New IFTA Paperwork Requirements

Introduction to IFTA Paperwork Requirements

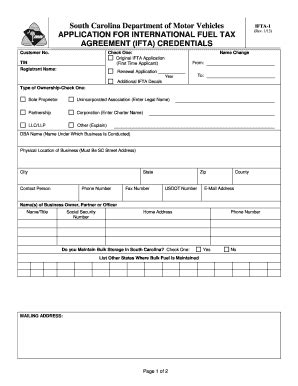

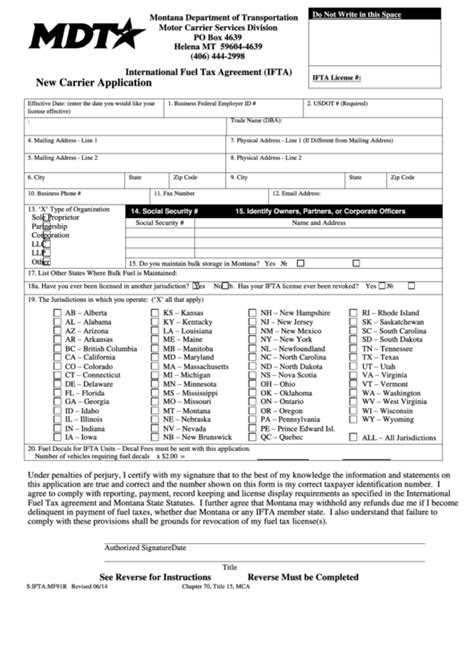

The International Fuel Tax Agreement (IFTA) is a cooperative arrangement between the 48 contiguous states in the United States and the 10 provinces of Canada. The primary goal of IFTA is to simplify the reporting of fuel use taxes by carriers who operate in multiple jurisdictions. As of recent updates, there are new IFTA paperwork requirements that carriers must comply with to avoid penalties and ensure smooth operations across state and provincial borders.

Understanding IFTA

Before diving into the new paperwork requirements, it’s essential to understand what IFTA entails. IFTA is designed for carriers who operate qualified motor vehicles in multiple jurisdictions. A qualified motor vehicle is one that is used, designed, or maintained for transportation of persons or property and has a gross vehicle weight of more than 26,000 pounds or has three or more axles, regardless of weight. Carriers operating such vehicles must obtain an IFTA license and file quarterly fuel tax returns with their base jurisdiction.

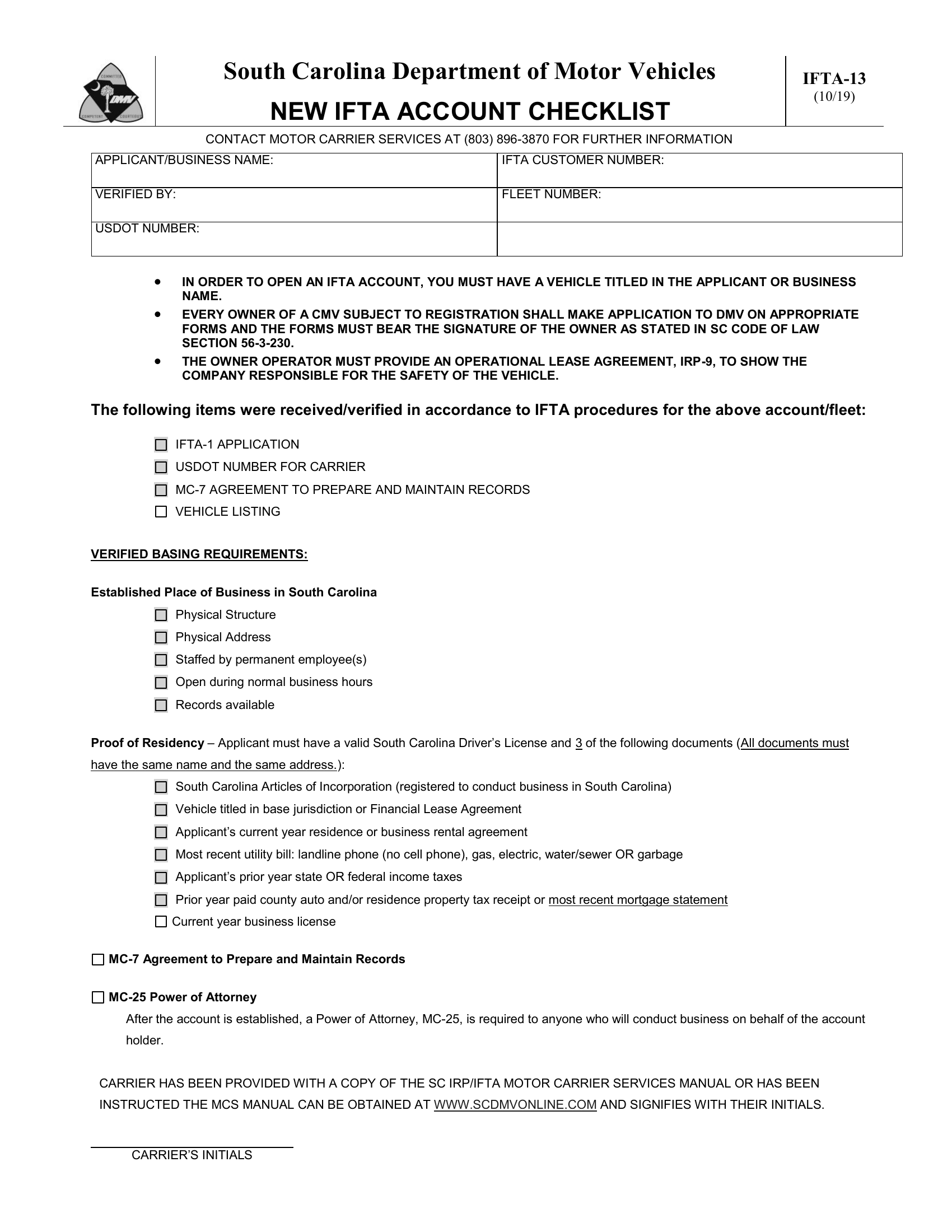

New IFTA Paperwork Requirements

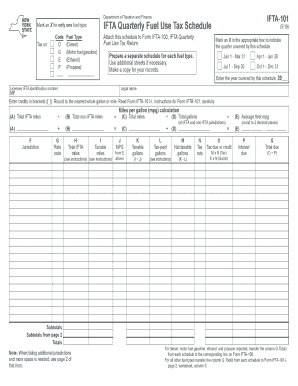

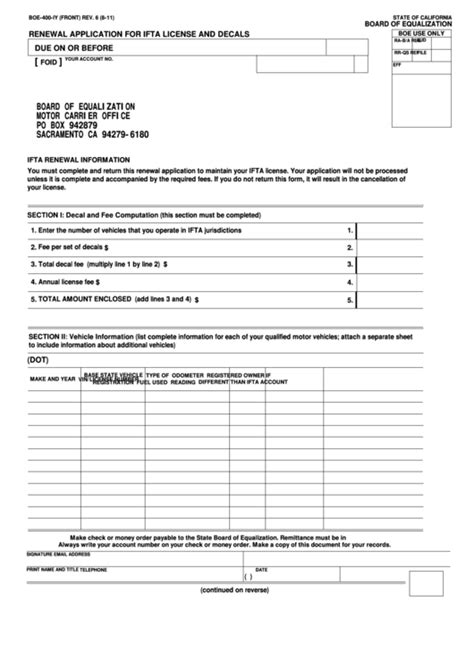

The new IFTA paperwork requirements aim to enhance compliance and reduce administrative burdens on carriers. Key aspects of these requirements include: - Electronic Filing: Many jurisdictions now require or encourage electronic filing of IFTA returns. This can simplify the process for carriers and reduce errors. - Detailed Records: Carriers must maintain detailed records of their fuel purchases and mileage accrued in each jurisdiction. These records must be accurate and readily available for audit. - IFTA License Display: Carriers are required to display their IFTA license in each qualified motor vehicle. The license indicates that the carrier is authorized to operate in multiple jurisdictions under the IFTA agreement.

Benefits of Compliance

Compliance with the new IFTA paperwork requirements offers several benefits to carriers, including: - Simplified Reporting: By standardizing fuel tax reporting across jurisdictions, IFTA simplifies the process for carriers who operate in multiple states or provinces. - Reduced Administrative Burden: Electronic filing and detailed record-keeping can reduce the administrative time and costs associated with managing fuel tax compliance. - Avoidance of Penalties: Compliance with IFTA requirements helps carriers avoid penalties and interest associated with late filing or incorrect reporting.

Challenges and Solutions

Despite the benefits, carriers may face challenges in complying with the new IFTA paperwork requirements, particularly in terms of maintaining detailed records and navigating the electronic filing process. Solutions to these challenges include: - Investing in Fleet Management Software: Utilizing software designed for fleet management can help carriers track fuel purchases, mileage, and other necessary data efficiently. - Training Personnel: Ensuring that personnel are well-trained in IFTA requirements and the use of any software or systems for tracking and reporting can reduce errors and improve compliance.

Importance of Accuracy

Accuracy in reporting and record-keeping is crucial for IFTA compliance. Inaccurate reporting can lead to penalties, fines, and even the revocation of IFTA licenses. Carriers must ensure that all fuel purchases and mileage are accurately recorded and reported to their base jurisdiction.

| Quarter | Reporting Period | Filing Deadline |

|---|---|---|

| 1st Quarter | January 1 - March 31 | April 30 |

| 2nd Quarter | April 1 - June 30 | July 31 |

| 3rd Quarter | July 1 - September 30 | October 31 |

| 4th Quarter | October 1 - December 31 | January 31 |

📝 Note: Carriers should be aware of the quarterly filing deadlines to ensure timely submission of their IFTA returns.

In summary, the new IFTA paperwork requirements are designed to streamline the fuel tax reporting process for carriers operating in multiple jurisdictions. By understanding these requirements and implementing solutions such as fleet management software and personnel training, carriers can ensure compliance, reduce administrative burdens, and avoid penalties. The key to successful IFTA compliance is maintaining accurate and detailed records, leveraging technology for efficient reporting, and staying informed about any updates or changes to the requirements. As the transportation industry continues to evolve, adherence to these regulations will remain crucial for carriers seeking to operate efficiently and legally across state and provincial lines. Ultimately, compliance with IFTA requirements is not just a legal necessity but a strategic move towards enhancing operational efficiency and reducing costs in the long run.

What is the primary purpose of IFTA?

+

The primary purpose of IFTA is to simplify the reporting of fuel use taxes by carriers who operate in multiple jurisdictions.

What vehicles are considered qualified motor vehicles under IFTA?

+

A qualified motor vehicle is one that is used, designed, or maintained for transportation of persons or property and has a gross vehicle weight of more than 26,000 pounds or has three or more axles, regardless of weight.

How often must IFTA returns be filed?

+

IFTA returns must be filed quarterly, with deadlines typically falling on the last day of the month following the end of each quarter.