Car Loan Paperwork Overview

Introduction to Car Loan Paperwork

When purchasing a vehicle, whether new or used, most buyers opt for financing options to make the acquisition more affordable. This is where car loans come into play. However, the process of securing a car loan involves more than just selecting a vehicle and a lender; it encompasses a significant amount of paperwork. Understanding the various documents and contracts involved in car loan paperwork is crucial for a smooth and transparent transaction. This overview aims to guide potential car buyers through the complex world of car loan documentation, highlighting key elements, and providing insights into the process.

Types of Documents Involved

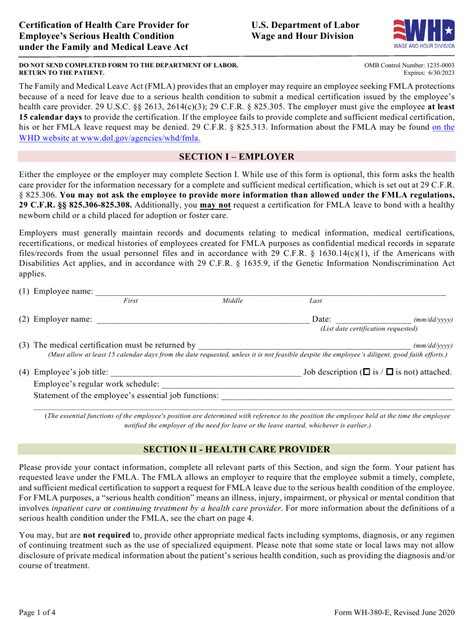

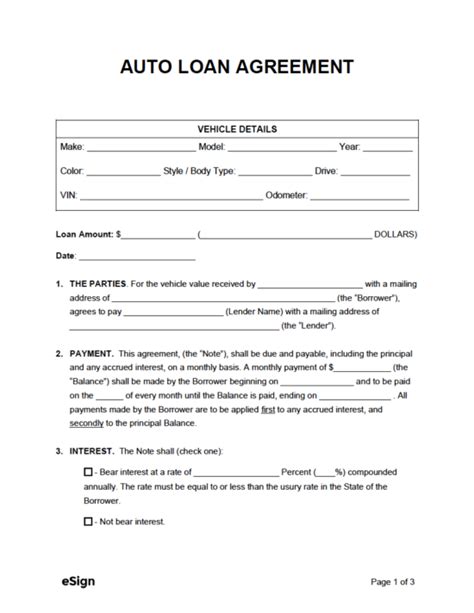

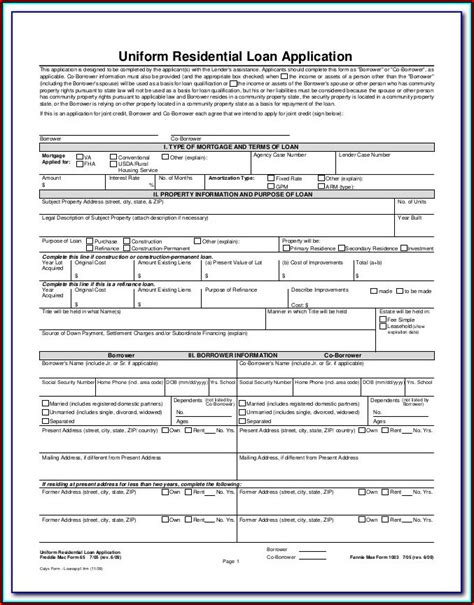

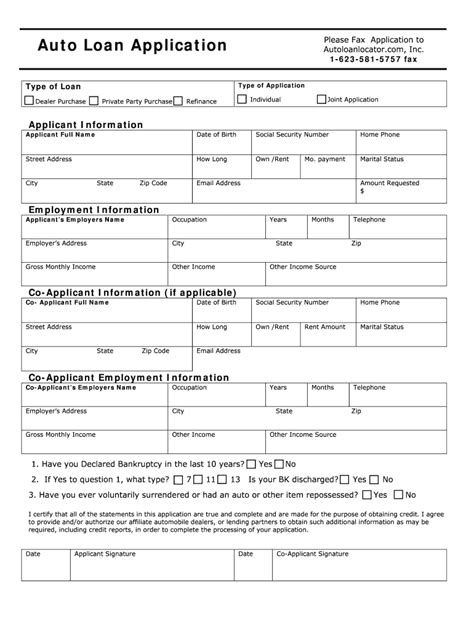

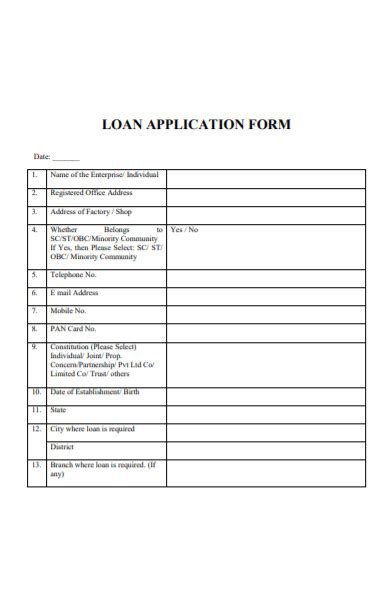

The car loan process involves several key documents, each serving a distinct purpose. These include: - Loan Application: This is the initial document where the borrower provides personal, financial, and employment information to the lender. The lender uses this information to assess the borrower’s creditworthiness. - Credit Report: A credit report is obtained by the lender to evaluate the borrower’s credit history. This report plays a significant role in determining the interest rate and loan terms. - Loan Agreement: Also known as the loan contract, this document outlines the terms and conditions of the loan, including the loan amount, interest rate, repayment terms, and any penalties for late payments. - Promissory Note: This is a promise to pay the loan back, including the principal, interest, and other costs, by a specified date. - Security Agreement: For secured loans, this document explains that the vehicle serves as collateral for the loan. If the borrower defaults, the lender has the right to repossess the vehicle. - Title and Registration: These documents prove ownership of the vehicle. The lender will typically hold the title until the loan is fully repaid.

Key Elements of Car Loan Paperwork

Several elements within the car loan paperwork are critical for borrowers to understand: - Annual Percentage Rate (APR): This is the rate of interest charged on the loan over a year, including fees. It gives borrowers a clear picture of the loan’s total cost. - Loan Term: The duration of the loan, typically expressed in months or years. Longer terms may reduce monthly payments but increase the total interest paid over the life of the loan. - Monthly Payments: Calculated based on the loan amount, APR, and loan term. Borrowers should ensure they can afford these payments. - Fees and Charges: In addition to interest, car loans may come with various fees, such as origination fees, late payment fees, and prepayment penalties.

Understanding the Fine Print

It’s essential for borrowers to carefully review the loan documents, paying close attention to the fine print. This includes: - Prepayment Penalties: Some loans may charge a fee for paying off the loan early. Borrowers should understand if such penalties apply and how they are calculated. - Default and Repossession: The consequences of missing payments, including how default is defined, the process of repossession, and any potential legal actions. - Insurance Requirements: Lenders often require borrowers to maintain comprehensive and collision insurance on the vehicle until the loan is paid off.

Steps to Complete Car Loan Paperwork

The process of completing car loan paperwork can be streamlined by following these steps: - Research and Comparison: Compare loan offers from different lenders to find the best terms. - Gather Required Documents: Typically, this includes identification, proof of income, proof of insurance, and the vehicle’s details. - Review and Understand the Loan Terms: Before signing, ensure all aspects of the loan are clear, including the total cost, monthly payments, and any potential fees. - Sign the Documents: Once satisfied with the terms, sign the loan agreement and other required documents.

📝 Note: It's crucial to read and understand all documents before signing. If any terms are unclear, do not hesitate to ask for clarification.

Importance of Accurate Documentation

Accurate and complete documentation is vital for a smooth car loan process. Errors or omissions can lead to delays or even loan rejection. Additionally, understanding and agreeing to the terms outlined in the paperwork protects both the lender and the borrower, ensuring a legally binding contract that is fair and transparent.

Technological Advancements in Car Loan Paperwork

The digital age has significantly impacted the car loan paperwork process, with many lenders offering online applications and digital document signing. This has made the process more convenient, faster, and more accessible. However, it’s still important for borrowers to carefully review all documents, even in a digital format, to ensure they understand and agree to the terms.

| Document | Purpose |

|---|---|

| Loan Application | To provide borrower information for credit assessment |

| Credit Report | To evaluate borrower's credit history |

| Loan Agreement | Outlines loan terms and conditions |

| Promissory Note | Promises repayment of the loan |

| Security Agreement | Specifies the vehicle as collateral |

In summary, car loan paperwork is a critical component of the vehicle financing process. By understanding the various documents involved, the key elements of the loan, and the importance of accurate and complete documentation, borrowers can navigate this process with confidence. Whether opting for traditional lending routes or exploring digital options, a thorough review of all paperwork is essential to ensure a satisfactory and legally binding agreement.

What is the most important document in car loan paperwork?

+

The Loan Agreement is arguably the most important document, as it outlines all the terms and conditions of the loan, including the loan amount, interest rate, repayment terms, and any penalties.

Can I negotiate the terms of my car loan?

+

Yes, it’s possible to negotiate the terms of your car loan. This can include the interest rate, loan term, and even some of the fees associated with the loan. It’s always a good idea to compare offers from different lenders and negotiate based on the best offer you receive.

What happens if I miss a payment on my car loan?

+

If you miss a payment on your car loan, you may be subject to late fees and potential damage to your credit score. Continuous missed payments can lead to default and the lender may repossess the vehicle. It’s crucial to communicate with your lender if you’re having trouble making payments to explore possible alternatives.