |

📝 Note: The specific documents required may vary depending on the lender or loan program.

Tips for Completing Loan Paperwork

To ensure a smooth loan application process, students should:

- Read and follow instructions carefully

- Complete all required forms and documents

- Submit applications and documents on time

- Keep copies of all paperwork and correspondence

In the end, understanding the paperwork requirements for college loans can help students navigate the process with confidence. By knowing what to expect and being prepared, students can focus on their studies and achieve their academic goals. The key is to stay organized, follow instructions carefully, and seek help when needed. With the right mindset and preparation, students can overcome the challenges of college loan paperwork and secure the funding they need to succeed.

What is the FAFSA and why is it required?

+

The FAFSA is the Free Application for Federal Student Aid, which is used to determine eligibility for federal, state, and institutional financial aid. It’s required for students who want to apply for federal student loans, grants, and work-study programs.

What are the typical paperwork requirements for private student loans?

+

Private student loans typically require a credit application, income verification, employment verification, asset information, and co-signer information (if applicable). The specific requirements may vary depending on the lender.

How long does it take to process a loan application?

+

The processing time for a loan application can vary depending on the lender and the type of loan. Federal loans typically take several weeks to process, while private loans may be processed more quickly. It’s best to check with the lender for specific processing times.