SR22 Paperwork Requirements

Introduction to SR22 Paperwork Requirements

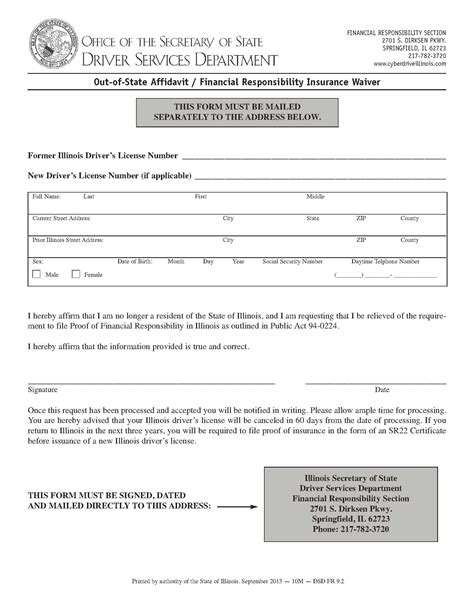

When it comes to driving, insurance requirements can be quite complex, especially for high-risk drivers. One of the most important documents for these individuals is the SR22 form, which is often required by the state’s Department of Motor Vehicles (DMV). The SR22 is not actually an insurance policy, but rather a certificate of financial responsibility that proves the driver has the minimum amount of liability insurance required by the state. In this blog post, we will delve into the world of SR22 paperwork requirements, exploring what they entail, how to obtain them, and the importance of maintaining compliance.

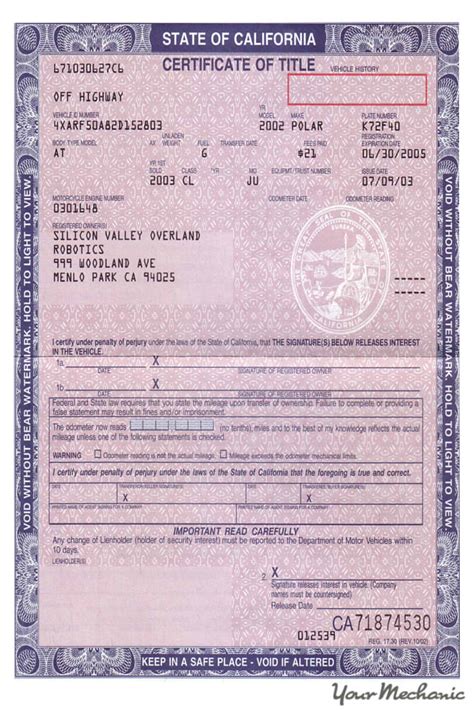

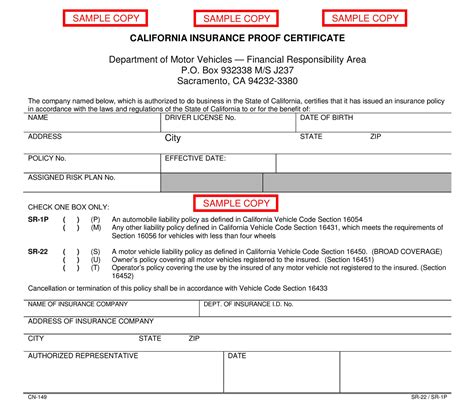

What is an SR22 Form?

The SR22 form is a document issued by an insurance company that verifies the driver has the necessary insurance coverage. It is usually required for drivers who have been involved in a serious traffic violation, such as a DUI (Driving Under the Influence) or reckless driving. The form is typically filed with the state’s DMV, which then monitors the driver’s insurance status to ensure they maintain the required coverage. There are three types of SR22 forms: * Operator’s SR22: For drivers who do not own a vehicle but still wish to maintain their driving privileges. * Owner’s SR22: For drivers who own a vehicle and need to provide proof of insurance. * Operator-Owner’s SR22: For drivers who own a vehicle and also wish to operate other vehicles.

How to Obtain an SR22 Form

Obtaining an SR22 form involves several steps: * Find an insurance company that offers SR22 insurance. Not all insurance companies provide this type of coverage, so it’s essential to shop around. * Purchase the required insurance policy. The insurance company will then file the SR22 form with the state’s DMV on behalf of the driver. * Pay the filing fee, which varies depending on the state and insurance company. * Receive confirmation that the SR22 form has been filed successfully.

🚨 Note: The SR22 form is usually required for a specified period, typically ranging from 1 to 3 years, depending on the state's regulations and the severity of the traffic violation.

Consequences of Non-Compliance

Failure to maintain the required insurance coverage and SR22 form can result in severe consequences, including: * License suspension or revocation * Vehicle registration suspension * Fines and penalties * Increased insurance premiums It’s crucial to understand the importance of complying with SR22 requirements to avoid these consequences and maintain driving privileges.

Maintaining Compliance

To maintain compliance, drivers must: * Keep their insurance policy active and up to date * Notify their insurance company of any changes to their policy or address * Pay their premiums on time to avoid policy cancellation * Monitor their SR22 status to ensure it remains active for the required period

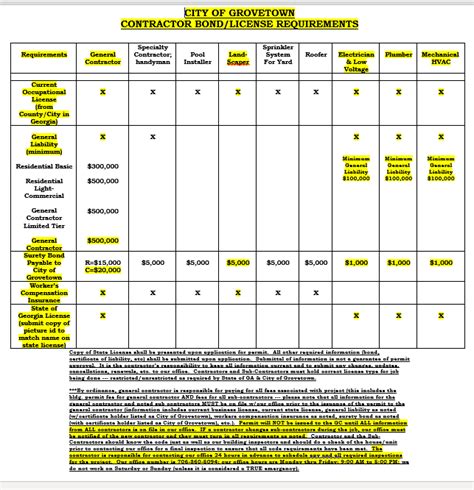

| State | Minimum Liability Insurance Requirements |

|---|---|

| California | $15,000 Bodily Injury, $30,000 per accident, $5,000 Property Damage |

| Florida | $10,000 Bodily Injury, $20,000 per accident, $10,000 Property Damage |

| Texas | $30,000 Bodily Injury, $60,000 per accident, $25,000 Property Damage |

Conclusion and Final Thoughts

In conclusion, understanding SR22 paperwork requirements is essential for high-risk drivers who need to maintain their driving privileges. By comprehending the process of obtaining an SR22 form, the consequences of non-compliance, and the importance of maintaining compliance, drivers can navigate the complex world of insurance requirements with confidence. Remember, insurance is not just a necessity, but a legal requirement, and staying informed is key to avoiding unnecessary complications and ensuring a smooth driving experience.

What is the purpose of an SR22 form?

+

The purpose of an SR22 form is to prove that a driver has the minimum amount of liability insurance required by the state, typically for high-risk drivers who have been involved in a serious traffic violation.

How long do I need to maintain SR22 insurance?

+

The length of time you need to maintain SR22 insurance varies depending on the state’s regulations and the severity of the traffic violation, typically ranging from 1 to 3 years.

Can I cancel my SR22 insurance policy?

+

No, you should not cancel your SR22 insurance policy until you have received confirmation from the state’s DMV that you are no longer required to maintain the SR22 form. Premature cancellation can result in severe consequences, including license suspension or revocation.