5 Billing Tips

Introduction to Efficient Billing Practices

In today’s fast-paced business environment, efficient billing practices are crucial for the financial health and success of any organization. Accurate and timely billing can significantly impact a company’s cash flow, customer satisfaction, and overall profitability. Implementing effective billing strategies can help businesses streamline their financial operations, reduce errors, and improve relationships with clients. This article will explore five essential billing tips to help organizations optimize their billing processes and achieve financial stability.

Understanding the Importance of Clear Billing

Clear and transparent billing is vital for building trust with customers and avoiding potential disputes. Well-structured invoices should include all necessary details, such as the services provided, payment terms, and contact information. This helps ensure that customers understand what they are being charged for and can easily identify any errors or discrepancies. By providing clear and concise billing information, businesses can reduce the risk of misunderstandings and promote a positive customer experience.

Implementing Automated Billing Systems

Automated billing systems can greatly enhance the efficiency and accuracy of an organization’s billing processes. These systems can help reduce manual errors, save time, and increase productivity. With automated billing, businesses can easily generate and send invoices, track payments, and manage customer accounts. Additionally, automated systems can provide real-time updates and notifications, enabling organizations to respond promptly to any issues or concerns that may arise.

Effective Communication with Customers

Effective communication with customers is critical for resolving billing-related issues and preventing potential problems. Businesses should establish clear communication channels and ensure that customers can easily reach out to them with questions or concerns. This can include providing multiple contact methods, such as phone, email, or online support portals. By maintaining open and transparent communication, organizations can build trust with their customers and resolve any billing-related issues promptly and efficiently.

Regular Review and Analysis of Billing Processes

Regular review and analysis of billing processes are essential for identifying areas of improvement and optimizing billing efficiency. Businesses should regularly review their billing procedures to ensure they are accurate, efficient, and aligned with their overall financial goals. This can involve analyzing payment trends, identifying potential bottlenecks, and implementing changes to improve the billing process. By regularly reviewing and refining their billing processes, organizations can reduce errors, improve customer satisfaction, and increase their overall financial performance.

📝 Note: Regular review and analysis of billing processes can help businesses identify potential issues before they become major problems, reducing the risk of financial losses and reputational damage.

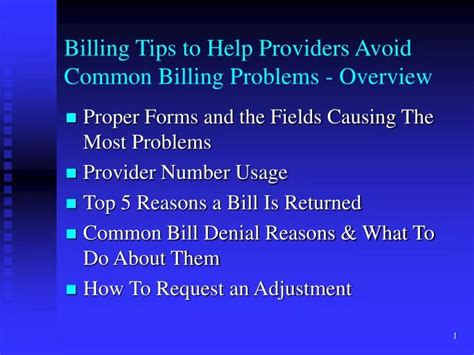

Best Practices for Billing and Invoicing

Implementing best practices for billing and invoicing can help businesses optimize their financial operations and improve customer satisfaction. Some key best practices include: * Using clear and concise language in invoices and billing communications * Providing accurate and detailed information about services provided and payment terms * Offering multiple payment options to accommodate different customer needs * Establishing clear and efficient communication channels for customer inquiries and concerns * Regularly reviewing and refining billing processes to ensure accuracy and efficiency

| Best Practice | Benefits |

|---|---|

| Clear and concise language | Reduces misunderstandings and errors |

| Accurate and detailed information | Builds trust with customers and reduces disputes |

| Multiple payment options | Improves customer satisfaction and reduces payment delays |

| Clear and efficient communication channels | Resolves issues promptly and efficiently |

| Regular review and refinement | Optimizes billing efficiency and reduces errors |

In summary, efficient billing practices are crucial for the financial health and success of any organization. By implementing clear and transparent billing, automated billing systems, effective communication with customers, regular review and analysis of billing processes, and best practices for billing and invoicing, businesses can optimize their financial operations, improve customer satisfaction, and increase their overall profitability. By following these essential billing tips, organizations can streamline their financial operations, reduce errors, and achieve financial stability.

What are the benefits of automated billing systems?

+

Automated billing systems can help reduce manual errors, save time, and increase productivity. They can also provide real-time updates and notifications, enabling organizations to respond promptly to any issues or concerns that may arise.

How can businesses establish clear communication channels with customers?

+

Businesses can establish clear communication channels with customers by providing multiple contact methods, such as phone, email, or online support portals. They should also ensure that customers can easily reach out to them with questions or concerns.

What are the key benefits of regular review and analysis of billing processes?

+

Regular review and analysis of billing processes can help businesses identify areas of improvement, reduce errors, and optimize billing efficiency. It can also help them identify potential issues before they become major problems, reducing the risk of financial losses and reputational damage.