Paperwork

5 Repossession Paperwork Tips

Understanding the Repossession Process

When a borrower defaults on a loan, the lender may repossess the collateral, which is typically a vehicle, to recover some of the losses. The repossession process involves several steps, including notification, seizure, and sale of the collateral. To navigate this complex process, it’s essential to understand the necessary paperwork and procedures. Repossession paperwork can be overwhelming, but with the right guidance, individuals can better manage the situation.

Repossession Paperwork Tips

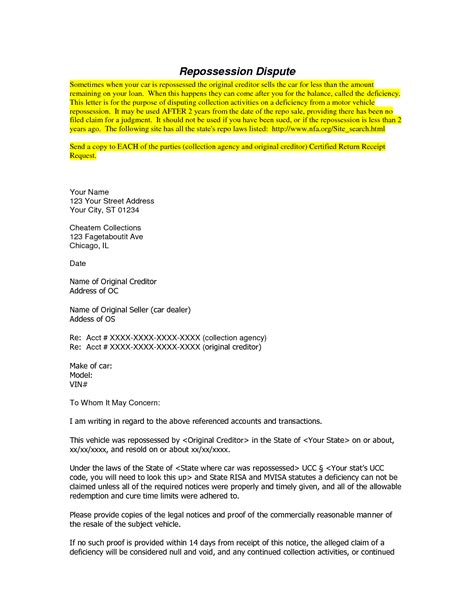

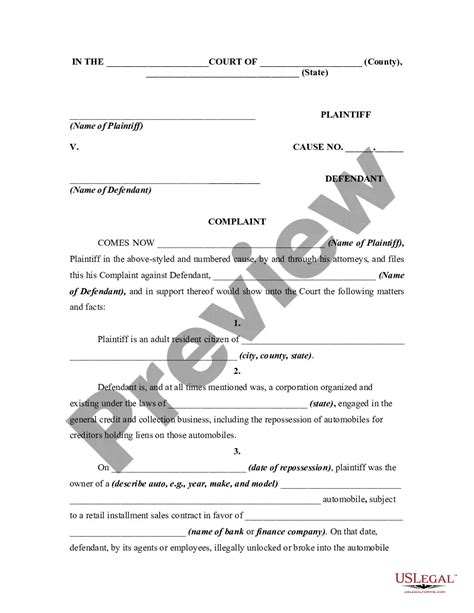

Here are five tips to help individuals deal with repossession paperwork: * Review the loan agreement: The loan agreement outlines the terms and conditions of the loan, including the repossession process. It’s crucial to review the agreement to understand the lender’s rights and the borrower’s obligations. * Understand the notice requirements: Lenders are required to provide notice to the borrower before repossessing the collateral. The notice should include information about the default, the amount owed, and the intention to repossess. * Keep detailed records: Keeping detailed records of all correspondence with the lender, including notices, payments, and communications, can help individuals track the repossession process and identify any potential errors or discrepancies. * Know your rights: Borrowers have rights during the repossession process, including the right to redeem the collateral or dispute the repossession. It’s essential to understand these rights and how to exercise them. * Seek professional advice: Repossession paperwork can be complex, and individuals may benefit from seeking professional advice from a lawyer or financial advisor to navigate the process.

The Importance of Accuracy

Accuracy is critical when dealing with repossession paperwork. Inaccurate or incomplete paperwork can lead to delays, disputes, or even legal issues. Individuals should ensure that all paperwork is accurate, complete, and timely to avoid any potential problems.

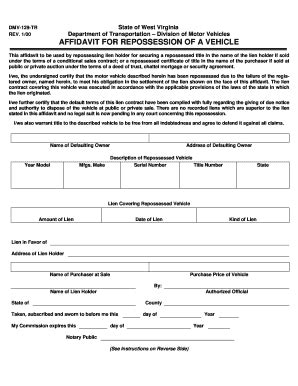

| Document | Description |

|---|---|

| Loan agreement | Outlines the terms and conditions of the loan |

| Notice of default | Notifies the borrower of the default and intention to repossess |

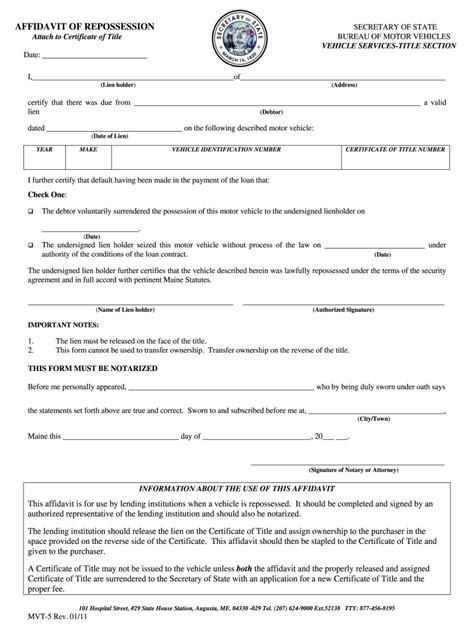

| Repossession affidavit | Provides evidence of the repossession and transfer of ownership |

Conclusion and Next Steps

In conclusion, repossession paperwork can be complex and overwhelming, but with the right guidance, individuals can navigate the process more effectively. By understanding the necessary paperwork, reviewing the loan agreement, keeping detailed records, knowing their rights, and seeking professional advice, individuals can better manage the repossession process. It’s essential to stay informed, organized, and proactive to achieve the best possible outcome.

What is repossession paperwork?

+

Repossession paperwork refers to the documents and forms required during the repossession process, including the loan agreement, notice of default, and repossession affidavit.

What are my rights during the repossession process?

+

Borrowers have the right to redeem the collateral, dispute the repossession, and seek professional advice. It’s essential to understand these rights and how to exercise them.

How can I avoid repossession?

+

To avoid repossession, individuals can make timely payments, communicate with the lender, and seek professional advice. It’s crucial to address any financial difficulties promptly to prevent default and repossession.