5 Ways Stop Payments

Understanding Stop Payments

Stop payments are a crucial aspect of personal finance and banking, allowing individuals to cancel or halt payments on checks, electronic transfers, or other financial transactions. This feature is especially useful in situations where a payment was made in error, a check is lost or stolen, or when there’s a dispute over a transaction. In this article, we’ll delve into the world of stop payments, exploring what they are, why they’re used, and the different methods through which they can be initiated.

Why Use Stop Payments?

Before diving into the ways to stop payments, it’s essential to understand the reasons behind using this financial tool. Preventing financial loss is a primary motivation, especially in cases of fraud or unauthorized transactions. Additionally, stop payments can help in resolving disputes between the payer and the payee, providing a temporary halt to the transaction until the issue is resolved. They can also be used to correct errors, such as when the wrong amount is transferred or when a payment is sent to the incorrect recipient.

Methods to Stop Payments

There are several methods to stop payments, each with its own set of requirements and deadlines. Understanding these methods is vital for effectively managing your finances and preventing potential losses.

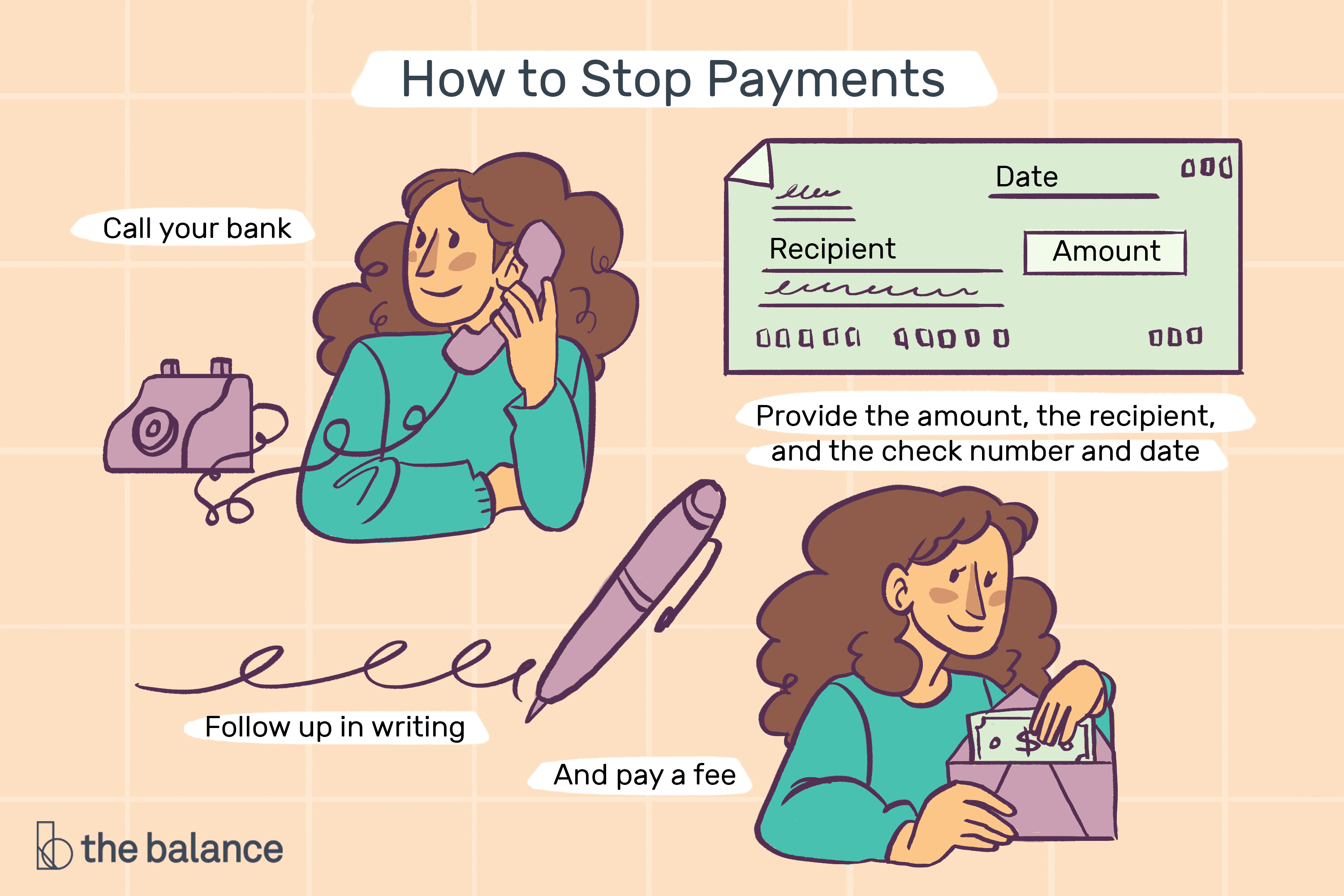

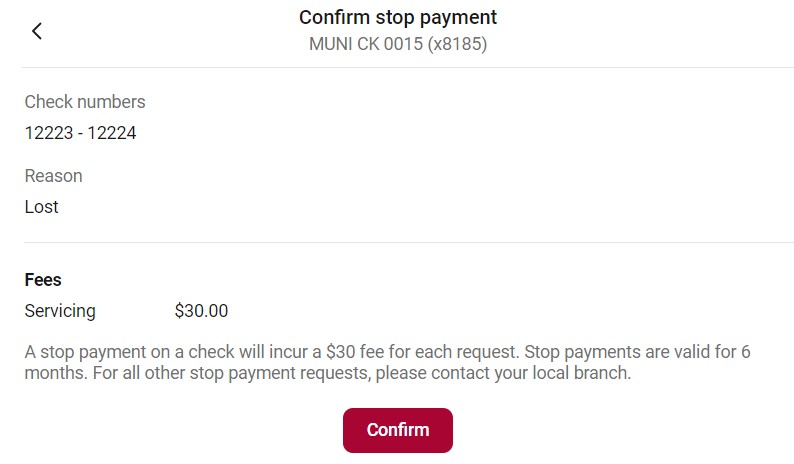

1. Stop Payment Order for Checks: This is one of the most common types of stop payments. To stop a check payment, you typically need to contact your bank as soon as possible and provide them with the check number, the date of the check, the payee’s name, and the amount of the check. Your bank may charge a fee for this service, and the stop payment order usually lasts for six months, although this can vary by bank.

2. Electronic Fund Transfer (EFT) Stop Payments: For electronic transactions, the process can be more complex. You’ll need to notify your bank at least three business days before the scheduled transaction date. Providing detailed information about the transaction, including the date, amount, and recipient, is crucial for successfully stopping the payment.

3. Debit Card Transactions: If you’ve authorized a recurring payment or a one-time payment through your debit card and wish to stop it, you should contact the merchant directly to request cancellation. If the merchant is uncooperative, reaching out to your bank for assistance may be necessary. It’s essential to act quickly in these situations to avoid unauthorized transactions.

4. Online Banking and Mobile Apps: Many banks offer the convenience of stopping payments directly through their online banking platforms or mobile apps. This method is often the fastest way to initiate a stop payment, as it can be done at any time and from any location with an internet connection. You’ll typically need to navigate to the transaction section, select the payment you wish to stop, and follow the on-screen instructions to confirm your request.

5. Visiting a Bank Branch: For those who prefer a more personal approach or have complex issues that require direct assistance, visiting a bank branch can be the best option. Bank representatives can guide you through the stop payment process, answer any questions you might have, and ensure that the request is handled promptly and correctly.

Key Considerations

When initiating a stop payment, several factors must be considered to ensure the process is handled effectively. Timing is critical; the sooner you request a stop payment, the higher the likelihood of preventing the transaction from being processed. Additionally, fees may apply, so it’s wise to inquire about any potential charges before proceeding. Documentation is also important; keeping records of your stop payment request, including the method of request and any reference numbers provided by the bank, can be useful for tracking purposes and in case of disputes.

💡 Note: Always review your bank's specific policies regarding stop payments, as procedures and requirements can vary significantly between institutions.

Preventing the Need for Stop Payments

While stop payments are a valuable tool, preventing the need for them in the first place is even better. Regularly monitoring your account activity can help you catch and address any issues promptly. Verifying transaction details before initiating a payment is also crucial, as this can prevent errors such as incorrect amounts or recipient information. Furthermore, maintaining open communication with merchants and your bank can resolve potential issues before they escalate.

Incorporating these strategies into your financial management routine can significantly reduce the likelihood of needing to stop a payment, saving you time, potential fees, and the stress associated with resolving financial discrepancies.

To further illustrate the importance of proactive financial management, consider the following tips: - Use secure payment methods that offer protections against fraud and unauthorized transactions. - Keep your banking information private to prevent identity theft and related financial crimes. - Stay informed about your bank’s policies and any changes to payment processing procedures.

By being proactive and informed, you can better protect your financial well-being and minimize the risk of needing to stop payments.

What is the primary reason for using stop payments?

+

The primary reason for using stop payments is to prevent financial loss due to unauthorized transactions, errors, or disputes over payments.

How do I stop a payment on a check?

+

To stop a payment on a check, contact your bank as soon as possible and provide them with the check number, date, payee's name, and amount. Be prepared for potential fees and note that the stop payment order typically lasts for six months.

Can I stop an electronic fund transfer (EFT) payment?

+

Yes, you can stop an EFT payment by notifying your bank at least three business days before the scheduled transaction date. Provide detailed information about the transaction for a successful stop payment.

In summary, stop payments are a vital financial tool that can help individuals and businesses manage their transactions more securely. By understanding the different methods to stop payments and taking proactive steps to prevent errors and unauthorized transactions, you can better protect your financial well-being. Remember, staying informed and acting promptly are key to navigating the world of stop payments effectively.