Paperwork

Open Bank Account Paperwork Required

Introduction to Opening a Bank Account

Opening a bank account is a crucial step in managing one’s finances effectively. It provides a secure place to store money, facilitates easy transactions, and offers a variety of financial services tailored to individual needs. However, the process of opening a bank account involves submitting specific paperwork required by banks to verify the identity and residency of the applicant. This requirement is in place to comply with anti-money laundering regulations and to ensure the security of financial transactions.

Types of Bank Accounts

There are several types of bank accounts that individuals can open, each designed for different purposes. The most common types include: - Checking Accounts: These accounts allow for frequent transactions, such as depositing and withdrawing money, writing checks, and using debit cards. - Savings Accounts: Designed to encourage saving, these accounts typically offer interest on deposits and may have restrictions on withdrawals. - Money Market Accounts: A type of savings account that may offer higher interest rates and limited check-writing and debit card privileges. - Certificate of Deposit (CD) Accounts: Time deposit accounts with fixed interest rates and maturity dates, offering a low-risk investment option.

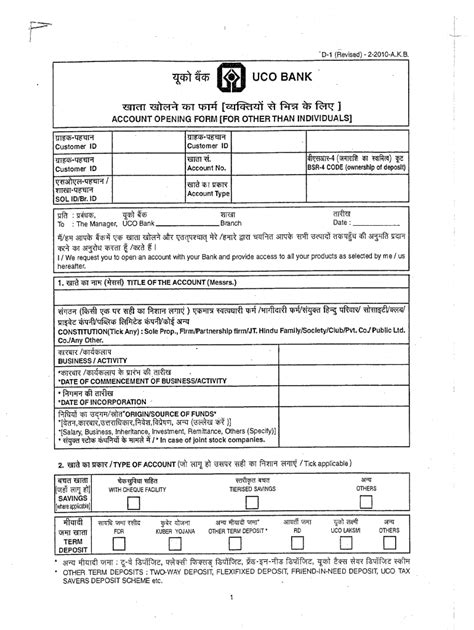

Required Paperwork for Opening a Bank Account

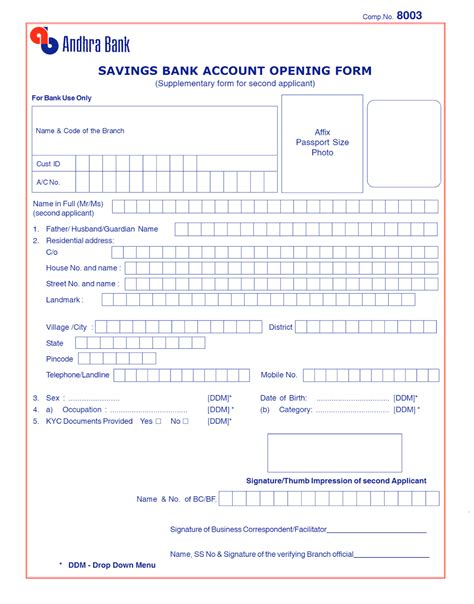

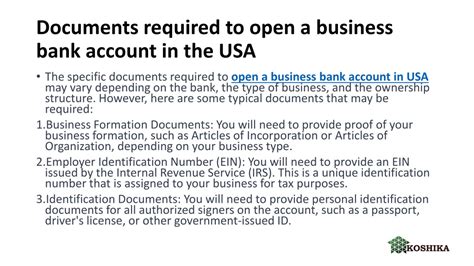

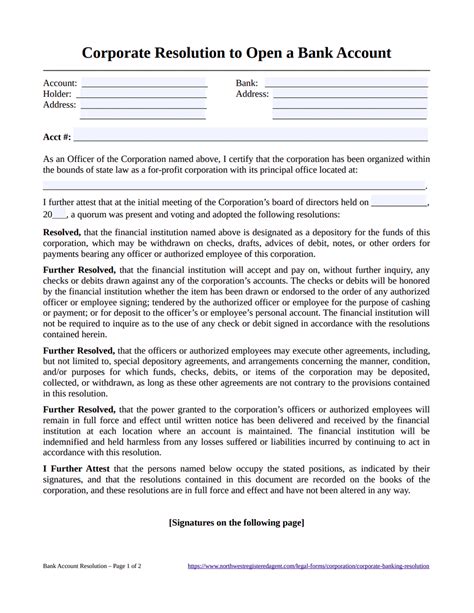

The specific paperwork required to open a bank account can vary depending on the bank, the type of account, and the applicant’s status (individual, business, etc.). However, there are certain documents that are commonly requested:

- Identification Documents: A valid government-issued ID, such as a driver’s license, state ID, or passport, is typically required to verify the applicant’s identity.

- Proof of Address: Documents like utility bills, lease agreements, or bank statements that show the applicant’s current address are often needed to verify residency.

- Social Security Number or Tax Identification Number: For tax reporting purposes and to comply with banking regulations, banks require applicants to provide their SSN or TIN.

- Employment Verification: In some cases, especially for business accounts or certain types of personal accounts, proof of income or employment may be requested.

Process of Opening a Bank Account

The process of opening a bank account can be straightforward and is often completed in a few steps: 1. Choose the Right Account: Select the type of bank account that best suits your financial needs. 2. Gather Required Documents: Ensure you have all the necessary paperwork to verify your identity and residency. 3. Visit the Bank or Apply Online: Many banks offer the option to open an account online, while others may require a visit to a branch. Choose the method that is most convenient for you. 4. Fill Out the Application: Provide accurate and complete information on the application form. 5. Fund Your Account: Once the account is approved, you will need to make an initial deposit to activate it.

Benefits of Having a Bank Account

Having a bank account offers numerous benefits, including: - Security: Banks are insured, which means your deposits are protected up to a certain amount. - Convenience: Bank accounts facilitate easy management of finances through online banking, mobile banking apps, and debit/credit cards. - Financial Inclusion: Access to a range of financial services and products that can help in achieving long-term financial goals. - Record Keeping: Banks provide statements and records of transactions, helping in tracking expenses and managing budgets.

Digital Banking and Online Account Opening

With the advancement of digital banking, many financial institutions now offer the option to open a bank account entirely online. This process typically involves:

- Visiting the Bank’s Website: Navigate to the bank’s official website or mobile app.

- Choosing the Account Type: Select the desired account type and click on the “Open Account” or “Apply Now” button.

- Filling Out the Application: Complete the online application form with the required information.

- Uploading Documents: Digitally upload the necessary identification and proof of address documents.

- Funding the Account: Make an initial deposit to open and activate the account.

📝 Note: The specific requirements for opening a bank account online may vary, so it's always a good idea to check with the bank beforehand.

Conclusion and Next Steps

Opening a bank account is a significant step towards organizing one’s finances and accessing a variety of banking services. By understanding the required paperwork and the process involved, individuals can make informed decisions about their financial management. Whether opting for a traditional brick-and-mortar bank or leveraging digital banking solutions, having a bank account is fundamental for personal and financial growth.

What documents are typically required to open a bank account?

+

The documents required usually include a valid government-issued ID, proof of address, and a Social Security Number or Tax Identification Number.

Can I open a bank account online?

+

Yes, many banks offer the option to open an account online. This process involves filling out an application form, uploading necessary documents, and making an initial deposit.

What are the benefits of having a bank account?

+

HAVING a bank account provides security for your money, convenience in managing finances, access to financial services, and helps in keeping track of expenses and budgets.