Paperwork

Car Finance Paperwork Explained

Introduction to Car Finance Paperwork

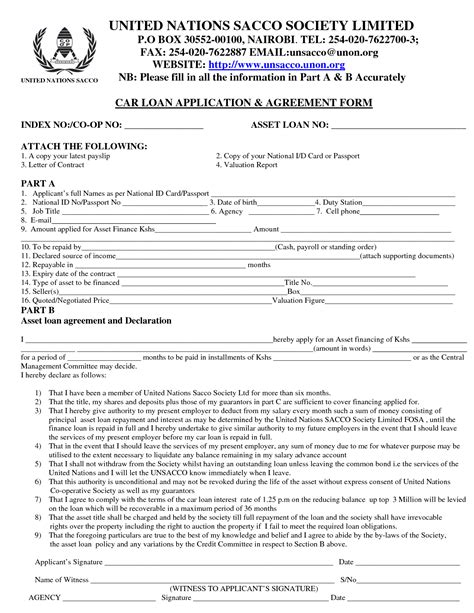

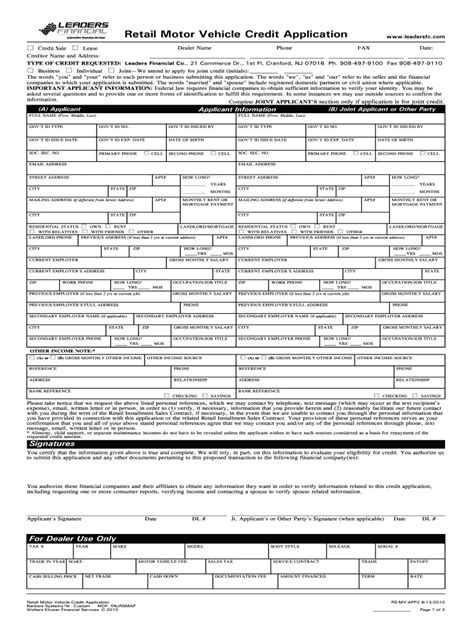

When purchasing a vehicle, whether new or used, through financing, the process involves a significant amount of paperwork. This paperwork is crucial as it outlines the terms of the loan, the responsibilities of both the lender and the borrower, and other essential details. Understanding the components of car finance paperwork is vital to ensure that buyers are well-informed and protected throughout the financing process.

Components of Car Finance Paperwork

Car finance paperwork typically includes several key documents, each serving a specific purpose. These documents are designed to protect both the lender and the borrower by clearly defining the terms of the agreement. The primary components include: - Finance Agreement: This is the core document that outlines the terms and conditions of the loan, including the loan amount, interest rate, repayment terms, and the duration of the loan. - Disclosure Statement: Provides detailed information about the loan, including the total amount payable, the annual percentage rate (APR), and any fees associated with the loan. - Guarantee (if applicable): In cases where a guarantor is required, this document outlines the guarantor’s obligations and liabilities. - Security Agreement: Since the vehicle serves as collateral for the loan, this document explains the lender’s rights over the vehicle in the event of default. - Insurance Details: Information regarding the insurance requirements for the vehicle, which often includes comprehensive insurance to protect the lender’s interest.

Understanding Key Terms and Conditions

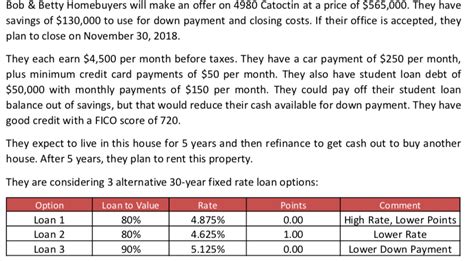

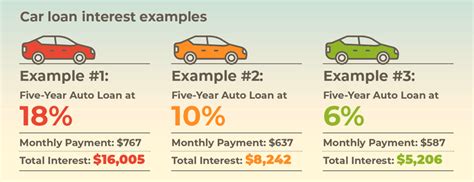

To navigate car finance paperwork effectively, it’s essential to understand certain key terms and conditions, including: - APR (Annual Percentage Rate): The rate of interest charged on the loan over a year, including any fees. - Loan Term: The length of time over which the loan is repaid. - Monthly Payments: The amount borrowed, plus interest, divided into equal monthly installments. - Early Repayment Fees: Charges that may apply if the borrower decides to pay off the loan early. -

Steps to Review Car Finance Paperwork

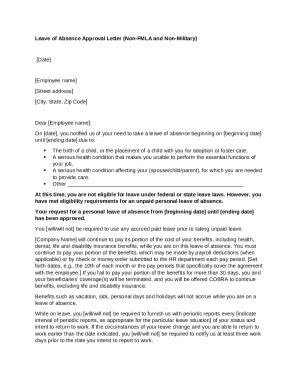

Reviewing car finance paperwork meticulously is crucial to avoid any misunderstandings or hidden costs. Here are steps to follow: 1. Read Carefully: Take time to read through all documents thoroughly. 2. Ask Questions: Clarify any doubts or concerns with the lender. 3. Check for Errors: Ensure all personal and vehicle details are accurate. 4. Understand the Total Cost: Calculate the total amount payable over the loan term. 5. Consider Seeking Advice: If unsure, consider consulting with a financial advisor.

Importance of Accuracy and Transparency

Accuracy and transparency in car finance paperwork are paramount. Inaccurate information or hidden fees can lead to disputes and financial hardships for the borrower. Lenders have a responsibility to provide clear, concise documentation, and borrowers should be vigilant in reviewing and understanding all terms before signing.

| Document | Purpose |

|---|---|

| Finance Agreement | Outlines loan terms and conditions |

| Disclosure Statement | Provides detailed loan information |

| Guarantee | Outlines guarantor's obligations (if applicable) |

| Security Agreement | Explains lender's rights over the vehicle |

| Insurance Details | Specifies insurance requirements |

📝 Note: Always ensure you have a copy of all signed documents for your records.

In the end, navigating the complexities of car finance paperwork requires patience, diligence, and a keen eye for detail. By understanding the components, terms, and conditions of the finance agreement, individuals can make informed decisions and avoid potential pitfalls. Whether you’re a first-time buyer or have experience with car financing, taking the time to thoroughly review and comprehend the paperwork is essential for a smooth and successful transaction. The process may seem daunting, but with the right approach and knowledge, it can be managed effectively, leading to a satisfying car ownership experience.