5 Bankruptcy Forms

Introduction to Bankruptcy Forms

When an individual or a business is unable to pay their debts, they may consider filing for bankruptcy. The process of filing for bankruptcy involves submitting various forms to the court, which provide detailed information about the debtor’s financial situation. In this article, we will discuss five key bankruptcy forms that are typically required in a bankruptcy case.

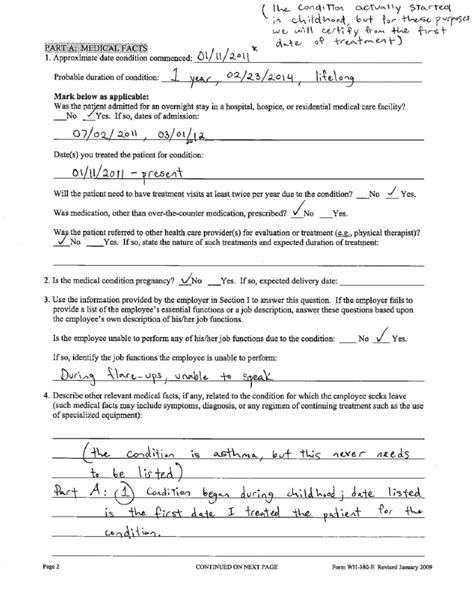

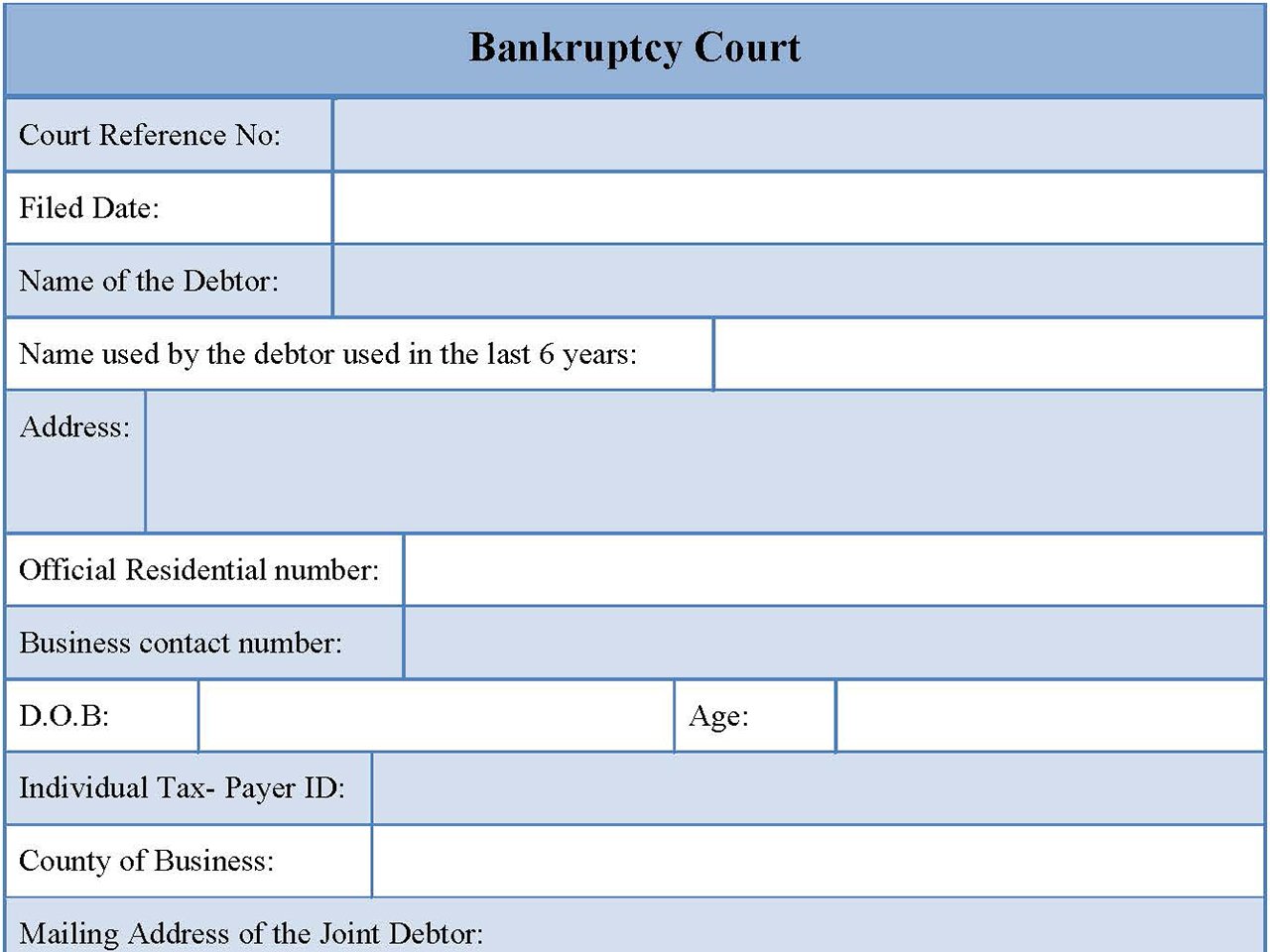

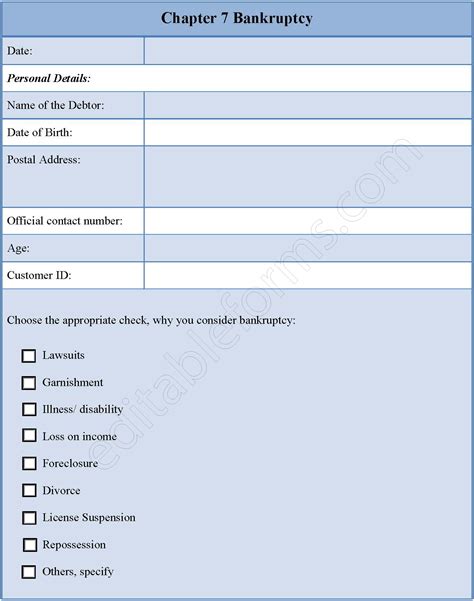

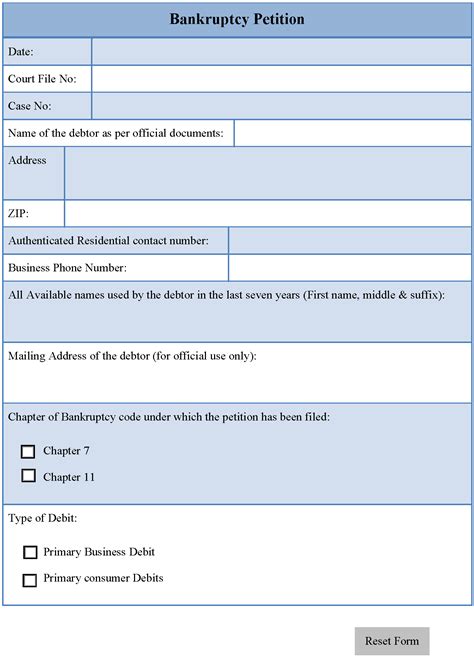

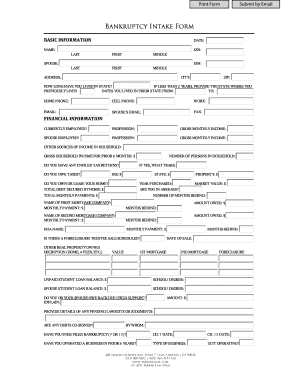

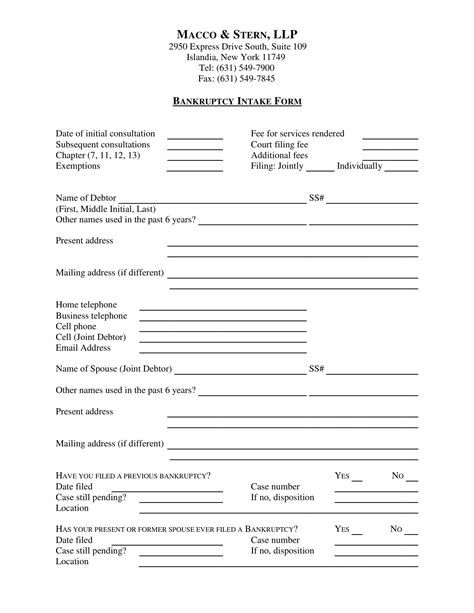

Form 1: Voluntary Petition

The voluntary petition, also known as Form 101, is the initial document that is filed with the court to commence a bankruptcy case. This form provides basic information about the debtor, including their name, address, and social security number. It also identifies the type of bankruptcy that is being filed, such as Chapter 7 or Chapter 13. The voluntary petition must be signed by the debtor and is usually accompanied by a filing fee.

Form 2: Schedules A/J

Schedules A/J, also known as Form 106A/J, are used to disclose the debtor’s real property and personal property. Schedule A is used to list the debtor’s real property, such as their primary residence or investment properties. Schedule J is used to list the debtor’s personal property, such as cash, bank accounts, and vehicles. These schedules must be completed accurately and thoroughly, as they provide a detailed picture of the debtor’s financial situation.

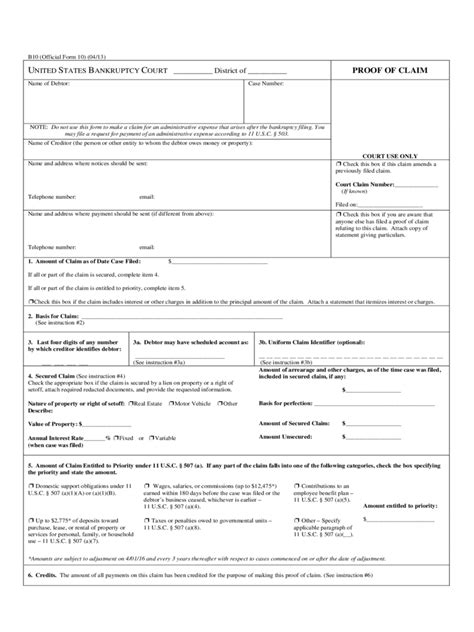

Form 3: Schedules D and E/F

Schedules D and E/F, also known as Form 106D and 106E/F, are used to disclose the debtor’s secured and unsecured debts. Schedule D is used to list the debtor’s secured debts, such as mortgages and car loans. Schedule E/F is used to list the debtor’s unsecured debts, such as credit card debt and medical bills. These schedules must be completed accurately and thoroughly, as they provide a detailed picture of the debtor’s debt obligations.

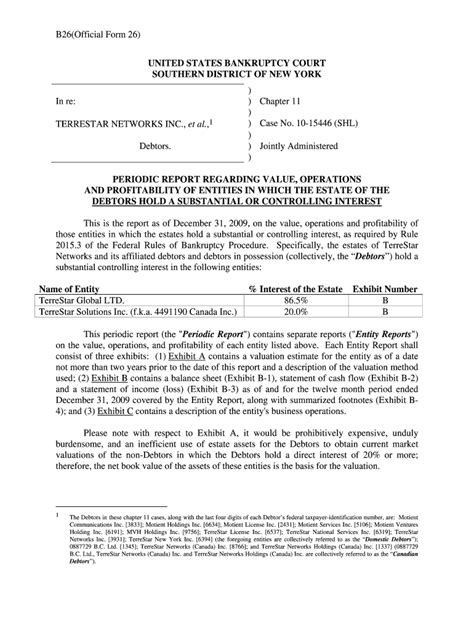

Form 4: Statement of Financial Affairs

The statement of financial affairs, also known as Form 107, is used to provide a detailed picture of the debtor’s financial activities over the past two years. This form requires the debtor to disclose information about their income, expenses, and financial transactions, including any gifts or transfers of property. The statement of financial affairs must be completed accurately and thoroughly, as it provides a detailed picture of the debtor’s financial situation.

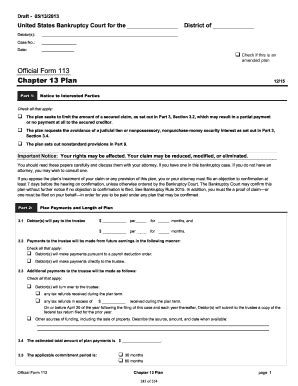

Form 5: Plan and Disclosure Statement

The plan and disclosure statement, also known as Form 113, is used in Chapter 13 bankruptcy cases to propose a plan for repaying debts over time. This form requires the debtor to propose a plan for repaying their debts, including the amount of payments and the length of time. The plan and disclosure statement must be approved by the court and is usually accompanied by a confirmation hearing.

📝 Note: It is essential to consult with a bankruptcy attorney to ensure that all required forms are completed accurately and thoroughly, as errors or omissions can result in delays or dismissal of the bankruptcy case.

In summary, the five key bankruptcy forms discussed in this article are essential for a successful bankruptcy filing. These forms provide detailed information about the debtor’s financial situation and are used to disclose their assets, debts, and financial activities. It is crucial to complete these forms accurately and thoroughly, as errors or omissions can have significant consequences.

What is the purpose of the voluntary petition in a bankruptcy case?

+

The voluntary petition is used to commence a bankruptcy case and provide basic information about the debtor, including their name, address, and social security number.

What is the difference between Schedules A and J in a bankruptcy case?

+

Schedule A is used to list the debtor’s real property, while Schedule J is used to list the debtor’s personal property.

What is the purpose of the statement of financial affairs in a bankruptcy case?

+

The statement of financial affairs is used to provide a detailed picture of the debtor’s financial activities over the past two years, including their income, expenses, and financial transactions.