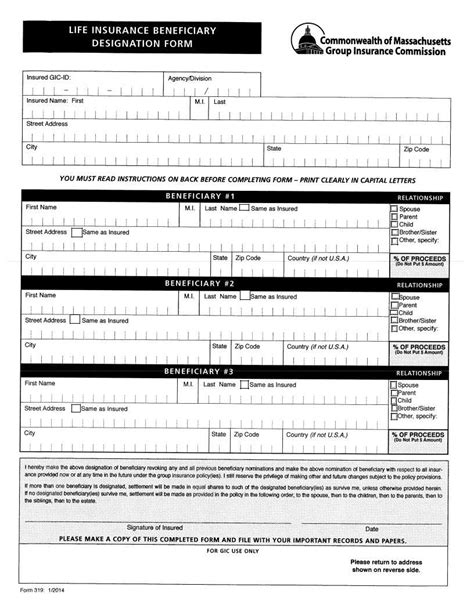

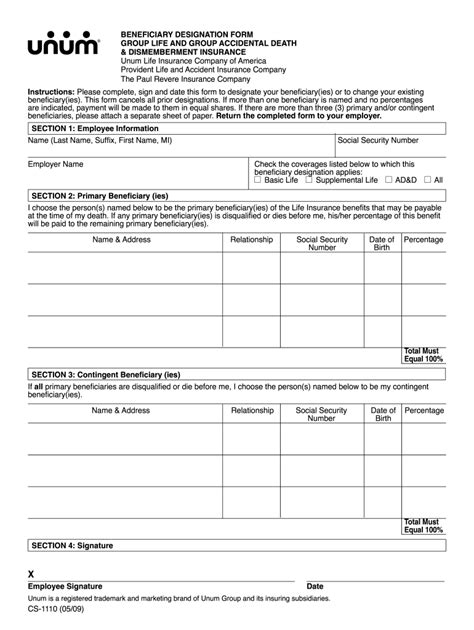

Beneficiary Paperwork for Work Requirements

Introduction to Beneficiary Paperwork

When individuals are beneficiaries of certain programs, such as Social Security or other government assistance, they are often required to meet specific work requirements to maintain their eligibility. This involves completing and submitting various forms of paperwork to verify their work status and ensure compliance with the program’s regulations. The process can be complex, and understanding the necessary paperwork is crucial for beneficiaries to avoid any disruptions in their benefits.

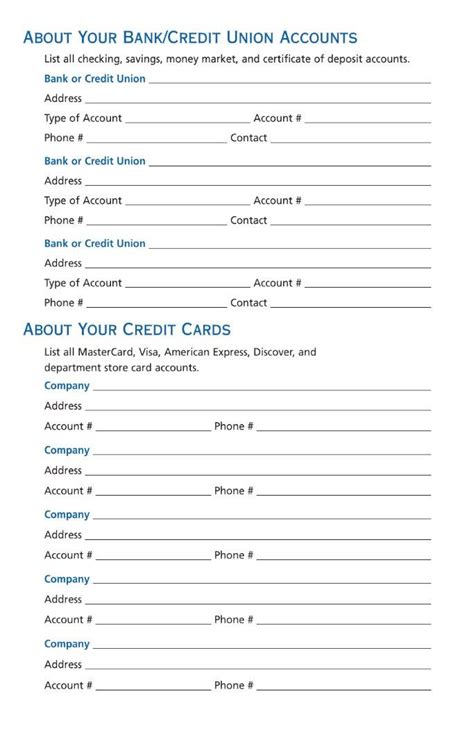

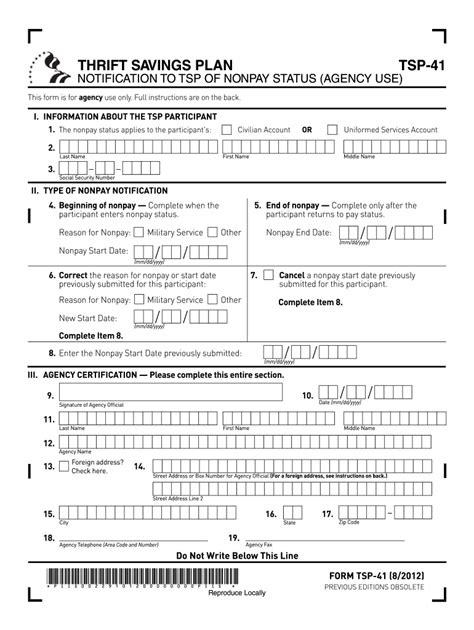

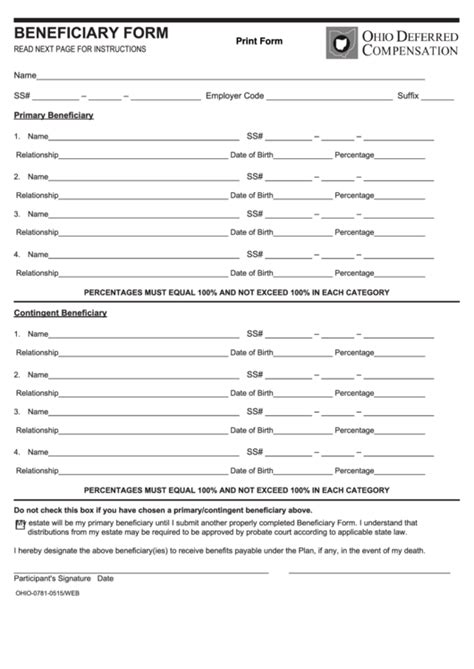

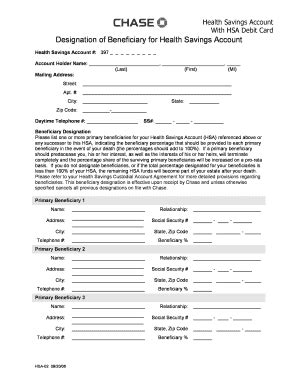

Types of Beneficiary Paperwork

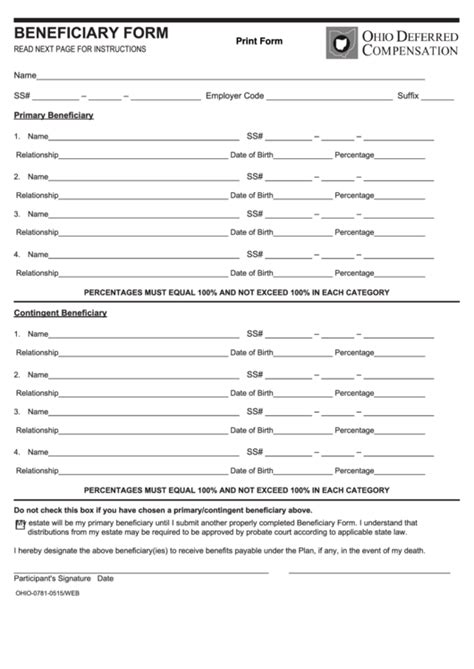

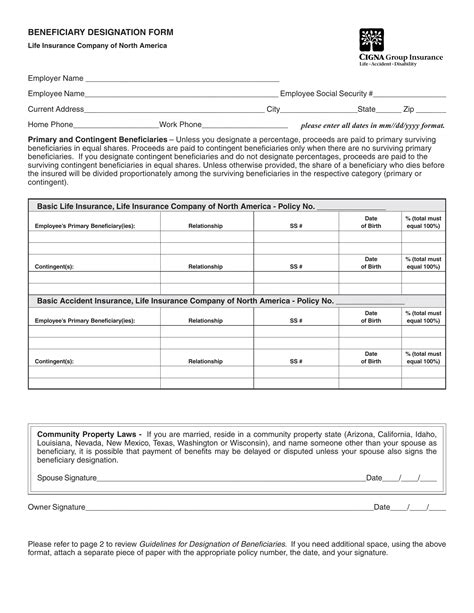

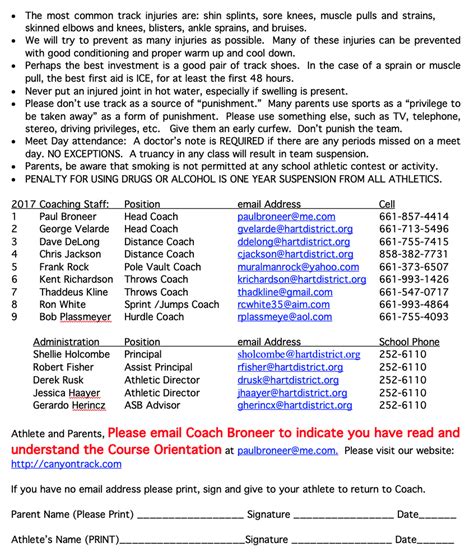

There are several types of paperwork that beneficiaries may need to complete, depending on the specific program they are enrolled in. Some common examples include: * Work Activity Reports: These forms require beneficiaries to detail their work activities, including the number of hours worked and the type of work performed. * Earnings Statements: Beneficiaries must provide proof of their earnings, which can include pay stubs, W-2 forms, or other documentation. * Employer Verification Forms: These forms are used to verify a beneficiary’s employment status and may require the employer’s signature or other verification. * Self-Employment Reports: For beneficiaries who are self-employed, these reports require them to detail their business income and expenses.

Completing Beneficiary Paperwork

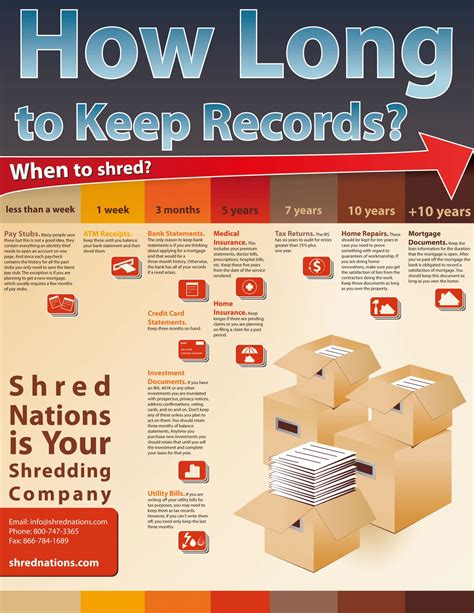

To complete the necessary paperwork, beneficiaries should follow these steps: * Gather required documents: Beneficiaries should collect all relevant documents, such as pay stubs, W-2 forms, and business records. * Fill out forms accurately: Beneficiaries should carefully complete the required forms, ensuring that all information is accurate and complete. * Submit paperwork on time: Beneficiaries should submit their paperwork by the designated deadline to avoid any disruptions in their benefits. * Keep records of submissions: Beneficiaries should keep a record of their submissions, including the date and method of submission, in case of any issues or disputes.

Common Challenges with Beneficiary Paperwork

Beneficiaries may encounter several challenges when completing their paperwork, including: * Incomplete or inaccurate information: Failure to provide complete or accurate information can result in delays or denial of benefits. * Missed deadlines: Failing to submit paperwork on time can lead to disruptions in benefits or even termination of eligibility. * Difficulty obtaining required documents: Beneficiaries may experience challenges in obtaining the necessary documents, such as employer verification or business records.

📝 Note: Beneficiaries should carefully review the program's regulations and requirements to ensure they are meeting all necessary paperwork obligations.

Benefits of Accurate Beneficiary Paperwork

Accurate and timely completion of beneficiary paperwork can have several benefits, including: * Uninterrupted benefits: By submitting complete and accurate paperwork, beneficiaries can ensure that their benefits continue without interruption. * Reduced risk of audits: Accurate paperwork can reduce the risk of audits or investigations, which can be time-consuming and stressful. * Increased confidence: Beneficiaries who complete their paperwork accurately and on time can feel more confident in their ability to manage their benefits and meet program requirements.

Table of Common Beneficiary Paperwork

| Type of Paperwork | Description | Frequency |

|---|---|---|

| Work Activity Reports | Detail work activities, including hours worked and type of work | Monthly |

| Earnings Statements | Provide proof of earnings, including pay stubs and W-2 forms | Quarterly |

| Employer Verification Forms | Verify employment status, including employer signature or verification | Annually |

| Self-Employment Reports | Detail business income and expenses | Semi-Annually |

As beneficiaries navigate the complex process of completing paperwork for work requirements, it is essential to remain organized, accurate, and timely. By doing so, they can ensure uninterrupted benefits, reduce the risk of audits, and increase their confidence in managing their benefits. Ultimately, understanding the necessary paperwork and completing it correctly is crucial for beneficiaries to maintain their eligibility and receive the benefits they deserve.

In wrapping up this discussion on beneficiary paperwork for work requirements, the key takeaway is the importance of accuracy, timeliness, and organization. Beneficiaries must be diligent in completing the necessary paperwork, and by doing so, they can avoid common challenges and ensure that they receive the benefits they are eligible for. Whether it’s work activity reports, earnings statements, or self-employment reports, each type of paperwork plays a critical role in verifying a beneficiary’s work status and ensuring compliance with program regulations.

What types of paperwork do beneficiaries need to complete for work requirements?

+

Beneficiaries may need to complete work activity reports, earnings statements, employer verification forms, and self-employment reports, depending on the specific program they are enrolled in.

How often do beneficiaries need to submit paperwork for work requirements?

+

The frequency of submitting paperwork varies depending on the type of paperwork and the program’s requirements, but it can range from monthly to annually.

What are the consequences of not completing paperwork accurately or on time?

+

Failure to complete paperwork accurately or on time can result in delays or denial of benefits, as well as increased risk of audits or investigations.