Bankruptcy Discharge Paperwork

Understanding Bankruptcy Discharge Paperwork

The process of filing for bankruptcy can be complex and overwhelming, especially when it comes to dealing with the paperwork involved. One of the most critical documents in the bankruptcy process is the discharge paperwork. In this article, we will delve into the world of bankruptcy discharge paperwork, exploring what it entails, its importance, and the steps involved in obtaining a discharge.

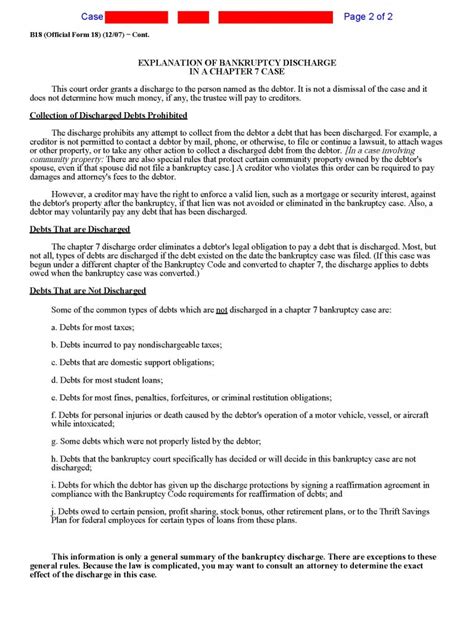

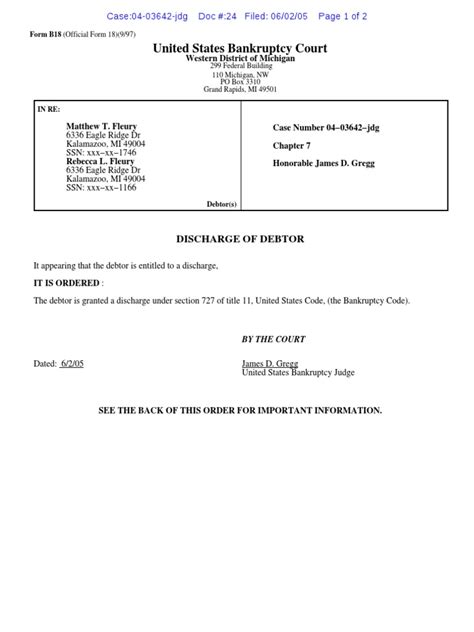

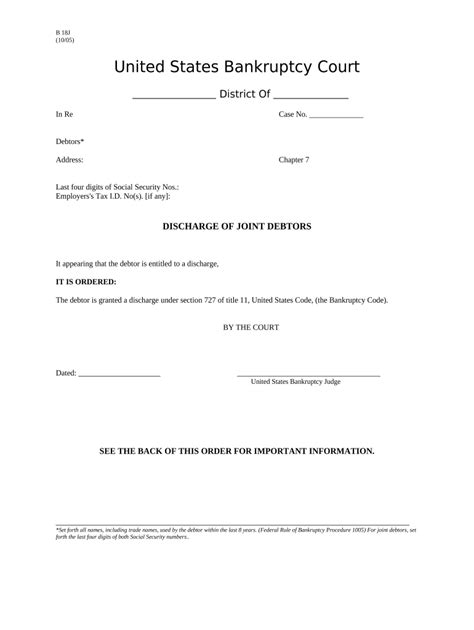

Bankruptcy discharge paperwork is a formal document issued by the court, stating that a debtor is no longer liable for certain debts. This document is typically issued after the completion of a Chapter 7 or Chapter 13 bankruptcy plan. The discharge paperwork serves as a legally binding agreement between the debtor and their creditors, releasing the debtor from their debt obligations.

The Importance of Bankruptcy Discharge Paperwork

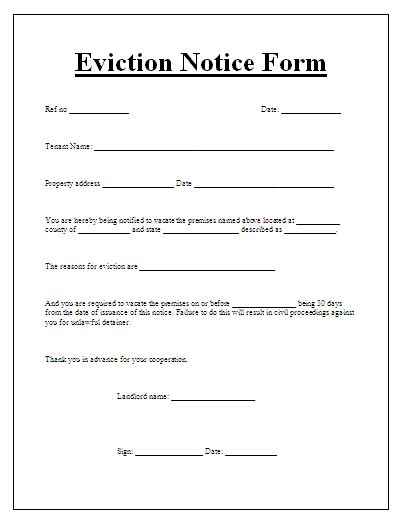

The bankruptcy discharge paperwork is essential for several reasons: * It provides a sense of relief and closure for debtors, allowing them to start anew. * It prevents creditors from pursuing further collection activities. * It ensures that debtors are not held liable for debts that have been discharged.

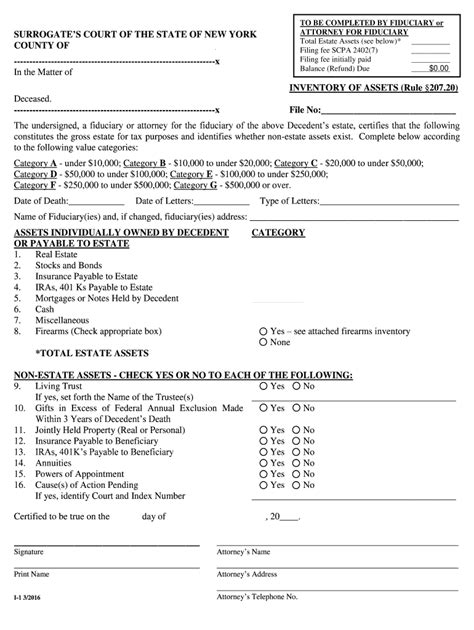

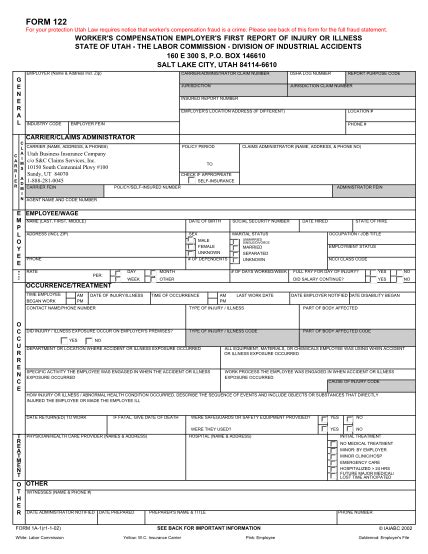

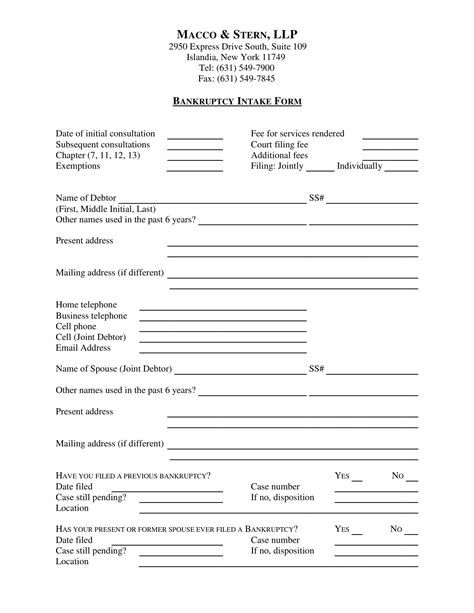

In order to obtain a bankruptcy discharge, debtors must first file a petition with the court, providing detailed information about their financial situation, including income, expenses, assets, and debts. The court will then review the petition and determine whether the debtor is eligible for a discharge.

Steps Involved in Obtaining a Bankruptcy Discharge

The process of obtaining a bankruptcy discharge involves several steps: * Filing a petition: The debtor must file a petition with the court, providing detailed information about their financial situation. * Credit counseling: The debtor must participate in a credit counseling course, which helps them understand their financial situation and develop a plan to manage their debts. * Meeting of creditors: The debtor must attend a meeting with their creditors, where they will be questioned about their financial situation and the debts they owe. * Discharge hearing: The court will hold a hearing to determine whether the debtor is eligible for a discharge. * Receipt of discharge paperwork: If the court approves the discharge, the debtor will receive formal discharge paperwork, releasing them from their debt obligations.

💡 Note: The process of obtaining a bankruptcy discharge can be complex and time-consuming. It is essential to work with an experienced bankruptcy attorney to ensure that all necessary steps are taken and that the discharge is obtained in a timely manner.

Types of Bankruptcy Discharge Paperwork

There are two primary types of bankruptcy discharge paperwork: * Chapter 7 discharge: This type of discharge is typically issued after the completion of a Chapter 7 bankruptcy plan, where the debtor’s assets are liquidated to pay off creditors. * Chapter 13 discharge: This type of discharge is typically issued after the completion of a Chapter 13 bankruptcy plan, where the debtor makes regular payments to creditors over a period of time.

Understanding the different types of bankruptcy discharge paperwork is crucial in determining the best course of action for debtors. It is essential to work with an experienced bankruptcy attorney to determine which type of discharge is most suitable for a debtor's specific situation.

Common Mistakes to Avoid

When dealing with bankruptcy discharge paperwork, there are several common mistakes to avoid: * Failure to provide complete information: Debtors must provide accurate and complete information about their financial situation, including income, expenses, assets, and debts. * Failure to attend required meetings: Debtors must attend all required meetings, including the meeting of creditors and the discharge hearing. * Failure to comply with court orders: Debtors must comply with all court orders, including the completion of a credit counseling course.

By avoiding these common mistakes, debtors can ensure a smooth and successful bankruptcy discharge process.

Conclusion and Final Thoughts

In conclusion, bankruptcy discharge paperwork is a critical document that plays a vital role in the bankruptcy process. Understanding the importance of this document, the steps involved in obtaining a discharge, and the types of discharge paperwork available is essential for debtors. By working with an experienced bankruptcy attorney and avoiding common mistakes, debtors can navigate the complex world of bankruptcy discharge paperwork and start anew.

What is bankruptcy discharge paperwork?

+

Bankruptcy discharge paperwork is a formal document issued by the court, stating that a debtor is no longer liable for certain debts.

What are the steps involved in obtaining a bankruptcy discharge?

+

The steps involved in obtaining a bankruptcy discharge include filing a petition, participating in credit counseling, attending a meeting of creditors, and attending a discharge hearing.

What are the types of bankruptcy discharge paperwork?

+

There are two primary types of bankruptcy discharge paperwork: Chapter 7 discharge and Chapter 13 discharge.