House Closing Paperwork Example

Introduction to House Closing Paperwork

When purchasing a house, the closing process is the final step where the buyer and seller sign the necessary documents to transfer ownership of the property. This process involves a significant amount of paperwork, which can be overwhelming for those who are not familiar with it. In this article, we will provide an overview of the house closing paperwork example and guide you through the different documents you can expect to sign during the closing process.

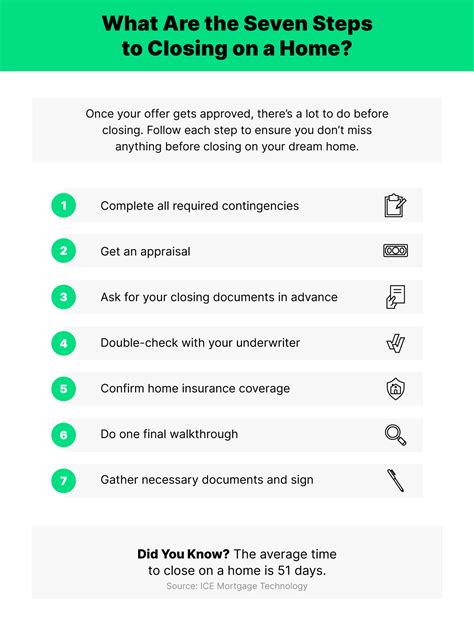

Types of Documents Involved in House Closing

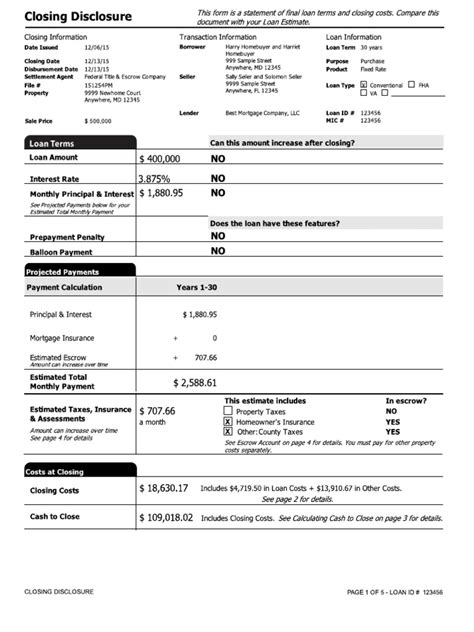

The house closing process involves several documents that are essential for the transfer of ownership. Some of the key documents include: * Deed: This document transfers the ownership of the property from the seller to the buyer. * Mortgage Note: This document outlines the terms of the loan, including the interest rate, payment schedule, and loan amount. * Mortgage Deed: This document secures the loan by placing a lien on the property. * Title Report: This document provides a detailed report of the property’s title, including any liens or encumbrances. * Insurance Policies: These documents provide proof of insurance coverage for the property.

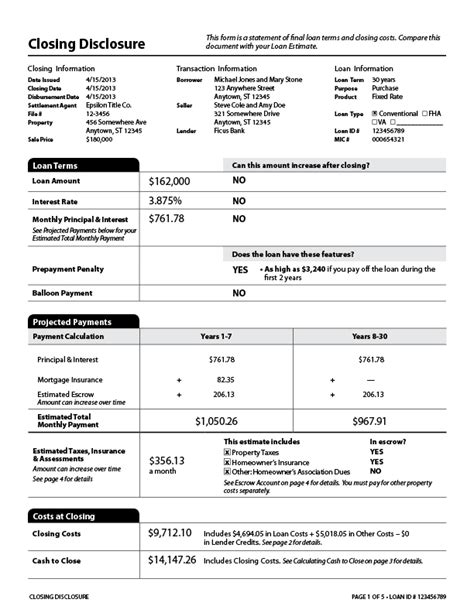

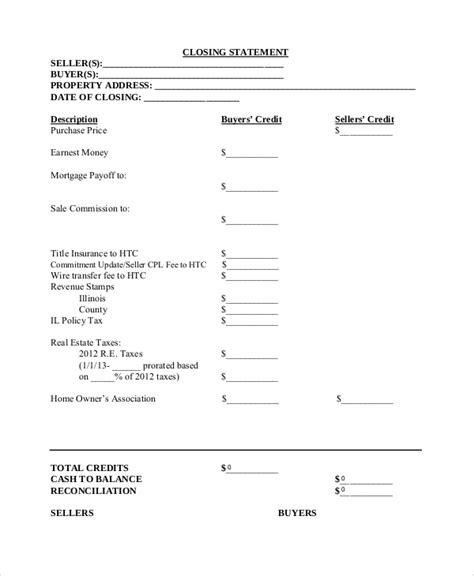

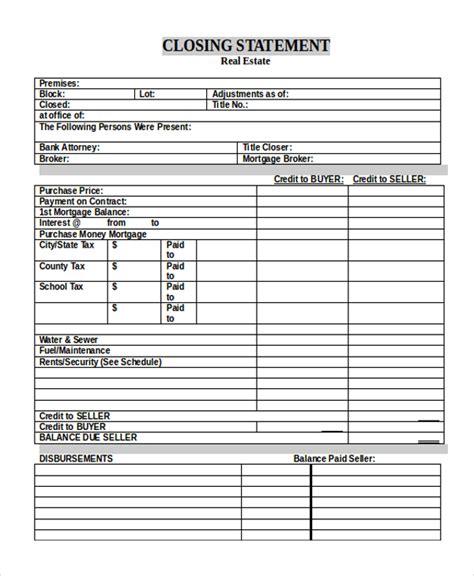

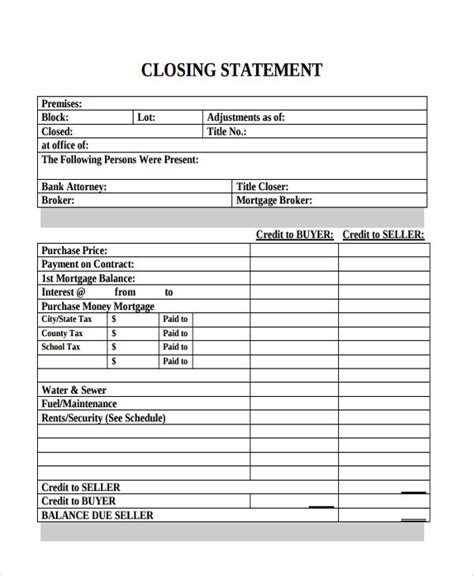

House Closing Paperwork Example

Here is an example of what the house closing paperwork might look like:

| Document | Description |

|---|---|

| Deed | Transfers ownership of the property from the seller to the buyer |

| Mortgage Note | Outlines the terms of the loan, including interest rate and payment schedule |

| Mortgage Deed | Secures the loan by placing a lien on the property |

| Title Report | Provides a detailed report of the property’s title, including any liens or encumbrances |

| Insurance Policies | Provides proof of insurance coverage for the property |

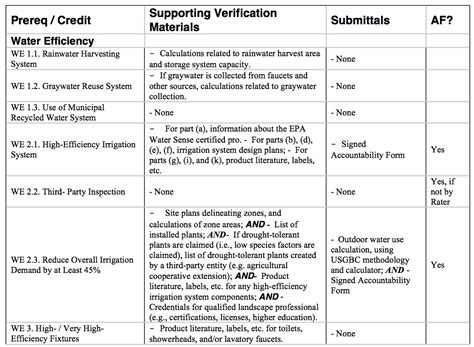

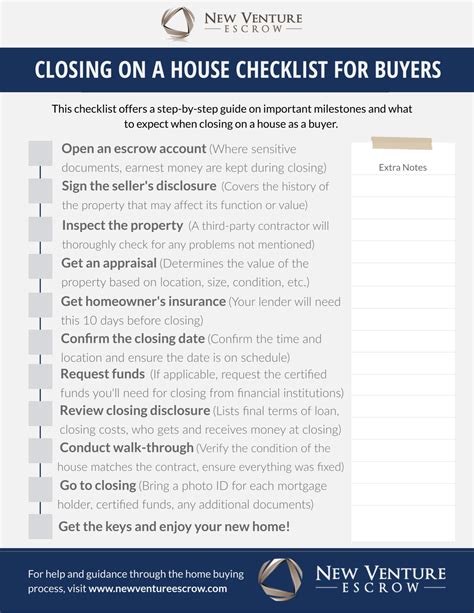

Steps Involved in the House Closing Process

The house closing process typically involves the following steps: * Pre-closing: The buyer and seller review and sign the necessary documents, and the buyer conducts a final walk-through of the property. * Closing: The buyer and seller meet with a representative from the title company to sign the final documents and transfer ownership of the property. * Post-closing: The title company records the documents with the county and issues the final title report.

📝 Note: The house closing process can vary depending on the state and local regulations, so it's essential to work with a reputable title company and real estate agent to ensure a smooth transaction.

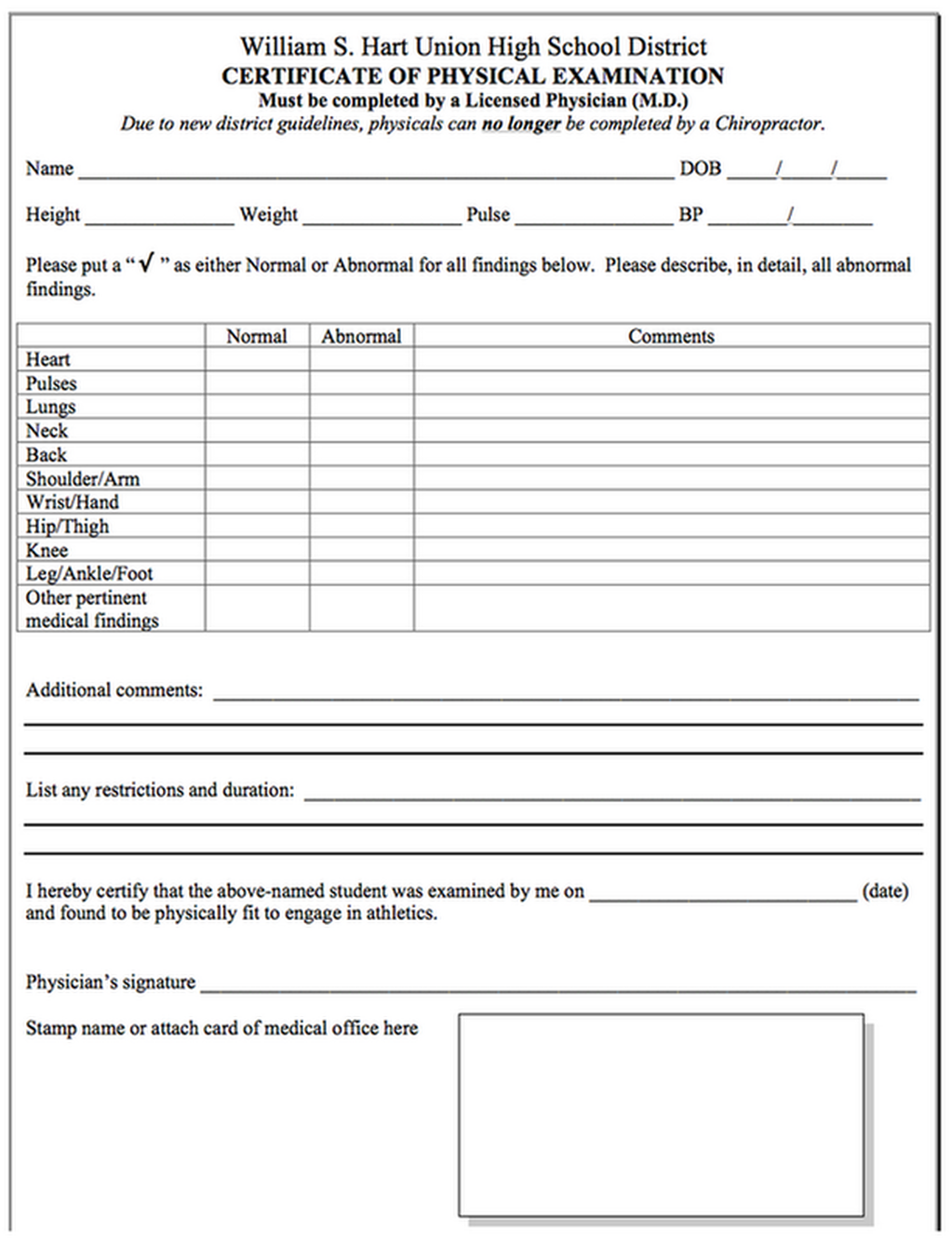

Importance of Reviewing House Closing Paperwork

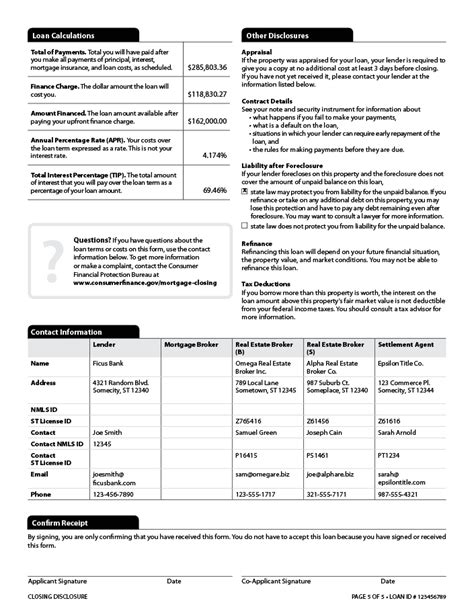

Reviewing the house closing paperwork carefully is crucial to ensure that all documents are accurate and complete. Some of the key things to look for include: * Accuracy of information: Verify that all information, including names, addresses, and loan terms, is accurate and complete. * Loan terms: Review the loan terms, including the interest rate, payment schedule, and loan amount, to ensure they are correct. * Insurance coverage: Verify that the insurance policies provide adequate coverage for the property.

Common Mistakes to Avoid in House Closing Paperwork

Some common mistakes to avoid in house closing paperwork include: * Failure to review documents carefully: Failing to review the documents carefully can lead to errors or inaccuracies that can cause delays or even cancel the transaction. * Not understanding loan terms: Not understanding the loan terms can lead to unexpected costs or fees. * Not verifying insurance coverage: Not verifying insurance coverage can leave the property unprotected in the event of a disaster or accident.

In final thoughts, the house closing process involves a significant amount of paperwork, and it’s essential to review all documents carefully to ensure a smooth transaction. By understanding the different types of documents involved and the steps involved in the house closing process, buyers can navigate the process with confidence and avoid common mistakes.

What is the purpose of the deed in the house closing process?

+

The deed transfers the ownership of the property from the seller to the buyer.

What is the difference between a mortgage note and a mortgage deed?

+

A mortgage note outlines the terms of the loan, while a mortgage deed secures the loan by placing a lien on the property.

Why is it essential to review the house closing paperwork carefully?

+

Reviewing the house closing paperwork carefully ensures that all documents are accurate and complete, and helps to avoid errors or inaccuracies that can cause delays or even cancel the transaction.